Best Car Insurance for Divorced Person in 2026 (Top 10 Companies)

For the best car insurance for divorced person, consider top choices: Progressive, USAA, and State Farm, offering discounts of up to 25%. Their personalized offerings for your post-divorce requirements, these companies strike the ideal balance between cost and protection.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Dan Walker graduated with a BS in Administrative Management in 2005 and has been working in his family’s insurance agency, FCI Agency, for 15 years (BBB A+). He is licensed as an agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. He reviews content, ensuring tha...

Daniel Walker

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated January 2025

hide

Company Facts

Full Coverage for Divorced Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Divorced Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Divorced Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Navigate the best car insurance for divorced person like Progressive, USAA, and State Farm. These companies offer competitive rates based on credit score, mileage, coverage, and driving record. Choose the best fit for post-divorce rates.

We will delve into specialized auto insurance options for divorced individuals and discuss how changes in marital status can impact your premiums.

Our Top 10 Company Picks: Best Car Insurance for Divorced Person

| Company | Rank | Usage-Based Discount | Multi-Policy Discount Percentage | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 18% | 23% | Customized Coverage | Progressive | |

| #2 | 25% | 20% | Military Savings | USAA | |

| #3 | 15% | 17% | Bundling Discount | State Farm | |

| #4 | 25% | 5% | Safe Driving | Allstate | |

| #5 | 15% | 25% | Tech-Savvy | Farmers | |

| #6 | 16% | 25% | Deductible Reduction | Nationwide |

| #7 | 21% | 24% | Replacement Coverage | Liberty Mutual |

| #8 | 20% | 13% | Bundling Benefits | Travelers | |

| #9 | 20% | 20% | Loyal Customers | American Family | |

| #10 | 22% | 25% | Rate Stability | Erie |

Finally, we will provide step-by-step guidance for transferring ownership of vehicles in a divorce situation and shed light on the role of alimony and child support in determining auto insurance rates.

- Progressive, USAA, and State Farm are top choices for divorced individuals

- Prompting quick policy updates for driving habits, finances, and stress

- Adjust coverage based on post-divorce needs and financial changes

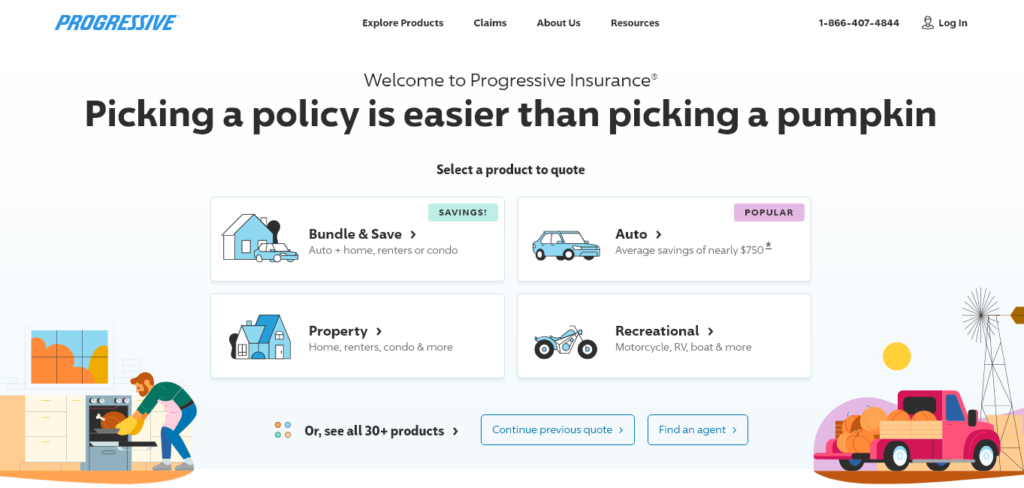

#1 – Progressive: Top Overall Pick

Pros

- Customized Coverage: Progressive offers customized coverage options, allowing customers to tailor their policies to meet specific needs.

- Comprehensive Coverage: Known for its comprehensive coverage, Progressive ensures that policyholders have protection in various situations.

- Low Complaint Level: Based on our Progressive insurance review, the company maintains a low complaint level, indicating a high level of customer satisfaction.

