Best Business Insurance for Live Event Performers in 2026 (Top 10 Companies)

Discover the best business insurance for live event performers with Travelers, USAA, and Nationwide. These industry leaders offer coverage options designed for live event performers. Enjoy a generous 12% discount and explore why they are renowned for their excellence in protecting performers and their businesses.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Karen Condor is an insurance and finance writer who has degrees in both journalism and communications. She began her career as a reporter covering local and state affairs. Her extensive experience includes management positions in newspapers, magazines, newsletters, and online marketing content. She has utilized her researching, writing, and communications talents in the areas of human resources...

Karen Condor

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Schimri Yoyo

Updated January 2025

Company Facts

Full Coverage For Live Event Performers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage For Live Event Performers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage For Live Event Performers

A.M. Best Rating

Complaint Level

Pros & Cons

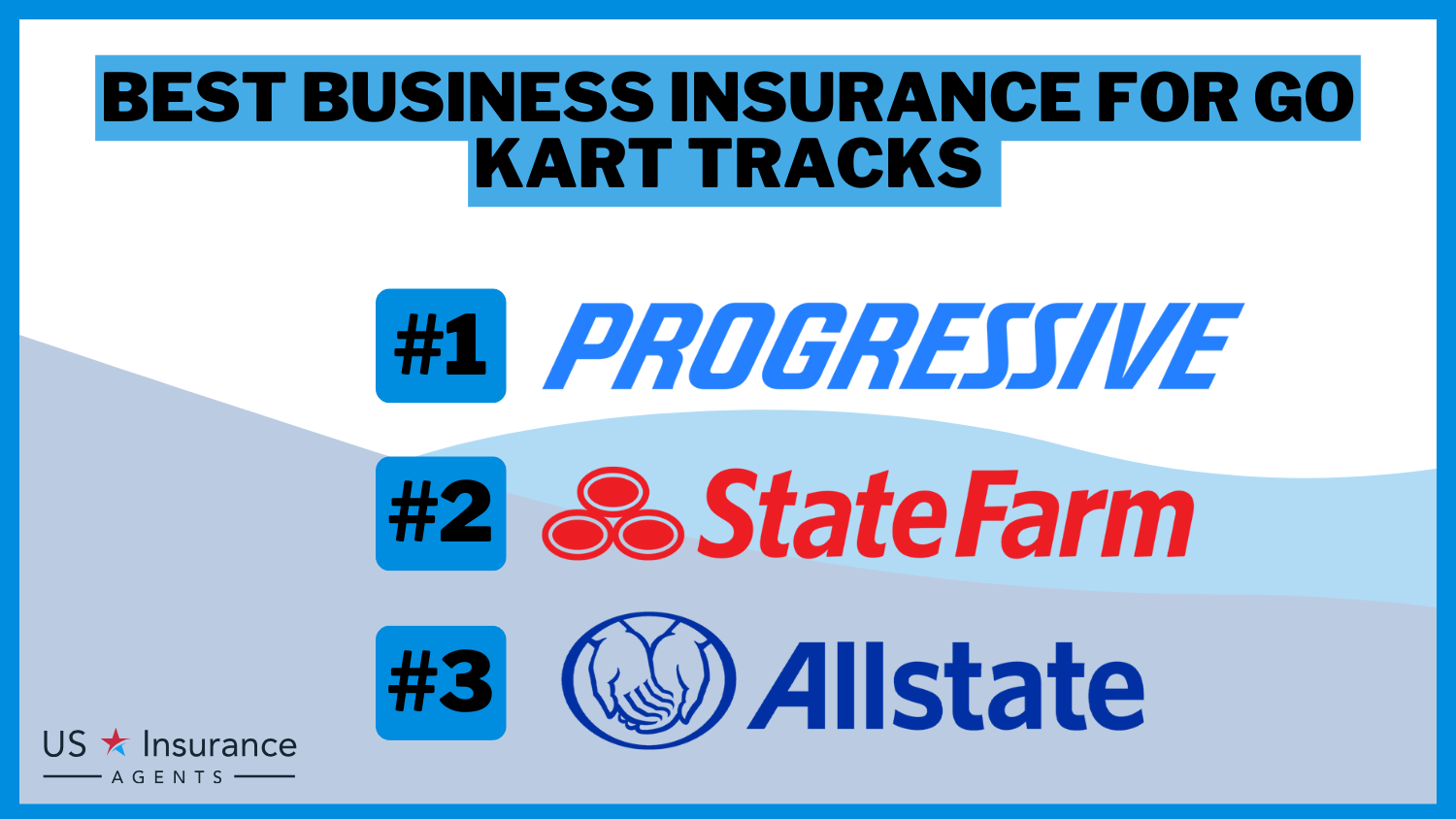

Travelers, USAA, and Nationwide are widely recognized as the top choices for the best business insurance for live event performers, offering specialized coverage and competitive rates tailored to the unique needs of the entertainment industry.

In this comprehensive guide, delve into essential factors to consider when selecting insurance, including coverage options such as equipment protection, liability coverage, and business interruption insurance.

Our Top 10 Company Picks: Best Business Insurance for Live Event Performers

| Company | Rank | Equipment Coverage Discount | Multi-Policy Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | 10% | Flexible Solutions | Travelers | |

| #2 | 12% | 15% | Military Families | USAA | |

| #3 | 15% | 20% | Tailored Coverage | Nationwide | |

| #4 | 10% | 15% | Business Coverage | Hiscox | |

| #5 | 15% | 10% | Specialized Protection | The Hartford |

| #6 | 10% | 12% | Personalized Service | State Farm | |

| #7 | 10% | 15% | Comprehensive Options | State Farm | |

| #8 | 12% | 10% | Business Solutions | Liberty Mutual | |

| #9 | 15% | 12% | High-Value Assets | Chubb | |

| #10 | 10% | 15% | Risk Management | CNA |

Explore customer satisfaction metrics and industry reputation to make an informed decision that safeguards your live event business effectively.

