Best Car Insurance for Drivers After an Accident in Michigan

Finding the Best Car Insurance for Drivers After an Accident in Michigan: A Comprehensive Guide to Protecting Your Vehicle and Finances in the Post-Accident Scenario

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. Through her years working in th...

Melanie Musson

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated September 2024

In Michigan, being involved in a car accident can have significant financial consequences. Repair costs, medical expenses, and legal fees can add up quickly, leaving drivers in a vulnerable position. That’s why it’s crucial for drivers in Michigan to have the best car insurance coverage after an accident. In this article, we will dive deep into the various aspects of car insurance for accident-prone drivers in Michigan, including the state’s no-fault car insurance system, factors to consider when choosing coverage, and how to file a claim.

Understanding Michigan’S No-Fault Car Insurance System

Michigan operates under a unique no-fault car insurance system. This means that drivers involved in car accidents are required to carry personal injury protection (PIP) coverage, which covers medical expenses and lost wages, regardless of who is at fault. Under this system, each driver’s insurance company pays for their own policyholder’s expenses, regardless of fault. However, this system can lead to expensive premiums for Michigan drivers, especially after an accident.

Drivers in Michigan should understand the nuances of the no-fault system and carefully consider their options when purchasing car insurance after an accident. By fully comprehending how this system works, drivers can make informed decisions about their coverage needs.

One important aspect of Michigan’s no-fault car insurance system is the requirement for drivers to carry property protection insurance (PPI). PPI covers damage to other people’s property, such as vehicles or buildings, caused by the policyholder’s car. This coverage is separate from personal injury protection and is essential for drivers to have in order to comply with Michigan’s insurance laws.

Another key feature of Michigan’s no-fault system is the unlimited medical benefits provided by personal injury protection coverage. Unlike in other states, where there may be limits on the amount of medical expenses covered, Michigan drivers have access to unlimited medical benefits for injuries sustained in car accidents. This can provide significant financial relief for policyholders who require extensive medical treatment or rehabilitation.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors To Consider When Choosing Car Insurance After An Accident In Michigan

After being involved in an accident, drivers in Michigan may face higher insurance premiums. Insurance companies consider a range of factors when determining rates, including the driver’s age, driving history, type of vehicle, and location. Additionally, insurers may also take into account the severity of the accident and whether the driver was at fault.

When selecting car insurance after an accident in Michigan, drivers should evaluate their coverage options carefully. They will need to balance their budget with the level of protection they desire. It’s prudent for drivers to compare quotes from multiple insurance companies, considering both price and coverage options, to find the best fit for their needs.

The Importance Of Having Adequate Coverage After An Accident In Michigan

Having adequate car insurance coverage after an accident is crucial for drivers in Michigan. Without the right protection, drivers may face financial hardships if they are involved in another accident. Adequate coverage can provide peace of mind knowing that medical expenses, vehicle repairs, and legal fees will be covered.

Drivers should consider increasing their coverage limits and adding additional protection beyond the minimum requirements of Michigan’s no-fault system. By doing so, they can better protect themselves and their assets in the event of a future accident.

How To File A Claim After An Accident In Michigan

Filing a claim after an accident in Michigan is a necessary step in receiving compensation for damages. After an accident, drivers must promptly notify their insurance company and provide detailed information about the incident. This includes documenting the damages, obtaining police reports, and gathering witness statements, if available.

Drivers should carefully follow their insurance company’s guidelines for filing a claim. It is important to be thorough and accurate in providing information to ensure a smooth claims process. Working closely with the insurance company and providing all necessary documentation will increase the likelihood of a successful claim.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring The Different Types Of Car Insurance Coverage Options In Michigan

Michigan drivers have a variety of car insurance coverage options to choose from. While the state’s no-fault system requires personal injury protection (PIP), drivers can also consider additional coverages such as bodily injury liability, property damage liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

Bodily injury liability coverage protects drivers if they injure someone else in an accident for which they are at fault. Property damage liability coverage covers damages to someone else’s property caused by the policyholder. Collision coverage pays for repairs to the policyholder’s vehicle when involved in a collision, regardless of fault. Comprehensive coverage, on the other hand, covers damages from non-collision incidents, such as theft or weather-related damages. Lastly, uninsured/underinsured motorist coverage provides protection if the at-fault driver does not have sufficient insurance coverage.

When deciding on coverage options, drivers should carefully assess their needs and budget to find the best combination of protections for their situation.

