Best Business Insurance for Mall Kiosks in 2026 (Top 10 Companies)

Nationwide, The Hartford, and Progressive stand out as the best business insurance for mall kiosks, with rates starting at $45/month. These companies offer tailored coverage, ensuring your mall kiosk venture is safeguarded against a multitude of unforeseen risks such as liability claims, property damage and more.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Michael Leotta

Updated January 2025

3,071 reviews

3,071 reviewsCompany Facts

Full Coverage For Mall Kiosks

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 765 reviews

765 reviewsCompany Facts

Full Coverage For Mall Kiosks

A.M. Best Rating

Complaint Level

Pros & Cons

765 reviews

765 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage For Mall Kiosks

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsThe top pick overall for the best business insurance for mall kiosks, offering competitive rates and coverage options designed to protect mall kiosk ventures from various risks.

With comprehensive policies addressing liability, property damage, and a range of other potential risks inherent to mall kiosk operations, these companies provide holistic protection.

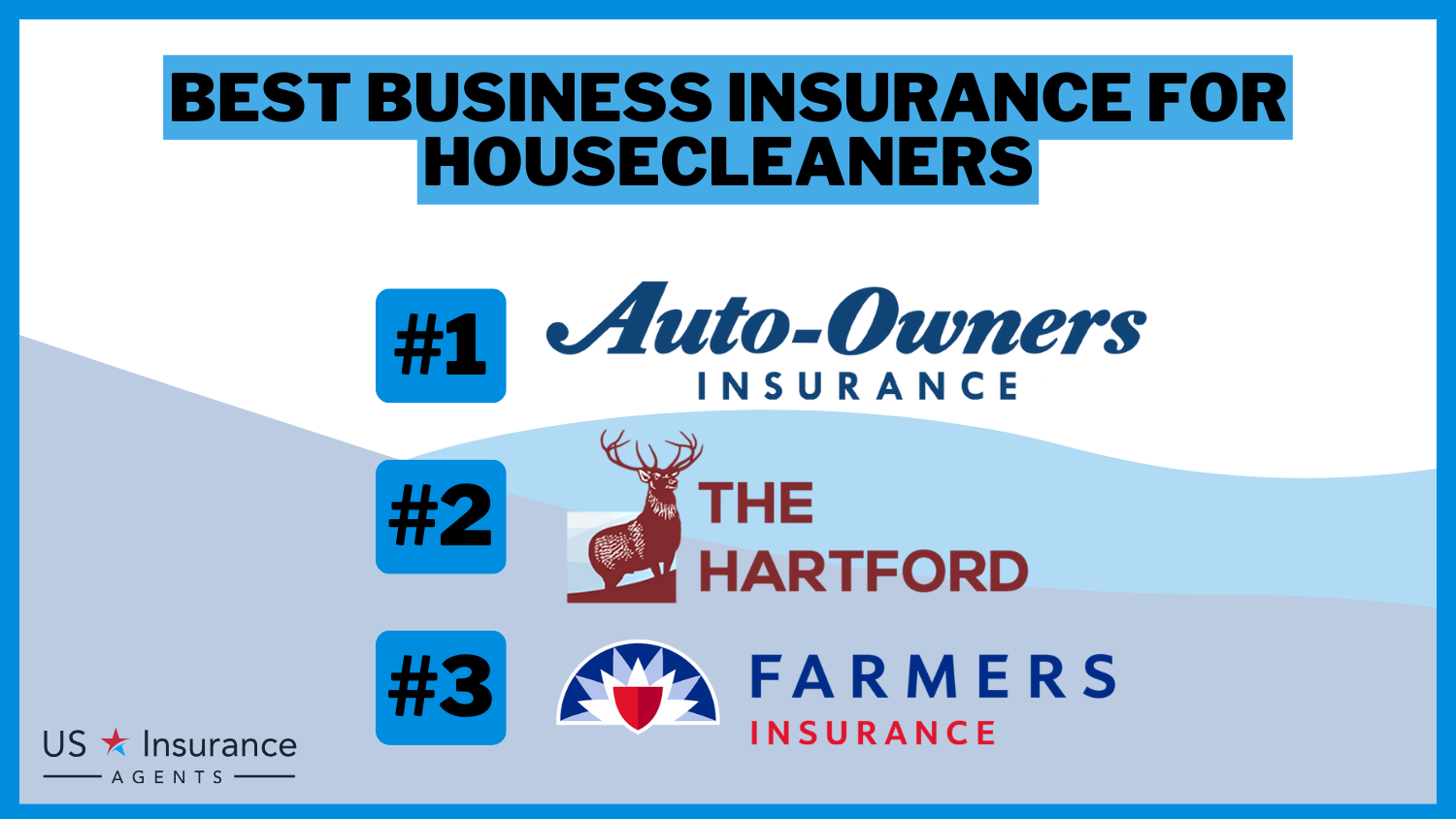

Our Top 10 Company Picks: Best Business Insurance for Mall Kiosks

| Company | Rank | Business Property Discount | Liability Coverage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | 10% | Diverse Coverage | Nationwide |

| #2 | 15% | 10% | Comprehensive Protection | The Hartford |

| #3 | 10% | 15% | Online Convenience | Progressive | |

| #4 | 10% | 15% | Small Businesses | Hiscox |

| #5 | 12% | 10% | High-Value Assets | Chubb | |

| #6 | 12% | 15% | Customized Solutions | Travelers | |

| #7 | 15% | 12% | Risk Management | CNA | |

| #8 | 10% | 15% | Personalized Service | Farmers | |

| #9 | 12% | 10% | Business Solutions | Liberty Mutual |

| #10 | 15% | 12% | Customized Policies | Allstate |

Mall kiosk owners can rest assured knowing that their businesses are safeguarded not only against common challenges but also against unforeseen circumstances that may arise in the dynamic retail environment.

Start comparing affordable insurance options by entering your ZIP code above into our free quote comparison tool today.

