Cheap Audi RS 6 Car Insurance in 2026 (Unlock Savings With These 10 Companies!)

The top companies for cheap Audi RS 6 car insurance are Chubb, USAA, and Nationwide, with rates as low as $37 per month. These companies offer competitive pricing and comprehensive coverage options, making them the best choices for affordable and reliable car insurance for your Audi RS 6.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Travis Thompson

Updated January 2025

82 reviews

82 reviewsCompany Facts

Min. Coverage for Audi RS 6

A.M. Best Rating

Complaint Level

Pros & Cons

82 reviews

82 reviews 6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage for Audi RS 6

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 3,071 reviews

3,071 reviewsCompany Facts

Min. Coverage for Audi RS 6

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsThe best providers for cheap Audi RS 6 car insurance are Chubb, USAA, and Nationwide. These companies offer the most competitive rates, starting at $37 per month. This article explores how various factors such as vehicle value, driving history, and location influence insurance costs.

We also discuss the importance of comprehensive affordable coverage for high-value vehicles like the Audi RS 6 and provide tips for finding affordable insurance options. Additionally, we highlight the role of safety features and deductibles in determining insurance premiums.

Our Top 10 Company Picks: Cheap Audi RS 6 Car Insurance

| Company | Ranking | Monthly Rates | Good Driver Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $37 | 26% | High-Value Coverage | Chubb | |

| #2 | $40 | 22% | Military Benefits | USAA | |

| #3 | $43 | 20% | Competitive Rates | Nationwide |

| #4 | $46 | 19% | Customer Satisfaction | Amica | |

| #5 | $49 | 17% | Personalized Service | State Farm | |

| #6 | $52 | 15% | Customizable Coverage | Liberty Mutual |

| #7 | $55 | 14% | Tailored Discounts | Progressive | |

| #8 | $58 | 12% | Specialized Coverage | Farmers | |

| #9 | $61 | 10% | Extensive Coverage | Travelers | |

| #10 | $64 | 9% | Safe Driving | Erie |

By comparing quotes from these top providers, you can find the best coverage at the lowest rates. Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

