Best Life Insurance for People With Down Syndrome in 2026 (Top 10 Companies)

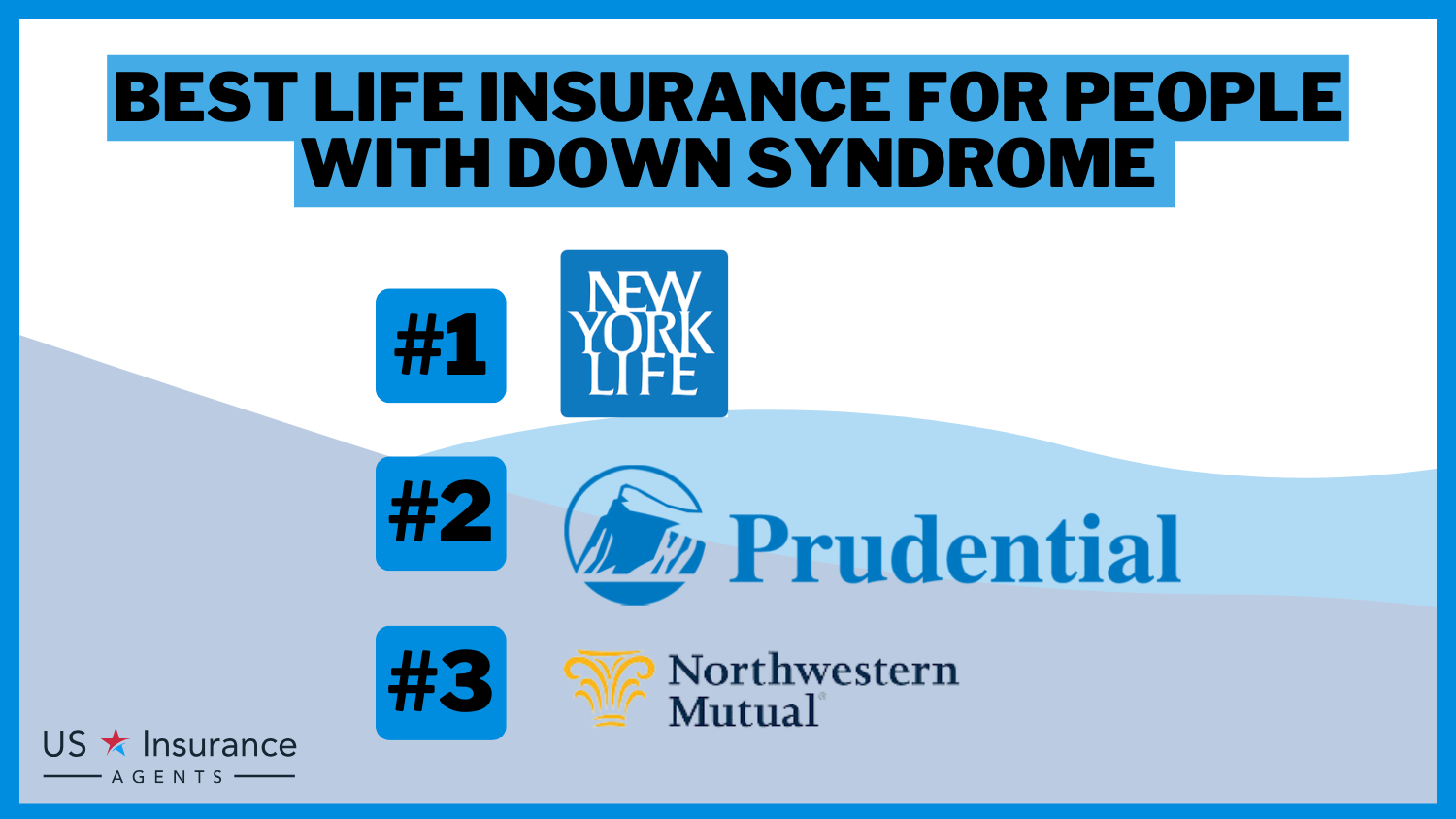

The best life insurance for people with Down syndrome are offered by New York Life, Prudential, and Northwestern Mutual providing tailored coverage options and discounts of up to 25% to ensure financial stability and peace of mind. Compare quotes and find the best coverage for your loved ones today.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Licensed Insurance Agent

