Best Business Insurance for Junk Removal Services in 2026 (Top 10 Companies)

Progressive, State Farm, and Nationwide are leading for the best business insurance for junk removal services, offering discounts of up to 15%. Among them, Progressive stands out with its exceptional policy flexibility and unique loyalty rewards program specifically tailored for junk removal businesses.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. Through her years working in th...

Melanie Musson

Licensed Real Estate Agent

Angie Watts is a licensed real estate agent with Florida Executive Realty. Specializing in residential properties since 2015, Angie is a real estate writer who published a book educating homeowners on how to make the most money when they sell their homes. Her goal is to educate and empower both home buyers and sellers so they can have a stress-free shopping and/or selling process. She has studi...

Angie Watts

Updated January 2025

Company Facts

Full Coverage for Junk Removal Services

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Junk Removal Services

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Junk Removal Services

A.M. Best Rating

Complaint Level

Pros & Cons

The top pick overall for the best business insurance for junk removal services is Progressive, complemented by State Farm and Nationwide, which also provide competitive and affordable options. Seek further understanding read our comprehensive guide on best business insurance for further insights.

Dive into our detailed guide on business insurance for deeper insights. The article delves into critical coverage considerations for junk removal businesses, emphasizing the significance of general liability and commercial auto insurance.

Our Top 10 Company Picks: Best Business Insurance for Junk Removal Services

| Company | Rank | Safety Discount | Policy Discount | Best for | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | 10% | Flexibility & Loyalty | Progressive | |

| #2 | 12% | 8% | Personalized Service | State Farm | |

| #3 | 10% | 5% | Nationwide Coverage | Nationwide |

| #4 | 14% | 10% | Comprehensive Protection | Allstate | |

| #5 | 12% | 8% | Eco-Friendly Initiatives | Liberty Mutual |

| #6 | 15% | 7.50% | Modest Expertise | Hiscox |

| #7 | 10% | 5% | Fleet Solutions | Travelers | |

| #8 | 13% | 7% | Specialized Coverage | Farmers | |

| #9 | 11% | 6% | High-Value Insurance | Chubb | |

| #10 | 12% | 8% | Customized Hazard | CNA |

It underscores the advantages of comparing offerings from online and traditional providers, empowering businesses to make informed decisions aligned with their specific needs.

Protect your company’s fleet of vehicles with commercial insurance. Enter your ZIP code above to find the cheapest coverage for your business.

- Progressive excels in junk removal business insurance with high satisfaction

- Tailored policies mitigate specific operator risks with a 15% discount

- Comprehensive coverage from Progressive meets diverse industry needs

#1 – Progressive: Top Overall Pick

Pros

- Competitive Rates: Progressive insurance review & ratings demonstrate the company’s customized coverage options that offer affordable business insurance rates, making it a budget-friendly choice for junk removal operators.

- Customizable Policies: Progressive provides tailored insurance policies that can be adjusted to address specific risks and coverage needs of junk removal businesses.

- Discount Opportunities: Progressive offers discounts, such as a 15% discount for junk removal services, helping operators save on insurance costs.

Cons

- Limited Availability: Progressive’s coverage may not be available in all locations, limiting options for businesses operating in certain regions.

- Complex Claims Process: Some customers report that Progressive’s claims process can be complex and lengthy, requiring additional time and effort to resolve issues.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Personalized Service

Pros

- Strong Financial Stability: State Farm is a well-established insurance company with strong financial stability, providing assurance that claims will be paid promptly.

- Extensive Network of Agents: State Farm insurance review & ratings highlight State Farm’s extensive network of local agents nationwide, providing personalized service and assistance.

- Multiple Coverage Options: State Farm offers a wide range of insurance products beyond business insurance, allowing for bundling and potential discounts.

Cons

- Potentially Higher Rates: State Farm’s rates may be higher compared to some competitors, especially for certain types of coverage.

- Limited Online Options: The online experience and digital tools provided by State Farm may not be as robust as those offered by some other insurers.

