Best Car Insurance for Postal Employees in 2026 (Top 10 Companies)

State Farm, Progressive, and Allstate lead as the best car insurance for postal employees, with State Farm offering a standout $22 monthly rate. These providers are renowned for their comprehensive understanding of the distinctive insurance requirements inherent to postal employees.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Updated January 2025

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Postal Employees

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Postal Employees

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Postal Employees

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsState Farm emerges as the best car insurance for postal employees seeking the best auto insurance, with Progressive and Allstate closely following in terms of value and coverage.

Postal employees have unique insurance needs that should be carefully considered when choosing a car insurance policy. This article will delve into the factors that need to be taken into account to ensure postal workers are adequately protected on the road.

Our Top 10 Company Picks: Best Car Insurance for Postal Employees

| Company | Rank | UBI Discount | Safe Driving Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | 18% | Employee Discounts | State Farm | |

| #2 | 20% | 16% | Professional Savings | Progressive | |

| #3 | 19% | 15% | Carrier Coverage | Allstate | |

| #4 | 18% | 14% | Service Benefits | Liberty Mutual |

| #5 | 22% | 17% | Delivery Rewards | Nationwide |

| #6 | 21% | 15% | Worker Advantage | Travelers | |

| #7 | 17% | 12% | Service Program | Farmers | |

| #8 | 24% | 20% | Employee Coverage | The Hartford |

| #9 | 21% | 16% | Specialized Plan | American Family | |

| #10 | 19% | 15% | Bundling Discounts | USAA |

From understanding the importance of comprehensive coverage to exploring special postal worker discounts and benefits available exclusively for postal workers, we will provide a comprehensive guide to help postal employees find the best car insurance coverage at affordable rates.

Protect your vehicle by entering your ZIP code into our free comparison tool above to find affordable car insurance quotes.

- At $33 per month, State Farm is the top car insurer for postal employees

- Special discounts and benefits can help postal employees save more

- State Farm, Progressive, and Allstate have tailored coverage for postal workers

#1 – State Farm: Top Overall Pick

Pros

- Employee Discounts: State Farm offers substantial postal workers discounts of up to 25%, ensuring affordability.

- Additional Savings: Postal employees can further reduce their premiums with an additional discount of up to 18%.

- Reputation: State Farm’s longstanding reputation for customer service and financial stability instills trust. Discover more in our State Farm car insurance review.

Cons

- Limited Specialization: While State Farm provides standard car insurance, it may not offer specialized coverage tailored to postal worker needs.

- Cost Variability: Actual savings may vary depending on individual circumstances and coverage options.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Professional Savings

Pros

- Professional Savings: Progressive offers up to 20% in professional savings, making it appealing to various professionals, including postal workers. Learn more details in our Progressive insurance review.

- Flexible Options: Progressive’s range of coverage options allows for customization based on individual needs.

- User-Friendly Tools: The company’s online platform and mobile app offer convenient tools for managing policies and claims.

Cons

- Costs: Progressive’s rates might be higher than some competitors, especially for full coverage.

- Customer Service: Some customers have reported mixed reviews regarding Progressive’s customer service experience.

#3 – Allstate: Best for Carrier Coverage

Pros

- Carrier Coverage: Allstate provides up to 19% in carrier coverage discounts, focusing on insurance for carriers and their unique needs.

- Financial Strength: Allstate’s A+ rating indicates strong financial stability and claims-paying ability.

- Coverage Options: Allstate offers a wide range of coverage options and additional features. Learn more about them in this Allstate insurance review.

Cons

- Cost: Allstate’s premiums may be on the higher side compared to some competitors.

- Policy Limitations: Some policyholders have noted limitations in coverage options for specialized needs.

#4 – Liberty Mutual: Best for Service Benefits

Pros

- Service Benefits: Liberty Mutual offers up to 18% in service benefits, making it attractive for postal employees seeking value-added services. Our Liberty Mutual insurance review will help you learn more.