#1 – Nationwide: Top Overall Pick

Pros

- Diverse Coverage: Offers a wide range of coverage options catering to various business needs.

- Discounts: Nationwide insurance review & ratings showcase significant discounts, offering 12% off for business property and 10% off for liability coverage, enhancing its competitive edge.

- Reputation: Nationwide has a well-established reputation in the insurance industry.

Cons

- Rates: May not have the most competitive rates compared to some other providers.

- Online Presence: Online service options might not be as advanced as some competitors.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – The Hartford: Best for Comprehensive Protection

Pros

- Comprehensive Protection: Offers comprehensive protection, ideal for businesses seeking all-in-one coverage.

- Discounts: Competitive discounts of 15% for business property and 10% for liability coverage.

- Financial Strength: The Hartford insurance review & ratings showcase robust financial stability, highlighted by an A+ rating from A.M. Best.

Cons

- Pricing: Premiums may be on the higher side compared to some competitors.

- Online Services: Online conveniences might not be as advanced as with certain other providers.

#3 – Progressive: Best for Online Protection

Pros

- Online Convenience: Stands out for user-friendly online services, making it easy for customers to manage policies.

- Discounts: Competitive discounts at 10% for business property and 15% for liability coverage.

- Affordability: Progressive insurance review & ratings highlight its reputation for providing competitive prices and various discount options.

Cons

- Coverage Limitations: Some businesses may find limitations in specialized coverage options.

- Industry Focus: May not be as specialized for certain industries as other insurers.

#4 – Hiscox: Best for Nurturing Businesses

Pros

- Specialized for Small Businesses: Tailored coverage specifically designed for the needs of small businesses.

- Discounts: Offers competitive discounts with 10% for business property and 15% for liability insurance coverage.

- Online Services: Known for a user-friendly online platform for policy management.

Cons

- Industry Specialization: May not be as versatile or specialized for larger enterprises or diverse industries.