#3 – Nationwide: Best for Coverage

Pros

- Wide Range of Coverage: Nationwide offers a comprehensive range of coverage options for various business needs, including junk removal services.

- Strong Financial Stability: As a well-established insurer, Nationwide is known for its financial stability and ability to pay claims promptly.

- Nationwide Network: Nationwide insurance review & ratings highlight Nationwide’s extensive network of agents and service providers, ensuring accessibility and convenience for policyholders.

Cons

- Potentially Higher Premiums: Nationwide’s comprehensive coverage and reputation may lead to slightly higher premiums compared to some competitors.

- Limited Local Presence: Despite its national reach, Nationwide’s local presence and personalized service may vary depending on location.

#4 – Allstate: Best for Comprehensive Protection

Pros

- Wide Range of Coverage: The Allstate insurance review & ratings encompass a diverse selection of coverage options, such as general liability, commercial auto, and property insurance, which can be advantageous for junk removal businesses.

- Strong Financial Stability: Allstate is a well-established insurance company with strong financial stability, providing assurance that claims will be handled efficiently and reliably.

- Good Customer Service: Allstate is known for its responsive customer service and support, making it easier for policyholders to address their insurance needs and concerns.

Cons

- Potentially Higher Premiums: While Allstate offers extensive coverage, its premiums may be on the higher side compared to some competitors, which could impact affordability for certain businesses.

- Limited Availability: Allstate’s business insurance offerings may not be available in all locations, limiting options for businesses operating in certain regions.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Eco-Friendly Initiatives

Pros

- Extensive Coverage Options: Liberty Mutual offers a wide range of coverage options, including customizable policies tailored to specific business needs.

- Strong Financial Stability: Liberty Mutual review & ratings highlight the company’s strong financial stability and reputable standing within the insurance sector, offering policyholders reliability and peace of mind.

- Tech-Savvy Solutions: Liberty Mutual offers convenient digital tools and online services for policy management and claims processing, enhancing customer experience.

Cons

- Mixed Customer Service Reviews: Some customers have reported inconsistent customer service experiences, including delays in claims processing and communication issues.

- Potentially Higher Premiums: While Liberty Mutual provides comprehensive coverage, its premiums may be higher compared to some other insurers in the market.

#6 – Hiscox: Best for Modest Expertise

Pros

- Specialized Coverage: Hiscox offers specialized coverage tailored for small businesses, including flexible options for different industries.

- Strong Financial Stability: Hiscox is known for its strong financial stability and high ratings from credit rating agencies.

- Online Convenience: Hiscox provides a user-friendly online platform for quotes and policy management, making it easy for businesses to access insurance.

Cons

- Limited Specialization: Competitors might provide more tailored attention to the specific risks encountered by auto repair shops compared to Hiscox’s focus on fleet vehicle insurance.

- Higher Premiums: Compared to some competitors, Hiscox’s premiums can be relatively higher, especially for certain coverage options.

#7 – Travelers: Best for Fleet Solutions

Pros

- Wide Range of Coverage: Travelers offers a comprehensive range of insurance products, including business insurance, home insurance, auto insurance, and more, catering to various needs.

- Strong Financial Stability: Travelers is a financially stable company with a strong reputation, providing assurance that claims will be handled efficiently.

- Discount Opportunities: Travelers insurance review & ratings demonstrate the company’s customized coverage options, including discounts such as multi-policy and safe driver discounts, designed to help customers save on premiums.

Cons

- Higher Premiums: Travelers’ premiums can sometimes be higher compared to other insurance providers, particularly for certain coverage types.

- Complex Claims Process: Some customers have reported that Travelers’ claims process can be complex and may require significant documentation and follow-up.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Coverage

Pros

- Wide Range of Coverage: The Farmers insurance review & ratings encompass a diverse array of insurance offerings, spanning home, auto, life, business, and additional coverage options.

- Strong Customer Service: Many customers appreciate Farmers’ responsive and helpful customer service representatives.

- Discount Opportunities: Farmers provides various discounts, such as multi-policy, safe driver, and loyalty discounts, helping customers save on premiums.

