Best Business Insurance for Swim Schools in 2026 (Top 10 Companies)

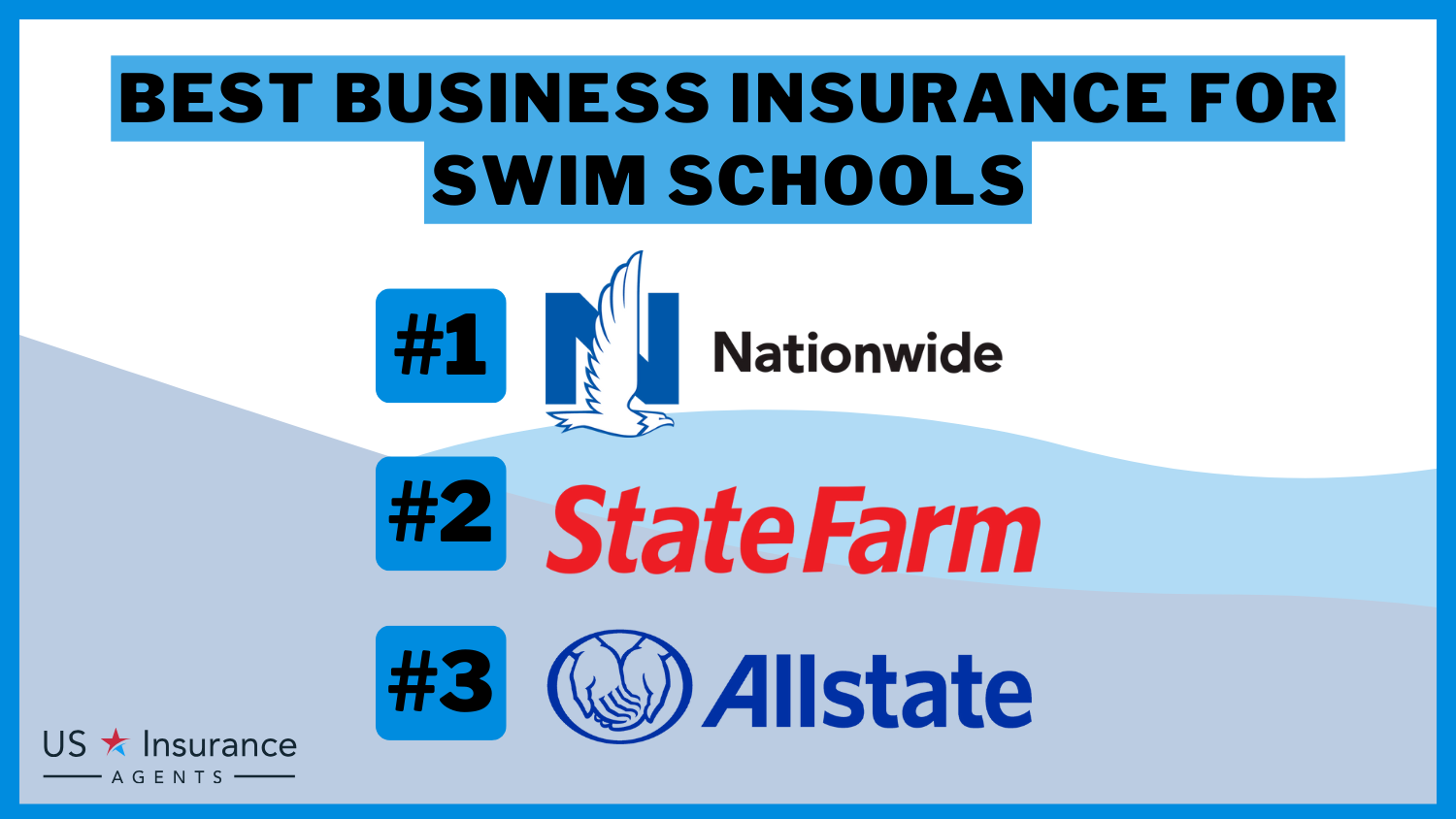

Explore best business insurance for swim schools, where Nationwide, State Farm, and Allstate lead the pack with a generous 15% discount. Their comprehensive coverage options are specifically designed to protect swim schools from various risks, ensuring peace of mind for owners and instructors alike.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Licensed Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Jeffrey Manola

Updated January 2025

3,071 reviews

3,071 reviewsCompany Facts

Full Coverage for Swim Schools

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Swim Schools

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Swim Schools

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsNationwide, State Farm, and Allstate emerge as the top contenders for the best business insurance for swim schools, thanks to their competitive rates and extensive coverage options tailored to the unique needs of swim school owners.