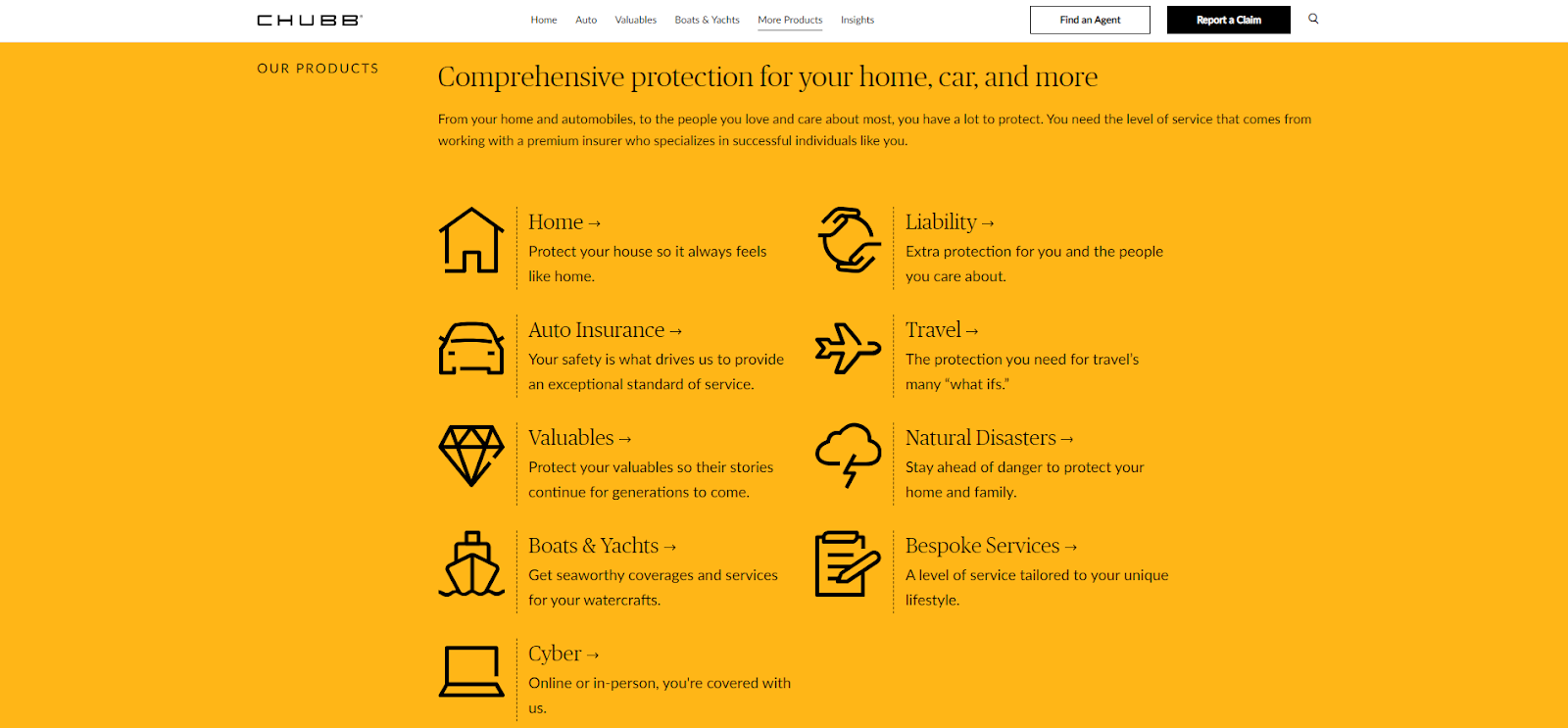

#1 – Chubb: Top Overall Pick

Pros

- High-Value Coverage: Chubb specializes in high-value insurance, ensuring comprehensive coverage for luxury vehicles like the Audi RS 6.

- Extensive Experience: Chubb has a long history and expertise in providing high-end insurance solutions.

- Excellent Customer Service: Chubb insurance review & ratings is known for its superior customer service and claims handling.

Cons

- High Premiums: Chubb’s premiums can be higher compared to other insurers.

- Limited Discounts: There are fewer discount options available with Chubb.

- Availability: Chubb’s coverage might not be available in all regions.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Benefits

Pros

- Exclusive Military Benefits: USAA review and ratings offers unique benefits and discounts for military members and their families.

- Highly Rated Customer Service: USAA consistently receives high marks for customer service and claims satisfaction.

- Competitive Rates: USAA provides competitive rates for its members, making it an affordable choice for many.

Cons

- Membership Restrictions: USAA is only available to military members and their families.

- Limited Coverage Options: USAA may not offer as many coverage options as other insurers.

- Online and Phone Support: USAA relies heavily on online and phone support, which may not suit everyone.

#3 – Nationwide: Best for Competitive Rates

Pros

- Competitive Rates: Nationwide insurance review & ratings offers attractive rates, especially for good drivers.

- Wide Range of Discounts: Nationwide provides a variety of discounts to help lower premiums.

- Flexible Coverage Options: Nationwide offers multiple coverage options to fit different needs.

Cons

- Average Customer Service: Nationwide’s customer service ratings are average compared to top competitors.

- Limited Availability: Some coverage options may not be available in all states.

- Complex Claims Process: Nationwide’s claims process can be cumbersome for some policyholders.

#4 – Amica: Best for Customer Satisfaction

Pros

- High Customer Satisfaction: Amica consistently ranks high in customer satisfaction and claims handling.

- Dividend Policies: Amica offers dividend policies that can provide policyholders with a portion of their premiums back.

- Comprehensive Coverage: Amica provides a wide range of coverage options, including some unique add-ons.

Cons

- Higher Premiums: Amica’s premiums can be higher than some competitors. Research more on various Amica car insurance discounts for more savings.

- Limited Availability: Amica’s services may not be available in all areas.