- Customization: Liberty Mutual provides customizable coverage options to meet specific needs.

- Discount Opportunities: The company offers various discount opportunities beyond the standard rates.

Cons

- Coverage Restrictions: Liberty Mutual may have restrictions or limitations on certain policy features.

- Customer Feedback: Some customers have expressed concerns about the claims process and customer service.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Delivery Rewards

Pros

- Delivery Rewards: Nationwide’s up to 22% delivery rewards offer significant savings for postal workers.

- Huge Network: Nationwide’s extensive network of agents and service providers offers convenience and accessibility.

- Additional Benefits: Nationwide has additional benefits and features to enhance the policyholder experience. Discover more in our Nationwide insurance review.

Cons

- Rate Fluctuations: Nationwide’s rates may fluctuate based on various factors, potentially impacting affordability.

- Coverage Limitations: Some policyholders have noted limitations or restrictions in coverage options.

#6 – Travelers: Best for Worker Advantage

Pros

- Worker Advantage: Travelers provides up to 21% worker advantage discounts, making it an appealing choice for postal employees.

- Coverage Options: The company offers a diverse range of coverage options to cater to various needs.

- Financial Strength: Travelers’ solid financial strength ensures the ability to handle claims effectively. Learn more in our Travelers insurance review.

Cons

- Pricing Complexity: Travelers’ pricing structure can be complex, and customers may find it challenging.

- Limited Discounts: While postal employee discounts are available, they may be more limited than those of some competitors.

#7 – Farmers: Best for Service Program

Pros

- Service Program: Farmers offer up to 17% service program discounts, contributing to additional cost savings for postal workers. For details, see our Farmers insurance review.

- Customizable Policies: Farmers allow policyholders to tailor their coverage, ensuring flexibility.

- Local Presence: With a wide network of local agents, Farmers offers personalized service and accessibility.

Cons

- More Expensive: Some customers may find Farmers’ rates to be higher compared to other insurers.

- Claims Process: There have been occasional reports of dissatisfaction with the claims handling process.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – The Hartford: Best for Employee Coverage

Pros

- Employee Coverage: The Hartford stands out with up to 24% employee coverage discounts, ensuring significant savings. The Hartford insurance review has more information about this provider.

- Additional Discounts: The company offers additional discounts, enhancing affordability.

- Specialized Plans: The Hartford provides specialized plans catering to specific needs.

Cons

- Availability: The Hartford’s services may not be available in all areas, limiting accessibility for some customers.

- Online Experience: The online interface may not be as user-friendly as some competitors.

#9 – American Family: Best for Specialized Plan

Pros

- Specialized Plans: American Family offers up to 21% discounts on specialized plans that meet unique requirements.

- Customer-Focused: The company emphasizes a customer-centric approach, enhancing overall satisfaction.

- Innovative Tools: American Family provides innovative tools and resources for policy management. Read more: American Family Insurance Review.

Cons

- Limited Regional Presence: American Family may have limited availability in certain regions.

- Policy Options: Some customers may find a more extensive range of policy options with other insurers.

#10 – USAA: Best for Bundling Discounts

Pros

- Bundle Discounts: USAA offers up to 19% bundle discounts, allowing members to save on multiple policies.

- Military-Focused: USAA’s commitment to serving military members results in specialized offerings and support.

- Highly-Rated Service: The company consistently receives high ratings for customer service and satisfaction. Check out insurance savings in our USAA insurance review.

Cons

- Membership Requirement: USAA is limited to military members and their families, restricting eligibility.

