Best Car Insurance for Uber Drivers in 2026 (Your Guide to the Top 10 Companies)

Progressive, Allstate, and State Farm stand out as the top choices for the best car insurance for Uber drivers, starting with competitive plans as low as $38 monthly. These providers offer extensive, cost-effective coverage options tailored specifically to address the distinct needs faced by Uber drivers.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Michael Leotta

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Updated January 2025

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Uber Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Uber Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Uber Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsThe top picks for the best car insurance for Uber drivers are Progressive, Allstate, and State Farm, known for their competitive rates and tailored coverage.

Whether you boast an excellent credit score, maintain low mileage, or possess a pristine driving record, this guide unveils how these companies offer the most advantageous rates tailored to diverse circumstances. Stay with us as we delve into the data, providing key insights into how these influential factors shape insurance rates, guiding you towards the optimal choice for your unique needs.

Our Top 10 Company Picks: Best Car Insurance for Uber Drivers

| Company | Rank | Good Driver Discount | Multi-Policy Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 18% | 14% | Rideshare Coverage | Progressive | |

| #2 | 20% | 16% | Ride for Hire | Allstate | |

| #3 | 15% | 12% | Extensive Agent | State Farm | |

| #4 | 14% | 10% | Auto Policies | Geico | |

| #5 | 16% | 11% | Educational Discounts | Farmers | |

| #6 | 17% | 13% | Competitive Rates | Travelers | |

| #7 | 13% | 15% | Car Replacement | Liberty Mutual |

| #8 | 18% | 14% | SmartRide Program | Nationwide |

| #9 | 15% | 12% | Personalized Service | American Family | |

| #10 | 14% | 11% | Member Benefits | AAA |

In recent years, the rise of rideshare services like Uber has revolutionized the transportation industry. As more and more individuals become Uber drivers, it becomes crucial for them to understand the unique insurance needs that come with this line of work.

