Best Business Insurance for Locksmiths in 2026 (Top 10 Companies)

The Hartford, Travelers, and Nationwide are the best business insurance for locksmiths, with rates starting as low as $45 per month. These companies offer comprehensive coverage tailored specifically to address the unique needs and ensuring protection against potential challenges and unforeseen circumstances.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Tim Bain is a licensed life insurance agent with 23 years of experience helping people protect their families and businesses with term life insurance. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated January 2025

765 reviews

765 reviewsCompany Facts

Full Coverage For Locksmiths

A.M. Best Rating

Complaint Level

Pros & Cons

765 reviews

765 reviews 1,733 reviews

1,733 reviewsCompany Facts

Full Coverage For Locksmiths

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage For Locksmiths

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsThe top picks for the best business insurance for locksmiths are The Hartford, Travelers and Nationwide, offering tailored protection and competitive rates.

This comprehensive coverage guide meticulously explores not only the coverage rates but also delves into the diverse range of options and enticing discounts provided by the industry’s leading insurance providers.

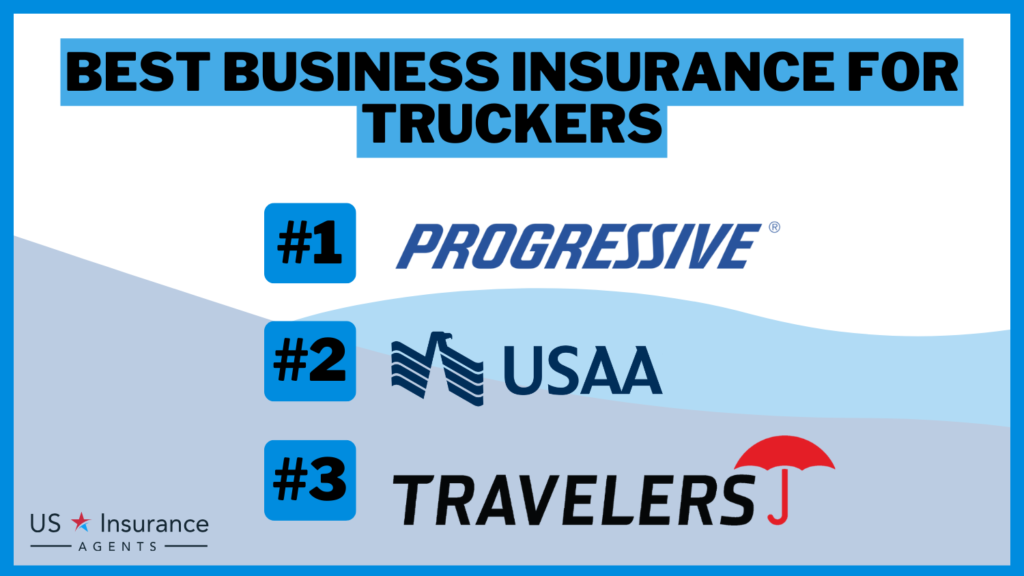

Our Top 10 Company Picks: Best Business Insurance for Locksmiths

| Company | Rank | Multi-Policy Discount | Liability Coverage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | 15% | Comprehensive Care | The Hartford |

| #2 | 15% | 12% | Customized Solutions | Travelers | |

| #3 | 12% | 10% | Network of Providers | Nationwide |

| #4 | 15% | 10% | Online Convenience | Progressive | |

| #5 | 10% | 12% | Flexible Coverage | Liberty Mutual |

| #6 | 12% | 15% | Risk Management | CNA | |

| #7 | 15% | 10% | Small Businesses | Hiscox |

| #8 | 10% | 12% | High-Value Assets | Chubb | |

| #9 | 12% | 15% | Customized Policies | Allstate | |

| #10 | 15% | 10% | Personalized Service | Farmers |

It highlights key aspects and empowers locksmiths with the knowledge needed to make informed decisions, thereby enabling them to safeguard their businesses with unwavering confidence and peace of mind.