Cons

- Average Customer Service: While generally satisfactory, some customers may find Progressive’s customer service to be average compared to other providers.

- Limited Discounts: While Progressive offers a usage-based discount, it may have fewer discount options compared to some competitors.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Savings

Pros

- Military Savings: USAA is known for its substantial military savings, catering to the unique needs of military members and their families.

- Exceptional Customer Service: USAA consistently receives high praise for its exceptional customer service and support.

- Affordable Rates: USAA offers consistently affordable rates, providing cost-effective solutions for its members.

Cons

- Eligibility Restrictions: USAA membership is limited to military members, veterans, and their families, which can be a barrier for the general public.

- Limited Physical Locations: USAA operates primarily online and through phone services, which might be a drawback for those who prefer in-person interactions. Learn more in our USAA insurance review.

#3 – State Farm: Best for Bundling Discount

Pros

- Bundling Discount: State Farm offers a 17% bundling discount, encouraging customers to combine multiple policies for additional savings.

- Vast Agent Network: With a vast network of agents, State Farm provides personalized service and local support.

- A+ A.M. Best Rating: As stated in our State Farm insurance review, State Farm holds an A+ A.M. Best rating, indicating financial strength and stability.

Cons

- Average Customer Satisfaction: While generally satisfactory, State Farm’s customer satisfaction may not be as consistently high as some other providers.

- Potentially Higher Rates: Depending on individual circumstances, State Farm’s rates may be higher for certain drivers compared to other options.

#4 – Allstate: Best for Safe Driving

Pros

- Safe Driving Discount: Allstate offers a 25% safe driving discount, rewarding policyholders with a proven track record of safe driving.

- Comprehensive Coverage Options: Allstate provides a range of coverage options, allowing customers to tailor policies to their specific needs. Learn more in our Allstate insurance review.

- Brand Recognition: As a well-known and established company, Allstate offers a sense of security and trust for its customers.

Cons

- Potentially Higher Premiums: Allstate’s premiums may be higher for some individuals compared to other providers.

- Mixed Customer Service Reviews: While many customers praise Allstate’s customer service, there are mixed reviews, with some citing areas for improvement.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Tech-savvy

Pros

- Tech-savvy: Farmers caters to tech-savvy customers with online tools and mobile apps for easy policy management.

- Personalized Service: As mentioned in our Farmers insurance review, Farmers offers personalized service and local support.

- Adequate Financial Strength: Farmers maintains financial strength, as reflected in its ability to meet policyholder obligations.

Cons

- Potentially Higher Rates: Some individuals may find Farmers’ rates to be on the higher side compared to other providers.

- Customer Service Variability: While many customers are satisfied, there can be variability in customer service experiences.

#6 – Nationwide: Best for Deductible Reduction

Pros

- Deductible Reduction: Nationwide offers a deductible reduction of 25%, providing potential savings for policyholders.

- Strong Financial Rating: Nationwide holds a strong financial rating, indicating stability and reliability.

- Wide Range of Coverage: Nationwide offers a wide range of coverage options, as outlined in our Nationwide insurance review, allowing customers to tailor policies to their specific needs.

Cons

- Potentially Higher Premiums: Depending on individual circumstances, Nationwide’s premiums may be higher for certain drivers.

- Mixed Customer Service Reviews: While many customers are satisfied, there are mixed reviews regarding Nationwide’s customer service.

#7 – Liberty Mutual: Best for Replacement Coverage

Pros

- Replacement Coverage: Liberty Mutual offers replacement coverage, ensuring that policyholders can replace a totaled car with a new one.

- Tech-Savvy Options: Liberty Mutual caters to tech-savvy customers, offering online tools and resources for easy policy management.

- Wide Range Of Coverage: Liberty Mutual provides a wide range of coverage options to meet various customer needs.

Cons

- Potentially Higher Rates: Some individuals may find Liberty Mutual’s rates to be higher compared to other providers. Learn more about their rates in our Liberty Mutual review.

- Customer Service Reviews: While many customers are satisfied, there are mixed reviews regarding Liberty Mutual’s customer service.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Bundling Benefits

Pros

- Bundling Benefits: Travelers offers a 13% discount for bundling multiple policies, providing additional savings for customers.

