Best Renters Insurance for People with a Home Office

Are you a remote worker with a home office? Protect your valuable equipment and assets with renters insurance tailored for people like you. Discover the benefits and coverage options in this comprehensive article on Renters Insurance for People with a Home Office.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated January 2025

Renters insurance is an important consideration for anyone who rents a home or apartment, but it becomes even more crucial when you have a home office. Your home office likely contains expensive equipment and may also be a space where clients or customers visit. In this article, we will explore the best renters insurance options for people with a home office, the importance of having renters insurance for your home office, and factors to consider when choosing a policy. We will also provide tips on how to get the most out of your renters insurance coverage.

Understanding Renters Insurance

Before we dive into the specifics of renters insurance for home offices, let’s first understand what renters insurance is. Renters insurance is a type of insurance policy designed to protect tenants from financial loss related to their personal belongings and liability. While landlords have insurance to cover the physical structure of the building, their policies typically do not extend to cover the belongings of tenants. This is where renters insurance steps in.

Renters insurance offers coverage for your personal belongings, such as furniture, electronics, and clothing, in the event of theft, fire, vandalism, or certain natural disasters. It also provides liability coverage in case someone is injured in your rented property and holds you responsible for their medical expenses or property damage.

What is Renters Insurance?

Renters insurance is a type of insurance policy that protects tenants from financial loss related to their personal belongings and liability. It provides coverage for personal belongings in case of theft, fire, vandalism, or certain natural disasters. Additionally, renters insurance offers liability coverage in the event someone is injured in your rented property and holds you responsible for their medical expenses or property damage.

Why Do You Need Renters Insurance?

Whether you have a home office or not, renters insurance is highly recommended for anyone renting a home or apartment. However, having a home office adds an extra layer of importance to having renters insurance.

One of the main reasons you need renters insurance is to protect your personal belongings. Your home office likely contains valuable equipment such as computers, printers, and other electronics. If these items were stolen or damaged in a covered event, such as a fire, your renters insurance policy would help replace or repair them.

Another reason to have renters insurance for your home office is liability coverage. If a client or customer visits your home office and is injured, you could be held legally responsible for their medical expenses and any damages they may seek. Renters insurance provides liability coverage to protect you in such situations.

In addition to protecting your belongings and providing liability coverage, renters insurance offers additional benefits. For example, some policies may include coverage for temporary living expenses if your rented property becomes uninhabitable due to a covered event. This can help you find alternative accommodation while repairs are being made.

Renters insurance also typically covers personal property even when it’s not in your rented property. For example, if your laptop is stolen while you’re traveling, your renters insurance may provide coverage for its replacement.

Furthermore, renters insurance can offer peace of mind. Knowing that you have financial protection in case of unexpected events can alleviate stress and allow you to focus on your work and personal life.

It’s important to note that renters insurance policies can vary in terms of coverage limits and exclusions. It’s essential to carefully review the terms and conditions of a policy before purchasing to ensure it meets your specific needs.

Free Rental Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Importance of Renters Insurance for Home Offices

Now that we understand the basics of renters insurance, let’s discuss its importance specifically for those with a home office. Whether you run a small business, work as a freelancer, or simply have a dedicated workspace, your home office is likely filled with valuable equipment and documents.

Having renters insurance for your home office is crucial for protecting your assets and ensuring your peace of mind. Let’s delve deeper into the reasons why renters insurance is essential for home offices.

Protecting Your Business Equipment

Imagine waking up one morning to find that your home has been burglarized. Your home office, with all your business equipment, has been ransacked, and your valuable computers, printers, and other equipment are gone. Without renters insurance, replacing these items can be a significant financial burden.

However, when you have a comprehensive renters insurance policy that covers theft, you can file a claim to help replace your stolen business equipment and get your home office up and running again. The insurance company will assess the value of the stolen items and provide you with the necessary funds to replace them.

Moreover, renters insurance not only covers theft but also protects your business equipment from other risks such as fire, water damage, and natural disasters. These unexpected events can cause significant damage to your home office, leading to costly repairs or replacements. With renters insurance, you can rest assured knowing that your insurance policy will help cover these expenses, allowing you to resume your business operations without financial strain.