Stop overpaying for your insurance by entering your ZIP code above to find the lowest rates in your area.

- The Hartford stands out as the top overall pick, rates start at $45/month

- Tailored coverage options to address locksmiths’ unique risks and challenges

- Ensures locksmiths’ businesses are safeguarded against unforeseen circumstances

#1 – The Hartford: Top Overall Pick

Pros

- Comprehensive Coverage: The Hartford insurance review & ratings highlight a generous 15% discount on liability coverage, providing locksmiths with comprehensive business protection.

- Multi-Policy Savings: With a 10% multi-policy discount, businesses can benefit from additional savings when bundling insurance needs with The Hartford.

- Well-Rounded Care: Known for comprehensive care, The Hartford understands and caters to the unique insurance needs of locksmiths.

Cons

- Moderate Multi-Policy Discount: While a 10% discount is offered, some competitors may provide more attractive multi-policy savings.

- Limited Customization: Locksmiths seeking highly customized solutions may find The Hartford’s offerings somewhat standardized.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Travelers: Best for Tailored Solutions

Pros

- Customized Solutions: Travelers stands out with a 15% multi-policy discount, allowing locksmiths to tailor their insurance solutions for optimal coverage.

- Competitive Liability Rates: A 12% liability coverage discount ensures locksmiths get cost-effective coverage without compromising on protection.

- Diverse Options: Travelers insurance review & ratings highlight Travelers’ reputation for offering tailored solutions to accommodate the diverse requirements and preferences of locksmiths.

Cons

- Slightly Lower Liability Discount: While competitive, the 12% liability discount might be slightly lower than what some competitors offer.

- Might not Offer the Lowest Prices: Locksmiths focused on the most budget-friendly options may find other providers with lower rates.

#3 – Nationwide: Best for Network Strength

Pros

- Network of Providers: Nationwide stands out with a 12% multi-policy discount, providing locksmiths with a network of reliable insurance options.

- Balanced Coverage: Locksmiths receive comprehensive protection at a competitive price with a 10% discount on liability coverage through Nationwide insurance review & ratings.

- Solid Reputation: Nationwide is known for its reliability and extensive network, making it a trusted choice for locksmiths.

Cons

- Slightly Lower Multi-Policy Discount: Some competitors offer higher multi-policy discounts, potentially making them more attractive for cost-conscious locksmiths.

- Might not Offer the Lowest Prices: Businesses with highly specific needs may find Nationwide’s offerings more generalized.

#4 – Progressive: Best for Online Convenience

Pros

- Convenient Online Services: Progressive provides a 15% multi-policy discount, coupled with online convenience, offering locksmiths an easy and streamlined insurance experience.

- Competitive Multi-Policy Discount: The 15% multi-policy discount ensures locksmiths can save significantly by bundling their coverage with Progressive.

- Nationwide Accessibility: Progressive insurance review & ratings showcases an effective digital platform, facilitating locksmiths nationwide in effortlessly accessing and overseeing their insurance policies.

Cons

- Average Liability Discount: While a 10% liability coverage discount is offered, some competitors may provide higher discounts in this category.

- May Lack Customization: Locksmiths with highly specific needs might find Progressive’s offerings less tailored compared to other providers.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Flexibility

Pros

- Flexible Coverage Options: Liberty offers locksmiths a 12% liability coverage discount with a focus on flexibility, allowing businesses to customize coverage to their unique needs.

- Balanced Discounts: Liberty Mutual insurance review & ratings showcase a balanced savings strategy for locksmiths, featuring a 10% multi-policy discount on bundled insurance.

- Versatile Coverage Solutions: Liberty stands out for its commitment to flexible coverage, accommodating locksmiths with various business models.

Cons

- Moderate Multi-Policy Discount: While 10% is competitive, some rivals may offer higher multi-policy discounts, potentially attracting more budget-conscious locksmiths.