Cons

- Premiums Can Be Higher: Compared to some competitors, Farmers’ premiums may be on the higher side for certain coverage types.

- Claim Process Complexity: Some policyholders have reported challenges or delays in the claims process, leading to frustration.

#9 – Chubb: Best for High-Value Insurance

Pros

- High-Value Asset Coverage: Chubb specializes in providing high-value asset insurance, making it an excellent choice for businesses with valuable assets.

- Customized Policies: Chubb insurance review & ratings feature personalized insurance policies that are adjustable to suit unique business requirements and risks.

- Strong Financial Stability: Chubb is known for its strong financial stability and reputation, providing assurance that claims will be handled efficiently.

Cons

- Higher Premiums: Chubb’s comprehensive coverage and specialized services may come with higher premiums compared to some other insurers.

- Limited Availability: Chubb’s services may not be as widely available or accessible in certain regions or for smaller businesses.

#10 – CNA: Best for Customized Hazard

Pros

- Specialized Coverage: CNA offers specialized insurance coverage tailored to specific industries and businesses, providing comprehensive protection for unique risks.

- Financial Strength: CNA is a financially strong and stable insurance company, which can provide reassurance and reliability to policyholders.

- Risk Management Services: CNA insurance review & ratings highlight CNA’s exceptional risk management services, aiding businesses in identifying, reducing, and averting risks to enhance safety and reduce insurance expenses.

Cons

- Limited Availability: CNA may have limited availability in certain regions or industries, making it challenging for some businesses to access their insurance products.

- Complex Claims Process: Some policyholders have reported that the claims process with CNA can be complex and may involve longer processing times compared to other insurers.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Insurance Coverage for Junk Removal Services

When it comes to insuring your junk removal business, there are several types of insurance policies to consider. However, the most crucial insurance policy for a junk removal business is general liability insurance.

This policy provides essential coverage for common risks associated with your business operations. Here’s why general liability insurance is the best insurance option for a junk removal business:

- Coverage for Accidents and Damage: General liability insurance protects your business if accidents happen or property gets damaged during junk removal jobs. It covers bodily injuries to others and any property damage caused by your business operations.

- Advertising Injuries Coverage: This insurance also covers advertising injuries, such as claims of libel or slander related to your marketing activities.

- Customizable Coverage: General liability insurance can be customized to meet your specific needs, ensuring you have the right coverage for your junk removal business.

To determine the best insurance coverage for your junk removal business, it’s advisable to consult with insurance professionals who specialize in small business insurance.

They can assess your specific needs and recommend the appropriate coverage options that offer the most comprehensive protection at an affordable price.

Read more: Best Business Insurance for Junkyards

Finding the Right Coverage for Your Junk Removal Services

Finding the right insurance coverage for your junk removal business is essential. Here are the steps to help you find the coverage you need:

- Assess Your Risks: Begin by identifying the specific risks associated with your junk removal business. Consider factors like potential property damage, accidents or injuries, advertising liabilities, and any other unique risks you may face.

- General Liability Insurance: Start with general liability insurance, as it’s a foundational coverage for most businesses. It protects against common risks such as bodily injury, property damage, and advertising injuries. Look for policies that offer sufficient coverage limits for your business needs.

In other hand research insurance providers specialize in small business coverage. Look for insurers with experience in the junk removal industry, as they will better understand your unique needs.

Review policy details are carefully review the policy details, including coverage limits, exclusions, deductibles, and any additional endorsements or riders. Ensure the policy meets your specific requirements and offers adequate protection.

- Additional Coverage Considerations: Evaluate if you require additional coverage based on your business operations. Consider factors such as commercial auto insurance if you use vehicles, workers’ compensation insurance if you have employees, and commercial property insurance if you have a physical location.

- Seek Professional Advice: Consider consulting with an insurance professional or broker who can provide expertise and guidance in selecting the right coverage for your junk removal business.

Obtain quotes from different insurance providers to compare coverage options and prices. Be sure to provide accurate information about your business operations to receive accurate quotes.