- Adequate Financial Strength: With a solid financial rating, Travelers demonstrates stability and reliability.

- Diverse Discounts: Travelers provides various discounts beyond bundling and safe driving, learn more about their discounts in our Travelers insurance review.

Cons

- Potentially Higher Premiums: Depending on individual circumstances, Travelers’ premiums may be higher for certain drivers.

- Mixed Customer Service Reviews: While many customers are satisfied, there are mixed reviews regarding Travelers’ customer service.

#9 – American Family: Best for Loyal Customers

Pros

- Loyalty Discounts: American Family offers loyalty discounts, rewarding customers for their continued business.

- Adequate Financial Strength: American Family maintains financial strength, ensuring the ability to meet policyholder obligations. Learn more in our American Family insurance review.

- Personalized Service: With a network of agents, American Family provides personalized service and local support.

Cons

- Potentially Higher Rates: Some individuals may find American Family’s rates to be on the higher side compared to other providers.

- Limited Physical Locations: American Family’s physical presence may be limited in certain areas, impacting accessibility for in-person support.

#10 – Erie Insurance: Best for Rate Stability

Pros

- Rate Stability: Erie Insurance offers rate stability, providing customers with predictability in their premium costs. Learn more about their premiums in our Erie insurance review.

- Tech-Savvy Options: Erie Insurance caters to tech-savvy customers, offering online tools for convenient policy management.

- Personalized Service: With a network of agents, Erie Insurance provides personalized service and local support.

Cons

- Limited Availability: Erie Insurance may have limited availability in certain regions, potentially limiting choices for some customers.

- Mixed Customer Service Reviews: While many customers are satisfied, there are mixed reviews regarding Erie Insurance’s customer service.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Average Monthly Rates for Divorced Person With Top 10 Car Insurance Companies

When it comes to securing car insurance for divorced individuals, making an informed decision is crucial. Here’s a detailed comparison of the average monthly rates for minimum and full coverage across the best car insurance companies, providing insights into the top choices and the reasons behind them.

Car Insurance for Divorced Person: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $75 | $150 |

| American Family | $70 | $140 |

| Erie Insurance | $65 | $130 |

| Farmers | $80 | $160 |

| Liberty Mutual | $85 | $170 |

| Nationwide | $72 | $145 |

| Progressive | $78 | $155 |

| State Farm | $68 | $136 |

| Travelers | $75 | $150 |

| USAA | $60 | $120 |

Among all the car insurance companies, three standout choices emerge. Progressive, recognized for its competitive rates and comprehensive coverage, is a solid option. Following closely, USAA, with consistently affordable rates and tailored services for military members, stands out as the most economical choice. State Farm, renowned for reliability and a vast network of agents, offers competitive rates and personalized service.

Jeff Root Licensed Life Insurance Agent

Examining minimum coverage, USAA leads at $60, while Progressive comes in at $78. For full coverage, USAA remains the most economical at $120, while Progressive is competitively priced at $155. It is crucial for divorced individuals to consider discounts, customer service, and coverage options to make an informed decision that aligns with their needs and budget.

Factors to Consider When Choosing Auto Insurance After a Divorce

When selecting auto insurance after a divorce, there are several critical factors to consider. Follow the steps below to ensure you find the right auto insurance policy for your post-divorce needs:

- Driving Habits and Mileage: Consider if your daily commute has changed or if you are driving less frequently. Inform your insurance provider as this can potentially lower your premiums.

- Coverage Needs: Assess the value of your vehicle and determine the level of protection you need against damage or theft. Adjust your coverage accordingly.

- Financial Situation: Take into account any changes in your financial situation and select an insurance policy that fits your budget.

- Marital Status Impact: Understand that being divorced may lead to higher insurance rates. Insurance companies may view divorced individuals as higher risk due to potential financial instability and increased stress levels.

- Shop Around and Compare: Compare quotes from different insurance providers to ensure you are getting the best rates possible.

- Look for Discounts: Seek out discounts or special programs available specifically for divorced individuals. (Read more: Best Auto Insurance Discounts for Divorced Person)

Taking the time to thoroughly research and consider these factors will help you make an informed decision and find the right auto insurance policy for your post-divorce needs. This effort can result in better coverage at a more affordable cost, providing peace of mind as you navigate this new chapter of your life.