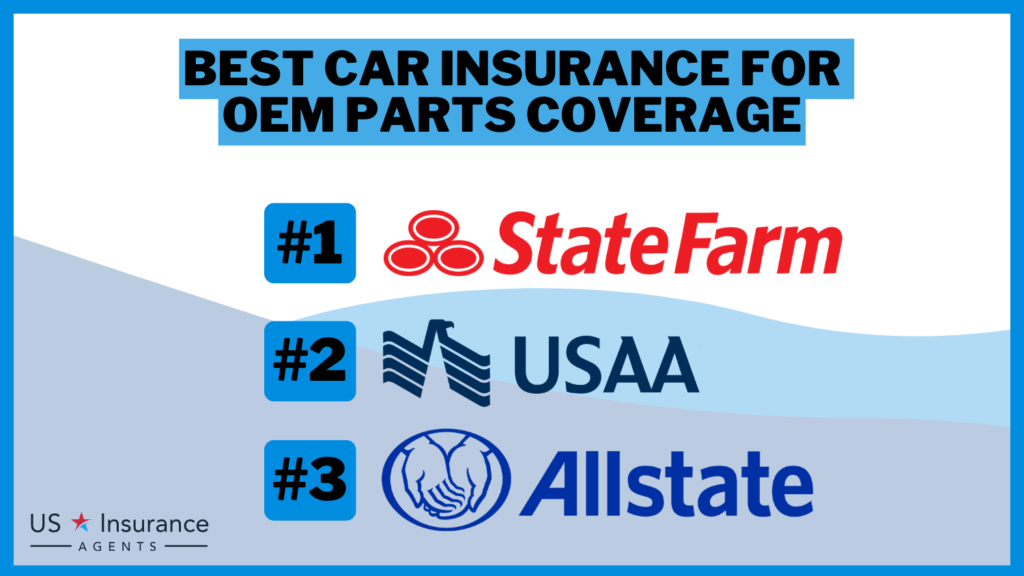

Comparing The Best Car Insurance Companies For Accident-Prone Drivers In Michigan

Michigan drivers who have been involved in an accident should conduct thorough research to find the best car insurance company for their needs. Factors to consider include financial stability, customer service, claims process efficiency, and affordability.

Companies such as State Farm, Progressive, Allstate, and Geico are popular choices for many Michigan drivers. However, it’s important to gather multiple quotes and compare them to ensure the best coverage at the most competitive rates. Reading customer reviews and seeking advice from trusted sources can provide valuable insights into each insurance company’s track record.

Tips For Finding Affordable Car Insurance Rates After An Accident In Michigan

Finding affordable car insurance rates after an accident in Michigan might seem challenging, but it’s not impossible. To secure the best rates, drivers should consider the following tips:

- Shop around: Get quotes from multiple insurance companies to compare rates and coverage options.

- Improve driving record: Take defensive driving courses or seek opportunities for traffic violation dismissals to demonstrate responsible driving behavior.

- Consider higher deductibles: Opting for higher deductibles can lower premiums in some cases.

- Bundle insurance policies: Bundling home or renters insurance with car insurance can often lead to discounted rates.

- Explore discounts: Inquire about discounts for safe driving, having multiple vehicles insured, or being a member of certain organizations.

By implementing these tips, drivers can increase their chances of finding affordable car insurance rates even after an accident.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Evaluating The Financial Stability And Customer Service Of Car Insurance Providers In Michigan

When selecting car insurance after an accident in Michigan, it is essential to evaluate the financial stability and customer service of potential insurance providers. An insurance company’s financial stability will indicate its ability to pay out claims promptly and effectively.

Additionally, assessing customer service is crucial to ensure a smooth and satisfactory claims process. Researching and reading customer reviews can provide valuable insight into the experiences of other policyholders. Utilizing resources such as J.D. Power or AM Best ratings can also help assess an insurance provider’s reputation.

The Role Of Personal Injury Protection (Pip) In Car Insurance After An Accident In Michigan

Personal injury protection (PIP) is a fundamental component of car insurance after an accident in Michigan. PIP coverage pays for medical expenses, lost wages, and other related costs for injuries sustained by the policyholder, regardless of fault.

Drivers in Michigan must carefully consider the level of PIP coverage they need, as it directly affects their premiums. Opting for higher PIP coverage limits can increase costs but also provides greater protection in the event of severe injuries.

Understanding The Impact Of At-Fault Accidents On Car Insurance Premiums In Michigan

Being at fault in a car accident can have a significant impact on car insurance premiums in Michigan. After an at-fault accident, drivers may experience an increase in their premiums due to the higher risk they pose to insurance companies.

Insurance companies consider the severity of the accident and the driver’s previous claims history when determining rate adjustments. Drivers with multiple at-fault accidents may face even steeper premium hikes.

Understanding the repercussions of at-fault accidents can motivate drivers to practice safe driving habits and avoid further accidents to mitigate the long-term financial impact.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Explaining The Process Of Subrogation And Its Effects On Car Insurance Rates After An Accident In Michigan

Subrogation is an important process that can affect car insurance rates after an accident in Michigan. Subrogation occurs when an insurance company seeks reimbursement from the at-fault party’s insurance company for the costs it has incurred on behalf of its policyholder.

If an insurance company successfully recovers funds through subrogation, it may lead to reduced premiums for the policyholder. However, if the at-fault party is uninsured or underinsured, the policyholder’s insurance premiums may increase due to the insurance company’s financial loss.

