Cheap Audi RS 4 Car Insurance in 2026 (Save Money With These 10 Companies)

Discover the top providers for cheap Audi RS 4 car insurance: Progressive, Travelers, and AAA lead with competitive rates starting at $56/month. Each company offers unique benefits that set them apart in the competitive Audi insurance market, ensuring value and comprehensive coverage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated January 2025

Company Facts

Min. Coverage for Audi RS 4

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Audi RS 4

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for cheap Audi RS 4 car insurance are Progressive, Travelers, and AAA, known for their affordable rates and excellent coverage options.

These companies provide tailored policies that cater specifically to the needs of Audi RS 4 owners, ensuring both protection and value. Factors influencing the cost of insuring your Audi RS 4 include your driving record, location, and the level of coverage chosen.

Our Top 10 Company Picks: Cheap Audi RS 4 Car Insurance

Company Rank Monthly Rates Safe Driver Discount Best For Jump to Pros/Cons

#1 $56 10% Online Convenience Progressive

#2 $59 10% Accident Forgiveness Travelers

#3 $60 15% Local Agents AAA

#4 $65 15% Customizable Polices Liberty Mutual

#5 $67 10% Military Savings USAA

#6 $70 13% Many Discounts State Farm

#7 $77 15% Local Agents Farmers

#8 $81 20% Student Savings American Family

#9 $83 15% Usage Discount Nationwide

#10 $84 10% Add-on Coverages Allstate

By comparing quotes and exploring discounts, drivers can find the best possible rates while maintaining comprehensive protection. Learn more in our “New Car Insurance Discount.”