Understanding the Impact of Divorce on Auto Insurance Rates

Divorce can have a significant impact on auto insurance rates. Insurance providers often use marital status as a rating factor, and divorced individuals may experience a change in their premiums. Statistics show that divorced individuals tend to have higher auto insurance rates compared to married couples.

This increase can be attributed to various factors, including changes in driving habits, financial instability, and increased risk of accidents due to higher stress levels. Understanding this impact is crucial in determining the best auto insurance options for divorced individuals.

One of the main reasons why divorced individuals may experience higher auto insurance rates is due to changes in driving habits. After a divorce, individuals may find themselves driving more frequently or for longer distances, as they may have to commute to work or transport children between households.

Increased mileage can lead to higher insurance premiums, as insurance providers consider higher mileage as a higher risk factor for accidents.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Update Your Auto Insurance Policy After a Divorce

Updating your auto insurance policy after a divorce is essential for ensuring adequate coverage. Start by notifying your insurance provider about the divorce and any changes in circumstances. You may need to provide documents such as divorce decrees or custody agreements to update your policy.

Take this opportunity to review your coverage and make any necessary adjustments. Ensure your policy reflects your current vehicles, ownership status, and any changes in drivers listed on the policy. It’s also vital to evaluate additional coverage options that may be beneficial to protect yourself and your assets. (Read more: How To Get Free Insurance Quotes Online).

Comparing Different Auto Insurance Providers for Divorced Individuals

When searching for the best auto insurance as a divorced individual, it’s crucial to compare different providers. Each insurer has its own underwriting guidelines and may offer varying rates for divorced policyholders. Take the time to research and obtain quotes from multiple insurance companies.

Consider factors such as coverage options, customer service, financial stability, and reputation. Look for insurance providers that specialize in serving divorced individuals or offer specific coverage options tailored to their needs. By comparing providers, you can find the best combination of coverage and affordability for your specific situation.

The Importance of Adequate Coverage for Divorced Individuals

Adequate auto insurance coverage is vital for divorced individuals. With the potential increase in auto insurance rates after a divorce, ensuring that you have sufficient coverage becomes even more critical. Comprehensive coverage can safeguard you against unexpected events such as accidents, theft, or natural disasters.

It provides financial protection and peace of mind, enabling you to navigate post-divorce life with confidence. Remember to select coverage that aligns with your current needs and consider additional options such as gap insurance or roadside assistance, depending on your circumstances.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips for Finding Affordable Auto Insurance After a Divorce

Finding affordable auto insurance after a divorce may seem challenging, but there are several strategies you can employ to lower your premiums. Start by shopping around and comparing quotes from multiple insurance providers. Take advantage of discounts, such as safe driver discounts, multi-policy discounts, or good student discounts if you have children under your policy.

Consider raising your deductible to reduce your premium, but ensure you can comfortably afford the deductible amount if you need to make a claim. Additionally, maintaining a good credit score and a clean driving record can positively impact your insurance rates. Learn more by reading our guide: Lesser Known Car Insurance Discounts

Navigating Joint Auto Insurance Policies During and After a Divorce

Many couples have joint auto insurance policies, which can be complex to navigate during and after a divorce. If you and your former spouse have joint coverage, it’s important to communicate and make arrangements for the future. One option is to maintain the joint policy until the divorce is finalized and then decide whether to continue with joint coverage or obtain separate policies.

If you decide to maintain joint coverage, ensure that both parties are listed accurately, and any required changes, such as removing a vehicle from the policy, are promptly made. If separate policies are obtained, make sure to transfer the appropriate vehicles and drivers to the respective policies to maintain continuous coverage.

Read more: Can you insure a car that is not in your name?

Common Mistakes to Avoid When Purchasing Auto Insurance as a Divorced Person

When purchasing auto insurance as a divorced person, it’s essential to be aware of common mistakes and avoid them. One common error is failing to inform your insurance provider about the divorce and any changes in circumstances promptly. Failure to provide accurate and updated information can lead to issues with coverage or claims in the future. (Read more: What is denial of claim?)