Drivers should be aware of the subrogation process and understand its potential effects on their car insurance rates.

How To Take Advantage Of Discounts And Savings Opportunities For Drivers After An Accident In Michigan

Even after an accident in Michigan, drivers can still take advantage of various discounts and savings opportunities to reduce their car insurance costs. Many insurance companies offer discounts for safe driving, accident forgiveness programs, and discounts for bundling multiple policies.

Additionally, maintaining a clean driving record, improving credit scores, and successfully completing defensive driving courses can also help drivers secure lower premiums. It’s essential for drivers to inquire about available discounts and explore all potential savings avenues to make their car insurance more affordable.

Tips For Improving Your Driving Record And Qualifying For Lower Premiums After An Accident In Michigan

Improving a driving record after an accident in Michigan is crucial for long-term savings on car insurance premiums. Drivers should take proactive steps to demonstrate responsible driving behavior to their insurance companies.

Attending traffic school, following all traffic laws, avoiding moving violations, and refraining from further accidents can all contribute to a cleaner driving record. By doing so, drivers can potentially qualify for lower premiums and save money on insurance costs in the long run.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Additional Coverage Options Beyond Basic Liability Insurance After An Accident In Michigan

Basic liability insurance may not always provide the level of coverage needed after an accident in Michigan. Drivers should consider exploring additional coverage options to protect themselves financially.

Collision coverage can help cover repairs to the policyholder’s vehicle, regardless of fault. Comprehensive coverage offers protection against non-collision incidents such as theft, vandalism, or natural disasters. Including these coverages in an insurance policy after an accident can provide greater peace of mind.

The Benefits Of Bundling Homeowners Or Renters Insurance With Car Insurance After An Accident In Michigan

Drivers in Michigan who have experienced an accident can benefit from bundling their car insurance with homeowners or renters insurance. Bundling policies with one insurance company can potentially lead to discounted rates and simplified management of insurance coverage. It’s worth checking with insurance providers to explore potential bundling options after an accident.

Understanding The Differences Between Comprehensive And Collision Coverage For Drivers After An Accident In Michigan

Understanding the differences between comprehensive and collision coverage is crucial for drivers after an accident in Michigan. While both coverages protect against damages to the policyholder’s vehicle, they differ in the types of incidents they cover.

Collision coverage pays for damages resulting from a collision with another vehicle or object, regardless of fault. On the other hand, comprehensive coverage covers damages caused by non-collision incidents such as theft, vandalism, fire, or weather-related damage.

Drivers should evaluate their needs and budget to determine whether comprehensive, collision, or both coverage types are necessary after an accident.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips For Negotiating With Insurers To Get A Fair Settlement After An Accident In Michigan

Drivers in Michigan should be prepared to negotiate with insurers to get a fair settlement after an accident. Insurers may initially offer a lower settlement amount, and it’s crucial for drivers to understand their rights and advocate for fair compensation.

Keeping detailed records of all medical expenses, vehicle repairs, and other accident-related costs can strengthen the negotiation process. If needed, seeking legal advice or consulting with a personal injury attorney can provide guidance on how to navigate the negotiation process effectively.

By being persistent and well-informed, drivers in Michigan can increase their chances of reaching a fair settlement with their insurance company.

In conclusion, finding the best car insurance for drivers after an accident in Michigan requires careful consideration of various factors. Understanding the no-fault car insurance system, evaluating coverage options, and knowing how to navigate the claims process are all crucial components of securing the right protection. By following the tips and suggestions provided in this article, drivers in Michigan can make informed decisions and find the best car insurance to meet their needs after an accident.

Frequently Asked Questions

What is the best car insurance for drivers after an accident in Michigan?

The best car insurance for drivers after an accident in Michigan depends on various factors such as the driver’s accident history, coverage needs, and budget. It is recommended to compare quotes from multiple insurance providers to find the best policy for individual circumstances.

What factors should I consider when choosing car insurance after an accident in Michigan?

When choosing car insurance after an accident in Michigan, it is important to consider factors such as the coverage options offered, the insurance company’s reputation for handling claims, the cost of the policy, and any additional benefits or discounts provided.

Will my car insurance rates increase after an accident in Michigan?

It is possible for car insurance rates to increase after an accident in Michigan. Insurance companies consider various factors when determining rates, including the driver’s accident history. However, the extent of the rate increase will depend on the severity of the accident and the driver’s overall driving record.

Can I switch car insurance providers after an accident in Michigan?

Yes, you can switch car insurance providers after an accident in Michigan. However, it is important to consider any potential impact on your claim and coverage. It is advisable to consult with your current insurance provider and new potential providers to understand the implications and make an informed decision.

What steps should I take after a car accident in Michigan to ensure a smooth insurance claims process?

After a car accident in Michigan, it is important to take the following steps to ensure a smooth insurance claims process:

1. Contact the police and report the accident.

2. Exchange

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.