- Coverage Limitations: Some policy features may be more restrictive compared to other insurers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Insurance Costs for Postal Employees

When trying to understand the financial aspect of car insurance for postal employees, it’s crucial to delve into the specific coverage rates offered by leading insurance providers. The table below illustrates the average monthly rates for both minimum and full coverage policies from notable companies catering to postal workers:

Monthly Car Insurance Rates for Postal Employees

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $61 | $160 |

| American Family | $44 | $117 |

| Farmers | $53 | $139 |

| Liberty Mutual | $68 | $174 |

| Nationwide | $44 | $115 |

| Progressive | $39 | $105 |

| State Farm | $33 | $86 |

| The Hartford | $43 | $113 |

| Travelers | $38 | $99 |

| USAA | $22 | $59 |

For minimum coverage, USAA offers the most competitive rate at $22 per month, followed closely by Travelers at $38 per month and State Farm at $33 per month. However, for those looking for full coverage, State Farm remains a front-runner with a rate of $86 per month, while Progressive and Nationwide come in at $105 per month and $115 per month, respectively.

Allstate and Liberty Mutual have rates of $160 per month and $174 per month for full coverage, emphasizing the need for postal employees to carefully evaluate their coverage needs and budget constraints when selecting an insurance provider.

The rates from Farmers, Hartford, American Family, and Nationwide also reflect variations, highlighting the importance of conducting thorough research to find the most suitable insurance plan that balances cost and coverage.

Understanding the Insurance Needs of Postal Employees

Postal employees often have specific requirements regarding car insurance coverage. As they spend a significant amount of time on the road delivering mail, their vehicles may be exposed to various risks that differ from those faced by other professions.

Therefore, it is crucial to consider these unique factors when selecting an insurance policy. Factors such as high mileage, frequent stops and starts, and exposure to challenging weather conditions may all influence the type of car insurance coverage.

Furthermore, postal employees may use personal vehicles for work purposes, which can impact insurance requirements. It is essential to understand exactly what your policy will cover in these situations to avoid any gaps in coverage that could leave you financially vulnerable.

Factors to Consider When Choosing Car Insurance for Postal Workers

When selecting car insurance for postal workers, several factors need to be considered. Firstly, the coverage options offered by insurance providers should be evaluated carefully.

Postal employees should look for policies that include comprehensive coverage, which protects against damages to their vehicle caused by events other than collisions. This is especially important considering the various risks postal workers encounter during their day-to-day activities.

Jeff Root Licensed Life Insurance Agent

Additionally, liability coverage should be given ample consideration. Postal employees should opt for coverage limits that adequately protect their financial interests in the event of an accident where they are at fault. It is crucial to strike a balance between affordability and sufficient coverage to avoid potential financial hardships in case of a claim.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Importance of Comprehensive Coverage for Postal Employees

Comprehensive coverage is crucial for postal employees due to the nature of their work. This type of coverage protects against damage to the insured vehicle caused by events such as theft, vandalism, natural disasters, or falling objects.

Given the exposure to diverse risks, having comprehensive coverage ensures that postal employees have comprehensive protection in case of unforeseen events. While comprehensive coverage may result in slightly higher premiums, the added peace of mind it provides is invaluable.

Exploring Special Discounts and Benefits for Postal Workers

Postal employees may be eligible for special discounts and benefits on auto insurance. Many insurance providers offer exclusive savings and perks tailored specifically for postal workers. These discounts can range from reduced premiums to additional coverage options at a lower cost.

To take advantage of these benefits, postal workers should shop around and request quotes from different insurance companies. By comparing offers and exploring unique discounts available for postal employees, they can find an insurance provider that offers the best combination of coverage, affordability, and perks.

Tips for Finding Affordable Auto Insurance Rates for Postal Employees

Finding affordable auto insurance rates can be challenging, but there are several strategies to help postal employees secure more affordable coverage. Firstly, it is crucial to maintain a clean driving record. By avoiding traffic violations and accidents, drivers can demonstrate their responsibility to insurance providers, which can lead to lower premiums.

Additionally, bundling auto and home insurance policies can often result in discounted rates. Postal employees should explore the option of combining their insurance needs with one provider to take advantage of potential savings. Furthermore, comparing rates from multiple insurance companies and seeking quotes regularly can help identify the most competitive offers in the market.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Different Insurance Providers for Postal Workers

When comparing car insurance providers, postal workers must assess their coverage offerings carefully. It is essential to look beyond the price and evaluate the extent of protection provided by each policy. Ensure that the policy covers the unique risks associated with the job and that the coverage limits are suitable for your needs.