In our comprehensive coverage guide, we meticulously examine the intricacies of swim school insurance, shedding light on Nationwide’s enticing 15% discount and the customized solutions offered by all three companies.

Our Top 10 Company Picks: Best Business Insurance for Swim Schools

| Company | Rank | Business Discount | Family Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 20% | 15% | Custom Coverage | Nationwide |

| #2 | 17% | 15% | Local Agents | State Farm | |

| #3 | 25% | 20% | Online Tools | Allstate | |

| #4 | 20% | 12% | Industry Expertise | Liberty Mutual |

| #5 | 22% | 22% | Risk Control | Travelers | |

| #6 | 19% | 20% | Business Focus | Hiscox |

| #7 | 19% | 19% | Claim Satisfaction | Auto-Owners | |

| #8 | 21% | 21% | Financial Stability | Chubb | |

| #9 | 18% | 20% | Global Reach | Progressive | |

| #10 | 14% | 14% | Variety of Coverages | Farmers |

Dive into our insights to fortify your swim school against unforeseen risks and ensure lasting peace of mind for you and your team.

Shield your business from financial setbacks. Enter your ZIP code above to shop for cheap commercial insurance rates from top providers near you.

- Nationwide provides a 15% discount, meeting swim schools’ insurance needs

- Tailored coverage options safeguard against unforeseen risks

- Comprehensive insights ensure optimal protection for owners

#1 – Nationwide: Top Overall Pick

Pros

- Customized Coverage Options: Nationwide offers tailored insurance solutions, allowing swim schools to choose coverage that meets their specific needs.

- Strong Financial Stability: Nationwide insurance review & ratings highlight the company’s robust financial stability, offering peace of mind that claims support processing will be efficient and reliable.

- Wide Range of Services: Beyond standard coverage, Nationwide offers additional services and resources to support swim school businesses.

Cons

- Potentially Higher Premiums: While offering comprehensive coverage, Nationwide’s premiums may be relatively higher compared to some competitors.

- Limited Local Agent Presence: Nationwide’s local agent network may be less extensive in certain areas, impacting personalized service availability.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Local Agents

Pros

- Local Agents: State Farm insurance review & ratings highlights the company’s customized coverage tailored to meet the specific needs of each community.

- Comprehensive Coverage: They provide a wide range of insurance products and services beyond business insurance, making it convenient to bundle policies.

- Strong Financial Stability: State Farm has a solid financial reputation, ensuring they can fulfill claims and provide reliable support.

Cons

- Potentially Higher Premiums: Some customers may find State Farm’s premiums to be higher compared to other insurers.

- Limited Online Quoting: The online quote process with State Farm may not be as streamlined as with some other insurance companies.

#3 – Allstate: Best for Online Tools

Pros

- Advanced Online Tools: Allstate offers convenient online tools and resources for managing policies and filing claims, providing ease of use for customers.

- Strong Customer Service: Allstate is known for its attentive customer service, with agents readily available to assist policyholders with their insurance needs.

- Comprehensive Coverage Options: The Allstate insurance review & ratings demonstrate that the company has customized coverage options for various business needs, ensuring flexibility and comprehensive protection.

Cons

- Potentially Higher Premiums: Some customers may find Allstate’s premiums to be relatively higher compared to other insurers, depending on the specific coverage and location.

- Mixed Customer Reviews: While Allstate boasts strong customer service, some customers have reported mixed experiences with claims processing and resolution.

#4 – Liberty Mutual: Best for Industry Expertise

Pros

- Industry Expertise: Liberty Mutual has extensive experience in local expertise that providing insurance solutions, including tailored options for swim schools.

- Custom Solutions: They offer personalized coverage options to meet the unique needs of swim schools, ensuring comprehensive protection.

- Strong Reputation: The Liberty Mutual insurance review & ratings highlight the company’s reputation for strong financial security and dependability, offering policyholders a sense of assurance and confidence.

Cons

- Cost: Premiums with Liberty Mutual may be higher compared to some competitors, depending on the specific coverage needs.

- Claims Process: Some customers have reported longer-than-expected claim processing times with Liberty Mutual, which can be a drawback for swim schools requiring prompt service.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Travelers: Best for Risk Control

Pros

- Comprehensive Coverage: Travelers offers a wide range of insurance products beyond standard policies, including specialized coverage options for unique business needs.