- Progressive is the top pick for Uber drivers seeking robust coverage

- Policies address unique insurance needs during rideshare operations

- Coverage options are specifically designed for Uber drivers

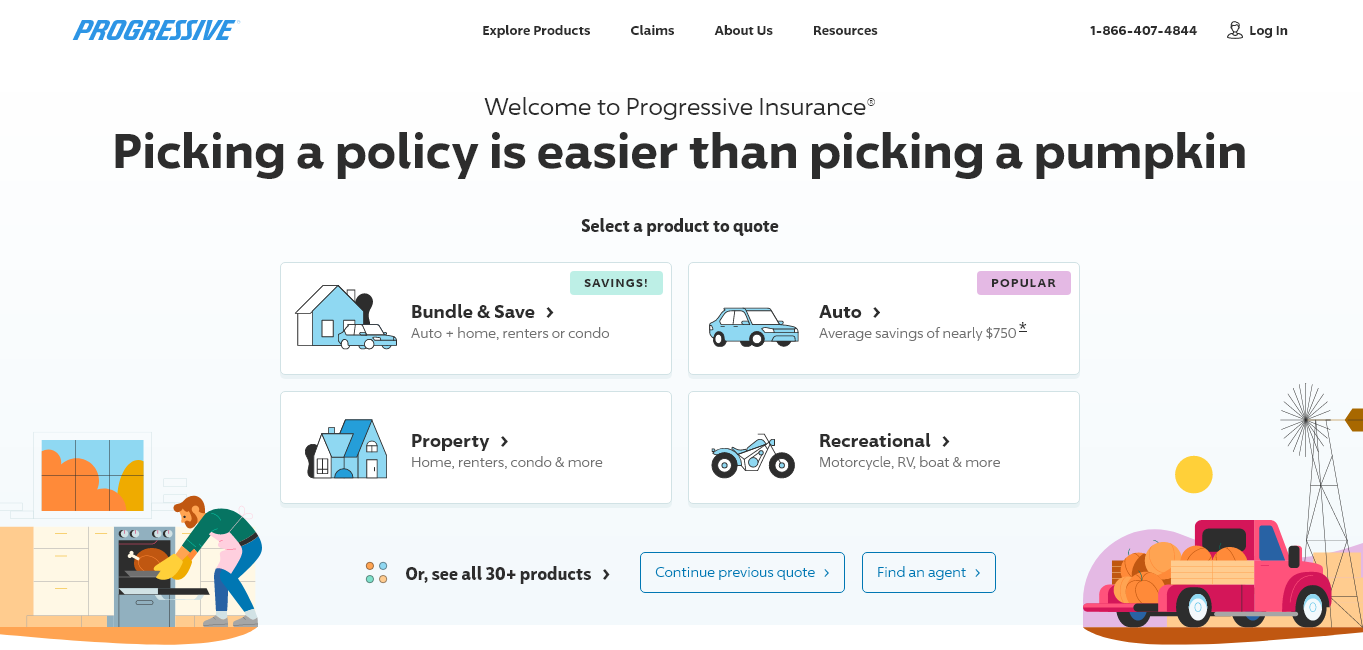

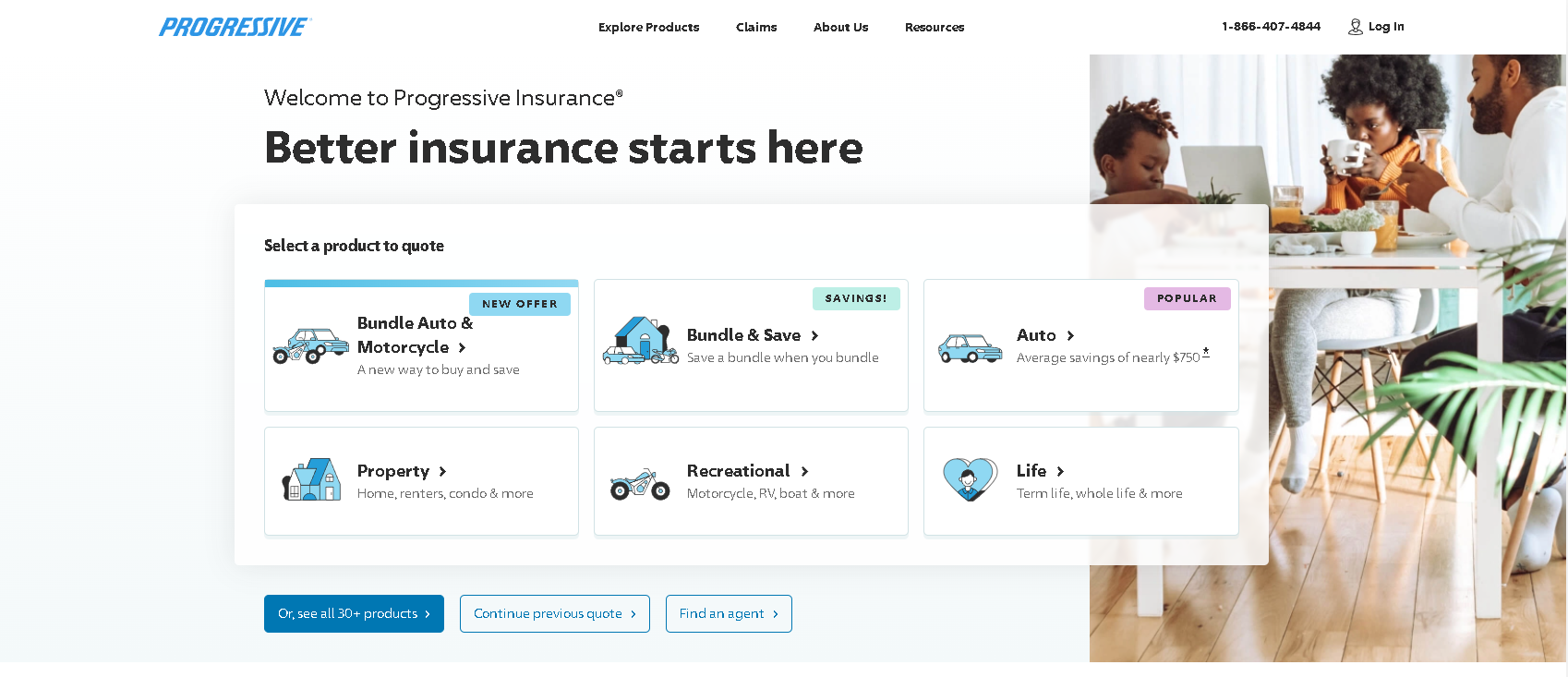

#1 – Progressive: Top Overall Pick

Pros

- Rideshare Coverage: Progressive is specially tailored for rideshare drivers, offering 18% off for good drivers.

- Multi-Policy Discount: Provides a 14% discount when bundling multiple policies. Discover insights in our Progressive insurance review & ratings.

- Customer Service: Known for responsive customer support tailored to driver needs.

Cons

- Higher Base Premiums: Despite discounts, premiums can be higher than some competitors.

- Limited Additional Discounts: Fewer opportunities for discounts beyond standard offers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Allstate: Best for Ride for Hire

Pros

- Ride for Hire Focus: Allstate offers coverage ideal for drivers engaged in ride-for-hire services with a 20% good driver discount. Unlock details in our Allstate insurance review & ratings.

- Strong Multi-Policy Discount: 16% discount on bundling policies enhances savings.

- Robust Coverage Options: Extensive coverage options that cater specifically to ride-for-hire drivers.

Cons

- Cost: Relative to competitors, Allstate can be expensive even with discounts.

- Claim Processing: Some users report slower claim processing times.

#3 – State Farm: Best for Extensive Agent

Pros

- Bundling Policies: Offers significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: Provides a substantial discount for low-mileage usage.

- Wide Coverage: Offers various coverage options tailored for different business needs. Delve into our evaluation of State Farm insurance review & ratings.

Cons

- Limited Multi-Policy Discount: The multi-policy discount is lower (12%) compared to some competitors.