- Limited Customization: Some businesses may find limitations in customizing policies to unique needs.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Chubb: Best for Elevating Security

Pros

- Caters to High-Value Assets: Chubb insurance review & ratings showcase expertise in providing insurance for enterprises possessing valuable assets.

- Discounts: Competitive discounts at 12% for business property and 10% for liability coverage.

- Global reach: Chubb’s extensive global network may benefit businesses with international operations.

Cons

- Cost: Premiums may be relatively higher, reflecting the specialized high-value coverage.

- Limited Small Business Focus: May not offer the same level of specialization for small businesses.

#6 – Travelers: Best for Tailored Solutions

Pros

- Customized Solutions: Offers tailored coverage solutions, catering to the specific needs of businesses.

- Discounts: Competitive discounts at 12% for business property and 15% for liability coverage.

- Financial Stability: Travelers insurance review & ratings highlight a well-established company with a robust financial standing.

Cons

- Pricing: Premiums may be on the higher side compared to some competitors.

- Online Presence: Online conveniences might not be as advanced as with certain other providers.

#7 – CNA: Best for Managing Risk

Pros

- Emphasis on Risk Management: CNA insurance review & ratings highlight CNA’s distinctive edge through its expertise in risk management.

- Discounts: Competitive discounts at 15% for business property and 12% for liability coverage.

- Global Presence: Offers coverage beyond national borders, beneficial for businesses with international operations.

Cons

- Pricing: Premiums may be relatively higher due to the emphasis on risk management.

- Online Services: Online functionalities might not be as advanced as some competitors.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Personalized Service

Pros

- Personalized Service: Farmers is known for delivering personalized service to its clients.

- Discounts: Competitive discounts with 10% for business property and 15% for liability coverage.

- Local Agents: Farmers insurance review & ratings highlight their extensive array of local agents who provide personalized assistance and support.

Cons

- Pricing: Premiums may be on the higher side compared to some competitors.

- Online Presence: Online conveniences might not be as advanced as with certain other providers.

#9 – Liberty Mutual: Best for Comprehensive Solutions

Pros

- Business Solutions: Liberty Mutual insurance review & ratings showcases a range of extensive business solutions.

- Discounts: Competitive discounts at 12% for business property and 10% for liability coverage.

- Global Reach: Offers coverage beyond national borders, beneficial for businesses with international operations.

Cons

- Pricing: Premiums may be relatively higher compared to some competitors.

- Online Services: Online functionalities might not be as advanced as some competitors.

#10 – Allstate: Best for Shield Crafting

Pros

- Customized Policies: Allstate insurance review & ratings showcase their reputation for offering customized policies designed to suit individual business requirements.

- Discounts: Competitive discounts with 15% for business property and 12% for liability coverage.

- Financial Stability: A well-established company with a strong financial standing.

Cons

- Pricing: Premiums may be on the higher side compared to some competitors.

- Online Presence: Online conveniences might not be as advanced as with certain other providers.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Business Insurance for Mall Kiosks: Understanding General Liability Coverage

General liability insurance is a crucial component of insurance coverage for kiosk businesses. Here are some key points to understand about general liability insurance for kiosks:

- Coverage for Accidents and Hazards: General liability insurance provides financial protection in the event of unexpected accidents and hazards that may occur at your kiosk. This coverage extends to injuries sustained by customers while on your premises.

- Medical and Hospital Expenses: If a customer injures themselves at your kiosk, general liability insurance will cover the associated medical and hospital costs. This ensures that the injured party receives necessary medical treatment without causing financial strain on your business.

- Protection Against Natural Disasters: General liability insurance also safeguards your business from losses caused by natural disasters such as floods, fires, or earthquakes. It helps cover the costs of repairing or replacing damaged property, allowing you to recover and resume operations.

- Coverage for Unforeseen Events: Unforeseen events can impact any business, and general liability insurance provides a safety net. It protects against losses resulting from incidents like slip-and-fall accidents, product liability claims, or damages caused by faulty equipment or installations.