- Risk Control Services: The Travelers insurance review & ratings demonstrate the company’s tailored coverage options designed to assist businesses in mitigating potential risks and enhancing safety measures.

- Strong Financial Stability: Travelers is a financially stable company with a solid reputation, offering reassurance that claims will be handled efficiently.

Cons

- Higher Premiums: Compared to some competitors, Travelers’ premiums can be relatively higher, especially for certain types of coverage.

- Limited Regional Availability: Travelers may not be available in all regions, which could limit options for businesses operating in specific locations.

#6 – Hiscox: Best for Business Focus

Pros

- Dedicated Business Focus: Hiscox specializes in serving small businesses, offering tailored coverage to meet unique needs.

- Online Convenience: Easy online quotes and policy management make it simple to get coverage quickly.

- Flexible Options: Hiscox provides comprehensive coverage that is customizable insuring solutions, allowing businesses to select coverage that fits their specific requirements.

Cons

- Limited Coverage for Larger Businesses: Hiscox primarily caters to small businesses, so larger companies might find coverage options limited.

- May Not Offer All Industry-Specific Coverages: Depending on the industry experience, some specialized coverages may not be available through Hiscox.

#7 – Auto Owners: Best for Claim Satisfaction

Pros

- High Claim Satisfaction: Recognized for outstanding performance in managing claims and ensuring high levels of customer satisfaction, Auto Owners Insurance review & ratings highlight its strong reputation in these areas.

- Competitive Discount Schemes: Offers up to 19% discount in both business insurance discount and additional discount.

- Comprehensive Coverage: Provides a wide range of coverage options to suit various business needs.

Cons

- Limited Availability: Not available in all states or regions.

- Less Focus on Technology: Less emphasis on online tools and digital management.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Chubb: Best for Financial Stability

Pros

- Financial Stability: Chubb is well-known for its strong financial stability, providing reassurance that claims will be covered reliably.

- Customizable Coverage: Chubb insurance review & ratings provides a diverse selection of coverage choices designed to meet distinct business requirements, guaranteeing thorough protection.

- High-Quality Service: Chubb is recognized for its excellent customer service and efficient claims handling, providing peace of mind to policyholders.

Cons

- Premium Costs: Chubb’s comprehensive coverage often comes at a higher premium compared to some other insurers.

- Limited Accessibility: Chubb’s policies may not be as widely available or accessible in certain regions, limiting options for potential customers.

#9 – Progressive: Best for Global Reach

Pros

- Global Reach: Progressive offers coverage across the United States, making it accessible for businesses operating in diverse locations.

- Innovative Technology: Progressive insurance review & ratings demonstrates the company’s tailored coverage options for policy management and claims processing, showcasing their commitment to personalized service.

- Competitive Pricing: Progressive often offers competitive rates and discounts, making it attractive for cost-conscious customers.

Cons

- Customer Service: Some customers have reported mixed experiences with customer service quality.

- Coverage Limitations: Certain specialized coverage options may not be as comprehensive compared to other providers.

#10 – Farmers: Best ford Variety of Coverages

Pros

- Variety of Coverages: Farmers offers a wide range of insurance options, including specialized coverage for unique needs like farm and ranch insurance.

- Strong Financial Stability: The company boasts solid financial stability, which provides reassurance to policyholders.

- Local Agents: The Farmers insurance review & ratings highlight the convenience of personalized service and support provided by their network of local agents, ensuring customers receive tailored assistance.

Cons

- Limited Online Tools: Farmers may have fewer online tools compared to some other insurers, which could impact convenience for tech-savvy customers.

- Potential Higher Premiums: Depending on individual circumstances, Farmers’ premiums could be relatively higher than those of some competitors.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dive Into Protection: General Liability Insurance for Swim Schools

General liability insurance is a fundamental policy that every swim school business should have. It provides coverage for various risks and acts as a safety net to protect your business from potential financial losses. Here are some key points to understand about general liability insurance for swim schools:

- Bodily Injuries: If a student or visitor gets injured at your swim school, general liability insurance covers their medical expenses. To gain profound insights, consult our extensive guide titled “Personal Injury Protection (PIP) Insurance.”

- Property Damage: It also provides coverage for accidental damage to someone else’s property, such as a student’s belongings or neighboring facilities.

- Limitations and exclusions: Remember that there may be specific scenarios not covered by general liability insurance. Review your policy carefully and consider additional coverage if needed.