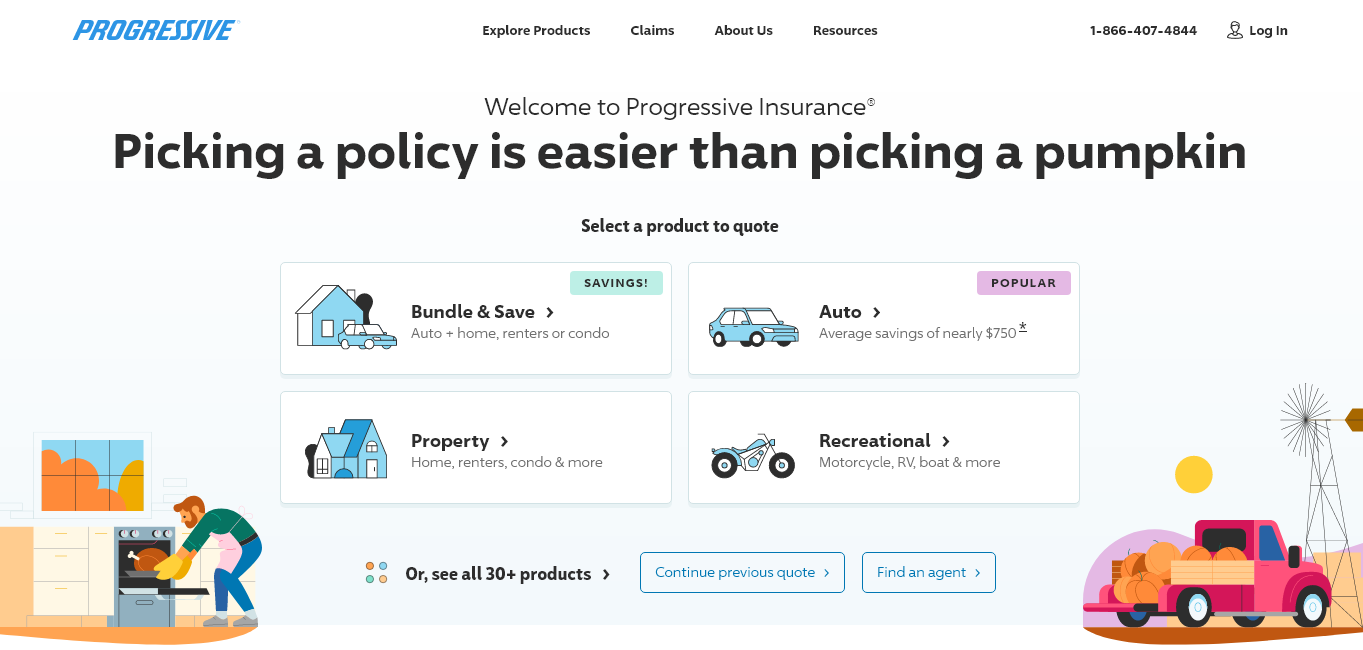

Searching for more affordable premiums? Insert your ZIP code above to get started on finding the right provider for you and your budget.

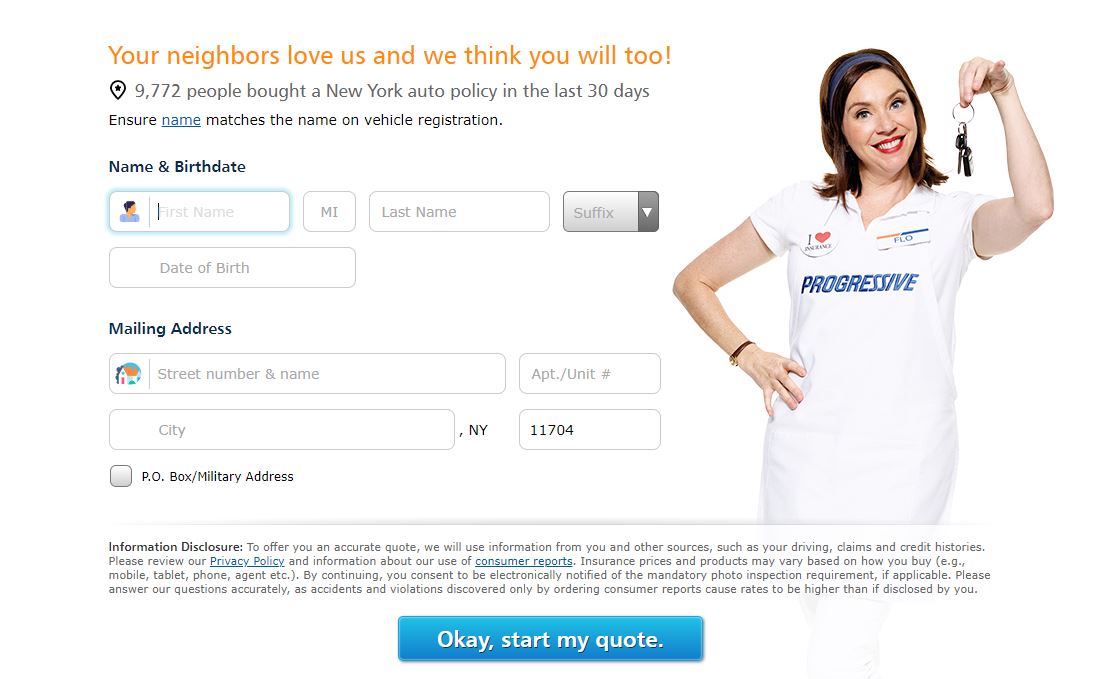

#1 – Progressive: Top Overall Pick

Pros

- Efficient Online Services: Progressive excels in offering streamlined online tools for managing policies.

- Competitive Rates: Offers one of the lowest monthly rates at $56. See more details on our Progressive car insurance review & ratings.

- Safe Driver Incentives: Provides a 10% discount for safe drivers, promoting responsible driving.

Cons

- Limited Personal Interaction: Less emphasis on agent interactions may affect users preferring personal service.

- Coverage Variability: Coverage options and discounts can vary significantly between states.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Protects your rate from going up after your first accident.

- Stable Pricing: Competitive monthly rate of $59 even for high coverage levels.