Tim Bain is a licensed life insurance agent with 23 years of experience helping people protect their families and businesses with term life insurance. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Updated January 2025

Company Facts

Full Coverage for People With Down Syndrome

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for People With Down Syndrome

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for People With Down Syndrome

A.M. Best Rating

Complaint Level

Pros & Cons

With specialized support and inclusive underwriting, these top companies stand out for their commitment to serving individuals with Down syndrome. Explore our comprehensive guide to discover the best life insurance companies and secure the best coverage for your unique needs.

Our Top 10 Company Picks: Best Life Insurance for People With Down Syndrome

| Company | Rank | A.M. Best | Multi-Policy Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | A++ | 25% | Flexible Coverage | New York Life | |

| #2 | A+ | 20% | Inclusive Underwriting | Prudential | |

| #3 | A++ | 20% | Financial Stability | Northwestern Mutual | |

| #4 | A++ | 17% | Competitive Rates | State Farm | |

| #5 | A++ | 15% | Specialized Support | MassMutual | |

| #6 | A+ | 20% | Inclusive Policies | Nationwide |

| #7 | A | 25% | Innovative Solutions | AIG | |

| #8 | A++ | 20% | Enhanced Benefits | Guardian Life | |

| #9 | A | 15% | Customizable Policies | Transamerica | |

| #10 | A+ | 20% | Extensive Network | MetLife |

Compare quotes now and safeguard your family’s future with the right life insurance policy. You can get free quotes for life insurance and secure financial protection for your loved ones by entering your ZIP code into our tool above.

#1 – New York Life Insurance: Top Overall Pick

Pros

- Flexible Coverage: New York Life Insurance offers flexible coverage options, allowing policyholders to tailor their plans to meet specific needs.

- Multi-Policy Discount: Customers can benefit from a significant multi-policy discount of up to 25%, encouraging bundling for added savings.

- Low-Mileage Discount: With a low-mileage discount of up to 15%, New York Life provides additional cost savings for policyholders who don’t frequently drive.

- Reputable Company: New York Life Insurance is a well-established and reputable company with a long history in the industry.

- Customer Support: New York Life insurance review & ratings highlight the company’s outstanding customer support, guaranteeing prompt assistance and information for clients.

Cons

- Premium Cost: The premium rates at New York Life Insurance might be relatively higher compared to some competitors.

- Complex Options: The abundance of coverage options may be overwhelming for customers looking for a straightforward insurance plan.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Prudential: Best for Inclusive Underwriting

Pros

- Inclusive Underwriting: Prudential is recognized for its inclusive underwriting process, making it a suitable option for individuals with diverse health conditions.

- Multi-Policy Discount: Policyholders can enjoy savings through a multi-policy discount of up to 20% when combining various insurance products.

- Reliable Coverage: Prudential provides reliable life insurance coverage with a range of policy options to suit different preferences.

- Financial Stability: Prudential Insurance review & ratings confirm the company’s financial stability, ensuring customers that their claims and benefits will be efficiently managed.

- Customer Education: Prudential offers educational resources to help customers understand their insurance options better.

Cons

- Limited Low-Mileage Discount: Prudential’s low-mileage discount is capped at 10%, which might be less attractive for policyholders with minimal driving habits.

- Complex Policies: Some customers may find Prudential’s policy offerings complex and challenging to navigate.

#3 – Northwestern Mutual: Best for Financial Stability

Pros

- Financial Stability: Northwestern Mutual is known for its strong financial stability, providing policyholders with confidence in their long-term commitments.

- Multi-Policy Discount: Customers can benefit from a multi-policy discount of up to 20% when bundling various insurance products.

- Low-Mileage Discount: Northwestern Mutual offers a low-mileage discount of up to 15%, catering to policyholders who drive less frequently.

- Customer Service: Northwestern Mutual insurance review & ratings boast the company’s outstanding customer service, guaranteeing that clients receive assistance throughout their insurance experience.