Having general liability insurance is a critical step in safeguarding your swim school business. It provides a layer of financial protection against unforeseen accidents, injuries, property damage, and legal disputes.

Remember to choose a policy that aligns with the specific needs and risks of your swim school.

Finding the Right Business Insurers Coverage for Swim Schools

When it comes to insuring your swim school, you have different options to choose from. Here are three types of insurers that cater to the unique needs of swim schools:

- Traditional Insurers: Well-established companies that offer a wide range of insurance products. They provide comprehensive coverage options but may have higher premiums.

- Online Insurers: Convenient and cost-effective option for small and new swim schools. They offer competitive rates and flexible coverage options through user-friendly online platforms.

- Specialized Insurers: Insurers that specialize in serving swim schools specifically. They understand the unique risks and challenges of the industry and provide tailored coverage options.

Obtaining quotes and conducting thorough research will help you make an informed decision that protects your swim school business effectively. For a comprehensive overview, explore our detailed resource titled “How To Get Free Insurance Quotes Online.”

Diversifying Coverage: Additional Business Insurance Options for Swim Schools

In addition to general liability insurance, swim schools may require additional coverage options to ensure comprehensive protection. Here are some key types of business insurance to consider for your swim school:

- Professional Liability Insurance: This coverage safeguards insurance for swim instructors from claims related to inadequate instruction or negligence, providing financial protection in the event of lawsuits.

Commercial auto insurance is very vital if your swim school uses vehicles for transportation or equipment delivery, commercial auto insurance protects against accidents, property damage, and injuries. Moreover commercial umbrella insurance policy provides an extra layer of liability coverage beyond general liability and other policies, offering increased financial protection in case of large claims.

- Workers’ Compensation Insurance: Essential for swim schools with employees, this insurance covers medical expenses and lost wages for instructors who sustain work-related injuries.

- Property Insurance: To safeguard physical assets like buildings, pools, and equipment, property insurance covers damages caused by fire, theft, or natural disasters.

Insurance for swimming instructors is crucial for protecting your swim school and its staff. Additionally, swim instructor insurance provides essential coverage. By understanding these additional coverage options and selecting the right policies for your swim school, you can ensure comprehensive protection and peace of mind.

Jeff Root Licensed Life Insurance Agent

Don’t forget to consult with insurance professionals to assess your specific needs and tailor your coverage accordingly.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Business Insurance Costs for Swim Schools

However, it’s important to note that this is just a general estimate, and the actual cost will depend on specific details of your swim school, such as the size of your facility, number of employees, location, and annual revenue. Factors that can influence the cost of business insurance for swim schools include:

- Costs vary, with an average of $300 to $800 per year for $1 million in general liability coverage. To enhance your understanding, explore our comprehensive resource on business insurance titled “Commercial General Liability (CGL) Insurance.”

- Factors like facility size, number of employees, and location influence costs.

- Compare quotes to ensure competitive rates and optimal coverage.

Compare quotes from multiple insurance providers to ensure you are getting the best coverage at the most competitive rates.

Business Insurance for Swim Schools: Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $70 $150

Auto-Owners $65 $140

Chubb $75 $155

Farmers $70 $145

Hiscox $65 $135

Liberty Mutual $80 $150

Nationwide $65 $145

Progressive $70 $150

State Farm $65 $155

Travelers $70 $150

By understanding the factors that influence pricing and exploring different insurance options, you can make an informed decision to protect your swim school business without overpaying.

Enhancing Safety: Additional Measures to Protect Your Swim School Business

Taking additional steps to protect your swim school by having business insurance to ensure its long-term success and minimizing risks. Here are key actions you can take:

- Prioritize Safety: Establish and enforce strict safety protocols, such as proper lifeguard supervision and regular facility inspections.

- Keep Records: Maintain detailed documentation of incidents, accidents, and potential risks within your swim school for legal purposes.

Provide ongoing training to your instructors and staff to ensure they are well-prepared to handle emergencies and follow the latest safety procedures. Regularly inspect and maintain your swimming pool, equipment, and facilities to prevent accidents caused by equipment failure or unsafe conditions.

- Stay Informed: Stay updated on regulations, safety guidelines, and industry best practices to ensure your swim school operates in compliance and follows the latest safety standards.

Crucial for protecting your swim school and its staff is insurance for swimming instructors, including swim instructor liability insurance. Additionally, essential coverage is provided by swim lesson insurance and swimming instructor insurance.