- Safe Driver Rewards: Offers a 10% discount for safe driving. More information is available about this provider in our Travelers insurance review & ratings.

Cons

- Higher Deductibles: Deductibles may be higher compared to other insurers.

- Complex Claims Process: Some users report a more complex claims process.

#3 – AAA: Best for Local Agents

Pros

- Strong Local Presence: Known for excellent customer service through local agents.

- Higher Safe Driver Discount: Offers a 15% discount for safe drivers, the highest among the top three.

- Accessible Physical Locations: Numerous offices for in-person support. Read up on the “AAA Insurance Review & Ratings” for more information.

Cons

- Membership Required: Requires a membership to access insurance services, which could be an extra cost.

- Inconsistent Experience: Experience can vary greatly depending on the local chapter.

#4 – Liberty Mutual: Best for Customizable Policies

Pros

- High Customization: Offers highly customizable policies to fit individual needs.

- Good for Young Drivers: Provides competitive rates and discounts for younger drivers.

- Safe Driver Benefits: 15% discount for safe driving habits. Check out insurance savings in our complete Liberty Mutual car insurance review & ratings.

Cons

- Variable Customer Service: Customer satisfaction can vary by location.

- Premium Costs: Slightly higher premiums at $65 compared to others.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Savings

Pros

- Exclusive to Military: Exclusively serves military members and their families with tailored benefits.

- Competitive Military Discounts: Offers substantial savings and benefits for service members.

- Reliable Customer Support: Consistently high ratings for customer service. Discover more about offerings in our USAA insurance review & ratings.

Cons

- Limited Eligibility: Only available to military members, veterans, and their families.

- Basic Online Tools: Online services are less comprehensive compared to industry leaders.

#6 – State Farm: Best for Many Discounts

Pros

- Wide Range of Discounts: Offers multiple discounts including a substantial 13% for safe drivers.

- Bundling Options: Significant savings available when bundling multiple policies. Access comprehensive insights into our State Farm car insurance review & ratings.

- Comprehensive Coverage: Wide array of coverage options tailored for diverse needs.

Cons

- Higher Premiums: Despite discounts, premiums can be higher for certain coverage levels.

- Limited Multi-Policy Discount: Multi-policy discounts are not as competitive as some others.

#7 – Farmers: Best for Local Agents

Pros

- Personalized Service: Strong focus on personalized customer service with local agent support.

- High Safe Driver Discount: Offers a 15% discount for safe drivers. Delve into our evaluation of Farmers car insurance review & ratings.

- Robust Policy Options: Provides a variety of policy options to meet local needs.

Cons

- Higher Premiums: Premiums tend to be higher, especially without bundling.

- Inconsistent Agent Quality: Quality of service can vary depending on the individual agent.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best for Student Savings

Pros

- Excellent Student Discounts: Offers the highest student discount at 20%. Unlock details in our American Family insurance review & ratings.

- Family-Focused Policies: Tailored policies that benefit families with student drivers.

- Competitive Pricing: Maintains competitive rates with comprehensive coverage options.

Cons

- Limited Availability: Not available in all states, which can limit accessibility.

- Focus on Specific Demographics: Primarily caters to families and students, which might not meet everyone’s needs.

#9 – Nationwide: Best for Usage Discount

Pros

- Usage-Based Savings: Offers discounts for low-mileage drivers and those who use their cars infrequently.

- Comprehensive Safe Driver Incentives: 15% discount for safe driving records. Discover insights in our Nationwide insurance review & ratings.

- Flexible Policies: Offers a range of flexible policies to cater to diverse driver needs.

Cons

- Complex Pricing Structure: Pricing can be complex and may require thorough evaluation.

- Customer Service Variability: Customer service experiences can vary widely by region.

#10 – Allstate: Best for Add-on Coverages

Pros

- Extensive Add-On Options: Offers a wide range of add-on coverages for personalized protection.

