Best Business Insurance for Railroad Contractors in 2026 (Top 10 Companies)

Discover the best business insurance for railroad contractors with Auto-Owners, Safeco, and The Hartford, with minimum rates start at $65/month. These top providers offer customized coverage for railroad contractors, ensuring protection against industry risks like property damage, liability claims, and accidents.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. Through her years working in th...

Melanie Musson

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Jeff Root

Updated August 2025

563 reviews

563 reviewsCompany Facts

Full Coverage For Railroad Contractors

A.M. Best Rating

Complaint Level

Pros & Cons

563 reviews

563 reviews 1,278 reviews

1,278 reviewsCompany Facts

Full Coverage For Railroad Contractors

A.M. Best Rating

Complaint Level

Pros & Cons

1,278 reviews

1,278 reviews 765 reviews

765 reviewsCompany Facts

Full Coverage For Railroad Contractors

A.M. Best Rating

Complaint Level

Pros & Cons

765 reviews

765 reviewsAuto-Owners, Safeco, and The Hartford stand out as top picks for the best business insurance for railroad contractors, offering tailored coverage and rates in protecting your operations.

With a focus on safeguarding your business against property damage, liability claims, and accidents, discover how these companies offer comprehensive protection for your operations.

Our Top 10 Company Picks: Best Business Insurance for Railroad Contractors

| Company | Rank | Business Policy Discount | Equipment Rental Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | 10% | Personalized Coverage | Auto-Owners | |

| #2 | 15% | 10% | Customizable Policies | Safeco | |

| #3 | 15% | 10% | Industry-Specific Expertise | The Hartford |

| #4 | 15% | 10% | BOP Coverage | Natiowide |

| #5 | 15% | 10% | Online Tools | Progressive | |

| #6 | 15% | 10% | Local Agents | State Farm | |

| #7 | 15% | 10% | Personalized Service | Farmers | |

| #8 | 15% | 10% | Tailored Coverage | Liberty Mutual |

| #9 | 15% | 10% | Bundled Policies | Allstate | |

| #10 | 15% | 10% | Big Discounts | The General |

This article aims to equip you with the necessary insights to make informed decisions, ensuring the long-term stability and success of your railroad contracting business.

Don’t let expensive insurance rates hold you back. Enter your ZIP code above and shop for affordable premiums from the top companies.

- Customized insurance plans designed specifically for railroad contractors

- Auto-Owners stands out as a top pick for coverage, with rates starts at $65/month

- Comprehensive coverage against industry-specific risks and more

#1 – Auto-Owners: Top Overall Pick

Pros

- Personalized Coverage: Provides a personalized coverage focus, along with up to a 15% discount on business insurance, according to Auto-Owners insurance review & ratings.

- Additional Discounts: Provides additional discounts of up to 10%, enhancing potential savings for customers.

- Industry Experience: Auto-Owners has earned a positive A+ A.M. Best rating, indicating financial stability and reliability.

Cons

- Limited Reviews: While the average rating is high, the number of reviews (1,164) may be considered relatively low for a comprehensive assessment.

- Average Monthly Rate not Specified: The content does not provide specific details on the average monthly rate for good drivers.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Safeco: Best for Tailoring Security

Pros

- Customizable Policies: Emphasizes up to 15% business insurance discount with a focus on customizable policies.

- Additional Discounts: Offers additional discounts of up to 10%, providing potential cost savings for customers.

- Solid A.M. Best Rating: Safeco insurance review & ratings showcase an A grade from A.M. Best, signifying strong financial stability and trustworthiness.

Cons

- Lack of Reviews: No customer reviews are provided, making it challenging to gauge customer experiences.

- Average Monthly Rate not Specified: Specific details on the average monthly rate for good drivers are missing.

#3 – The Hartford: Best for Crafting Excellence

Pros

- Industry-Specific Expertise: Ranked as the third-best option, emphasizing specialized knowledge within the industry, according to The Hartford insurance review & ratings.