Additionally, do not assume that staying with your current insurance provider is the best option without comparing rates from other companies. Finally, avoid sacrificing necessary coverage just to save on premiums. While it’s essential to find affordable insurance, it’s equally crucial to ensure adequate protection for yourself and your assets.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Specialized Auto Insurance Options for Divorced Individuals

As a divorced individual, you may benefit from exploring specialized auto insurance options. Some insurance providers offer policies specifically designed for divorced individuals, taking into account the unique needs and circumstances that arise during and after a divorce.

These specialized policies may include coverage for temporary transportation, legal assistance, or enhanced coverage for assets such as rental properties or valuable belongings. Exploring these options can help you find a policy that provides the comprehensive protection you need during this transitional period.

How Changes in Marital Status can Affect Your Auto Insurance Premiums

Changes in marital status can have a direct impact on your auto insurance premiums. While insurance providers consider many factors when calculating rates, marital status is among the significant ones. Thus, being aware of how a change in marital status affects your premiums is essential.

Typically, divorce leads to an increase in rates due to the aforementioned statistical data suggesting a higher risk for divorced individuals. However, it’s important to remember that each person’s situation is unique, and other factors such as driving record, age, or location may also influence premium adjustments.

Steps to Take When Transferring Ownership of Vehicles in a Divorce Situation

Transferring ownership of vehicles in a divorce situation requires careful attention to detail to ensure a smooth transition. The first step is to establish ownership of each vehicle and determine who will be keeping them. If both parties agree to sell the vehicles, the proceeds can be divided as per the divorce settlement. (Read More: Can my husband insure a car that is titled in my name without transfer of title?)

However, if one party will be retaining the vehicle, it’s crucial to transfer ownership officially. This usually involves completing the appropriate paperwork provided by the Department of Motor Vehicles and paying any required fees. Make sure to update the vehicle’s title, registration, and insurance policy to reflect the new owner to avoid any legal or insurance complications.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding the Role of Alimony and Child Support in Determining Auto Insurance Rates

Alimony and child support can play a role in determining auto insurance rates, especially for divorced individuals. When providing insurance quotes, insurance providers may inquire about income and financial obligations, including any court-ordered alimony or child support payments.

These factors can influence your rates as they reflect your overall financial stability and ability to meet your insurance obligations. It’s essential to provide accurate information about your financial situation to ensure that your rates are calculated correctly. Failing to disclose alimony or child support payments can potentially lead to issues with your coverage or claims in the future.

How to Maximize Savings on Auto Insurance as a Newly Divorced Individual

Maximizing savings on auto insurance as a newly divorced individual requires a proactive approach. Start by comparing quotes from different insurance providers to find the best rates. Take advantage of any available discounts and consider bundling policies if you require other types of insurance.

Assess your coverage needs and adjust them accordingly, ensuring you have sufficient protection without paying for unnecessary coverage. Additionally, maintaining a good driving record and periodically reviewing your policy can help you identify opportunities for savings. Get more discounts by reading our guide, “Best Auto Insurance Discounts for Divorced Person“.

Tips for Maintaining Continuous Coverage During and After a Divorce

Maintaining continuous auto insurance coverage during and after a divorce is essential to protect yourself legally and financially. Follow these steps to ensure your coverage remains uninterrupted:

- Communicate Changes Promptly: Inform your insurance provider immediately about any changes in your circumstances, such as separation or divorce.

- Update Policy Information: Ensure your policy reflects accurate details, including changes in drivers, vehicles, and ownership status. If transitioning from a joint policy to separate policies, make necessary adjustments to avoid gaps in coverage.

- Keep Insurance Documentation: Maintain records of all insurance-related documentation. Consult your insurance agent or provider for any questions or concerns.

- Proactively Manage Your Coverage: Continuously manage your coverage to maintain protection throughout the divorce process and beyond.

In conclusion, securing the best auto insurance for divorced individuals involves careful consideration of various factors. Understand the impact of divorce on insurance rates, update your policy accordingly, and explore specialized options to secure the coverage you need.

Read more: What happens if I let my car insurance policy lapse?

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Choosing the Best Car Insurance After Divorce

Case studies provide valuable insights into how different insurance providers offer tailored solutions to meet the unique circumstances of divorced individuals. Here, we explore three case studies featuring Progressive, USAA, and State Farm, highlighting their ability to adapt to the needs of individuals going through a divorce.