- Legal Expenses: In addition to covering medical expenses, general liability insurance can help with legal expenses if a lawsuit arises from an incident at your kiosk. It can cover attorney fees, court costs, and settlements or judgments, providing financial protection and peace of mind.

It’s crucial to emphasize that the scope and extent of general liability insurance can differ significantly. When securing this insurance for your mall kiosk enterprise, it’s essential to meticulously examine the policy particulars, encompassing exclusions and limitations.

Jeff Root Licensed Life Insurance Agent

Collaborating with an experienced insurance advisor is imperative to guarantee that your coverage adequately addresses your unique requirements and potential liabilities.

Business Insurance for Mall Kiosks: Comprehensive Coverage of a Business Owners Policy (BOP)

A Business Owners Policy (BOP) is a comprehensive insurance package designed for small businesses, including mall kiosks. Here are important points to understand about BOP coverage for mall kiosks:

- Combined Coverage: A BOP combines general liability insurance, which protects against accidents and injuries, with property protection coverage. This integration offers a comprehensive insurance solution that addresses both liability and property-related risks. To gain further insights, consult our comprehensive guide titled “Personal Injury Protection (PIP) Insurance: A Complete Guide.”

- Customizable Options: BOPs offer flexibility, allowing you to select specific policy options that align with the unique needs of your mall kiosk business. You can tailor the coverage based on factors such as the value of your assets, the type of products or services you offer, and the level of risk you face.

- Property Protection: With a BOP, your kiosk’s physical assets are safeguarded against various perils, including fire, theft, vandalism, or natural disasters. This coverage extends to your kiosk’s inventory, equipment, signage, and other tangible property essential to your business operations.

- Liability Coverage: In addition to property protection, a BOP includes general liability coverage, which shields your business from third-party claims arising from bodily injuries, property damage, or personal and advertising injury. This coverage can help cover legal costs, settlements, or judgments associated with these claims.

- Cost-Effective Solution: BOPs are often cost-effective for small businesses, including mall kiosks, as they bundle multiple coverages into a single policy. This approach can potentially result in lower premiums compared to purchasing each coverage separately.

- Comprehensive Protection: By opting for a BOP, you can obtain comprehensive protection for both your assets and liabilities, simplifying your insurance needs. It provides a convenient and efficient way to ensure your mall kiosk business is adequately protected against a wide range of risks.

When considering a BOP for your mall kiosk business, consult with an insurance professional to assess your specific requirements and tailor the coverage accordingly. They can guide you in choosing the right options and policy limits to adequately protect your assets and liabilities.

Business Insurance for Mall Kiosks: Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $50 $120

Chubb $55 $130

CNA $45 $110

Farmers $60 $140

Hiscox $65 $150

Liberty Mutual $55 $130

Nationwide $50 $100

Progressive $48 $105

The Hartford $52 $140

Travelers $47 $115

Monthly rates for business insurance for mall kiosks vary: Allstate offers minimum coverage at $50 and full coverage at $120; Nationwide starts at $50 for minimum and $100 for full coverage; Hiscox’s rates start at $65 for minimum and $150 for full coverage.

Business Insurance for Mall Kiosks: Essential Coverage for Business Auto Protection

Business auto coverage is an essential insurance component for mall kiosk businesses that utilize vehicles for deliveries and services. Here are important points to understand about Business Auto Coverage:

- Protection for Accidents: Commercial auto insurance protects your business from losses arising from auto accidents involving vehicles used for kiosk-related activities. It covers damages to the vehicles involved, including repair or replacement costs.

- Medical Coverage: In the event of an accident, commercial auto insurance provides medical coverage for injuries sustained by drivers, passengers, or pedestrians involved in the incident. This coverage helps ensure that medical expenses are taken care of, reducing financial burdens on your business.

- Legal Liability Coverage: Business Auto Coverage also includes liability protection for your business. It covers legal expenses, settlements, or judgments if your business is found responsible for causing injury or property damage to others in an auto accident. This coverage is crucial for safeguarding your business’s financial stability and reputation.