- May Lack Specialization: Businesses with highly specialized needs might find Liberty’s offerings more generalized compared to industry-specific providers.

#6 – CNA: Best for Managing Risk

Pros

- Focus on Risk Management: CNA specializes in risk management, providing locksmiths with a 15% multi-policy discount and tailored coverage addressing specific business risks.

- Competitive Multi-Policy Discount: The 15% discount enhances the appeal for locksmiths seeking comprehensive coverage while saving on bundled policies.

- Specialized Expertise: CNA insurance review & ratings highlight the specialized risk management support provided to locksmiths, catering to businesses confronting distinct obstacles with valuable expertise.

Cons

- May not be the Most Affordable: While competitive, CNA’s rates may not be the most budget-friendly option for locksmiths looking for cost-effective coverage.

- Potentially Limited Customization: Locksmiths seeking highly customized policies might find CNA’s offerings more standardized.

#7 – Hiscox: Best for Tailored Assistance

Pros

- Tailored for Small Businesses: Hiscox focuses on small businesses, offering a 15% multi-policy discount and specialized coverage that caters to the unique needs of locksmiths.

- Competitive Multi-Policy Discount: Hiscox offers a 15% discount, making it an attractive choice for locksmiths seeking to combine their coverage at a more budget-friendly rate, particularly with its low-mileage discounts.

- Specialized Coverage: Hiscox’s emphasis on small businesses ensures locksmiths receive coverage designed to address the specific challenges faced by smaller enterprises.

Cons

- May not Suit Larger Businesses: Hiscox’s specialization in small businesses may make it less suitable for larger locksmith enterprises with different needs.

- Average Liability Discount: While 10% is offered, some competitors may provide higher discounts in the liability coverage category.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Chubb: Best for Safeguarding

Pros

- Coverage for High-Value Assets: Chubb specializes in high-value assets, providing locksmiths with a 12% multi-policy discount and coverage tailored for businesses with valuable assets.

- Competitive Multi-Policy Discount: The 12% discount enhances Chubb’s appeal for locksmiths seeking comprehensive coverage and savings through bundled policies.

- Expertise in Specialized Coverage: Chubb insurance review & ratings emphasize tailored coverage for locksmiths, safeguarding their valuable equipment by addressing specific risks inherent to high-value assets.

Cons

- May not be Budget-Friendly: Locksmiths prioritizing cost-effectiveness might find Chubb’s rates less accommodating compared to more budget-focused competitors.

- Average Liability Discount: While a 10% liability coverage discount is provided, some rivals may offer higher discounts in this category.

#9 – Allstate: Best for Customization

Pros

- Customized Policies: Allstate offers locksmiths a 15% multi-policy discount with a focus on providing highly customized policies to meet the unique needs of individual businesses.

- Balanced Multi-Policy Discount: With a 12% discount, Allstate strikes a balance between comprehensive coverage and affordability for locksmiths bundling their policies.

- Nationwide Presence: Allstate insurance review & ratings highlight the convenience for locksmiths nationwide to easily access and handle their policies due to the company’s extensive coverage.

Cons

- May not be the Most Budget-Friendly: Locksmiths seeking the most affordable options might find other providers with more budget-focused rates.

- Average Liability Discount: While 12% is offered, some competitors may provide higher discounts in the liability coverage category.

#10 – Farmers: Best for Personalized Solutions

Pros

- Personalized Service: Farmers insurance review & ratings highlight the company’s focus on personalized service, with a 15% multi-policy discount for locksmiths and customized coverage to suit each business’s specific needs.

- Competitive Multi-Policy Discount: The 15% discount positions Farmers as a cost-effective option for locksmiths seeking comprehensive coverage and bundled policy savings.

- Nationwide Accessibility: Farmers’ widespread presence ensures locksmiths across the country can access and manage their policies with ease.