- Discounts Offered: Provides up to 15% business insurance discount and up to 10% additional discount.

- High A.M. Best Rating: Boasts an A+ A.M. Best rating, indicating strong financial stability.

Cons

- No Average Monthly Rate Information: The average monthly rate for good drivers is not specified in the content.

- Limited Reviews: The content mentions “N/A” reviews, leaving gaps in understanding customer sentiments.

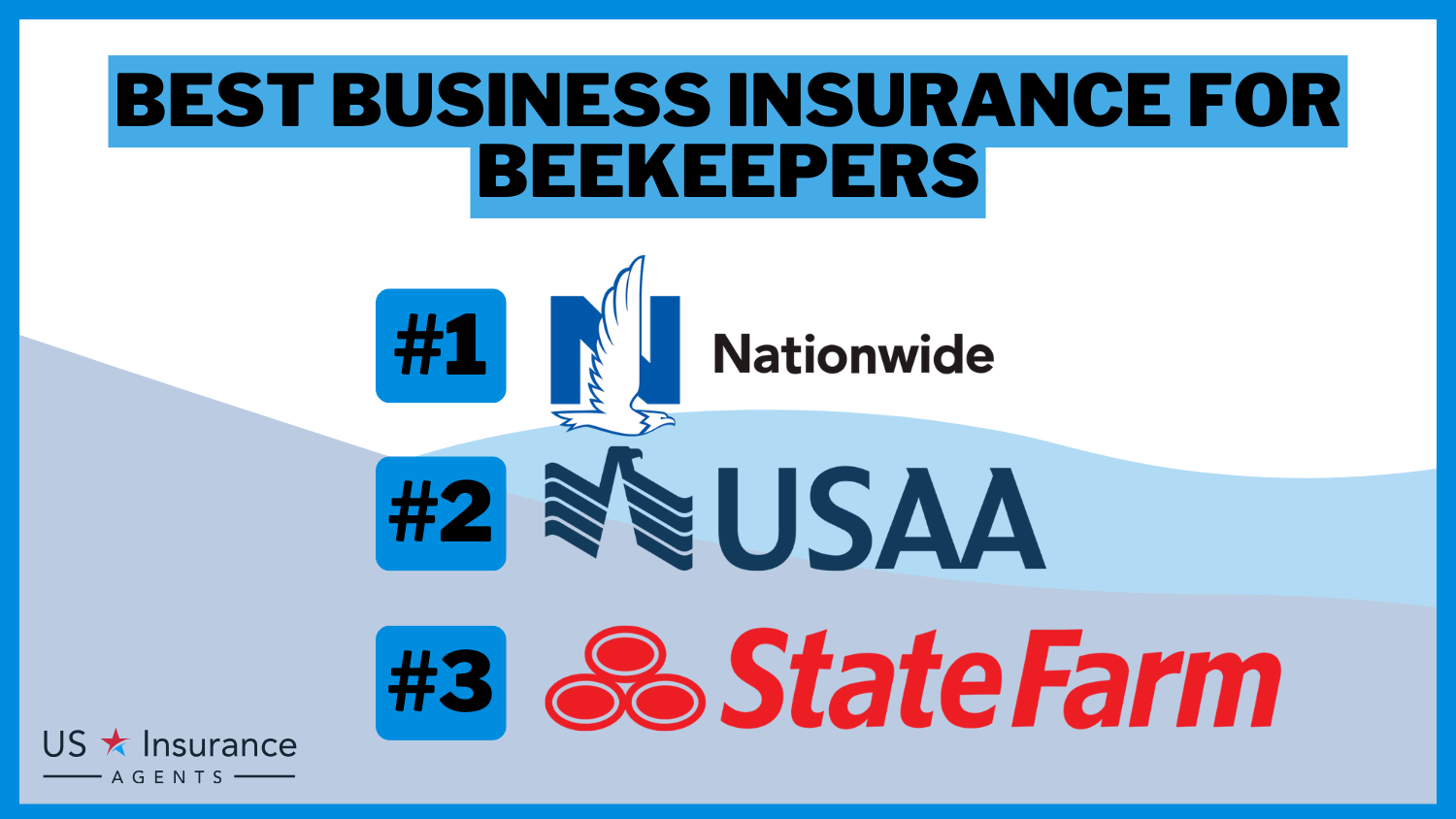

#4 – Nationwide: Best for Comprehensive Coverage

Pros

- BOP Coverage: Specializes in Business Owner’s Policy (BOP) coverage, catering to the comprehensive needs of business owners.