- Few Discounts: There are fewer discount opportunities compared to other insurers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – State Farm: Best for Personalized Service

Pros

- Personalized Service: State Farm agents provide personalized service to meet individual needs.

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies.

- Extensive Network: State Farm insurance review & ratings boast having a large network of agents and service centers.

Cons

- Limited Multi-Policy Discount: The multi-policy discount of State Farm is not as high compared to some competitors.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels.

- Average Claims Handling: State Farm’s claims handling can be average compared to top competitors.

#6 – Liberty Mutual: Best for Customizable Coverage

Pros

- Customizable Coverage: Liberty Mutual insurance review & ratings offers a variety of coverage options that can be tailored to individual needs.

- Numerous Discounts: Liberty Mutual provides a wide range of discounts to help reduce premiums.

- Accident Forgiveness: Liberty Mutual offers accident forgiveness, which can prevent rate increases after an accident.

Cons

- Higher Premiums: Liberty Mutual’s premiums can be higher than some competitors.

- Mixed Customer Service Reviews: Customer service reviews for Liberty Mutual are mixed.

- Complex Policy Options: The variety of coverage options can be overwhelming for some customers.

#7 – Progressive: Best for Tailored Discounts

Pros

- Tailored Discounts: Progressive offers a variety of discounts tailored to different driving behaviors and needs.

- Usage-Based Insurance: Progressive’s Snapshot program allows drivers to save based on their driving habits.

- Competitive Rates: Progressive insurance review & ratings excel in providing competitive rates, particularly for high-risk drivers.

Cons

- Variable Customer Service: Progressive’s customer service ratings can be inconsistent.

- Limited Local Agents: Progressive relies heavily on online and phone support, with fewer local agents available.

- Claims Process: Progressive’s claims process can be slower compared to other insurers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Specialized Coverage

Pros

- Specialized Coverage: Farmers offers specialized coverage options for different types of drivers and vehicles.

- Good Customer Service: Farmers car insurance review & ratings is known for its responsive and helpful customer service.

- Flexible Payment Options: Farmers provides various payment options to suit different financial needs.

Cons

- Higher Rates: Farmers’ insurance rates can be higher than those of some competitors.

- Fewer Discounts: Farmers offers fewer discounts compared to other insurers.

- Limited Online Tools: Farmers’ online tools and resources are not as comprehensive as those of other insurers.

#9 – Travelers: Best for Extensive Coverage

Pros

- Extensive Coverage Options: Travelers offers a wide range of coverage options, including many add-ons.

- Strong Financial Stability: Travelers has strong financial ratings, ensuring reliability and security.

- Good Claims Handling: Travelers insurance review & ratings stand out for efficient and fair claims handling.

Cons

- Higher Premiums: Travelers’ premiums can be higher than those of some competitors.

- Average Customer Service: Customer service ratings for Travelers are average.

- Limited Discounts: There are fewer discount opportunities available with Travelers.

#10 – Erie: Best for Safe Driving

Pros

- Safe Driving Discounts: Erie offers significant discounts for safe drivers.

- Competitive Rates: Erie provides competitive rates, especially for low-risk drivers.

- High Customer Satisfaction: Erie insurance review & ratings consistently ranks high in customer satisfaction surveys.

Cons

- Limited Availability: Erie is only available in a limited number of states.

- Fewer Coverage Options: Erie offers fewer coverage options compared to larger insurers.

- Basic Online Tools: Erie’s online tools and resources are more basic compared to other insurers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding the Factors That Influence Audi RS 6 Car Insurance Rates

When it comes to determining car insurance rates for an Audi RS 6, several factors come into play. Insurance providers take into account the vehicle’s value, horsepower, repair costs, and safety features. Generally, high-performance cars like the Audi RS 6 tend to have higher insurance rates due to their increased risk on the road.

Another crucial factor is the driver’s age and driving record. Younger drivers and those with a history of traffic violations or accidents may be subjected to higher insurance premiums. Insurance companies also consider the geographic location where the vehicle will be primarily driven. Areas with higher crime rates and dense traffic may result in higher insurance rates.