Shield your business from financial setbacks. Enter your ZIP code above to shop for cheap commercial insurance rates from top providers near you.

#1 – Travelers: Top Overall Pick

Pros

- Tailored Coverage Options: Travelers insurance review & ratings demonstrate the company’s customized coverage for the specific risks encountered by live event performers.

- Discounts and Savings: Travelers provides equipment and multi-policy discounts, helping performers save on insurance costs.

- Reputation and Reliability: Travelers is a reputable insurer known for reliability and customer service.

Cons

- Premium Pricing: Travelers’ premiums may be higher compared to some other insurers.

- Coverage Limitations: Certain policies may have limitations or exclusions that affect coverage for live event performers.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Families

Pros

- Exclusive Savings for Military Families: USAA offers discounted rates and specialized insurance products tailored to military members, veterans, and their families.

- Excellent Customer Service: The USAA insurance review & ratings highlight USAA’s reputation for excellent customer satisfaction, characterized by effective claims processing and attentive customer support.

- Comprehensive Coverage Options: USAA provides a wide range of insurance products beyond auto and home insurance, including life insurance and renters insurance.

Cons

- Membership Restrictions: Membership is limited to current and former military members and their families, excluding others from accessing USAA’s services.

- Limited Branch Locations: USAA primarily operates online and by phone, with few physical branch locations, which may be inconvenient for those who prefer in-person services.

#3 – Nationwide: Best for Tailored Coverage

Pros

- Tailored Coverage Options: Nationwide offers customizable insurance solutions specifically designed for live event performers, ensuring that your unique risks and needs are adequately addressed.

- Strong Reputation and Financial Stability: Nationwide is a well-established insurance provider with a solid reputation for financial stability, giving you confidence that your claims will be handled efficiently.

- Multi-Policy Discounts: Nationwide insurance review & ratings demonstrates the company’s commitment to tailored coverage for live event performers by offering appealing discounts when combining multiple insurance policies, showcasing their focus on personalized protection.