- Rewards Program: Features a rewards program for safe drivers. If you want to learn more about the company, head to our Allstate insurance review & ratings.

- Comprehensive Support: Strong support network with local agents nationwide.

Cons

- Higher Cost of Add-Ons: Add-ons can significantly increase the overall cost.

- Premium Pricing: Generally higher monthly rates at $84, especially with additional coverages.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Audi RS 4 Insurance: Compare Monthly Rates by Provider and Coverage Level

When choosing car insurance for an Audi RS 4, understanding how different levels of coverage impact the monthly rates can guide your decision-making process. Here, we have compiled the rates from various insurance companies for both minimum and full coverage policies.

Car Insurance for Audi RS 4: Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $60 $152

Allstate $84 $185

American Family $81 $178

Farmers $77 $175

Liberty Mutual $65 $156

Nationwide $83 $181

Progressive $56 $144

State Farm $70 $168

Travelers $59 $150

USAA $67 $164

The monthly rates for minimum coverage start as low as $56 with Progressive and can go up to $84 with Allstate, showcasing a wide range in cost depending on the provider. For full coverage, which offers more comprehensive protection, the rates are understandably higher, ranging from $144 at Progressive to $185 at Allstate.

This significant difference underscores the importance of comparing what each level of coverage entails against the potential risks you face.

By evaluating these rates, Audi RS 4 owners can make more informed decisions, balancing their budget constraints with the need for adequate coverage. Discover insights in our “Is it cheaper to insure an Audi or Mercedes?”

Factors That Affect the Cost of Audi RS 4 Car Insurance

When it comes to insuring your Audi RS 4, there are several factors that can influence the cost of your car insurance. Insurance providers take into account various variables to determine the premiums for your specific vehicle. Here are some key factors that can affect the cost of Audi RS 4 car insurance:

- Age and Driving Experience: Younger and less experienced drivers often face higher insurance rates. This is due to their increased likelihood of being involved in accidents.

- Location: Where you live can also impact your insurance premiums. Areas with higher rates of accidents or theft may have higher insurance costs.

- Credit Score: Believe it or not, your credit score can affect your car insurance rates. Insurance providers use credit scores to assess the risk associated with insuring you.

- Deductibles: The deductible is the amount you need to pay out of pocket before your insurance coverage kicks in. Higher deductibles typically result in lower monthly premiums, while lower deductibles mean higher premiums.

- Driving Record: Your driving record plays a significant role in determining your insurance rates. Traffic violations and accidents can increase your premiums, as they indicate a higher risk of future incidents. Unlock details in our “Car Driving Safety Guide for Teens and Parents.”

- Vehicle’s Value: The value of your Audi RS 4 also affects the cost of insurance. The higher the value, the higher the premiums, as it would be more expensive to repair or replace.

- Insurance History: If you have a history of filing claims or have been uninsured in the past, insurance providers may consider you a higher risk and charge higher premiums.

Understanding the factors that affect Audi RS 4 car insurance costs is crucial for securing a policy that balances affordability with adequate coverage. By considering aspects such as driving experience, location, and vehicle value, drivers can better navigate their insurance options and potentially lower their premiums.

Understanding the Insurance Premiums for an Audi RS 4

Understanding your insurance premiums for an Audi RS 4 requires comprehending the various components that contribute to the overall cost. Insurance premiums are calculated based on several factors. The base rate serves as the starting point and is influenced by your age, driving record, and location.

Additional coverage options, such as comprehensive and collision coverage, can increase your premiums. Discounts may be available from insurance providers for reasons like having safety features installed in your Audi RS 4, being a safe driver, or bundling multiple policies with the same provider. Delve into our evaluation of “Collision vs. Comprehensive Car Insurance.”

Different insurance companies also have varying pricing structures and algorithms for calculating premiums.