Jeff Root Licensed Life Insurance Agent

By following these steps, you can find the insurance coverage that suits your junk removal business, mitigating potential risks and protecting your financial interests.

Calculating the Cost: Business Insurance for Junk Removal Services

The cost of insurance for a junk removal business can vary depending on factors such as the size of your business, location, coverage needs, and other specific circumstances. Here’s a simplified overview:

- General Liability Insurance: On average, junk removal businesses in the US can expect to pay between $450 – $1,000 per year for $1 million in general liability coverage. To gain further insights, consult our comprehensive guide titled “Liability Insurance: A Complete Guide“

- Business Owner’s Policy (BOP): A Business Owner’s Policy, which combines general liability, business interruption, and property insurance, can provide junk removal insurance cost savings compared to purchasing separate policies.

- Additional Coverage: If you have commercial vehicles, you’ll need commercial auto insurance. The cost of this coverage will depend on factors like the number of vehicles, usage, driving records, and coverage limits. Workers’ compensation insurance costs vary based on factors such as payroll, job classifications, and claims history.

To get an accurate cost estimate, request quotes from insurance providers who specialize in small businesses or the junk removal industry.

Business Insurance Monthly Rates for Junk Removal Services

Insurance Company Minimum Coverage Full Coverage

Allstate $150 $250

Chubb $160 $260

CNA $155 $255

Farmers $145 $245

Hiscox $155 $255

Liberty Mutual $160 $260

Nationwide $140 $240

Progressive $135 $235

State Farm $165 $265

Travelers $168 $268

By comparing quotes, you can find affordable coverage that meets your specific needs. Prioritize obtaining adequate coverage to protect your business from potential risks and liabilities.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Key Situations Covered by General Liability Insurance for Junk Removal Services

General liability insurance provides coverage for various situations that may arise in the course of operating a junk removal business. Here are some common scenarios where general liability insurance can offer protection:

- General liability insurance for junk removal services covers property damage and bodily injuries during service, including accidents like tripping over debris or damaging customer property. For additional details, explore our comprehensive resource titled “Personal Injury Protection (PIP) Insurance: A Complete Guide“

- Provides coverage for advertising injuries, such as copyright infringement or false advertising accusations, and protects against products liability claims related to items your business sells.

- Offers completed operations coverage to protect against claims arising after a junk removal job is completed, such as discovered property damage.

The specific coverage and limits provided by general liability insurance can vary depending on the policy terms and conditions. To ensure you have adequate protection, it’s recommended to review your policy carefully and consult with an insurance professional who can help tailor coverage to your business needs.

Exploring Additional Coverage Options for Your Junk Removal Services

While general liability insurance is essential, there are other types of coverage that can benefit a junk removal business. Here are additional insurance policies to consider:

- Commercial Auto Insurance: Essential for your junk removal business with vehicles, providing protection for accidents and damages during business vehicle use.

- Commercial Property Insurance: Crucial if you have a physical business location, covering damage from fire, theft, or natural disasters.

- Business Interruption & Umbrella Insurance : Helps cover lost income and expenses during business downtime due to events like fire or equipment failure. Umbrella Insurance provides extra liability coverage beyond primary policies, safeguarding your business from large claims and financial loss.

Consult with an insurance professional who can assess your specific risks and help determine the most appropriate coverage options for your business.

The specific junk removal insurance requirements, including waste removal business insurance and junk removal general liability insurance, for your Junk truckers business may vary based on factors like business size, location, and the services you offer. For a comprehensive analysis, refer to our detailed guide titled “Best Business Insurance for Truckers.”

Enhance Protection: Steps for Your Junk Removal Business

In addition to having the right insurance coverage, there are several steps you can take to further protect your junk removal business. Here are the seven important measures to consider:

- Provide proper employee training and safety protocols to minimize accidents during junk handling.

- Use detailed contracts outlining responsibilities to manage expectations and reduce disputes.

- Regularly maintain equipment and obtain necessary licenses to ensure compliance with local regulations.