- Premium Costs: Despite discounts, premiums might still be relatively higher for certain coverage levels.

#4 – Geico: Best for Car Policies

Pros

- Auto Policy Expertise: Geico is renowned for its auto policies, offering a 14% good driver discount.

- Simpler Policy Management: Streamlined policy management ideal for individual vehicle owners.

- Cost-Effective Options: Competitive pricing on basic and comprehensive auto policies. Access comprehensive insights into our “Do Geico Employees get Car insurance discounts?“

Cons

- Less Flexibility: Fewer options for customization compared to competitors.

- Smaller Multi-Policy Discount: Only a 10% discount for bundling policies.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Educational Discounts

Pros

- Educational Discounts: Farmers offers discounts for educational purposes, including a 16% good driver discount.

- Variety of Coverage: Diverse insurance options that cater to different segments including educational institutions.

- Customer Support: Strong customer support tailored to specific client groups. Discover more about offerings in our Farmers insurance review & ratings.

Cons

- Limited Reach: Coverage options might not be as extensive in all regions.

- Higher Costs for Specific Plans: Certain plans can be more costly relative to basic coverage.

#6 – Travelers: Best for Competitive Rates

Pros

- Competitive Rates: Offers competitive rates with a 17% discount for good drivers.

- Strong Policy Options: Wide range of policy options suitable for various needs.

- Multi-Policy Savings: 13% discount for bundling policies, adding value. Check out insurance savings in our complete Travelers insurance review & ratings.

Cons

- Coverage Limitations: Some coverage areas might be more limited compared to other big names.

- Service Variability: Service quality can vary significantly from one region to another.

#7 – Liberty Mutual: Best for Car Replacement

Pros

- Car Replacement: Liberty Mutual stands out with options for car replacement.