Therefore, comparing quotes from multiple providers is crucial to ensure you get the best rate for your Audi RS 4. By understanding these factors—base rates, additional coverages, available discounts, and specific insurer pricing strategies—you can effectively manage and potentially reduce your insurance premiums.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Importance of Comparing Car Insurance Rates for Audi RS 4

When it comes to insuring your Audi RS 4, it’s vital to compare car insurance rates from different providers. The cost of car insurance can vary significantly between companies, and taking the time to compare rates can result in significant savings.

By comparing car insurance rates, you can ensure that you are getting the best coverage at the most affordable price. Remember that the cheapest option may not always be the best, so review each policy’s coverage and features before making a decision.

Kristine Lee Licensed Insurance Agent

Additionally, comparing car insurance rates can help you identify any potential discounts or savings opportunities. Some insurance providers offer discounts for having safety features in your Audi RS 4 or for bundling multiple policies together.

Tips to Get Affordable Car Insurance for Your Audi RS 4

Getting affordable car insurance for your Audi RS 4 doesn’t have to be a daunting task. Here are some tips to help you secure the best rates:

- Shop Around: Don’t settle for the first insurance quote you receive. Explore options from different providers to ensure you’re getting the most competitive rates.

- Take Advantage of Discounts: Many insurance companies offer discounts that can help reduce your premiums. Look for discounts such as safe driver discounts, multi-policy discounts, and discounts for safety features. Access comprehensive insights into our “Lesser Known Car Insurance Discounts.”

- Increase Your Deductible: Consider raising your deductible to lower your monthly premiums. Just make sure you have enough funds set aside to cover the deductible if you need to make a claim.

- Bundle Your Policies: If you have multiple insurance policies, such as home or renters insurance, consider bundling them with the same provider. Bundling can often lead to discounted rates.

- Maintain a Good Credit Score: Your credit score can impact your car insurance rates. Make sure to maintain a good credit score by paying your bills on time and managing your credit responsibly.

- Consider Usage-Based Insurance: Some insurance companies offer usage-based insurance programs where your premiums are based on your driving habits. If you’re a safe driver, this can potentially lead to lower rates.

Remember, each insurance provider has its own criteria and pricing structure, so it’s essential to compare quotes and policies to find the most affordable car insurance for your Audi RS 4.

Exploring Different Types of Coverage Options for Your Audi RS 4

When it comes to insuring your Audi RS 4, there are various coverage options available, and understanding these options can help you determine the type of coverage that best suits your needs.

Firstly, liability insurance is required in most states and covers damages or injuries you cause to others if you’re at fault in an accident. Secondly, collision coverage pays for damages to your Audi RS 4 if you’re involved in an accident with another vehicle or an object. Learn more in our “Collision Car Insurance: A Complete Guide.”

Ty Stewart Licensed Insurance Agent

Comprehensive coverage protects your vehicle from damages caused by non-collision events, such as theft, vandalism, or natural disasters. Additionally, uninsured/underinsured motorist coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough coverage to pay for the damages.

Medical payments coverage helps cover medical expenses for you and your passengers if you’re injured in an accident.

Lastly, gap insurance can be beneficial if you have a lease or loan on your Audi RS 4, as it covers the difference between the vehicle’s value and the amount you owe in case of a total loss. When choosing coverage options for your Audi RS 4, it’s essential to consider your budget, driving habits, and the level of protection you desire.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Lower Your Car Insurance Costs for an Audi RS 4

If you’re looking to lower your car insurance costs for your Audi RS 4, here are some strategies that can help.

Consider increasing your deductibles; by opting for higher deductibles, you can lower your monthly premiums. Just ensure you have enough savings to cover the deductible if needed. Take advantage of discounts offered by many insurance providers for things like safety features, being a safe driver, or bundling multiple policies together.

Inquire about available discounts and see if you qualify for any. If you have an older Audi RS 4, consider dropping certain coverage options, such as collision or comprehensive, if the car’s value doesn’t justify the cost of the premiums. Practice safe driving habits to maintain a clean driving record, which can help keep your premiums low.