- Protect sensitive client information with strong cybersecurity measures and maintain financial stability by monitoring cash flow. Join professional associations to access industry resources and stay updated on trends.

By implementing these additional steps, you can strengthen the overall protection and resilience of your junk removal business access insurance, minimizing risks and enhancing your reputation in the industry.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Practical Applications of Business Insurance for Junk Removal Services

Explore essential coverage options and strategies to protect your junk removal business from risks and liabilities in the world of business insurance.

- Case Study #1 – Property Damage Liability: Green Clean Junk Removal accidentally damaged a client’s garage door during a job. Fortunately, their general liability insurance covered the repair costs, ensuring customer satisfaction and protecting the business financially. For detailed information, refer to our comprehensive report titled “Professional Liability (Errors & Omissions) Insurance.”

- Case Study #2 – Workers’ Compensation: Junk Away Services had an employee injured while lifting heavy items. Their workers’ compensation insurance covered medical expenses and lost wages, aiding the employee’s recovery and avoiding legal issues for the business.

- Case Study #3 – Data Breach Protection: Fast Haul Junk Removal faced a cyber attack compromising customer information. Their cyber liability insurance covered investigation, notification, and security enhancement costs, preserving their reputation and client trust.

By implementing these valuable insights and effective protection strategies, you can significantly enhance the security and resilience of your junk removal business, ensuring comprehensive coverage against potential risks and liabilities while bolstering your overall operational stability and longevity.

Ty Stewart Licensed Life Insurance Agent

Roundup: Business Insurance for Junk Removal Services

Securing the right insurance coverage is vital for protecting your junk removal business. General liability insurance, including coverage from next insurance, shields against accidents, property damage, and injuries. Commercial auto insurance ensures the safety of your vehicles, essential for junk removal operations.

Workers’ compensation, a necessary part of insurance needed for junk removal business, covers work-related injuries, providing crucial support for your employees. Insurance costs for junk removal business insurance typically range from $450 – $1,000 annually for $1 million in general liability coverage, varying based on business size and location.

To further protect your junk removal business, consider essential measures such as training, equipment maintenance, licensing, data security, and maintaining financial stability. These proactive steps, combined with junk removal commercial insurance, minimize risks and ensure long-term success and growth.

Ready to find the best fleet insurance? Enter your ZIP code in our comparison tool below to see affordable commercial insurance rates in your area.

Frequently Asked Questions

What are the key considerations for obtaining debris and junk removal business insurance?

Key considerations for obtaining debris and junk removal business insurance include general liability coverage, commercial auto insurance for your vehicles, and potentially workers’ compensation depending on your operations and state requirements.

What is the best truck for junk removal business?

The best truck for a junk removal business depends on factors like the size of items being hauled, the volume of materials, and the terrain, with popular options including the Ford F-150, Chevrolet Silverado 1500, and Ford Transit, each suited for different load capacities and environments.

Searching for more affordable premiums? Insert your ZIP code below to get started on finding the right provider for you and your budget.