- Coverage for Owned and Leased Vehicles: Whether your business owns or leases vehicles for kiosk operations, commercial auto insurance can provide the necessary coverage. It extends protection to both owned and leased vehicles, ensuring that your business is adequately insured regardless of the vehicle ownership status.

- Additional Coverage Options: Depending on your specific needs, commercial auto insurance may offer additional coverage options such as comprehensive coverage (for non-collision incidents like theft, vandalism, or natural disasters) and uninsured/underinsured motorist coverage (for accidents involving drivers without sufficient insurance).

- Compliance With Legal Requirements: Having commercial auto insurance is not only a prudent choice but also a legal requirement in most jurisdictions. It ensures that your business complies with mandatory insurance laws, preventing potential fines or penalties.

When securing business auto coverage for your mall kiosk business, it’s crucial to engage in a detailed discussion with an experienced insurance professional. By doing so, you can tailor the coverage to meet your precise needs.

Melanie Musson Published Insurance Expert

These professionals can guide you in selecting suitable coverage limits, taking into account any unique aspects related to your vehicles or drivers. Their expertise ensures that your business receives comprehensive protection in the unfortunate event of an auto accident.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Business Insurance for Mall Kiosks: Assessing Your Insurance Needs for Comprehensive Protection

When it comes to choosing the right insurance coverage for your mall kiosk business, it’s important to assess your specific needs. Consider the following factors to determine the appropriate level of coverage:

- Evaluate your business operations. Take a close look at your kiosk business and identify potential risks. Assess the nature of your activities, the types of products or services you offer, and any potential hazards involved. This evaluation will help you understand the specific risks your business faces.

- Analyze your assets. Consider the value of your equipment, inventory, and other assets associated with your kiosk business. Determine the financial impact that damage, theft, or loss of these assets could have on your operations. This assessment will guide you in selecting the appropriate property coverage. For additional details, explore our comprehensive resource titled “Commercial Insurance: A Complete Guide.”

- Understand contractual requirements. Review any contracts or agreements you have with shopping malls or other establishments where your kiosks are located. Check if there are specific insurance requirements mentioned in the contracts, such as minimum coverage limits or additional insured endorsements. Ensure that your insurance policy meets these contractual obligations.

- Consider potential liabilities. Think about the potential liabilities your business may face. This could include customer injuries, product liability claims, or allegations of negligence. Assessing these liabilities will help you determine the necessary level of general liability coverage.

- Evaluate workforce risks. If you have employees, consider the risks associated with their work. Identify potential hazards and the likelihood of work-related injuries. This assessment will help you understand the need for workers’ compensation insurance to protect your employees and comply with legal requirements.

By thoroughly evaluating these factors, you empower yourself to make well-informed decisions regarding the most suitable types and levels of insurance coverage for your mall kiosk business, ensuring comprehensive protection.

It’s essential to consistently revisit and review your insurance policies as your business evolves and as new risks emerge, thereby maintaining adequate coverage aligned with the dynamic nature of your operations.

Business Insurance for Mall Kiosks: Case Studies Showcasing the Importance of Insurance Coverage

Understanding the significance of insurance coverage for mall kiosks extends beyond theoretical knowledge—it finds practical validation through real-life case studies. By delving into these examples, we uncover the crucial role insurance plays in safeguarding mall kiosk businesses.

- Case Study #1 – General Liability Insurance: Sarah’s jewelry kiosk faced a potential crisis when a customer tripped over a display stand, but thanks to her general liability insurance, medical costs were covered, lawsuits avoided, and her business reputation protected—a clear example of insurance’s vital role in unforeseen accidents. Check out our ranking of the top providers titled “Best Business Insurance for Jewelry Stores.”

- Case Study #2 – Business Owners Policy (BOP): Michael, running a kiosk selling high-end electronics, faced a break-in resulting in stolen devices. His business owners policy with property coverage reimbursed him, exemplifying how such coverage safeguards against theft and ensures business continuity.