Cons

- Availability and Regional Limitations: Nationwide’s coverage may not be available in all areas, and the specific coverage options can vary by region, potentially limiting options for some performers.

- Customer Service Experience: While Nationwide generally has a positive reputation for customer service, individual experiences may vary, and some performers may encounter challenges in resolving claims or inquiries.

#4 – Hiscox: Best for Business Coverage

Pros

- Tailored Coverage: Hiscox offers business customized insurance solutions specifically designed for live event performers, addressing their unique risks and needs.

- Specialized Expertise: With extensive experience in the entertainment industry, Hiscox provides knowledgeable and relevant insurance services.

- Flexible Policies: Hiscox offers adaptable policies that can be tailored to suit individual performer requirements.

Cons

- Cost: Premiums for Hiscox’s specialized coverage may be relatively higher compared to some other insurance providers.

- Limited Availability: Hiscox’s coverage may not be available in all regions, potentially limiting options for performers outside their service area.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – The Hartford: Best for Specialized Protection

Pros

- Specialized Coverage: The Hartford insurance review & ratings showcase the company’s customized coverage for live event performers, addressing specific risks like equipment damage and liability.

- Financial Stability: The company is financially strong, ensuring they can meet claims and obligations reliably.

- Industry Expertise: With extensive experience, The Hartford understands the unique needs of performers, providing knowledgeable service.

Cons

- Limited Availability: Coverage may not be offered in all states or regions.

- Potentially Higher Costs: Premiums could be relatively higher compared to other insurers, requiring performers to consider their budget carefully.

#6 – State Farm: Best for Personalized Service

Pros

- Personalized Service: State Farm offers personalized customer service, with agents who work closely with clients to understand their needs and provide customized insurance solutions.

- Comprehensive Coverage Options: State Farm insurance review & ratings highlights the company’s tailored coverage options, demonstrating their ability to customize policies for individual needs.

- Financial Stability: State Farm is a financially stable insurance company, which means customers can rely on prompt and fair claims processing.

Cons

- Higher Premiums: State Farm’s premiums may be higher compared to some competitors.

- Limited Online Quoting: The company primarily relies on agent-based sales, which may not suit customers seeking immediate online quotes and policy issuance.

#7 – Allstate: Best for Comprehensive Options

Pros

- Wide Range of Coverage Options: Allstate offers comprehensive insurance solutions, including specialized coverage for live event performers, making it convenient to manage multiple insurance needs with one provider.

- Strong Reputation for Customer Service: Allstate is well-regarded for its responsive customer support and efficient claims processing, ensuring performers receive timely assistance when needed.

- Customizable Policies: The Allstate insurance review & ratings highlights how performers can customize their policies with flexibility, allowing them to match coverage to their unique risks and financial constraints, ensuring appropriate protection.

Cons

- Potential Higher Premiums: Allstate’s comprehensive coverage may come at a higher cost compared to some competitors, requiring performers to carefully assess affordability.

- Limited Availability: Allstate’s coverage may not be available in all areas or for all types of live event performances, requiring performers to verify coverage availability and suitability.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Business Solutions

Pros

- Comprehensive Coverage Options: The Liberty Mutual insurance review & ratings showcases the company’s tailored coverage for a variety of industries, demonstrating their specialized options designed specifically for live event performers.

- Financial Stability: As a well-established insurer, Liberty Mutual boasts strong financial stability ratings, ensuring reliability in claims payment and service.

- Discount Opportunities: Customers can benefit from various discounts, such as bundling policies or maintaining a claims-free record, helping to lower insurance costs.

Cons

- Mixed Customer Service Reviews: Some customers have reported inconsistent experiences with Liberty Mutual’s customer service, with occasional issues in responsiveness or claims handling.

- Potentially Higher Premiums: In certain cases, Liberty Mutual’s premiums may be comparatively higher, necessitating careful consideration of overall value when choosing an insurer.