- Strong Multi-Policy Discount: Offers a 15% discount on multiple policies. Read up on the Liberty Mutual insurance review & ratings for more information.

- Customer Oriented: Tailors services to meet the specific needs of individual customers.

Cons

- Higher Premiums: Tends to have higher premiums for advanced features.

- Complex Policy Details: Some customers find policy structures complex.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Smartride Program

Pros

- SmartRide Program: Offers unique SmartRide program with discounts up to 18% for good drivers.

- Substantial Multi-Policy Discount: Strong 14% discount for bundling policies. More information is available about this provider in our Nationwide insurance review & ratings.

- Innovative Coverage Solutions: Provides innovative solutions tailored to modern driving habits.

Cons

- Cost: May be more expensive compared to other insurers with similar offerings.

- Navigational Challenges: Some users report difficulties with managing their policies online.

#9 – American Family: Best for Personalized Service

Pros

- Personalized Service: Known for its high level of personalized customer service.

- Diverse Coverage: Offers a range of insurance products with a focus on personal touch.

- Good Driver Reward: 15% discount for maintaining a good driving record. See more details on our American Family insurance review & ratings.

Cons

- Higher Rates: Generally higher rates for premium services.

- Limited Discounts: Fewer discount options for bundling compared to others.

#10 – AAA: Best for Member Benefits

Pros

- Membership Benefits: AAA provides extensive benefits and services to its members.

- Focused Discounts: Offers targeted discounts including an 11% multi-policy discount.

- Roadside Assistance: Renowned for exceptional roadside assistance services. Learn more in our AAA insurance review & ratings.

Cons

- Membership Requirement: Benefits are tied to membership, which might be a barrier for some.

- Limited Customization: Fewer options for policy customization compared to others.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Navigating Coverage Discounts for Uber Drivers: Tailored Incentives From Top Insurance Providers

For Uber drivers, navigating car insurance involves a crucial balance between comprehensive coverage and budget considerations. This section provides insights into specific coverage rates tailored for Uber drivers, offering a detailed overview of average monthly rates for both minimum and full coverage policies from various insurance providers.

Car Insurance for Uber Drivers: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $38 | $86 |

| Allstate | $67 | $160 |

| American Family | $51 | $117 |

| Farmers | $64 | $139 |

| Geico | $32 | $80 |

| Liberty Mutual | $77 | $174 |

| Nationwide | $53 | $115 |

| Progressive | $50 | $105 |

| State Farm | $39 | $86 |

| Travelers | $40 | $99 |

Understanding the intricacies of specific coverage rates is vital for Uber drivers, who operate in a unique professional context that blends personal and commercial use of their vehicles. Progressive, known for its flexibility, offers rates of $50 for minimum coverage and $105 for full coverage, catering to Uber drivers who value versatile insurance options.

Allstate, with its comprehensive offerings, showcases average rates of $67 for minimum coverage and $160 for full coverage, providing Uber drivers with robust protection. State Farm, recognized for its reliability, offers rates of $39 for minimum coverage and $86 for full coverage, presenting affordable options for Uber drivers seeking trustworthy coverage.

As Uber drivers make decisions regarding their insurance choices, this breakdown of specific coverage rates becomes a valuable tool, assisting in aligning choices with both budget constraints and the need for tailored protection in their dynamic professional landscape. Learn more in our “What is included in comprehensive car insurance?”

Understanding the Unique Insurance Needs of Uber Drivers

Unlike traditional personal car insurance policies, which typically exclude coverage for commercial activities, Uber drivers require a specialized insurance policy. This is because they are providing a service for which they receive compensation, raising their risk profile in the eyes of insurance companies.

As such, it is essential to have an car insurance policy that provides adequate coverage while you drive for Uber. One of the main reasons why traditional personal car insurance policies do not cover Uber driving is due to the insurance “gap” that exists during different periods of Uber driving. When you are not actively engaged in a ride or waiting for a passenger, your personal car insurance policy is typically in effect.