- Case Study #3 – Commercial Auto Insurance: Rebecca’s kiosk, offering mobile phone repair services, relies on company vehicles for on-site repairs. When an employee’s accident occurred, Rebecca’s commercial auto insurance covered repair costs, ensuring business continuity and employee well-being.

These case studies vividly demonstrate the critical importance of obtaining comprehensive insurance coverage for your mall kiosk business. By studying these examples and the risks they help mitigate, you can make well-informed decisions to protect your business and its assets from potential threats.

Laura Walker Former Licensed Agent

Understanding the specific challenges faced by other kiosk owners highlights the need for tailored insurance solutions, ensuring your business is adequately protected in the face of adversity.

Roundup: Business Insurance for Mall Kiosks: Safeguarding Your Business and Assets With the Right Coverage

Protect your mall kiosk business with the right insurance coverage. Consider key points to safeguard assets and mitigate risks. General liability covers accidents and customer injuries, while a BOP offers customizable property protection. Commercial auto insurance and workers’ compensation are essential for comprehensive coverage.

Careful assessment of operations, assets, liabilities, and workforce risks enables informed decisions on insurance coverage for your mall kiosk. Regular policy reviews maintain alignment with evolving needs and obligations, ensuring long-term resilience and success.

No matter how much coverage you need, you can find the lowest rates by entering your ZIP code into our free comparison tool below.

Frequently Asked Questions

How can insurance help small businesses?

By getting insurance for your small business, you’re purchasing protection. This protection will be there for you if something bad happens to the business. For some people, it can be hard to see the value of buying something like insurance because it’s intangible and is something that you don’t always use.

Why is insurance for shopping malls important?

Insurance for shopping malls is essential to protect both mall owners and tenants from various risks and liabilities. This type of insurance typically includes coverage for property damage, liability claims, theft, vandalism, and other unforeseen events that may occur within the mall premises. It helps ensure financial protection and peace of mind for all parties involved in the operation and management of shopping malls.

Enter your ZIP code below to compare rates from the top providers near you.

What does food kiosk liability insurance cover?

Food kiosk liability insurance provides coverage for potential risks associated with operating a food kiosk in a shopping mall insurance. This type of insurance typically includes protection against claims related to foodborne illnesses, slip and fall accidents, and other liabilities that may arise from serving food to customers.

For a thorough understanding, refer to our detailed analysis titled “Professional Liability (Errors & Omissions) Insurance: A Complete Guide.”

How do I set up a kiosk in my mall?

The first step would be to contact the mall management team. They can provide information on the requirements and regulations for setting up a kiosk in their mall, as well as information on available kiosk locations and rental fees.

What is micro insurance business?

Micro insurance is specifically intended for the protection of low -income people, with affordable insurance products to help them cope with and recover from financial losses.

What is the best location for kiosk business?

Look for areas with consistent traffic that match the profile of your target customers. Proximity to Anchor Stores: Position your kiosk near anchor stores or popular retail destinations. These high-traffic areas attract a substantial number of shoppers, increasing the likelihood of your kiosk being noticed.

Explore our list of the leading providers titled “Best Health Insurance For Shop Keepers.”

What is a commercial claim?

A commercial claim is an obligation to owe money which is incurred during the course of conducting a business which arises from goods sold or leased, services rendered, or monies loaned for use in conducting business.

Are kiosks profitable?

Mall kiosk play a pivotal role in revenue generation, often yielding high-profit margins due to their low operational costs and the high visibility they offer.

What does general insurance cover?

What is general insurance? General insurance covers non-life assets, such as your home, vehicle, health, and travel. You get compensation for damages or losses incurred due to flood, fire, theft, accidents, or any man-made disasters.

To learn more, explore our comprehensive resource on commercial auto insurance titled “What documents need to submit with flood insurance application?“

What does premium mean in business?

Broadly speaking, a premium is a price paid for above and beyond some basic or intrinsic value. Relatedly, it is the price paid for protection from a loss, hazard, or harm (e.g., insurance or options contracts).

Enter your ZIP code below to compare quotes instantly and find the cheapest insurance available.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.