Cons

- May not be the Most Budget-Friendly: Locksmiths prioritizing cost-effectiveness might find other providers with more budget-focused rates.

- Average Liability Discount: While 10% is offered, some competitors may provide higher discounts in the liability coverage category.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Unlocking the Importance of Business Insurance for Locksmiths

Having the right insurance coverage in place ensures that you can handle these situations without significant financial burden. Here are some key reasons why insurance is essential for locksmiths:

- Property Damage: Accidental damage to a client’s property during lock installation or repairs can occur. Insurance coverage safeguards locksmiths from potential lawsuits and expenses related to property damage claims.

- Liability Claims: Injuries to clients or third parties while on your premises or due to your services can lead to liability claims. Insurance, such as general liability coverage, helps cover legal fees and settlements in such situations.

- Employee Injuries: If you have employees, workers’ compensation insurance is vital to provide coverage for their medical expenses and lost wages in case of job-related injuries.

- Tool and Equipment Protection: Specialized locksmithing tools can be expensive to repair or replace if they are stolen, damaged, or lost. Insurance coverage for tools and equipment provides financial protection in such instances.

- Professional Errors: Professional liability insurance covers legal expenses if a client files a claim due to perceived professional negligence or mistakes, ensuring locksmiths are protected from potential lawsuits.

- Business Continuity: Insurance, such as commercial property coverage, ensures that your locksmith business can recover and continue serving clients even in the face of unexpected events like natural disasters or accidents.

Insurance is crucial for locksmiths to protect their businesses and minimize potential risks and liabilities. As a locksmith, you work with valuable assets and face various unforeseen circumstances that can lead to property damage, liability claims, employee injuries, and professional errors.

Jeff Root Licensed Life Insurance Agent

By securing the right insurance coverage, locksmiths can have peace of mind, protect their financial stability, and maintain a thriving business. Don’t underestimate the importance of insurance in safeguarding your locksmithing operations.

Comprehensive Insurance Coverage for Locksmith Businesses

As a locksmith, it’s essential to have the right insurance coverage to protect your business from potential risks and liabilities. Here are some key types of business insurance for locksmiths:

- General Liability Insurance: Covers third-party claims for bodily injury, property damage, or personal injury that may occur during your locksmith services.

- Business Owner’s Policy (BOP): Combines multiple insurance coverages, including general liability and commercial property insurance, into a comprehensive package for cost savings and broad protection.

- Workers’ Compensation Insurance: Required in most states if you have employees, it provides benefits for work-related injuries or illnesses and safeguards your business from potential lawsuits.

- Commercial Auto Insurance: Commercial auto insurance is necessary if you use vehicles for your locksmith business, it covers accidents, damages, and theft involving your business vehicles.

- Contractor’s Tools and Equipment Insurance: Protects your valuable locksmith tools and equipment from loss, theft, or damage.

- Professional Liability Insurance: Covers claims resulting from professional errors, negligence, or mistakes that may cause financial loss or damage to clients.

Having the right combination of these insurance coverages ensures that locksmiths are adequately protected from various risks and can operate their businesses with confidence and peace of mind.

Business Insurance for Locksmiths: Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $50 $120

Chubb $55 $130

CNA $45 $110

Farmers $60 $140

Hiscox $65 $150

Liberty Mutual $55 $130

Nationwide $50 $100

Progressive $48 $115

The Hartford $52 $140

Travelers $47 $99

The data illustrates the monthly insurance rates for locksmith businesses, showcasing a range of costs among different insurance providers and coverage tiers. Nationwide offers the lowest minimum coverage at $50, while Hiscox and Liberty Mutual charge the highest at $65.

For full coverage, Nationwide remains the most affordable at $100, while Chubb and Liberty Mutual are the priciest at $130. Farmers and The Hartford also fall on the higher end, at $140 per month.