- Diverse Products: Northwestern Mutual provides a range of financial products beyond life insurance, offering customers comprehensive financial planning.

Cons

- Higher Premiums: The premium rates at Northwestern Mutual may be on the higher side compared to some competitors.

- Less Innovative: The company may lag in terms of innovative solutions compared to newer players in the industry.

#4 – State Farm: Best for Competitive Rates

Pros

- Competitive Rates: State Farm offers competitive rates, making it an attractive option for budget-conscious individuals seeking reliable life insurance.

- Multi-Policy Discount: Policyholders can enjoy savings through a multi-policy discount of up to 17%, encouraging bundling for added benefits.

- Low-Mileage Discount: State Farm provides a low-mileage discount of up to 10%, appealing to individuals with minimal driving habits.

- Strong Reputation: State Farm insurance review & ratings underscore the company has a strong and trusted reputation in the insurance industry.

- Convenient Online Tools: State Farm provides convenient online tools for policy management and customer service.

Cons

- Limited Innovation: State Farm may be perceived as less innovative compared to some newer entrants in the insurance market.

- Less Specialized Support: The company may not offer the same level of specialized support as some competitors with a focus on specific customer needs.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – MassMutual: Best for Specialized Support

Pros

- Specialized Support: MassMutual stands out for its specialized support, offering tailored assistance to individuals with unique needs.

- Multi-Policy Discount: Policyholders can benefit from a multi-policy discount of up to 15%, promoting bundling for increased savings.

- Low-Mileage Discount: MassMutual provides a low-mileage discount of up to 12%, appealing to customers with infrequent driving habits.

- Customization Options: The company offers a variety of customization options, allowing policyholders to design coverage that aligns with their preferences.

- Strong Financial Backing: MassMutual insurance review & ratings is backed by strong financial stability, instilling confidence in policyholders regarding the company’s ability to fulfill its commitments.

Cons

- Premium Cost: MassMutual’s premium rates may be relatively higher compared to some competitors.

- Limited Innovation: The company may not be as innovative as some newer players in the insurance market.

#6 – Nationwide: Best for Inclusive Policies

Pros

- Inclusive Policies: Nationwide is recognized for its inclusive policies, catering to a diverse range of customers and needs.

- Multi-Policy Discount: Policyholders can enjoy savings through a multi-policy discount of up to 20%, encouraging bundling for added benefits.

- Low-Mileage Discount: Nationwide provides a low-mileage discount of up to 10%, appealing to individuals with minimal driving habits.

- Online Access: Nationwide insurance review & ratings provides convenient online access, making it easy for policyholders to manage their accounts and access information.

- Strong Reputation: The company has a strong reputation for reliability and customer satisfaction.

Cons

- Complex Options: Some customers may find Nationwide’s policy options complex and challenging to navigate.

- Less Innovative: Nationwide may be perceived as less innovative compared to some newer entrants in the insurance market.

#7 – AIG: Best for Innovation and Global Presence

Pros

- Innovative Solutions: AIG is known for its innovative solutions, providing customers with cutting-edge options in the life insurance space.

- Multi-Policy Discount: Policyholders can benefit from a significant multi-policy discount of up to 25%, encouraging bundling for added savings.

- Low-Mileage Discount: AIG offers a low-mileage discount of up to 15%, providing additional cost savings for policyholders with minimal driving habits.

- Global Presence: AIG’s global presence enhances its credibility and reassures customers about the company’s stability.

- Specialized Coverage: AIG insurance review & ratings accentuate specialized coverage options tailored to individuals with unique needs and circumstances.

Cons

- Higher Premiums: AIG’s premium rates may be higher compared to some competitors.

- Complex Underwriting: The underwriting process at AIG may be more complex compared to some simpler and streamlined alternatives.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Guardian Life: Best for Enhanced Benefits

Pros

- Enhanced Benefits: Guardian Life offers enhanced benefits, providing additional perks and advantages to its policyholders.