Reading customer reviews and understanding the reputation and financial stability of insurance providers can also be beneficial. By considering these factors, postal employees can select an insurance provider that offers the best combination of coverage, customer service, and competitive rates.

Common Mistakes to Avoid When Buying Auto Insurance as a Postal Employee

When purchasing auto insurance as a postal employee, some common mistakes should be avoided to ensure adequate protection. One mistake is not considering the specific needs associated with the nature of the job. Failing to account for high mileage, frequent stops, and exposure to challenging weather conditions may result in insufficient coverage.

Another mistake to avoid is simply choosing the cheapest policy without evaluating the coverage provided. While affordability is important, it is also crucial to ensure that the policy adequately protects you financially. Postal employees should strike a balance between cost and coverage to avoid potential financial hardships in case of a car accident.

How to File an Insurance Claim as a Postal Worker

Filing an insurance claim as a postal worker can be daunting, but understanding the steps involved can make it smoother. It is crucial to promptly report any accidents or incidents to your insurance provider and provide all the necessary documentation, such as police reports and photographs of the damage. Read more: Why You Should Always Take Pictures After a Car Accident

Melanie Musson Published Insurance Expert

Cooperating fully with the insurance claims adjuster and providing accurate and detailed information about the incident will also facilitate the process. Following the outlined steps in your insurance policy and maintaining open communication with your provider will help ensure a seamless claims experience.

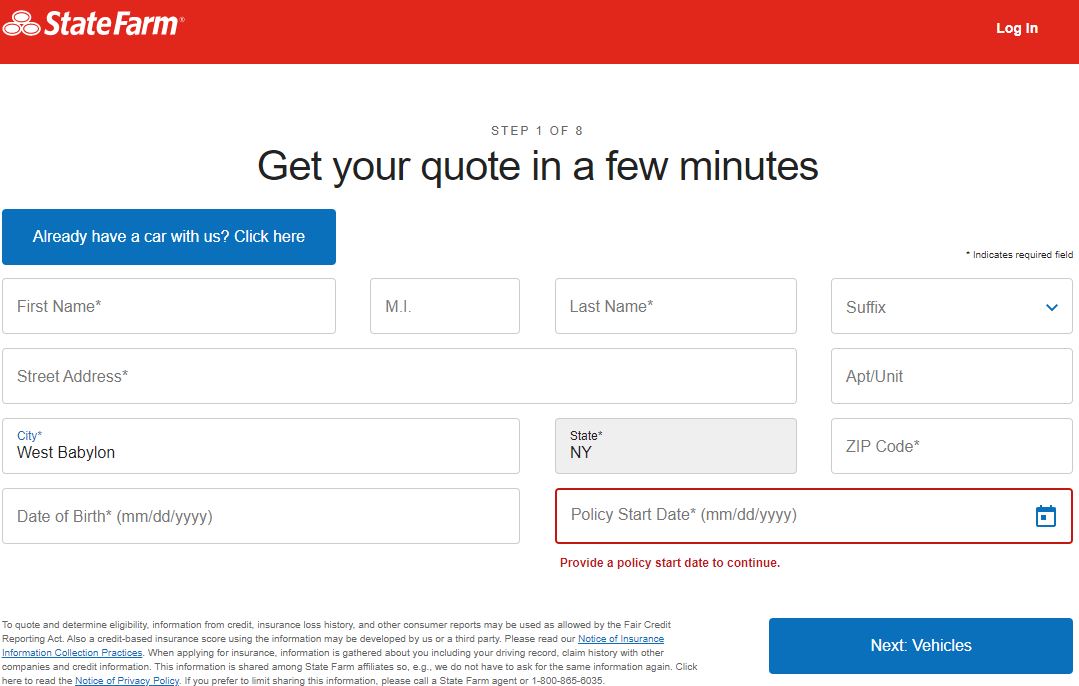

For example, the State Farm claim process is designed to be straightforward, allowing you to file claims online, through their mobile app, or by contacting an agent directly. Following the outlined steps in your insurance policy and maintaining open communication with your provider, such as State Farm, will help ensure a seamless claims experience.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Benefits of Bundling Home and Auto Insurance for Postal Employees