Avoid traffic violations and accidents to demonstrate to insurance providers that you’re a safe driver. Some insurance companies offer discounts for completing a defensive driving course; not only will this help lower your premiums, but it will also improve your driving skills. Regularly review your insurance policy to ensure it still meets your needs. See more details on our “Best Car Insurance by Vehicle.”

As your Audi RS 4 ages or your circumstances change, adjusting your coverage options can help lower costs. Remember, lowering your car insurance costs doesn’t mean sacrificing coverage. It’s about finding the right balance between affordability and adequate protection for your Audi RS 4.

The Benefits of Bundling Your Audi RS 4 Insurance With Other Policies

Bundling your Audi RS 4 insurance with other policies, such as home or renters insurance, can offer several benefits.

One significant advantage is cost savings; many insurance providers offer discounts when you bundle multiple policies with them, leading to lower overall premiums compared to purchasing each policy separately. Discover more about offerings in our “Can I bundle my car insurance with other policies?”

Additionally, bundling your insurance policies can provide convenience, as having all your policies with one provider simplifies management and payment, making it easier to keep track of renewal dates and policy details. Moreover, having multiple policies with a single insurance provider can increase your leverage when negotiating rates or making changes to your policies.

Another benefit is a streamlined claims process; if you need to file a claim involving multiple policies, having them all with one provider can make the process more efficient and less stressful.

However, before bundling your insurance policies, it’s crucial to compare rates from different providers, as sometimes it may be more cost-effective to have separate policies with different companies despite the bundling discount. Always consider your specific needs and financial situation when deciding whether to bundle your Audi RS 4 insurance.

Common Mistakes to Avoid When Insuring Your Audi RS 4

Insuring your Audi RS 4 requires careful consideration to avoid common mistakes that can lead to higher costs or insufficient coverage. One mistake is choosing the minimum coverage to save money, which might not offer adequate protection. It’s important to assess your needs and consider additional coverage options.

Another error is not comparing quotes from multiple providers, which can result in higher premiums. Shop around to find the best rate. Overlooking discounts offered by insurance companies is another common mistake. Inquire about and utilize any discounts that apply to your situation. Check out insurance savings in our complete “Best Safe Driver Car Insurance Discounts.”

Additionally, not reviewing your policy annually can result in missed savings opportunities and outdated coverage. Make it a habit to review your policy each year. If you make modifications or enhancements to your Audi RS 4, such as adding performance upgrades or aftermarket parts, update your policy to reflect the current value of your vehicle.

Lastly, don’t settle for the first insurance quote you receive. Compare multiple quotes and coverage options to make an informed decision. Avoiding these common mistakes can help ensure you have the right coverage at the best price for your Audi RS 4.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How the Location and Driving Record Impact Audi RS 4 Insurance Rates

The location you reside in and your driving record can significantly impact Audi RS 4 insurance rates. Insurance providers consider various factors, such as crime rate, traffic congestion, and the likelihood of accidents in your area when determining premiums.

If you live in a region with higher rates of accidents or theft, your insurance rates may be higher compared to those in lower-risk areas. Additionally, maintaining a clean driving record demonstrates to insurance providers that you are a safe driver, which can result in lower premiums. Discover insights in our “Car Accidents: What to do in Worst Case Scenarios.”

Conversely, traffic violations, accidents, and driving under the influence can lead to higher insurance rates. Insurance providers assess the risk associated with insuring your Audi RS 4 based on these factors. Therefore, it is essential to be mindful of your driving habits and location when seeking car insurance to ensure fair and accurate premiums.

The Role of Deductibles in Determining the Cost of Audi RS 4 Car Insurance

Deductibles play a crucial role in determining the cost of Audi RS 4 car insurance. A deductible is the amount you are responsible for paying out of pocket before your insurance coverage applies. Here’s how deductibles impact insurance costs:

- Higher Deductible, Lower Premiums: Opting for a higher deductible will result in lower monthly premiums. This is because you are taking on a larger portion of the risk, and insurance providers reward this by offering lower rates.