By implementing these additional steps, you can create a safe and secure environment for your swim school business, protect your reputation, and provide peace of mind to both students and their families. This proactive approach not only ensures the well-being of all individuals involved but also fosters trust and peace of mind within your community.

Case Studies: Success Stories in Swim School Insurance

Discover the essential guide to securing the best business insurance for swim schools. From top providers to coverage options, dive into expert insights to protect your swim school against unforeseen risks and ensure peace of mind for you and your students.

- Case Study #1 – Equipment Protection: A swim school’s pool ladder breaks during a class, causing injury. Equipment insurance covers repair costs, ensuring safety and continuity.

- Case Study #2 – Liability Incident: A spectator slips at a swim meet, sustaining injuries. General liability insurance covers medical expenses and legal claims, protecting the swim school. For detailed information, refer to our comprehensive report titled “Liability Insurance.”

- Case Study #3 – Business Interruption: Pool maintenance forces closure, causing revenue loss. Business interruption insurance compensates, ensuring financial stability during downtime.

Ensure the safety and success of your swim school by prioritizing comprehensive insurance coverage.

Ty Stewart Licensed Life Insurance Agent

With tailored options and expert guidance, you can navigate potential challenges with confidence, safeguarding your business for years to come.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Upshot: Protecting Your Swim School Business and Peace of Mind

Obtaining the right insurance coverage is essential for safeguarding your swim school business. General liability insurance is the foundation, covering accidents and property damage. Additional types of coverage, such as professional liability, workers’ compensation, and commercial auto insurance, offer tailored protection.

To further protect your swim school, prioritize safety, maintain detailed records, provide staff training, and stay informed about regulations and best practices. Online insurers offer cost-effective options for small and new swim schools.

Remember, insurance is not the only defense. Implement comprehensive safety measures and maintain well-maintained facilities. By taking these steps, you can ensure the long-term success of your swim school and provide peace of mind to students and their families.

Protect your business today by entering your ZIP code below into our comparison tool for free commercial insurance quotes.

Frequently Asked Questions

What does cybersecurity insurance cover for swim schools?

Cybersecurity insurance for swim schools typically covers expenses related to data breaches, cyberattacks, and other security incidents, including costs for investigation, notification, legal fees, and possible financial losses.

How much can swim school insurance cost?

The cost of swim school insurance can vary widely depending on factors like facility size, location, coverage options, and the insurance provider. Typically, premiums range from a few hundred to several thousand dollars annually.

What does general liability insurance for swim schools cover?

General liability insurance for swim schools covers bodily injury, property damage, and personal injury claims. It provides financial protection if a third party is injured or their property is damaged on your premises or due to your business operations. Coverage may include legal fees and settlements for covered claims, but specifics can vary depending on your premium.

To gain profound insights, consult our extensive guide titled “How does the insurance company determine my premium?.”

What does personal trainer insurance cover?

Personal trainer insurance typically covers liability claims arising from injuries to clients, property damage, and other related risks during training sessions.

Start comparing affordable insurance options by entering your ZIP code below into our free quote comparison tool today.

What insurance do swim schools need to consider?

Swim schools should consider insurance options like general liability, professional liability, workers’ comp, property, auto, disability, and umbrella coverage to protect their business, staff, and clients.

For a comprehensive overview, explore our detailed resource titled “What is Disability?.

Will swim school insurance completely protect my business?

While swim school insurance provides essential protection against various risks, it may not cover all potential liabilities. It’s crucial to review policy details and consider additional coverage options to ensure comprehensive protection for your business.

What insurance do swim schools need to consider?

Swim schools should consider insurance options like general liability, professional liability, workers’ comp, property, auto, disability, and umbrella coverage to protect their business, staff, and clients.

What does public liability insurance cover for swim schools?

Public liability insurance for swim schools covers claims for injuries or property damage that occur to third parties, such as customers or visitors, while on the premises of the swim school.

Searching for more affordable premiums? Insert your ZIP code below to get started on finding the right provider for you and your budget.

What does professional liability insurance cover for swim schools?

Professional liability insurance for swim schools covers claims of professional negligence or failure to perform duties adequately, providing financial protection in case of lawsuits related to professional services.

For detailed information, refer to our comprehensive report titled “Professional Liability (Errors & Omissions) Insurance“

What do products and services typically encompass for a swim school?

Products and services for a swim school usually include swimming lessons, coaching sessions, aquatic equipment, and related amenities offered to students and patrons.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.