Best Business Insurance for Financial Services in 2026 (Top 10 Companies)

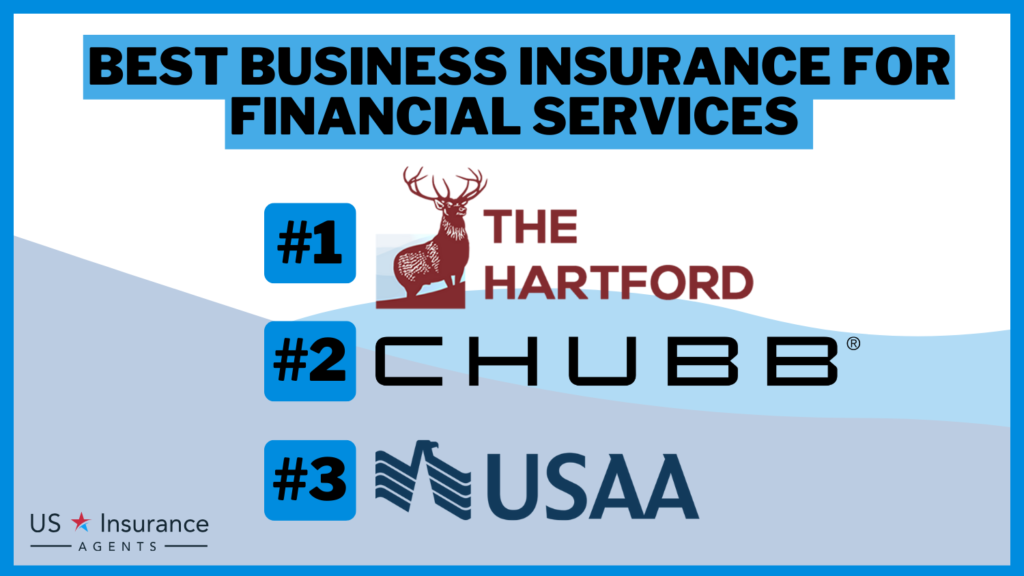

The best business insurance for financial services comes from The Hartford, Chubb, and USAA, offering rates with discounts up to 20%. These top providers ensure tailored coverage essential for financial services, providing optimal protection, significant savings, and exceptional service quality.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. In 2018, she started writing for the cannabis industry. She curated news articles and insider interviews with investors and small business ow...

Laura Kuhl

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Schimri Yoyo

Updated January 2025

765 reviews

765 reviewsCompany Facts

Full Coverage for Financial Services

A.M. Best Rating

Complaint Level

Pros & Cons

765 reviews

765 reviews 82 reviews

82 reviewsCompany Facts

Full Coverage for Financial Services

A.M. Best Rating

Complaint Level

Pros & Cons

82 reviews

82 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Financial Services

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews

These companies excel not only in competitive rates but also provide substantial savings, making them the best options for cost-effective and comprehensive coverage. The Hartford stands out with the best rates when considering various factors such as coverage options, customer service, and discount availability.

Our Top 10 Company Picks: Best Business Insurance for Financial Services

| Company | Rank | Multi-Policy Discount | Bundling Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 5% | 30% | Exclusive Benefits | The Hartford |

| #2 | 10% | 20% | Policy Options | Chubb | |

| #3 | 25% | 15% | Military Savings | USAA | |

| #4 | 20% | 15% | Bundling Discounts | Nationwide |

| #5 | 10% | 30% | Coverage Options | Progressive | |

| #6 | 25% | 30% | UBI Savings | Allstate | |

| #7 | 13% | 30% | Safety Features | Travelers | |

| #8 | 20% | 15% | Quick Claims | Liberty Mutual |

| #9 | 17% | 15% | Financial Strength | State Farm | |

| #10 | 10% | 15% | Corporate Responsibility | CNA |

Choosing the right insurer from these top contenders ensures that financial service providers are well-protected against diverse risks with tailored insurance solutions. Enter your ZIP code above to get started on comparing business insurance quotes.

#1 – The Hartford: Top Overall Pick

Pros

- Deductible Reduction: The Hartford stands out with a maximum multi-policy discount of up to 5%, coupled with an impressive low-mileage discount of up to 30%, making it an excellent choice for those seeking deductible reduction options.

- Comprehensive Coverage: The Hartford’s focus on providing a range of policy options ensures that customers have the flexibility to choose coverage that precisely aligns with their needs.

- Maximum Multi-Policy Discount: The Hartford excels in offering a maximum multi-policy discount of up to 5%, providing customers with the opportunity to save on their premiums by bundling multiple insurance policies.