Bundling home and auto insurance policies can offer significant benefits for postal employees. By combining policies (read our “Combined Insurance Review & Ratings” for more information) with one provider, policyholders can often enjoy discounted rates and streamlined coverage management. Bundling can result in cost savings, as insurance companies frequently offer discounts for multiple policies.

Moreover, having both home and auto insurance with one provider may simplify claims processes, as there will be a single point of contact for any issues that arise. This can enhance efficiency and ensure a smoother experience in case of a claim.

Driving Record’s Role in Obtaining Low-Cost Insurance for Postal Workers

A clean driving record is crucial in obtaining the cheapest car insurance quotes for postal workers. Insurance providers often reward drivers with a history of responsible driving by offering lower premiums. On the other hand, a record of frequent traffic violations and accidents can result in higher insurance rates.

Postal employees should prioritize safe driving habits and adhere to traffic laws to maintain a clean driving record. Taking defensive driving courses may also demonstrate a commitment to safe driving and potentially lead to discounted rates offered by insurance providers.

Additional Coverage Options for Postal Employees

Besides standard coverage options, postal employees may want to consider additional coverage benefits such as roadside assistance and rental car reimbursement. Roadside assistance can provide peace of mind and practical support in case of breakdowns or other automotive emergencies.

Rental car reimbursement is another valuable coverage option, as it ensures that postal employees have access to alternative transportation while their vehicle is being repaired after an accident. Exploring and understanding these additional coverage options can help postal workers tailor their insurance policies to their specific needs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Save on Auto Insurance Premiums as a Postal Employee

Postal employees can maximize their savings on auto insurance premiums by implementing several strategies. Firstly, maintaining a good credit score can help in securing lower rates. When determining premiums, insurance providers often consider credit history as a factor.

Furthermore, taking advantage of available discounts, such as those for safe driving records, affiliations with certain organizations, or completion of defensive driving courses, can result in reduced premiums. Regularly reviewing and updating the insurance policy to reflect any changes, such as vehicle upgrades or changes in driving habits, is also essential to avoid overpaying for coverage.

The Pros and Cons of Car Insurance Deductibles for Postal Workers

Choosing the right deductible is an important decision for postal workers. A deductible is the amount policyholders must pay out of pocket before insurance coverage kicks in, and it directly affects insurance premiums. Opting for a higher deductible can result in lower premiums, but it also means assuming more financial risk in case of a collision accident.

Postal employees should carefully evaluate their financial situation and risk tolerance when selecting a deductible. It is important to strike a balance between a deductible that leads to affordable premiums while still being manageable in case an accident occurs.

What to Expect When Filing an Auto Insurance Claim as a Postal Employee

Knowing what to expect when filing an auto insurance claim as a postal employee can help alleviate any concerns throughout the process. After reporting the incident to your insurance provider, a claims adjuster will be assigned to assess the damages and determine the coverage provided by your policy.

The claims adjuster will work with you to gather all necessary documentation, such as police reports, eyewitness statements, and proof of damages. Once the claims adjuster has reviewed all the necessary information, they will guide you through the compensation process and work towards a resolution.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Coverage Considerations for Personal Vehicles Used by Postal Employees

When personal vehicles are used for work purposes as a postal employee, it is crucial to consider the appropriate insurance coverage. The vehicle should be insured for both personal and business use to ensure comprehensive protection. Postal employees should carefully review their insurance policies to make sure they have the correct coverage in place.