Essential Tips to Secure Business Insurance for Locksmiths

Finding affordable coverage is a key consideration for locksmiths. Here are some tips to help you secure cost-effective business insurance:

- Compare quotes. Get quotes from multiple insurance providers to find the best rates for your locksmith business. To access more details, compare our online quotes using “Insurance Quotes Online.”

- Bundle policies. Consider bundling different insurance policies together, such as general liability and commercial property insurance, to potentially save on premiums.

- Assess your coverage needs. Evaluate your specific business requirements to determine the right amount of coverage. Avoid over-insuring or under-insuring your locksmith business.

- Work with experienced agents. Seek guidance from insurance agents who specialize in locksmith business insurance. They can help you find cost-effective solutions tailored to your needs.

- Maintain a good risk profile. Implement safety measures and follow best practices to minimize risks. This can potentially lead to lower insurance costs.

- Regularly review and update policies. As your locksmith business evolves, review your insurance coverage periodically to ensure it still meets your needs and make any necessary adjustments.

This ensures that you secure comprehensive coverage tailored to your business’s unique needs while still obtaining it at a competitive price point.

Melanie Musson Published Insurance Expert

Remember, finding affordable coverage doesn’t mean compromising on quality. By following these tips and working with reputable insurance providers, you can secure comprehensive coverage that meets your locksmith business’s needs at a competitive price.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

A Step-by-Step Guide to Obtaining Comprehensive Coverage

Obtaining business insurance for locksmiths is a straightforward process. Here are the nine steps to help you navigate through it:

- Assess your insurance needs. Determine the specific coverage requirements for your locksmith business based on factors like the size of your operation, number of employees, and the value of your equipment.

- Research insurance providers. Look for reputable insurance companies that specialize in business insurance for locksmiths. Read reviews and compare their offerings.

- Consult with an insurance agent. Seek guidance from a licensed insurance agent who can provide expert advice and help you choose the right coverage options for your locksmith business.

- Request insurance quotes. Contact insurance providers and request quotes based on your specific needs. Provide accurate information for accurate quotes.

- Compare coverage and costs. Review the quotes you receive, considering not only the costs but also the coverage limits, deductibles, and additional benefits offered.

- Select a policy. Choose the insurance policy that best suits your needs and budget. Contact the insurance provider to proceed with the purchase.

- Complete the application process. Provide the required information and complete the application forms as instructed by the insurance provider.

- Pay premiums. Arrange for the payment of premiums according to the insurance provider’s guidelines. To gain further insights, consult our comprehensive guide titled “How does the insurance company determine my premium?“

- Obtain proof of insurance. After purchasing the policy, the insurance provider will issue a certificate of insurance as proof of coverage.

Implementing the essential tips outlined for securing business insurance is fundamental for locksmiths to mitigate risks and safeguard their operations.

By partnering with reputable insurers and tailoring coverage to their specific needs, locksmiths can navigate the complexities of insurance effectively, ensuring they are adequately protected against unforeseen events.

Case Studies: Highlighting the Importance of Business Insurance for Locksmiths

Case studies serve as compelling narratives showcasing the critical role of business insurance for locksmiths. Through insightful case studies, we delve into real-life scenarios that illuminate why having the right insurance coverage is indispensable for locksmiths.

- Case Study #1 – General Liability Insurance: John, a locksmith with a small shop and a team, faced a lawsuit when a client tripped over a toolbox in his store and got injured. Luckily, John had general liability insurance which covered legal fees and medical expenses, easing his financial worries.

- Case Study #2 – Workers’ Compensation Insurance: Sarah’s locksmith employee injured their wrist on a client’s property. With workers’ compensation, their medical bills and wages were covered, shielding Sarah’s business from potential lawsuits.

- Case Study #3 – Commercial Auto Insurance: Mark, a mobile locksmith, had a car accident while heading to a job. His commercial auto insurance covered the van repairs and medical expenses for both him and the other driver. This ensured a quick recovery and allowed him to continue his locksmith services smoothly.