Cons

- Limited Online Convenience: While The Hartford excels in discounts and coverage, it may not be the ideal choice for those who prioritize online convenience in managing their policies.

- Competitive Market: In a highly competitive market, The Hartford faces stiff competition from other providers, which may influence pricing and discounts. Check out our The Hartford insurance review & ratings for more details.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Chubb: Best for Policy Options

Pros

- Policy Options: Chubb distinguishes itself with a maximum multi-policy discount of up to 10%, making it an attractive choice for those seeking diverse policy options.

- Discount Flexibility: Offering a maximum low-mileage discount of up to 20%, Chubb caters to customers who value flexibility in managing their policies. Explore our Chubb insurance review & ratings for more insights.

- Maximum Multi-Policy Discount: Chubb offers a competitive maximum multi-policy discount of up to 10%, providing customers with significant savings when bundling multiple insurance policies with the company.

Cons

- Cost Considerations: Chubb’s premium rates may be comparatively higher due to its focus on providing an extensive range of policy options, making it less budget-friendly for some customers.

- Limited Military Benefits: While Chubb offers competitive discounts, it may not be the top choice for military personnel seeking the extensive savings and benefits provided by specialized insurers.

#3 – USAA: Best for Military Savings

Pros

- Military Savings: USAA takes the lead with a remarkable maximum multi-policy discount of up to 25%, coupled with a generous low-mileage discount of up to 15%. This makes it an unbeatable choice for military personnel seeking substantial savings.

- Customer-Centric Approach: With a focus on military members and their families, USAA offers customizable policies, providing tailored coverage that caters to the unique needs of its customer base.

- Maximum Multi-Policy Discount: USAA offers an industry-leading maximum multi-policy discount of up to 25%, making it an excellent choice for military members looking to maximize their savings through bundling insurance policies.

Cons

- Membership Limitations: USAA’s eligibility criteria restrict access to military personnel and their families, limiting its availability to the general public. Please review our USAA insurance review & ratings for additional information.

- Potentially Higher Rates: While USAA excels in military savings, individuals not eligible for membership may find more cost-effective options elsewhere.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Safeguarding Financial Services: The Importance of Business Insurance

Business insurance refers to a range of insurance policies designed to protect businesses from financial losses resulting from various risks. It offers coverage against potential damages, liabilities, and interruptions that may arise during the course of running a business.

Business Insurance Monthly Rates for Financial Services by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $200 | $400 |

| Chubb | $250 | $500 |

| CNA | $220 | $450 |

| Liberty Mutual | $210 | $420 |

| Nationwide | $190 | $380 |

| Progressive | $200 | $400 |

| State Farm | $210 | $420 |

| The Hartford | $220 | $430 |

| Travelers | $200 | $400 |

| USAA | $180 | $360 |

Monthly insurance rates for financial services offered by various providers, categorized by coverage level. The rates vary depending on the insurance company, with minimum coverage ranging from $180 to $250, and full coverage ranging from $360 to $500 per month. This information assists businesses in selecting an insurance provider and coverage level that best suits their needs and budget.

Chris Abrams Licensed Insurance Agent

One of its primary advantages lies in providing financial security against potential losses, instilling a sense of confidence in entrepreneurs. Moreover, business insurance aids in risk management by pinpointing potential threats and securing appropriate coverage, thereby enabling businesses to effectively navigate and mitigate risks to their operations.

Additionally, in the face of unforeseen setbacks like accidents, lawsuits, or property damage, business insurance plays a crucial role in facilitating recovery and ensuring continuity. By assisting companies in swiftly resuming operations and minimizing financial repercussions, it proves indispensable in maintaining business stability and resilience.

Consulting with insurance professionals is crucial to assess the specific risks faced by a business and determine the most suitable insurance policies to protect its financial stability and operations. For additional details, refer to our comprehensive guide titled “Commercial Insurance: A Complete Guide.”

Comprehensive Coverage for Financial Services: Types of Business Insurance Policies

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies of Business Insurance for Financial Services Providers

In the complex and often unpredictable realm of financial services, having the right business insurance policies is crucial. These real-world case studies illustrate how various types of insurance protect firms from significant financial and reputational damage.

- Case Study #1 – Professional Liability: A financial advisory firm encountered a lawsuit claiming inadequate investment advice resulting in substantial client losses. Their professional liability (errors & omissions) insurance covered the legal expenses and settlements, safeguarding the firm’s financial stability and reputation.

- Case Study #2 – Cyber Liability: A fintech company experienced a severe data breach that compromised customer information. Their cyber liability insurance helped manage the crisis by covering the costs associated with legal defense, customer notifications, and public relations efforts.