- Business Discount: Offers a significant business insurance discount of up to 15%.

- Additional Discounts: Enhances potential savings by offering up to a 10% additional discount through Nationwide insurance review & ratings.

Cons

- Limited Information: The content lacks specific details about Nationwide’s coverage options and policies.

- No Average Monthly Rate Information: The average monthly rate for good drivers is not specified.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for Digital Assurance

Pros

- Online Tools: Stands out with a focus on providing online tools for customer convenience.

- Insurance Discount: Provides a notable 15% discount on business insurance, as highlighted in Progressive insurance review & ratings.

- Additional Discounts: Provides up to 10% additional discount, potentially enhancing overall savings.

Cons

- Limited Information: The content could provide more detailed information about Progressive’s coverage options and policies.

- No Average Monthly Rate Information: The average monthly rate for good drivers is not specified.

#6 – State Farm: Best for Global Protection

Pros

- Local agents: State Farm insurance review & ratings highlights the importance of local agents, offering tailor-made and community-oriented customer service.

- Significant Discount: Offers a significant business insurance discount of up to 15%.

- Additional Discounts: Provides up to 10% additional discount, potentially enhancing overall savings.

Cons

- Limited Information: The content lacks specific details about State Farm’s coverage options and policies.

- No Average Monthly Rate Information: The average monthly rate for good drivers is not specified.

#7 – Farmers: Best for Beyond Policies

Pros

- Personalized Service: Focuses on providing personalized service, catering to the individual needs of customers.

- Offers Discount: Provides a notable reduction of up to 15% on business insurance through Farmers insurance review & ratings.

- Additional Discounts: Provides up to 10% additional discount, potentially enhancing overall savings.

Cons

- Limited Information: The content lacks specific details about Farmers’ coverage options and policies.

- No Average Monthly Rate Information: The average monthly rate for good drivers is not specified.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Safeguarding

Pros

- Tailored Coverage: Focuses on providing tailored coverage, indicating flexibility to meet specific needs.

- Significant Discount: Provides a noteworthy discount of up to 15% on business insurance through Liberty Mutual insurance review & ratings.

- Additional Discounts: Provides up to 10% additional discount, potentially enhancing overall savings.

Cons

- Limited Information: The content lacks specific details about Liberty Mutual’s coverage options and policies.

- No Average Monthly Rate Information: The average monthly rate for good drivers is not specified.

#9 – Allstate: Best for Integrated Assurance

Pros

- Bundled Policies: Focuses on offering bundled policies, potentially providing convenience and cost savings.

- Business Insurance Discount: Offers a significant business insurance discount of up to 15%.

- Additional Discounts: Enhances overall savings by offering a potential additional discount of up to 10% through the Allstate insurance review & ratings.

Cons

- Limited Information: The content lacks specific details about Allstate’s coverage options and policies.

- No Average Monthly Rate Information: The average monthly rate for good drivers is not specified.

#10 – The General: Best for Discount Dynamics

Pros

- Big Discounts: The General insurance review & ratings highlights significant savings, potentially attracting budget-conscious clientele.

- Offers Discount: Offers a significant business insurance discount of up to 15%.

- Additional Discounts: Provides up to 10% additional discount, potentially enhancing overall savings.

Cons

- Limited Information: The content lacks specific details about The General’s coverage options and policies.