Liability Coverage for Clients Visiting Your Home Office

Now, let’s consider a scenario where a client visits your home office and accidentally trips over a loose cable, injuring themselves. Without renters insurance, you would be personally responsible for their medical bills and any legal costs if they decide to sue you.

However, if you have liability coverage under your renters insurance policy, you can feel more at ease knowing that your insurance will help cover these expenses, protecting both your personal and business finances. In the event of an accident or injury on your premises, your renters insurance will provide coverage for medical expenses, legal fees, and even potential settlements or judgments.

Furthermore, liability coverage extends beyond physical injuries. If, for example, you accidentally disclose confidential client information or your work results in financial losses for a client, renters insurance can offer protection against potential lawsuits and associated costs.

Having renters insurance for your home office not only safeguards your personal belongings but also provides a safety net for potential accidents or incidents involving clients. It allows you to focus on your work without worrying about the financial consequences of unexpected events.

In conclusion, renters insurance is an indispensable investment for individuals with home offices. It offers comprehensive coverage for your business equipment, protecting you against theft, damage, and other unforeseen circumstances. Additionally, the liability coverage provided by renters insurance ensures that you are financially protected in case of accidents or incidents involving clients visiting your home office. By securing a renters insurance policy, you can create a secure and stable environment for your home office, allowing you to focus on what truly matters – your work.