#9 – Chubb: Best for High-Value Assets

Pros

- Enhanced Prestige: Owning high-value assets like luxury cars, yachts, or rare art can elevate your social status and reputation.

- Potential Investment: Chubb insurance review & ratings highlight that high-value assets can increase in value over time, offering opportunities for financial growth and serving as a safeguard against inflation.

- Personal Enjoyment: These assets offer unique experiences and enjoyment, such as traveling on a private jet or hosting events on a luxury yacht.

Cons

- High Costs: Acquiring, maintaining, and insuring high-value assets can be costly, including expenses for storage, security, and upkeep.

- Market Volatility: The value of certain high-value assets can be subject to market fluctuations, impacting their resale or investment value.

#10 – CNA: Best for Risk Management

Pros

- Specialized Coverage: CNA offers tailored insurance solutions designed specifically for live event performers, addressing unique risks in the entertainment industry.

- Reputation and Experience: With decades of experience, CNA has a strong reputation for providing reliable coverage and exceptional customer service to businesses.

- Financial Stability: The CNA insurance review & ratings underscore robust financial ratings, indicating their ability to efficiently and promptly process claims.

Cons

- Limited Availability: CNA’s coverage may not be available in all areas, limiting options for certain performers based on location.

- Premium Cost: Some performers might find CNA’s premiums relatively higher compared to other insurance providers offering similar coverage.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Determining the Need for Business Insurance: Live Event Performers

Business insurance for live event performers is necessary for anyone involved in the entertainment industry. Here are some examples of professionals who can benefit from business insurance:

- Musicians

- Actors and Actresses

- Dancers

- Variety Performers (Magicians, jugglers, acrobats, etc.)

- Speakers and Presenters

- Comedians

- Performance Groups and Bands

These are just a few examples, but business insurance for live event performers is crucial for anyone working in the entertainment industry.

Jeff Root Licensed Life Insurance Agent

It provides financial protection and peace of mind, ensuring that you can focus on your performances while being prepared for unexpected events. To gain further insights, consult our comprehensive guide titled “Best Insurance for Pursuing Financial Independence.”

Protect Your Passion: Business Insurance for Live Event Performers

Finding the best performers insurance is crucial for live event performers to ensure they have the right coverage. Here’s why our specialized live performance insurance stands out:

- Industry Expertise and Customizable Coverage: are vital for live event performers. We understand the unique risks of the entertainment industry and offer tailored insurance solutions that consider your performances, equipment, and specific risks.

- Comprehensive Protection and Competitive Pricing: Our insurance covers a wide range of risks, including injuries, property damage, equipment theft, and liability claims. So offering cost-effective solutions without compromising on the quality and coverage of your insurance plan. We strive to provide competitive pricing that suits your budget.

- Claims Assistance and Strong Partnership: In the unfortunate event of a claim, we provide guidance and support throughout the process. And having strong partnerships with reputable insurance providers specializing in the entertainment industry. These partnerships ensure access to the best insurance for performers products available.

Choose specialized business insurance for live event performers to protect your business effectively. Benefit from our industry expertise, customizable coverage, competitive pricing, exceptional service, and commitment to your success. For additional details, explore our comprehensive resource titled “What is comprehensive coverage?.”

Coverage Options for Live Event Performers

When it comes to business insurance for live event performers, it’s essential to have comprehensive coverage that protects you from potential risks and liabilities. Here are some common coverage options available for live event performers:

- General Liability Insurance: Protects you from claims if someone is injured or their property is damaged during your performances.

- Professional Liability Insurance: Covers claims of professional negligence or errors in your performances or productions.

Equipment insurance covers the repair or replacement costs for your valuable performance equipment in the event of damage, theft, or loss. Business interruption insurance provides financial protection if unforeseen events prevent you from performing or conducting business as usual. Commercial auto insurance covers accidents and damages that may occur while using vehicles for business purposes.