- No Average Monthly Rate Information: The average monthly rate for good drivers is not specified.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Safeguarding Your Railroad Contractors Business: Recommended Insurance Coverage

As a railroad contractor, protecting your business is essential to ensure its long-term success. One crucial aspect of safeguarding your operations is having the right insurance coverage. Here are some recommended insurance options specifically tailored for railroad contractors:

- General Liability Coverage: Protects your business against claims for bodily injury, property damage, and personal injury from third parties. It provides financial protection for potential lawsuits, medical expenses, and legal fees.

- Property Coverage: Safeguards your physical assets, such as buildings, equipment, and inventory, against perils like fire, theft, and natural disasters. This coverage ensures your business can recover quickly and resume operations.

- Commercial Auto Coverage: Essential if your business relies on vehicles for transportation and hauling. It covers accidents, collisions, and damages to your business-owned vehicles and provides liability protection.

- Inland Marine Insurance: Specifically designed to protect movable property frequently transported over land, such as specialized equipment and tools used in your operations. It covers theft, damage, or loss during transportation or on the job site.

- Railroad Protective Liability: Tailored for businesses working near or alongside railroads, providing protection against claims for bodily injury or property damage arising from railroad operations.

- Umbrella Coverage: Offers an additional layer of liability protection beyond the limits of your primary insurance policies. It provides higher coverage limits and broader protection against large-scale liability claims.

Remember, each railroad contracting business has its own specific needs and risks. It is advisable to consult with an experienced insurance agent or broker who specializes in railroad contractors to assess your unique requirements and customize the appropriate insurance coverage for your business. Check out our ranking of the top providers: Best Business Insurance for Contractors

Business Insurance for Railroad Contractors: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $70 | $180 |

| Auto-Owners | $75 | $87 |

| Farmers | $80 | $200 |

| Liberty Mutual | $72 | $185 |

| Nationwide | $68 | $175 |

| Progressive | $65 | $170 |

| Safeco | $73 | $71 |

| State Farm | $69 | $175 |

| The General | $67 | $170 |

| The Hartford | $71 | $140 |

Discover the range of monthly rates for business insurance tailored to railroad contractors. From minimum to full coverage, rates vary among providers like Auto-Owners, offering competitive rates starting at $75 for minimum coverage and $87 for full coverage, and Safeco, offering full coverage at just $71 per month.

Steps to Acquire Business Insurance for Railroad Contractors

Obtaining the right business insurance for your railroad contracting business is crucial for protecting your operations and mitigating risks. To help you navigate the process, here are six simple steps to follow:

- Assess your specific insurance needs. Evaluate the size of your operations, equipment used, employee count, and project scope to determine the types and amounts of coverage required.

- Research reputable insurance providers. Look for insurers with expertise in providing coverage to railroad contractors. Read reviews and seek recommendations to ensure reliability.

- Request quotes and compare rates. Contact multiple insurance providers for quotes, comparing rates, policy features, and coverage limits to find the best options.

- Consult with an insurance agent or broker. Seek guidance from an experienced agent or broker specializing in railroad contractor insurance to navigate policy complexities. For a thorough understanding, refer to our detailed analysis titled “Your Insurance Agent’s Role in the Claims Process.”

- Review and understand policy terms. Carefully review policy terms, including coverage limits, exclusions, deductibles, and additional endorsements or riders.

- Purchase your insurance policy. Once satisfied with the coverage and terms, proceed with purchasing your insurance policy, ensuring all necessary documentation is in order.

Keep in mind that obtaining business insurance for railroad contractors is not just a procedural step but a vital necessity in safeguarding your operations and minimizing potential risks that could jeopardize your business’s stability and continuity.

Jeff Root Licensed Life Insurance Agent

By following these steps and working with a reputable insurance provider, you can secure the appropriate coverage that meets the unique needs of your railroad contracting business.

Decoding the Price of Business Insurance for Railroad Contractors

The cost of business insurance for railroad contractors fluctuates based on factors such as business size, coverage needs, asset value, claims history, and operational risk. While it’s difficult to provide an exact cost without specific details, here are some factors to consider that can influence the cost of your insurance:

- Coverage Types: The specific types of insurance coverage you choose, such as general liability, property coverage, commercial auto, inland marine, railroad protective liability, and umbrella coverage.