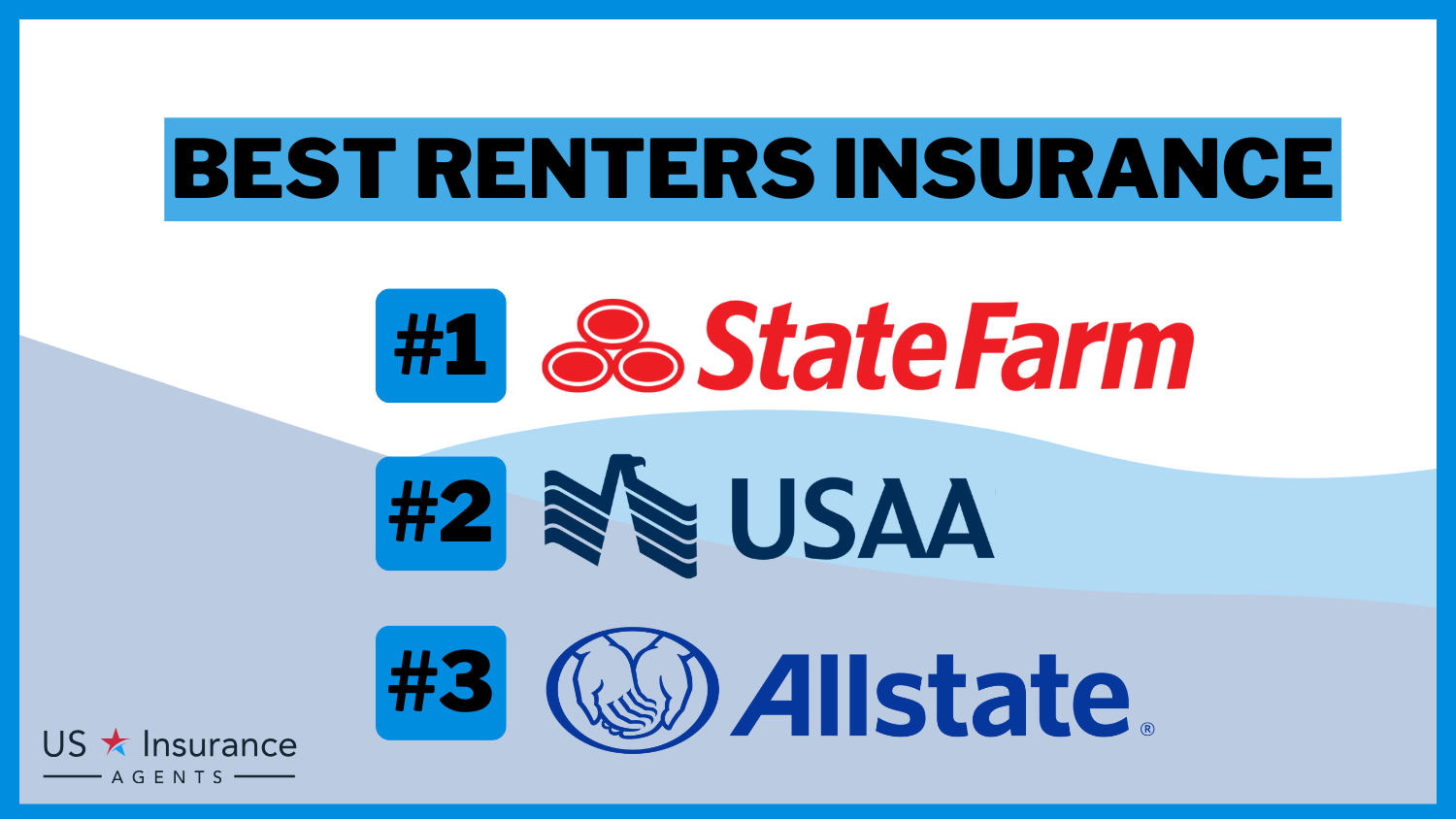

Top Renters Insurance Companies for Home Offices

When it comes to choosing the best renters insurance for your home office, there are several reputable companies to consider. Here, we will review three top renters insurance companies known for their coverage options, customer service, and affordability.

Company 1 Review

Company 1 has a strong reputation for providing comprehensive renters insurance coverage at competitive rates. They offer specific endorsements tailored to home office needs, such as additional coverage for business equipment and liability protection for client interactions. Their customer service support is also highly praised, with knowledgeable representatives available to assist with policy inquiries or claim filing.

Furthermore, Company 1 understands the unique challenges faced by home office owners. They go beyond traditional coverage options by offering specialized policies that address the risks associated with running a business from your residence. Whether you have expensive computer equipment, valuable inventory, or frequent client interactions, Company 1 has you covered.

Additionally, their commitment to customer satisfaction is evident through their user-friendly online portal. With just a few clicks, you can easily manage your policy, update coverage limits, and even file claims. Their website also provides valuable resources and educational materials to help home office owners better understand their insurance needs and make informed decisions.

Company 2 Review

Company 2 is another top choice for renters insurance for home offices. They offer flexible coverage options that can be customized to meet your specific needs. Their policies include coverage for business equipment and liability protection for client visits, ensuring that you have comprehensive coverage for your home office.

What sets Company 2 apart is their commitment to technological innovation. They have developed a user-friendly website and mobile app that make managing your policy a breeze. From requesting policy changes to filing claims, everything can be done conveniently from the palm of your hand. Their advanced digital tools also provide real-time updates on claims status, making it easier for you to stay informed and focused on your business.

In addition to their technological prowess, Company 2 boasts a team of dedicated insurance professionals who are well-versed in the unique needs of home office owners. They understand the importance of quick and efficient claims processing, ensuring that you can get back to work as soon as possible in the event of a loss.

Company 3 Review

Company 3 is well-known for its affordability and transparent pricing. They offer competitive rates for renters insurance policies that include coverage for home offices. While their coverage options may be more basic compared to other companies, they still provide the essential protection needed for your business equipment and liability concerns.

One of the key advantages of choosing Company 3 is their online quote tool. With just a few simple steps, you can quickly get a personalized quote and explore available options. This allows you to compare prices and coverage levels, ensuring that you find the policy that best suits your budget and needs.

Moreover, Company 3 understands that running a home office often means juggling multiple responsibilities. They aim to simplify the insurance process by providing clear and concise policy documents that outline coverage details and exclusions. This transparency allows you to make informed decisions and eliminates any surprises when it comes to filing a claim.

When it comes to protecting your home office, it’s important to choose a renters insurance company that understands your unique needs. Whether you prioritize comprehensive coverage, technological convenience, or affordability, these top renters insurance companies have proven themselves to be reliable options. Take the time to compare their offerings and consider your specific requirements to ensure that you find the perfect policy for your home office.

Factors to Consider When Choosing Renters Insurance for a Home Office

When selecting renters insurance for your home office, it’s essential to consider a few key factors that will impact your coverage and overall satisfaction with the policy.