- Multi-Policy Discount: Policyholders can enjoy savings through a multi-policy discount of up to 20%, promoting bundling for increased benefits.

- Customer Support: Guardian Life is known for its excellent customer support, ensuring that clients receive assistance promptly.

- Financial Stability: The company boasts financial stability, assuring customers that their claims and benefits will be handled efficiently.

- Specialized Coverage: Guardian Life insurance review & ratings offers specialized coverage options tailored to meet the unique needs and circumstances of individuals.

Cons

- Premium Cost: The premium rates at Guardian Life may be relatively higher compared to some competitors.

- Limited Online Tools: Guardian Life may offer fewer online tools and resources compared to some competitors, potentially affecting customer convenience.

#9 – Transamerica: Best for Customization and Affordability

Pros

- Customizable Policies: Transamerica insurance review & ratings indicate that the company provides customizable policies, enabling policyholders to customize their coverage according to their individual needs.

- Multi-Policy Discount: Customers can benefit from a multi-policy discount of up to 15%, encouraging bundling for added savings.

- Low-Mileage Discount: Transamerica provides a low-mileage discount of up to 10%, appealing to individuals with minimal driving habits.

- Customer Education: Transamerica provides educational resources to help customers understand their insurance options better.

- Competitive Rates: The company offers competitive rates, making it an attractive option for budget-conscious individuals.

Cons

- Less Innovative: Transamerica may be perceived as less innovative compared to some newer entrants in the insurance market.

- Limited Specialized Support: The company may not offer the same level of specialized support as some competitors with a focus on specific customer needs.

#10 – MetLife: Best for Extensive Network and Reputable Service

Pros

- Extensive Network: MetLife insurance review & ratings highlight the company’s extensive network, offering customers widespread accessibility and convenience.

- Multi-Policy Discount: Policyholders can enjoy savings through a multi-policy discount of up to 20%, encouraging bundling for added benefits.

- Low-Mileage Discount: MetLife offers a low-mileage discount of up to 12%, providing additional cost savings for policyholders with minimal driving habits.

- Reputable Company: MetLife is a well-established and reputable company with a long history in the insurance industry.

- Customer Service: The company is known for its reliable customer service, ensuring that clients receive support throughout their insurance journey.

Cons

- Higher Premiums: MetLife’s premium rates may be on the higher side compared to some competitors.

- Less Specialized Support: MetLife may not offer the same level of specialized support as some competitors with a focus on specific customer needs.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Down Syndrome Coverage Pricing: Understanding the Costs

Life insurance is a crucial financial tool that provides financial security and peace of mind for individuals and their families. When it comes to determining life insurance rates, various factors come into play, including health conditions. Individuals with Down Syndrome may face unique considerations when seeking life insurance coverage.

In this section, we delve into the specific coverage rates offered by prominent insurance companies for individuals with Down Syndrome, examining both the minimum and full coverage amounts.

Life Insurance for People With Down Syndrome: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AIG (American Int'l Group) | $130 | $330 |

| Guardian Life | $120 | $320 |

| MassMutual | $140 | $350 |

| MetLife | $125 | $310 |

| Nationwide | $110 | $300 |

| New York Life Insurance | $110 | $300 |

| Northwestern Mutual | $130 | $340 |

| Prudential | $120 | $320 |

| State Farm | $100 | $280 |

| Transamerica | $100 | $290 |

Examining the provided data, we observe variations in the minimum and full coverage rates among different insurance companies. State Farm, for instance, offers the most affordable minimum coverage at $100, while MassMutual has the highest minimum coverage premium at $140.

In terms of full coverage, State Farm also remains competitive with a monthly premium of $280, compared to MassMutual’s highest full coverage premium of $350.

It’s crucial to note that these figures represent averages and can vary based on individual circumstances and underwriting considerations. Insurers assess factors such as the individual’s health history, age, and lifestyle when determining premiums.

Therefore, these rates provide a general overview, and individuals seeking coverage should consult with insurance professionals to obtain personalized quotes tailored to their specific situations.