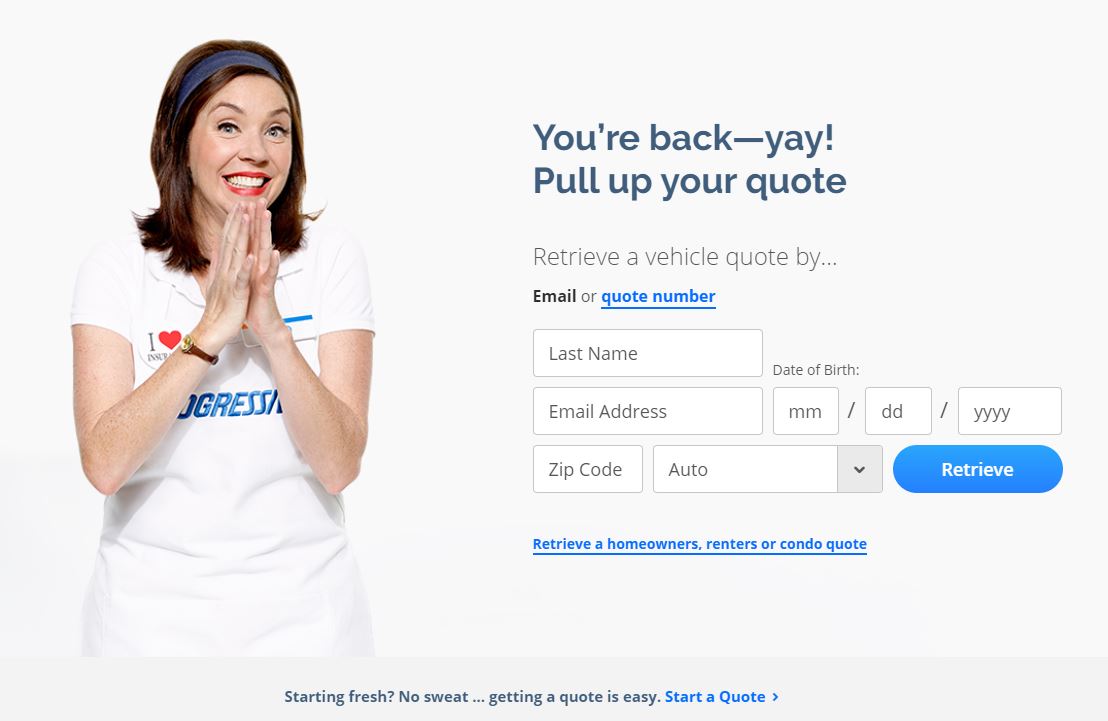

How do I create a junk removal business plan and get free insurance quotes online?

To create a junk removal business plan, outline your services, target market, pricing strategy, and operational details. Then, for free insurance quotes online, use reputable insurance comparison websites to compare quotes from different providers tailored to your business needs.

To gain in-depth knowledge, consult our comprehensive resource titled “How to Get Free Insurance Quotes Online.”

What are those contractor’s tools and equipment insurance for junk removal services?

Contractor’s tools and equipment insurance for junk removal services covers essential tools like hand tools, power tools, lifting equipment, and safety gear against damage, theft, or loss during operations.

Do you need insurance for junk removal?

Yes, insurance is essential for junk removal businesses to protect against potential liabilities, property damage, and other risks associated with their operations. Having insurance provides financial security and ensures compliance with legal requirements, giving peace of mind to both the business owner and their clients.

Do you need a contractors license for junk removal in California, and what are the requirements for Health Insurance?

In California, you generally don’t need a contractor’s license for basic junk removal. As for health insurance, consider coverage for yourself and employees to protect against medical expenses and ensure well-being.

For detailed information, refer to our comprehensive report titled “Health Insurance: A Complete Guide.”

What are junk removal insurance cost?

The cost of insurance for junk removal businesses varies depending on factors like business size, location, coverage needs, and specific services provided. It can range from a few hundred to over a thousand dollars annually. To get an accurate cost estimate, request quotes from insurers based on your business details and requirements.

Ready to find the best fleet insurance? Enter your ZIP code in our comparison tool below to see affordable commercial insurance rates in your area.

What does junk removal general liability insurance cover?

Junk removal general liability insurance typically covers third-party bodily injury, property damage, and related legal expenses. It helps protect businesses from liabilities arising during operations, such as accidental damage to a client’s property or injuries caused to third parties. This insurance is essential for junk removal businesses to mitigate financial risks and ensure compliance with legal requirements.

Is it possible to obtain same-day insurance for junk removal services with the assistance of multiple agents and where I can contact them?

Yes, it’s possible to obtain same-day insurance for junk removal services with the assistance of multiple agents. You can contact insurance agents through local agencies, online platforms, or by using insurance comparison websites to explore options and get quotes quickly.

To gain profound insights, consult our extensive guide titled “Insurance Agents.”

What is the difference between junk and bin?

The difference between junk and a bin is that junk refers to unwanted or discarded items, while a bin is a container used to collect and transport junk for disposal or recycling.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.