Exploring the Different Types of Car Insurance Coverage For Audi RS 6

When insuring an Audi RS 6, it is essential to understand the various types of car coverage available. Liability coverage is typically required by law and protects against injuries or property damage caused by the insured vehicle. In addition to liability coverage, comprehensive and collision coverage are commonly chosen for high-value vehicles like the Audi RS 6.

Comprehensive coverage provides protection against non-collision incidents, such as theft, vandalism, or natural disasters. Collision coverage, on the other hand, covers damages resulting from collisions with other vehicles or objects. It’s crucial to weigh the benefits of each coverage type and determine which options best meet your needs and budget.

The Cost of Insuring an Audi RS 6 by Coverage Level

When examining the monthly insurance rates for an Audi RS 6 across various providers and coverage levels, several trends emerge. First, there is a noticeable disparity between the rates offered by different insurance companies. For minimum coverage, Amica offers the lowest rate at $37 per month, while USAA offers the highest at $64 per month. This $27 difference underscores the importance of shopping around for insurance.

Similarly, for full coverage, Chubb provides the most affordable option at $101 per month, while Erie offers the highest rate at $130 per month. This $29 difference highlights the significant variation in pricing among providers.

Audi RS 6 Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Amica $37 $111

Chubb $40 $101

Erie $43 $130

Farmers $46 $124

Liberty Mutual $49 $118

Nationwide $52 $108

Progressive $55 $121

State Farm $58 $115

Travelers $61 $127

USAA $64 $104

Another observation is the general trend that as coverage level increases, so does the monthly premium. This is evident in the data, with higher rates for full coverage compared to minimum coverage across all insurance companies listed. However, the extent of this increase varies depending on the provider.

Furthermore, some insurance companies maintain relatively consistent pricing regardless of coverage level. For instance, USAA offers a minimal difference of $5 between its minimum and full coverage rates ($64 for minimum coverage and $104 for full coverage), indicating a consistent pricing strategy across coverage levels.

Kristen Gryglik Licensed Insurance Agent

In contrast, other providers, such as Nationwide and Progressive, exhibit more significant differences between their minimum and full coverage rates, with variations of $56 and $66, respectively. This suggests that these companies may adjust their pricing based on the level of coverage chosen by the policyholder.

Overall, this analysis underscores the importance of considering multiple factors, including coverage level and provider, when selecting car insurance for an Audi RS 6. By carefully evaluating these variables and comparing rates from different companies, drivers can make informed decisions to secure adequate coverage at competitive prices.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips For Finding Affordable Car Insurance For Your Audi RS 6

While insuring a high-performance vehicle like the Audi RS 6 may come at a higher cost, there are several steps you can take to find more affordable insurance rates. Firstly, shopping around and obtaining quotes from multiple insurance providers allows you to compare prices and coverage options.

Additionally, maintaining a clean driving record and taking defensive driving courses may help reduce insurance premiums. You can also consider increasing deductibles, as higher deductibles typically result in lower insurance rates. Bundling your car insurance with other policies, such as homeowners or renters insurance, may also lead to savings.

Factors to Consider When Comparing Car Insurance Quotes for an Audi RS 6

When comparing car insurance quotes for an Audi RS 6, it’s essential to look beyond the price tag. Consider the level of coverage provided, the reputation and financial stability of the insurance company, and any additional benefits or discounts available. Ensure the policy meets your specific needs and offers adequate protection for your Audi RS 6.

Analyzing the Safety Features of the Audi RS 6 and Its Impact on Insurance Rates

The safety features of the Audi RS 6 can play a significant role in determining insurance rates. Advanced safety technologies, such as collision warning car or avoidance systems, adaptive cruise control, and lane-keeping assist, may qualify the vehicle for insurance discounts.

These features help mitigate the risk of accidents and reduce the severity of potential damages. As a result, insurance companies may offer lower rates for Audi RS 6 vehicles equipped with such safety features. Therefore, it is advisable to inquire with insurance providers about potential discounts based on the safety features present in your Audi RS 6.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Relationship Between the Age and Condition of Your Audi RS 6 and its Insurance Premium

The age and condition of your Audi RS 6 can impact insurance premiums. As the vehicle ages, its value may depreciate, which could result in lower insurance costs. However, it’s important to note that the condition of the vehicle and regular maintenance also influence insurance rates. Explore more information on “How does the insurance company determine my premium?“.