Life Insurance Options for Individuals With Down Syndrome

Individuals with Down syndrome can obtain life insurance, but it’s challenging. Down syndrome is often considered a pre-existing condition by insurance companies. They typically conduct a health assessment to determine if the individual can independently care for themselves. Additionally, life expectancy may be evaluated as part of the process.

The National Association for Down Syndrome reports that the average life expectancy for those with Down syndrome is decreased to 60 years as opposed to the standard 70 years or more. This affects life insurance rates for people with Down syndrome. In other words, you will have to compare life insurance for high-risk individuals. Let’s move on to learn what form of coverage will suit your needs.

Explore more information on our “What Is The Connection Between Risk And Life Insurance?”.

Those with Down syndrome can get coverage, but it will be a slightly more complex process. You will see elevated rates due to medical conditions that are frequently experienced in conjunction with Down syndrome. These factors, along with whether or not the insured can care for themself, is critical to the rates they will pay.

Essentially, a non-traditional policy like guaranteed issue life insurance coverage could be the more affordable option. Otherwise, those with Down syndrome will be lumped into a category indicating the presence of a pre-existing condition, which comes with substandard rates.

Ty Stewart Licensed Insurance Agent

Substandard rates are typically 25% more and reflect the extra risk the insurance company is taking to cover the individual. Let’s now look at a table that compares State Farm’s standard and substandard rates.

Life Insurance for People With Down Syndrome: Monthly Rates for Standard vs. Substandard Coverage by Age

| Age | Standard | Substandard |

|---|---|---|

| 25 Years Old | $89 | $112 |

| 30 Years Old | $103 | $128 |

| 35 Years Old | $121 | $151 |

| 40 Years Old | $143 | $179 |

| 45 Years Old | $173 | $217 |

| 50 Years Old | $213 | $267 |

| 55 Years Old | $269 | $336 |

| 60 Years Old | $355 | $444 |

| 65 Years Old | $475 | $594 |

As you can see, you can find life insurance rates for people with Down syndrome. However, the rates will be more expensive.

Group Life Insurance for Individuals With Down Syndrome: What You Need to Know

If your loved one with Down syndrome works a job that is 30 or more hours per week, they may be eligible for group life insurance through their employer.

Group life insurance is a single policy that covers a group, such as coworkers. If available, group life is a great way to pay inexpensive life insurance rates for people with Down syndrome.

Know further information on our “What are some disadvantages of a group life insurance plan?“.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Obtaining an Online Quote: Life Insurance for People With Down Syndrome

If you’re considering purchasing life insurance, obtaining an insurance quote online is a convenient first step. Here’s how you can get an online quote quickly and easily:

- Visit the website. Go to the website of the life insurance company you’re interested in.

- Navigate to the quote section. Look for a section labeled “Get a Quote” or “Request a Quote” on the website’s homepage.

- Fill out the form. Enter the required information, including your age, gender, zip code, and any relevant medical history.

- Choose your coverage. Select the type and amount of coverage you’re interested in.

- Review and submit. Review the information you provided, make any necessary changes, and submit your request for a quote.

- Receive your quote. Once you’ve submitted your information, you should receive a life insurance quote either instantly on the website or via email shortly after.

Obtaining an online quote for life insurance is a quick and convenient way to compare rates and coverage options from multiple companies without the need for lengthy phone calls or meetings.

It allows you to explore different policies at your own pace and find the best coverage for your needs and budget. Take advantage of this simple tool to secure the financial protection your loved ones deserve.

Case Studies: Best Life Insurance for People With Down Syndrome

Here are some case studies highlighting real-life scenarios of individuals with life insurance for Down syndrome finding suitable coverage:

- Case Study #1 – Guaranteed Issue Policy: Sarah, a 35-year-old woman with Down syndrome, secured a guaranteed issue life insurance policy to ensure financial protection for her family. Despite her pre-existing condition, Sarah found affordable coverage that provided peace of mind.

- Case Study #2 – Substandard Rate Policy: Michael, a 28-year-old man with Down syndrome, was initially denied traditional life insurance. With the help of a specialized insurance agent, Michael found a policy with substandard rates that fit his budget while providing adequate coverage for his family’s needs.