- Workers’ Compensation Insurance: Provides coverage for work-related injuries or illnesses suffered by your employees or hired performers.

- Cyber Liability Insurance: Protects against data breaches and cyberattacks if you use online platforms and social media for promotion.

- Event Cancellation Insurance: Protects you financially if you need to cancel or postpone an event due to unforeseen circumstances.

These coverage options can vary depending on the insurance provider and your specific needs. Working with an experienced insurance professional can help you assess the risks associated with your live performances and customize a policy that provides the appropriate coverage for your business.

Remember, having the right insurance coverage tailored to your needs is crucial for protecting your business, your livelihood, and your future as a live event performer. To learn more, explore our comprehensive resource on commercial auto insurance titled “Best Business Insurance for Media Entertainment Companies”

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cost for Live Event Performers

It’s important to consider these factors when determining the insurance coverage that best suits your needs. While we cannot provide specific prices as it varies among insurance providers, here are some factors that can influence the cost of insurance for live event performers:

- Performer type and business size can impact insurance costs, with larger businesses often requiring more extensive coverage.

- Higher coverage limits usually result in higher premiums, so it’s important to balance protection with affordability. To delve deeper, refer to our in-depth report titled “How does the insurance company determine my premium?.”

- Common coverage options include general liability, professional liability, equipment coverage, and personal injury protection.

- Claims history and deductible choices also influence insurance costs. Factors like performance location, equipment value, and coverage duration can impact overall costs.

Obtaining business insurance for live event performers is an investment in protecting your livelihood and assets. While the cost may vary, the peace of mind and financial security it provides in the face of unforeseen circumstances make it a worthwhile expense.

Business Insurance for Live Event Performers: Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $48 $120

Chubb $55 $138

CNA $50 $125

Hiscox $42 $105

Liberty Mutual $49 $122

Nationwide $46 $100

State Farm $47 $118

The Hartford $44 $110

Travelers $43 $99

USAA $40 $59

To get an accurate cost estimate for your specific insurance needs, it is recommended to reach out to insurance providers and request personalized quotes based on your circumstances and requirements. They will be able to provide you with more detailed information regarding the cost of business insurance for live event performers.

How to Obtain Business Insurance for Live Event Performers

Obtaining business insurance for live event performers is an important step in protecting your livelihood and ensuring the long-term success of your career. Here are the general eight steps to follow when seeking business insurance coverage:

- Identify Insurance Needs and Purchase Insurance: Assess risks like equipment damage, liability, property damage, or cancellations and complete the application process for chosen coverage.

- Research Providers and Consult With Agents: Seek specialized insurers with entertainment industry experience and engage agents for tailored coverage options.

- Discuss Tailored Options and Maintain Communication: Explore coverage like liability, equipment insurance, and business interruption and make sure you keep insurer updated on business changes.

- Obtain Quotes and Review Policy: Compare premiums, deductibles, and terms for value and understand coverage limits, exclusions, and deductibles. For a thorough understanding, refer to our detailed analysis titled “What is Annual deductible combined?.”

Remember, the steps outlined above are general guidelines. It’s essential to work closely with an insurance professional who can provide personalized guidance and tailor the coverage to your specific circumstances as a live event performer.

They can help you navigate the complexities of insurance options and ensure you have the right level of protection for your unique needs and risks.

Case Studies: Business Insurance for Live Event Performers

Explore essential business insurance for live event performers tailored to the unique needs of the entertainment industry.

- Case Study #1 – Equipment Protection: During a live concert, a performer’s guitar is damaged by stage equipment. Equipment insurance covers repair costs, ensuring minimal disruption and financial impact on the artist’s career.

- Case Study #2 – Liability Incident: At a theater performance, a guest slips and falls due to a wet floor. General liability insurance covers medical expenses and potential legal claims, providing essential protection for event organizers. To expand your knowledge, refer to our comprehensive handbook titled “Commercial General Liability (CGL) Insurance.“

- Case Study #3 – Business Interruption: An outdoor festival is canceled due to extreme weather conditions. Business interruption insurance compensates for lost revenue and ongoing expenses, helping the organizer navigate financial challenges during unforeseen events.