Coverage Limits

One of the first factors to consider is the coverage limits of the policy. The coverage limits determine the maximum amount your insurance provider will pay for a covered loss. It’s crucial to assess the value of your business equipment and ensure that the coverage limits adequately protect these items. If needed, you can add a scheduled personal property endorsement to increase the coverage limits for specific high-value items.

Deductibles

Another important factor is the deductible amount. The deductible is the amount you must pay out of pocket before your insurance coverage kicks in. Generally, higher deductibles result in lower monthly premiums, but it’s essential to find the right balance that suits your budget and risk tolerance. Consider the potential financial impact of a deductible on your ability to replace stolen or damaged business equipment.

Policy Exclusions

Reviewing the policy exclusions is also crucial. Policy exclusions are specific situations or events that are not covered by your renters insurance policy. For example, some policies may exclude coverage for certain natural disasters, such as earthquakes or floods. Understanding the exclusions will help you assess the level of protection offered by the policy and determine if additional coverage, such as a separate flood insurance policy, is necessary for your home office.

Free Rental Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Get the Most Out of Your Renters Insurance

Now that you have chosen a renters insurance policy that suits your home office needs, let’s explore some tips on how to maximize your coverage and make the most of your policy.

Tips for Lowering Your Premium

While renters insurance is essential, it’s always helpful to find ways to lower your premium without sacrificing coverage. Here are a few tips:

- Bundle your renters insurance with other policies, such as auto insurance, to qualify for multi-policy discounts.

- Install safety features, such as smoke detectors or security systems, to reduce the risk of theft or fire.

- Opt for a higher deductible if you have enough savings to cover the out-of-pocket costs in the event of a claim.

- Review and update your policy annually to ensure you have adequate coverage and are not paying for unnecessary add-ons.

Making a Successful Claim

If you ever need to file a claim, following these steps can increase the chances of a smooth and successful process:

- Contact your insurance provider as soon as possible to report the incident and gather the necessary information and documentation.

- Document the damage or theft by taking photos and keeping receipts or invoices for any repairs or replacements.

- Cooperate fully with the insurance company’s investigation, providing any requested information or supporting documents promptly.

- Keep records of all communication with the insurance company, including dates, names, and summaries of conversations.

By following these tips, you can ensure that your renters insurance provides the maximum benefit and assistance when needed.

In conclusion, choosing the best renters insurance for people with a home office requires careful consideration of coverage options, reputable insurance providers, and factors such as coverage limits, deductibles, and policy exclusions. Renters insurance offers invaluable protection for your personal belongings and liability, especially in the context of a home office. By understanding your needs, comparing policies, and taking steps to lower your premium and make a successful claim, you can secure the peace of mind that comes with comprehensive renters insurance coverage for your home office.

Frequently Asked Questions

What is renters insurance for people with a home office?

Renters insurance for people with a home office is a type of insurance policy that provides coverage for both personal belongings and business equipment within a rented living space where a home office is set up.

What does renters insurance for people with a home office typically cover?

Typically, renters insurance for people with a home office covers personal property such as furniture, electronics, and clothing, as well as business equipment like computers, printers, and office supplies. It also provides liability coverage for accidents that may occur in the home office area.

Is renters insurance for people with a home office necessary?

While it is not legally required, having renters insurance for people with a home office is highly recommended. It protects your personal and business belongings from theft, damage, or loss, and provides liability coverage in case someone is injured in your home office.

Can I add additional coverage for expensive business equipment?

Yes, most renters insurance policies allow you to add additional coverage specifically for expensive business equipment. This can be done by purchasing a rider or an endorsement to your policy, which provides higher coverage limits for valuable items.

Are there any exclusions in renters insurance for people with a home office?

While coverage may vary depending on the insurance provider and policy, some common exclusions in renters insurance for people with a home office include damage caused by floods, earthquakes, or intentional acts. It’s important to review the policy details and understand the exclusions before purchasing.

Can I deduct renters insurance premiums for my home office on my taxes?

In most cases, renters insurance premiums cannot be directly deducted for a home office on personal tax returns. However, if you use a portion of your home exclusively for business purposes, you may be eligible for a home office deduction on your business taxes. It’s recommended to consult with a tax professional for accurate advice.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.