- Case Study #3 – Group Life Insurance: Emily, a 40-year-old woman with Down syndrome, enrolled in a group life insurance policy through her full-time job. With the support of her HR department, Emily obtained affordable coverage, ensuring peace of mind for her and her family.

These case studies illustrate that while securing life insurance for individuals with Down syndrome can be challenging, it’s not impossible. With the right guidance and understanding of available life insurance type options, individuals like Sarah, Michael, and Emily can find suitable coverage to protect their loved ones and provide financial security for the future.

The Bottom Line: Life Insurance for People With Down Syndrome

Securing life insurance for individuals with Down syndrome is crucial for providing financial protection and peace of mind for their families. By exploring the options offered by top insurance companies like New York Life, Prudential, and Northwestern Mutual, individuals with Down syndrome can find tailored coverage options that meet their unique needs.

Kristine Lee Licensed Insurance Agent

Whether through guaranteed issue policies, substandard rate policies, or group life insurance, there are options available to ensure that everyone has access to the protection they deserve. With the right guidance and understanding of available options, individuals with Down syndrome can find suitable coverage to safeguard their loved ones’ financial future.

Safeguard your family’s future while saving on coverage — enter your ZIP code below to compare life insurance quotes with our free tool today.

Frequently Asked Questions

Can individuals with Down Syndrome buy life insurance?

Yes, individuals with Down syndrome can buy life insurance, but it may be challenging as it is considered a pre-existing condition by most insurers.

Will people with Down Syndrome pay more for life insurance?

Yes, people with Down syndrome will pay more for life insurance due to the elevated risks associated with the condition. They may have to pay 25% more in premiums.

Delve more details on our “How does the insurance company determine my premium?“.

What’s the life expectancy of a Down syndrome person?

According to the National Association for Down Syndrome, the average life expectancy for people with Down syndrome is 60 years.

Save time on your life insurance search by entering your ZIP code below into our free comparison tool today.

What are the life insurance options available for people with Down Syndrome?

People with Down syndrome can opt for non-traditional policies like guaranteed issue life insurance, which may be more affordable. They may also have to choose from substandard rates for individuals with pre-existing conditions.

Can individuals with Down Syndrome get group life insurance?

Yes, individuals with Down syndrome working 30 or more hours per week may be eligible for group life insurance through their employer.

Discover more information regarding group life insurance from employers on our “Can a company require you to pay for or Opt in to their Life Insurance plan?“.

Does Down syndrome have any advantages?

Many children with Down syndrome often demonstrate certain learning strengths, such as a clear preference for visual learning, a high capacity for empathy and social understanding, and a strong visual short-term memory.

What is the best treatment for Down syndrome?

There isn’t a universal treatment for Down syndrome. Instead, treatments are tailored to meet the individual physical and intellectual needs, strengths, and limitations of each person. Early interventions focus on assisting children with Down syndrome in reaching their maximum potential for development.

Getting affordable life insurance with a medical issue can be a challenge, but it’s not impossible. Use our free quote comparison tool below to find the lowest rates.

What is the biggest risk for Down syndrome?

Risk factors for Down syndrome include maternal age. The likelihood of a woman giving birth to a child with Down syndrome increases as she gets older because older eggs have a higher risk of improper chromosome division. A woman’s risk of conceiving a child with Down syndrome rises after the age of 35.

What is the most common cause of death in Down syndrome?

Pulmonary infections are the primary cause of death among individuals with Down syndrome, resulting from a combination of intrinsic factors (morphological issues) and extrinsic factors (immune system dysfunction). Genes associated with impaired heart, lung, and immune function are depicted in the cartoon of each organ.

Gain further insight into our “What is the best life insurance policy to get when you have pulmonary fibrosis?“.

What drugs should Down syndrome patients avoid?

Adults diagnosed with Down syndrome (Trisomy 21) should avoid taking ciprofloxacin or fluvoxamine. Fluoroquinolone antibiotics like floxacin and norfloxacin can disrupt the metabolism of tizanidine. It is important to use caution when combining tizanidine with medications that cause central nervous system depression.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.