Select the right insurance coverage to focus on delivering unforgettable performances and events with confidence, knowing that Travelers provides specialized protection tailored to your needs.

Zach Fagiano Licensed Insurance Broker

With Travelers, you can perform without worries, knowing your equipment and business are safeguarded effectively. Their expertise and customizable policies provide tailored solutions for the entertainment industry.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Rounding Off: Business Insurance for Live Event Performers

In the dynamic world of live event performances, comprehensive insurance is essential to safeguard your business and ensure its long-term success. Tailored coverage, including general liability, equipment protection, professional liability, worker’s compensations and business interruption insurance, addresses the unique risks faced in the entertainment industry.

By investing in the right insurance, live event performers can confidently pursue their passion while minimizing financial risks associated with accidents, liability claims, and interruptions to business operations. Secure your live event performer business with proper coverage and perform with confidence, knowing that you have taken proactive steps to protect your livelihood, reputation, and financial well-being.

Protect your business today by entering your ZIP code below into our comparison tool for free commercial insurance quotes.

Frequently Asked Questions

Do I need insurance as a performer?

If you turn up to a gig without the correct insurance, you could be not allowed to perform. If you perform and have no insurance, you could be prosecuted. Bands need insurance, most importantly public liability insurance which protects your finances in the case of a claim made against the band.

What is an example of event insurance?

Special event insurance is a type of liability insurance that protects you against the financial consequences of claims related to organizing or participating in an event. For example, if your party guest slips on the dance floor and hurts their arm, event liability could protect you if they take legal action.

Start comparing affordable insurance options by entering your ZIP code below into our free quote comparison tool today.

What is performers liability insurance?

Performers insurance, policy, covers claims that could possibly come about from your performance or operations during an event you’re at. This coverage is an important component of your business and is designed to protect your financial assets if you were to be sued.

To gain profound insights, consult our extensive guide titled “Liability Insurance.”

What is insurance in event management?

Most event insurance products will start with Public Liability Insurance protection at their core. In fact, it is possible to obtain event insurance protection which only covers against public, or 3rd party liability risks if the budget for the event does not extend to a fully comprehensive insurance plan.

What is event risk insurance?

Event risk, which is synonymous with pure risk, hazard risk, or insurance risk, presents no chance of gain, only of loss. The perils covered by traditional property and casualty (P&C) insurance products are within the realm of event risk, event risk.

What is premium liability insurance?

The term liability premium in car insurance pertains to the payment or sum allocated for the coverage responsible for addressing costs associated with bodily injury and property damage you might be accountable for in the event of an accident.

For a comprehensive overview, explore our detailed resource titled “Personal Injury Protection (PIP) Insurance.”

What comes after event insurance?

After the event insurance, or ATE insurance, is a type of legal expenses insurance policy taken out to provide cover for legal costs incurred in litigation or arbitration.

How do I get entertainer insurance with cyber insurance coverage?

To get entertainer insurance with cyber insurance coverage, you can contact insurance providers specializing in entertainment industry coverage and inquire about policies that include cyber insurance.

Searching for more affordable premiums? Insert your ZIP code below to get started on finding the right provider for you and your budget.

Looking for a business owner’s policy that offers one application for multiple quotes?

A business owner’s policy (BOP) streamlines the insurance process by allowing you to submit a single application and receive multiple insurance quotes tailored to your specific business needs. This convenient approach simplifies the comparison of coverage options and helps you find the best insurance solution for your business efficiently.

For detailed information, refer to our comprehensive report titled “How to Get Free Insurance Quotes Online.”

Why is event coverage important?

As mentioned, planning and executing an event are very determining in the success of the event. However, documenting the event is just as crucial because it can become part of your portfolio and be used to reach more customer who fail to attend the event.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.