However, once you accept a passenger request or have a passenger in your vehicle, your personal policy no longer covers you. During this time, Uber provides limited liability coverage, but it may not offer full protection for all situations. It is important to note that the insurance coverage provided by Uber may vary depending on the specific stage of the ride.

For example, during the period when you have accepted a passenger request but have not yet picked up the passenger, Uber’s liability coverage may be limited. This means that if an accident were to occur during this time, you may not have sufficient coverage to protect yourself and your vehicle.

Case Studies: Best Car Insurance for Uber Drivers

Navigating the world of rideshare driving comes with its own set of challenges, from unexpected accidents to mechanical failures. This collection of case studies showcases how top insurance providers have stepped in with solutions that are as compassionate as they are comprehensive, truly understanding the needs of their clients.

- Case Study #1 – Bridging Coverage Gaps: Recently, Uber driver Sarah faced an unexpected challenge when involved in an accident during a ride. Her personal car insurance coverage was insufficient during this active rideshare period. Fortunately, Progressive’s rideshare coverage came to the rescue. Progressive’s comprehensive policy ensured that Sarah received the necessary coverage, addressing the unique insurance gaps that often arise during Uber driving.

- Case Study #2 – A Ride for Hire, A Shield for Protection: John, an experienced Uber driver, found solace in Allstate’s “Ride for Hire” coverage. During a ride, his vehicle encountered an unexpected mechanical issue, leading to additional expenses. Allstate’s specialized coverage not only addressed the repair costs but also ensured John’s income loss during the downtime was compensated.

- Case Study #3 – Personalized Support in Times of Need: When Uber driver Mark faced a complex claims process after an accident, he turned to State Farm for assistance. State Farm’s extensive agent support proved invaluable, guiding Mark through the claims procedure and ensuring a swift resolution. This personalized assistance went beyond the typical insurance experience, demonstrating State Farm’s commitment to providing tailored support for rideshare drivers.

These stories illuminate the vital role of personalized insurance in the lives of rideshare drivers, showcasing how companies like Progressive, Allstate, and State Farm have gone the extra mile to provide support when it’s most needed.

Jeff Root Licensed Life Insurance Agent

Through these examples, we see the profound impact of having an insurance partner that truly understands and responds to the unique demands of rideshare driving.

Learn more: Best Auto Insurance Discounts for Rideshare Driver

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Practices for Maintaining a Good Driving Record and Lowering Your Premiums

In addition to selecting the right car insurance policy, Uber drivers should also focus on maintaining a good driving record. Insurance companies often consider driver history when determining premiums, and a clean driving record can significantly impact your rates. See more details on how does the insurance company determines my premium.

Some best practices for maintaining a good driving record and lowering your premiums as an Uber driver include obeying traffic laws at all times, avoiding distractions while driving, and regularly servicing and maintaining your vehicle. Additionally, it is crucial to continuously update your insurance company with any changes in your driving circumstances and promptly report any accidents or claims that may arise.

Lowering your premiums can also be achieved by taking defensive driving courses, which may offer discounts on your car insurance. These courses not only help you become a safer driver but can also save you money in the long run. In conclusion, finding the best car insurance for Uber drivers requires careful consideration of the unique insurance needs, available coverage options, and price.

By understanding the factors to consider when choosing car insurance for Uber drivers, comparing different options, and keeping in mind the essential coverage types every Uber driver should have, you can make an informed decision that ensures your financial protection.

Combined with proper driving practices and a focus on maintaining a good driving record, you can enjoy peace of mind while providing transportation services as an Uber driver. Another important practice for maintaining a good driving record and lowering your premiums is to avoid driving under the influence of alcohol or drugs.

Not only is it illegal and dangerous, but it can also lead to serious consequences for your insurance rates. By always driving sober and making responsible choices, you can protect yourself and others on the road.