- Case Study #3 – Property Insurance: An asset management company suffered extensive damage to its office due to a fire. Property insurance facilitated a swift recovery by compensating for the damages to their physical assets and covering the cost of temporary relocation.

- Case Study #4 – Workers’ Compensation: A brokerage firm had an employee sustain injuries during work, resulting in expensive medical treatments and rehabilitation. Workers’ compensation insurance provided the necessary financial support for the employee’s medical expenses and lost wages.

- Case Study #5 – General Liability: During a client seminar, an attendee was injured, leading to substantial medical and legal costs. The company’s general liability insurance covered these expenses, safeguarding the firm from potential financial fallout.

These case studies underscore the indispensable role of insurance in safeguarding financial services businesses against a spectrum of risks.

Brad Larson Licensed Insurance Agent

Whether it’s a cyber incident, workplace injury, or a liability lawsuit, the right insurance coverage ensures firms can weather unexpected events and maintain operational continuity. Investing in comprehensive insurance is not just a safety net—it’s a strategic asset for any financial services provider.

Roundup: The Importance of Business Insurance for Financial Services

In conclusion, business insurance is a vital component for financial services providers to safeguard their operations and mitigate potential risks and liabilities. Understanding the purpose of insurance and the various types of coverage available, including liability, property, and employee insurance, allows businesses to protect their financial stability and ensure continuity.

Implementing risk management strategies further enhances the overall protection of the business. By investing in the right insurance coverage tailored to their specific needs, financial services providers can navigate uncertainties, protect their reputations, and maintain strong client relationships.

Consulting with insurance professionals and making informed decisions will help ensure the long-term success and stability of their financial services business. Explore our article titled “Paycheck Protection Program for Female Business Owners [10 Best States + Insurance Advice]” for additional insights.

Frequently Asked Questions

What are the different types of business insurance policies recommended for financial services providers?

Financial services providers should consider a range of insurance policies, including professional liability insurance to protect against client lawsuits, cyber liability insurance for data breaches, property insurance to safeguard physical assets, and general liability insurance for third-party injury or property damage claims.

To find out more, explore our guide titled “How to Document Damage for Car Insurance Claims.”

Why is business insurance important for financial services providers?

Business insurance is crucial for financial services providers as it acts as a protective measure against various risks and uncertainties. It offers financial stability and peace of mind by providing coverage for potential damages, liabilities, and interruptions that may arise during the course of running a financial services business.

Enter your ZIP code into our quote comparison tool below to secure cheaper insurance rates for your business.

How can insurance help financial services providers mitigate risks and protect their operations?

Insurance plays a vital role in mitigating risks for financial services providers. Case studies illustrate scenarios where professional liability insurance safeguards against client lawsuits, cyber liability insurance helps recover from data breaches, property insurance ensures business continuity after physical damage, and general liability insurance covers third-party injury or property damage claims.

Can different business insurance coverages be combined under one policy for convenience?

Yes, some insurance providers offer package policies that combine multiple coverages into one comprehensive policy. This approach provides convenience and potential cost savings for financial services providers, allowing them to manage various coverages under a single policy.

What is the purpose of business insurance for financial services providers?

The purpose of business insurance for financial services providers is to mitigate potential risks and uncertainties that could threaten the company’s financial stability and operations. It offers protection against various risks, including professional liability, cyber threats, property damage, and general liabilities, ensuring the business can navigate challenges without facing severe financial burdens

What is insurance in business finance?

Insurance in business finance protects against financial losses due to risks such as theft, liability, or property damage. Top providers like The Hartford offer multi-policy discounts, which can enhance savings for financial firms. Is The Hartford a good insurance company? Read our review for more information.

What is insurance risk in finance?

Insurance risk involves the uncertainty of financial loss a company might face and influences the cost and terms of insurance policies. For example, companies like Chubb and USAA offer varying discounts based on risk factors.

How can insurance protect you from financial loss?

Insurance compensates for covered losses, reducing the financial impact on businesses. Companies like Nationwide and Progressive provide specific discounts for multi-policy and low-mileage usage that mitigate potential financial losses.

How do financial managers assess risks in business?

Managers evaluate financial risks by analyzing market trends and operational data. Insurers like Travelers offer tailored policies with discounts that aid in managing these risks. Explore our guide on how to pay your Travelers insurance premium for further details.

Is insurance risk a financial risk?

Yes, insurance risk is a financial risk as it affects a company’s financial stability and planning. Firms like Liberty Mutual address this by offering significant multi-policy discounts.

How much does insurance cost for financial institutions?

Do finance and accounting professionals need professional indemnity insurance?

Why should accountants and finance businesses carry cyber insurance?

What other insurance policies should finance and accounting professionals carry?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.