- Lower Deductible, Higher Premiums: Choosing a lower deductible means you will pay less out of pocket if you need to make a claim. However, this also means that your monthly premiums will be higher since the insurance company is taking on a larger portion of the risk.

Choosing the right deductible is a key strategy in managing the cost of Audi RS 4 car insurance. Unlock details in our “What is the difference between a deductible and a premium in car insurance?”

Melanie Musson Published Insurance Expert

By understanding the trade-off between deductible amounts and premium costs, owners can better tailor their policy to fit their financial comfort and coverage needs.

Enter your ZIP code below to compare rates from the top providers near you.

Frequently Asked Questions

What factors affect the cost of Audi RS 4 car insurance?

The cost of Audi RS 4 car insurance can be influenced by various factors such as the driver’s age, location, driving history, coverage options, deductibles, and the insurance company’s policies.

For additional details, explore our comprehensive resource titled “What age do you get cheap car insurance?“

Are Audi RS 4 car insurance rates higher than average?

Insurance rates for the Audi RS 4 may be higher than average due to its performance capabilities and potential repair costs. Additionally, factors such as the driver’s age and driving history can further impact insurance rates.

Is it more expensive to insure a new Audi RS 4 compared to an older model?

In general, insuring a new Audi RS 4 may be more expensive than an older model. Newer vehicles often have higher values and repair costs, which can result in higher insurance premiums. Additionally, newer models may have advanced safety features that could potentially lower insurance rates.

Do Audi RS 4 car insurance rates vary by location?

Yes, insurance rates for the Audi RS 4 can vary based on the location where the vehicle is primarily driven and parked. Areas with higher population densities, increased traffic congestion, or higher rates of car theft may result in higher insurance premiums.

Can I reduce the cost of Audi RS 4 car insurance?

There are several ways to potentially reduce the cost of Audi RS 4 car insurance. These include maintaining a clean driving record, opting for a higher deductible, bundling insurance policies, taking advantage of available discounts, and comparing quotes from multiple insurance companies.

To find out more, explore our guide titled “Defensive Driving Courses Can Lower Your Car Insurance Rates.”

How much does it cost to insure an Audi S4?

The annual cost of auto insurance for an Audi S4 is approximately $2,891, which exceeds the national average for luxury sedans by $666. This estimate is based on a comparison study involving a 40-year-old driver with a clean driving record, full coverage, good credit, and an annual mileage of about 13,000 miles.

Is car insurance higher for an Audi?

Insuring an Audi is costlier than insuring nonluxury brands but relatively affordable compared to other luxury carmakers. While insuring a Toyota or Honda typically costs around $2,000 annually, the average cost to insure an Audi is about $3,400 per year.

Are Audis reliable?

Consumer Reports has commended Audi for its reliability. This assessment was based on data from over 300,000 vehicles spanning 22 model years, from 2000 to 2022, and evaluated across 17 different problem area categories. In total, Consumer Reports ranked 24 car brands for reliability.

Is Audi or BMW more affordable?

Although Audis are typically less expensive than BMWs, BMW models come with more standard features that are desirable for driving on Cresskill roads.

To learn more, explore our comprehensive resource on “BMW Car Insurance Discount.”

How much does the average Audi owner make?

Audi recently shared a notable statistic regarding the household income of owners of its A3 series in North America. For A3 owners, the average family income is $120,000 (approximately 766,800 yuan). For S3 owners, it is $150,000, and for RS3 owners, it reaches $200,000.

Do Audis lose value fast?

Is Lexus better than Audi?

Does Audi negotiate price?

Is Audi cheaper than Mercedes?

Is an Audi A4 a luxury car?

What usually goes wrong with Audi?

Is Audi more affordable than BMW?

Is Audi A4 good on gas?

What cars are in the same class as Audi A4?

What is the life expectancy of Audi A4?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.