Moreover, it is advisable to inform the insurance provider when using a personal vehicle for work-related activities. Failure to disclose this information could potentially lead to a claim denial in case of an accident while on duty.

Read more: Best Car Insurance by Vehicle

Tips for Maintaining a Clean Driving Record to Keep Insurance Costs Low

Maintaining a clean driving record is key to keeping insurance costs low for postal workers. It is important to always follow traffic laws, avoid speeding, and prioritize safe driving habits. Additionally, attending defensive driving courses can refresh driving skills and potentially lead to discounted insurance rates.

Avoiding accidents and traffic violations not only keeps insurance premiums affordable but also helps preserve a positive driving record, which can be an asset when negotiating rates with insurance providers. Consistently practicing safe driving habits can help you get a safe driver car insurance discount.

The Impact of Vehicle Type and Usage on Auto Insurance Rates for Postal Workers

The type of vehicle and its usage plays a significant role in determining auto insurance rates for postal workers. Insurance providers consider factors such as the vehicle’s make, model, age, safety features, and market value when calculating premiums.

Higher-priced or sportier cars may result in higher insurance costs due to increased potential repair and replacement expenses. Read more: How do insurance companies define sports cars?

Laura Walker Former Licensed Agent

Usage is also a critical factor, with postal workers who use their vehicles for business purposes typically facing higher insurance premiums. It is important to accurately disclose the vehicle’s usage to the insurance provider to ensure proper coverage and avoid potential claim denials.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors in Determining Liability Coverage Limits for Postal Employees

Determining liability insurance coverage limits is essential for postal employees. Liability coverage protects against claims for damages and injuries caused to others in an accident where the insured driver is at fault. When considering the appropriate liability coverage limits, factors such as personal assets, income, and potential legal expenses need to be evaluated.

It is crucial to select liability coverage limits that adequately protect your financial interests in case of an accident. Postal employees should carefully consider their personal circumstances and consult with insurance professionals to determine the appropriate level of liability coverage for their needs to avoid potential financial hardships resulting from an accident.

The Importance of Regular Auto Insurance Reviews for Postal Employees

Regularly reviewing and updating your auto insurance policy as a postal employee is vital to ensure you have the coverage you need. Life circumstances, vehicle changes, or modifications to your job requirements may all impact your insurance needs, making it necessary to adjust your policy accordingly.

By staying proactive and regularly reviewing your policy, you can identify any gaps in coverage and make necessary updates. This ensures that you remain adequately protected both on and off the job.

By considering all these factors and making informed decisions, postal employees can navigate the complexities of auto insurance and find the best coverage options tailored to their unique needs. Remember, your auto insurance policy is a crucial safeguard on the road, providing financial protection and added peace of mind.

Learn more: Best Auto Insurance Discounts for Postal Employees

Case Studies: Top Car Insurance Companies for Postal Employees

This brief explores the car insurance landscape for postal employees, showcasing how companies like State Farm, Progressive, and Allstate cater to their specific needs with discounts and tailored coverage options through case studies of individuals making informed choices.

Case Study #1 – Unlock Employee Discounts

In this fictional case, postal worker Alex opts for State Farm, enticed by the up to 25% employee discounts and an additional 18% discount. Enjoying a stellar monthly rate of $86 for full coverage, Alex finds State Farm’s reputation for customer service and financial stability reassuring.

Case Study #2 – Experience Professional Savings

In our hypothetical scenario, postal worker Jordan seeks professional savings and chooses Progressive for its up to 20% discount. Although the monthly rate for good drivers is $109.17, Jordan values the flexibility in coverage options and the convenience of Progressive’s online tools.

Case Study #3 – Ensuring Carrier Coverage

For fictional postal employee Taylor, carrier coverage is a priority, leading to the selection of Allstate. With an up to 19% discount, Taylor values Allstate’s A+ rating and extensive coverage options. The monthly rate of $160 for full coverage insurance reflects the emphasis on carrier-specific needs.