- Business Size: The size and scale of your business, including the number of employees and annual revenue.

- Risk Assessment: The level of risk associated with your business activities, such as working with heavy machinery, proximity to railroads, and exposure to hazardous materials.

- Claims History: Your past claims history and the frequency or severity of claims made.

- Deductibles and Limits: The deductibles and coverage limits you select for your insurance policies.

- Insurance Provider: Different insurance providers have varying pricing structures and underwriting guidelines.

It’s essential to directly engage with insurance providers, as they possess the expertise and resources necessary to assess your specific needs, analyze risk factors, and tailor coverage options accordingly.

By discussing your specific business details and insurance requirements with experienced agents, you can obtain tailored quotes and find the most cost-effective business insurance options for your railroad contracting business.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Proactive Measures for Safeguarding Your Railroad Contractors Business

In addition to obtaining the recommended insurance coverage, there are additional five steps you can take to further protect your railroad contractors business:

- Prioritize safety. Establish clear safety protocols, train employees on safety procedures, and provide them with proper protective equipment. Regularly inspect the work environment and conduct safety training sessions to prevent accidents and injuries.

- Maintain equipment. Perform regular maintenance and inspections of equipment, machinery, and vehicles. Address any issues promptly to avoid breakdowns or accidents caused by faulty equipment. Explore our list of the leading providers: Best Car Insurance by Vehicle

- Keep organized records. Maintain detailed records of contracts, safety measures, and maintenance activities. Good record-keeping helps in the event of incidents or claims and ensures compliance with regulations.

- Stay informed. Stay updated on industry regulations and compliance requirements. Regularly review and update safety protocols, employee training, and equipment standards to meet the latest standards.

- Seek professional advice. Work with experienced professionals who understand the specific risks of railroad contracting. Consultants, legal advisors, and risk management experts can provide valuable guidance on risk mitigation and compliance.

Protecting your railroad contractors business involves a comprehensive approach that combines appropriate insurance coverage, robust safety measures, diligent equipment maintenance, accurate record-keeping, and staying informed about industry regulations.

Laura Walker Former Licensed Agent

By implementing these additional steps, you can enhance the overall protection of your business and minimize potential risks and liabilities.

Case Studies: Success Stories of Business Insurance for Railroad Contractors

These case studies vividly illustrate the indispensable role that business insurance plays in the world of railroad contracting. From protecting against liability claims to ensuring continuity in the face of unexpected events, insurance serves as a vital safety net for businesses in this industry.

- Case Study #1 – General Liability Coverage: RailWorks Construction, contracted for a new railroad crossing, faces a lawsuit due to a pedestrian injury on-site. Luckily, their general liability insurance covers legal fees, medical expenses, and potential settlements, safeguarding them from major financial repercussions.

- Case Study #2 – Property Coverage: TransTrack Maintenance’s warehouse suffered a fire due to an electrical issue, damaging the building and equipment. Luckily, their insurance covered the repairs and replacements, enabling TransTrack to bounce back financially and continue their operations smoothly.

- Case Study #3 – Commercial Auto Coverage: FastTrack Rail Services’ vehicle collided en route to a job site, causing damage and injuries. Thankfully, their commercial auto insurance steps in, covering repair costs, medical expenses, and liability claims. This ensures FastTrack can manage the financial impact and sustain operations seamlessly.

- Case Study #4 – Inland Marine Insurance: RailTech Contractors, a track maintenance specialist, faced a setback when their track-laying machine got damaged in a storm during transportation. Luckily, their inland marine insurance covered the repair/replacement costs, ensuring uninterrupted operations.

- Case Study #5 – Railroad Protective Liability: BridgeRail Construction, building a bridge over an active railway, accidentally damages tracks, stopping train operations. The railway firm sues. Thankfully, BridgeRail has railroad protective liability coverage, covering legal fees and settlements, easing the lawsuit process.