Furthermore, it is essential to be aware of your surroundings and practice defensive driving techniques. This includes staying alert, anticipating potential hazards, and maintaining a safe following distance. By being proactive and cautious on the road, you can reduce the likelihood of accidents and demonstrate your commitment to safe driving, which can positively impact your insurance premiums.

Our free online comparison tool below allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

Frequently Asked Questions

Why do Uber drivers need specialized insurance coverage?

Traditional personal car insurance policies often exclude coverage for commercial activities, and Uber driving falls into this category. Specialized insurance is necessary as Uber drivers are providing a service for compensation, altering their risk profile in the eyes of insurance companies. Without specific coverage, drivers may face gaps in protection during different stages of Uber driving.

Learn more in our “Types of Car Insurance Coverage.”

How does rideshare coverage address the insurance gap during Uber driving?

Rideshare coverage bridges the insurance gap by providing additional protection for drivers using their personal vehicles for services like Uber. It comes into play during the periods when personal car insurance is typically inactive – specifically, when a driver has accepted a ride request or has a passenger in the vehicle. This coverage ensures comprehensive protection during all stages of the ride.

What factors should Uber drivers consider when choosing car insurance?

Uber drivers should weigh factors such as coverage options tailored for ridesharing, the cost of the insurance policy, deductible amounts, the insurance company’s customer service reputation, additional benefits or discounts for Uber drivers, and adherence to specific state or city requirements. Considering these factors ensures drivers select a policy that meets their unique needs.

How can Uber drivers lower their insurance premiums?

Maintaining a good driving record is crucial for lowering insurance premiums. Obeying traffic laws, avoiding distractions while driving, regular vehicle maintenance, and promptly reporting any changes in driving circumstances or accidents contribute to a positive record. Additionally, taking defensive driving courses, staying sober while driving, and practicing defensive driving techniques can lead to discounts.

What are some insurance companies that offer ridesharing coverage for Uber drivers?

Some insurance companies that offer ridesharing coverage for Uber drivers include Geico, Progressive, Allstate and Statefarm. Before making a decision, it’s advisable for Uber drivers to compare coverage options, pricing, and additional benefits offered by these companies to find the best fit for their specific needs.

For additional details, explore our comprehensive resource titled “Best Auto Insurance Discounts for Uber Drivers.”

What does insurance for rideshare drivers cover?

Insurance for rideshare drivers typically covers the gaps between personal auto insurance and the coverage provided by rideshare companies, offering protection while the app is on but before a ride is accepted.

What are the benefits of AAA rideshare insurance?

AAA rideshare insurance provides additional coverage during all phases of ridesharing, including when the app is turned on and no passengers are yet picked up, which is often not covered by personal insurance.

Is there specific AAA uber insurance available?

Yes, AAA offers uber insurance that specifically caters to Uber drivers, covering periods that are not fully covered by Uber’s own policy, such as waiting for a ride request.

What is included in Allstate ride for hire coverage?

Allstate ride for hire coverage includes additional protection for drivers when logged into a ridesharing app and waiting for a job, extending beyond typical personal auto insurance limits.

To find out more, explore our guide titled “How to Get Free Insurance Quotes Online.”

How does Allstate uber insurance support drivers?

Allstate uber insurance provides a seamless coverage experience by covering drivers from the moment they turn on their Uber app to when they drop off their passengers, ensuring they are protected during all phases of the drive.

What does American Family rideshare insurance cover?

What should I look for in auto insurance for Uber drivers?

What is the average price of a rideshare insurance policy in Arizona?

Which provider offers the best auto insurance for rideshare drivers?

Who provides the best auto insurance for Uber drivers?

What is the best car insurance for gig workers?

Which provider offers the best car insurance for rideshare drivers?

What are the best insurance companies for Uber drivers?

Who is the best insurance company for Uber drivers?

What is the best insurance for rideshare drivers?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.