The experiences of Alex, Jordan, and Taylor highlight the tailored insurance solutions available to postal workers, underlining the value of comparing offers to secure the best coverage and postal service employee discounts tailored to their unique professional requirements.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tailored Car Insurance Solutions for Postal Employees: Top Picks for Coverage and Savings

Postal employees have unique car insurance needs due to their job demands, including frequent driving, high mileage, and potential risks on the road. State Farm, Progressive, and Allstate are the top choices for postal workers, offering tailored coverage, discounts, and reliable service.

State Farm stands out with its competitive rates and employee-focused benefits, while Progressive and Allstate provide professional savings and specialized plans for carriers. By comparing options and considering factors like discounts, coverage limits, and policy features, postal employees can secure comprehensive protection while maximizing savings.

If you’re wondering, “How much car insurance do I need?” consider factors like your driving habits, vehicle value, and coverage preferences. Save by entering your ZIP code below into our free comparison tool to find the best car insurance rates.

Frequently Asked Questions

How can postal employees save money on car insurance?

Postal employees can save money by taking advantage of car insurance discounts, maintaining a good driving record, bundling their car insurance with other insurance policies, opting for a higher deductible, and comparing quotes from multiple insurance companies.

What factors make State Farm the best car insurance for postal workers?

State Farm stands out for postal employees due to its up to 25% employee discounts, additional savings of up to 18%, and a low complaint level. The combination of affordability and a strong reputation makes it a popular choice.

How does Progressive cater to postal workers’ needs?

Progressive appeals to postal employees with up to 20% professional savings, offering flexibility in coverage options. While rates may be slightly higher, the company’s user-friendly tools and range of options make it an attractive choice.

Can USPS employees get special auto insurance rates?

Yes, auto insurance for USPS employees offers special rates and USPS employee car insurance discount, recognizing their government status.

What makes Allstate suitable for carrier coverage?

Allstate provides up to 19% discounts specifically for carrier coverage, emphasizing its commitment to meeting the unique needs of postal employees. With an A+ rating and a diverse array of coverage options, Allstate ensures comprehensive protection.

By entering your ZIP code, you can get instant car insurance quotes from top providers.

How does Liberty Mutual benefit postal employees beyond standard coverage?

Liberty Mutual offers up to 18% in service benefits, providing additional value for postal workers. While customizable coverage options are available, potential restrictions and customer feedback on claims processes must be considered.

What should I look for in car insurance for postal workers?

Look for policies offering comprehensive coverage, flexibility for work-related vehicle use, and potential auto insurance discounts for postal workers.

What is car insurance for postal employees?

Car insurance for postal employees is tailored coverage designed to meet the unique needs of individuals working in mail delivery and postal services.

How does auto insurance for postal workers differ from standard policies?

Auto insurance for postal workers may offer specific benefits and discounts that address the higher mileage and unique risks associated with postal duties.

Do postal workers get government discounts on auto insurance?

Postal workers often qualify for government employee discounts on auto insurance, recognizing their contributions as federal employees.

Does the APWU offer auto insurance?

Can I get car insurance at the post office?

What is Georgia Farm Bureau roadside assistance?

What type of car insurance do mail carriers need?

How does car insurance with post office work?

What types of insurance for postal workers are available?

What discounts for postal employees are available on car insurance?

Are there any specific discounts for postal workers?

What does post insurance cover?

What is mail car insurance?

What does postal insurance cover?

Which type of car insurance is best?

What is the most trusted car insurance company?

Who is known for the cheapest car insurance?

Which insurance cover is best for a car?

What is the maximum postal insurance?

Which type of car insurance is the cheapest?

What is the lowest form of car insurance?

What are the top 3 types of insurance?

What vehicles are best for insurance?

What is the number 1 safest car company?

Which car insurance covers the most?

Who gives the best car insurance?

What is the cheapest reliable car to insure?

What is the most expensive car to insure?

Which type of insurance is best for a car?

What are the benefits of a post office worker?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.