- Case Study #1 – Progressive’s Tailored Coverage for Sarah’s Changing Needs: Sarah, a recently divorced individual, faced the challenge of adapting her auto insurance to reflect her new circumstances. Progressive’s reputation for customized coverage caught her attention. Sarah leveraged Progressive’s flexibility to adjust her policy according to her evolving driving habits and lifestyle post-divorce.

- Case Study #2 – USAA’s Military Savings and Exceptional Service: James, a military veteran undergoing a divorce, sought an insurance provider that understands and caters to the unique needs of the military community. Limited by eligibility criteria, James found solace in USAA’s military discounts and exceptional customer service. USAA’s commitment to serving veterans provided James with reliable and affordable coverage during this transitional period.

- Case Study #3 – State Farm’s Personalized Support for Emily’s Bundling Needs: Emily, amidst the changes following her divorce, valued personalized service and sought bundling discounts. State Farm’s vast agent network and bundling discount became vital factors in Emily’s decision-making process. State Farm’s commitment to customer support and financial incentives influenced Emily’s choice of auto insurance, providing her with a comprehensive and cost-effective solution.

By providing tailored solutions, these insurance providers support their clients through challenging times, helping them maintain financial stability and confidence in their auto insurance choices. Whether through Progressive’s flexible coverage, USAA’s military-centric services, or State Farm’s bundling discounts, divorced individuals can find insurance options that best suit their new circumstances.

Enter your ZIP code below into our free comparison tool to see how much car insurance costs in your area.

Frequently Asked Questions

How does divorce impact car insurance rates?

Divorce can lead to changes in driving habits, financial instability, and increased stress, which may result in higher auto insurance rates. Insurers often view divorced individuals as higher risk, affecting premium costs.

What factors should be considered when updating auto insurance after a divorce?

It’s crucial to inform your insurance provider promptly about the divorce, update driving habits and mileage, review coverage needs, assess vehicle values, and consider changes in your financial situation.

Ready to find affordable car insurance? Use our free comparison tool below to get started.

How do I maximize savings on auto insurance after a divorce?

To maximize savings, compare quotes from different insurers, take advantage of available discounts (such as safe driver or multi-policy discounts), consider raising deductibles, maintain a good credit score, and periodically review your policy for potential adjustments.

Access comprehensive insights in our review of “The Best Ways to Get the Cheapest Car Insurance Quotes.”

What steps should be taken to transfer ownership of vehicles in a divorce situation?

Determine vehicle ownership, decide whether to sell or transfer ownership, complete required paperwork provided by the Department of Motor Vehicles, and update the vehicle’s title, registration, and insurance policy to reflect the new owner.

Can my ex-spouse and I share the same auto insurance policy after divorce?

After divorce, you can maintain a joint auto insurance policy if both parties agree and the policy meets your individual coverage needs. However, it’s often recommended to separate policies to ensure each person’s coverage and obligations are distinct.

Can alimony and child support affect auto insurance rates?

Yes, alimony and child support may impact rates. Insurance providers may inquire about income and financial obligations, and these factors can influence rates by reflecting overall financial stability and the ability to meet insurance obligations.

Read our guide for more info called “What is Alimony?“

How can I prove my new marital status to my insurance provider?

To prove your new marital status, you may need to provide your insurance provider with a copy of your divorce decree or other legal documentation that confirms the change in your marital status.

Are there any special discounts available for divorced individuals?

Some insurance providers offer discounts specifically for divorced individuals, such as safe driving discounts, multi-policy discounts, or group discounts based on affiliation with certain organizations. Check with your provider for available options.

How can I make sure my auto insurance covers my children after divorce?

If you have custody of your children, make sure they are listed as covered drivers on your policy if they will be driving your vehicle. If they are driving a separate vehicle, consider obtaining a separate policy for them or including their vehicle under your policy.

Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

What should I do if my ex-spouse’s driving record affects my premiums?

If your ex-spouse’s driving record negatively affects your premiums on a joint policy, consider transferring to separate policies. Discuss the situation with your insurance provider to find a solution that minimizes your rates and provides the best coverage for you.

More information is available in our “How does the insurance company determine my premium?“

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.