- Case Study #4 – Contractor’s Tools and Equipment Insurance: Lisa, a self-employed locksmith, lost all her specialized tools when her van was broken into during a busy day. Thanks to her contractor’s tools and equipment insurance, she filed a claim and got reimbursed, allowing her to replace the tools promptly and keep her business running smoothly.

- Case Study #5 – Professional Liability Insurance: Locksmith Mike damaged a door while unlocking it, leading to a lawsuit for negligence. Luckily, his errors and omissions insurance covered legal fees and settlement, safeguarding his reputation and finances.

These case studies vividly illustrate the significance of having the right insurance coverage for locksmiths, emphasizing the need for proactive risk management and protection.

Laura Walker Former Licensed Agent

By learning from these examples, locksmiths can better understand the importance of insurance in ensuring the longevity and success of their businesses.

Brief Recap: Protect Your Locksmith Business With the Right Insurance Coverage

Having the appropriate insurance coverage is essential for safeguarding your locksmith business. General liability insurance, a business owner’s policy (BOP), workers’ compensation insurance, commercial auto insurance, contractor’s tools and equipment insurance, and professional liability insurance all play crucial roles in protecting against various risks and liabilities.

By evaluating your needs, researching reputable providers, and comparing quotes, you can find affordable options that meet your specific requirements. Don’t underestimate the importance of insurance—take the necessary steps to protect your locksmith business and ensure peace of mind for the future.

Shopping for insurance can feel overwhelming, but you don’t have to do it alone. Enter your ZIP code below into our free comparison tool to get started.

Frequently Asked Questions

What are the best restaurant insurance companies?

The best restaurant insurance companies vary based on specific needs, but popular options include The Hartford, Travelers, and Nationwide.

How much does locksmith insurance cost?

The cost of locksmith insurance depends on factors like coverage types, business size, and location, but rates typically range from $45 to $130 per month.

No matter how much coverage you need, you can find the lowest rates by entering your ZIP code into our free comparison tool below.

What does locksmith insurance coverage include?

Locksmith insurance coverage typically includes general liability, commercial property, workers’ compensation, and professional liability to protect against various risks and liabilities.

For additional details, explore our comprehensive resource titled “Commercial Insurance: A Complete Guide.”

Do locksmiths need liability insurance?

Yes, locksmiths need liability insurance, also known as locksmith liability insurance, to protect against claims of property damage, bodily injury, and other liabilities arising from their services.

How can locksmiths obtain insurance coverage?

Locksmiths insurance can obtain coverage by contacting insurance providers specializing in commercial insurance, comparing quotes, and selecting the most suitable policy for their needs.

How profitable is a locksmith business?

The revenue potential for a locksmith business ranges from $95,000 to $440,000 per year, with a profit potential between $75,000 and $130,000 per year. With the increasing popularity of smart locks and new security systems, now is a great time to start a locksmith business.

Check out our ranking of the top providers titled “Best Health Insurance For Lock Keepers.”

Is locksmithing a good side business?

For a very good living, a locksmith can make over $100,000 per year. Of course, how much money a locksmith makes also depends on the type of work that they do. Locksmiths who specialize in commercial work can make more money than those who focus on residential work.

How do locksmiths get customers?

To make your locksmith business stand out, offer exclusive discounts and promotions to new and returning clients. You can promote these offers through social media, email marketing, or your website to entice potential customers and encourage loyalty.

Do people still use locksmiths?

Locksmithing has become one of the most important and most versatile industries over its lifespan. In recent years, locksmithing has morphed from the mechanical to digital. Even the job description has changed. Locksmiths don’t just make keys for individuals anymore.

Explore our list of leading providers titled “Best Health Insurance For Mechanics.”

What is the most common locksmith task?

One of the most common jobs for locksmiths is making duplicate keys. This is often needed when people lose their keys or when a new employee needs a key to access a building.

You can find the cheapest insurance coverage tailored to your needs by entering your ZIP code below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.