By investing in comprehensive coverage tailored specifically to their unique needs, railroad contractors can effectively minimize risks, ensuring smooth operations and creating opportunities for growth and success.

Melanie Musson Published Insurance Expert

With customized insurance solutions in place, they can navigate challenges confidently, seize opportunities, and propel their businesses forward on the tracks of prosperity.

Wind-Up: Safeguarding Your Railroad Contracting Business

Securing adequate insurance protects your railroad contracting business. Consult experts, customize policies, and ensure coverage for liabilities like general, property, commercial auto, inland marine, railroad protective, and umbrella. For a comprehensive comprehension, consult our in-depth examination titled “Commercial Insurance: A Complete Guide.”

Invest in insurance for your railroad contracting business to tackle accidents, lawsuits, and disasters, ensuring financial stability with coverage for legal, medical, and repair expenses. Evaluate risks, choose appropriate coverage, and compare rates for protection, allowing focus on delivering exceptional services and gaining peace of mind.

Understanding how insurance works can feel complicated, but finding affordable rates doesn’t have to be. Enter your ZIP code below for the best insurance rates possible.

Frequently Asked Questions

What is business insurance for railroads?

Business insurance for railroads refers to insurance coverage specifically tailored to the needs of railroad companies. It provides financial protection against various risks and liabilities associated with railroad operations, including property damage, liability claims, accidents, and environmental hazards.

To enhance your understanding, explore our comprehensive insurance titled “Liability Insurance: A Complete Guide.”

What types of coverage are typically included in railroad insurance policies?

Railroad insurance policies often include a range of coverage options, such as general liability insurance, property insurance, commercial auto insurance for railroad vehicles, inland marine insurance for equipment and cargo, railroad protective liability insurance, and umbrella coverage for additional liability protection.

How do railroad insurance companies differ from other insurers?

Railroad insurance companies specialize in providing insurance solutions designed specifically for the unique risks and challenges faced by railroad businesses. Unlike general insurers, they have a deep understanding of the railroad industry and offer customized coverage options to address the specific needs of railroad operators.

See which companies have the cheapest rates for you by entering your ZIP code in our free comparison tool below.

Why is it important for railroad companies to choose a specialized insurance provider for their coverage needs?

Selecting a specialized railroad insurance company ensures that railroad companies receive coverage that is tailored to their unique risks and operations. These insurers have expertise in understanding the intricacies of railroad operations and can provide comprehensive coverage options that address specific industry-related risks, offering peace of mind to railroad operators.

What is the RRP policy?

The RRP policy protects a railroad from liability it incurs because of the work of the designated contractor on or near the railroad right of way. This covers the railroad entity when it comes to physical damage to the railroad’s property.

Which risk is covered by insurance contracts?

A classic example of pure risk is that of an earthquake or an accident. These events may either occur or not since there is no third outcome. A loss can arise only if these events occur. Insurance contracts only cover pure risks.

Check out the standout providers listed in our compilation: Best Life Insurance Policies for Construction Workers

What is a contractor’s all risk insurance?

Contractors’ all risks (CAR) insurance is a non-standard insurance policy that provides coverage for property damage and third-party injury or damage claims, the two primary types of risks on construction projects.

What does general insurance cover?

General insurance covers non-life assets, such as your home, vehicle, health, and travel. You get compensation for damages or losses incurred due to flood, fire, theft, accidents, or any man-made disasters.

What is the meaning of construction insurance?

Construction insurance is insurance protection that provides financial compensation for covered losses to a building or structure, as many mistakes, errors, and unforeseen events can lead to damages and losses during the construction of a building.

Discover the top providers on our list: Best Health Insurance For Building Managers

What is a contractor insurance company?

Contractors’ All-Risk insurance is designed to offer comprehensive protection against losses to contract works, construction plant and equipment, construction machinery and liability to third-party. It also provides financial stability to all parties in the construction contract.

Compare insurance rates today by entering your ZIP code into our free comparison tool below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.