Properly maintaining your Audi RS 6 and ensuring it remains in good condition can help reduce the risk of accidents or breakdowns. Insurance providers may view well-maintained vehicles as less likely to file claims, potentially resulting in lower insurance premiums.

How Your Driving History and Location Affects the Cost of Insuring an Audi RS 6

Your driving history plays a crucial role in determining the cost of insuring an Audi RS 6. Insurance companies typically consider your past traffic violations, accidents, and claims history when calculating premiums. Drivers with a clean driving record generally qualify for lower insurance rates, as they are viewed as less risky and more responsible on the road.

If you have a history of traffic violations or accidents, insurance premiums may be higher due to the increased likelihood of future claims. It’s important to note that insurance rates can change over time as traffic violations and accidents become less recent. Continuously maintaining a clean driving record can help lower insurance premiums in the long run.

Jeff Root Licensed Life Insurance Agent

Your location significantly impacts the cost of insuring an Audi RS 6. Insurance companies consider the crime rates, population density, and traffic conditions of the area where the vehicle will primarily be driven. Urban areas with higher crime rates and heavier traffic may result in higher insurance rates compared to rural or suburban areas.

Location also affects the likelihood of accidents and vehicle theft. Insurance providers assess the overall risk associated with insuring an Audi RS 6 in a specific location. Therefore, it’s important to consider how your location may impact your insurance costs when owning an Audi RS 6.

Understanding Deductibles on Audi RS 6 Car Insurance Rates

Deductibles are an important consideration when determining Audi RS 6 car insurance rates. A deductible is the amount of money the policyholder must pay out of pocket before the insurance coverage kicks in. Choosing to raise your deductible can typically result in lower insurance premiums, as the policyholder assumes more financial responsibility in the event of a claim.

However, it’s crucial to ensure that the chosen deductible is an amount you can comfortably afford. While a higher deductible may lead to more affordable insurance rates, it also means more financial burden should a claim arise. Weighing the potential savings against the potential financial impact is essential when selecting a deductible for your Audi RS 6 car insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Discounts and Savings Opportunities for Audi RS 6 Car Insurance

Insurance providers often offer various discounts and savings opportunities for Audi RS 6 car insurance. These discounts may include safe driver discounts, multi-policy discounts, good student discounts, and others. It’s important to inquire with insurance providers about potential discounts and explore which ones you may qualify for.

When shopping for insurance, ask about available discounts and provide accurate information about your driving history and any safety features your Audi RS 6 possesses. Taking advantage of these discounts can help lower your insurance premium while still maintaining adequate coverage for your Audi RS 6.

The Importance of Comprehensive Coverage for an Audi Rs 6 and its Cost Implications

Comprehensive coverage is particularly important for high-value vehicles like the Audi RS 6. This coverage protects against theft, vandalism, and damage caused by non-collision incidents such as fire, natural disasters, or falling objects. While comprehensive coverage offers peace of mind, it can come with higher insurance premiums.

When considering comprehensive coverage for your Audi RS 6, it’s crucial to evaluate the cost implications based on the vehicle’s value, repair costs, and risk factors. You may also need to consider the additional expense of setting a deductible for the comprehensive coverage portion of your insurance policy.

The Benefits of Bundling Your Car Insurance With Other Policies for Your Audi RS 6

Bundling your car insurance with other policies, such as homeowners or renters insurance, can offer several benefits for your Audi RS 6. Insurance companies often provide discounts when multiple policies are combined, resulting in overall cost savings.

Besides potential discounts, bundling your insurance policies can streamline the process, as you’ll have a single provider managing multiple coverages. This can simplify payments, claims, and overall management of your insurance coverage. It’s worth considering bundling your car insurance with other policies as a way to save money and enhance convenience for your Audi RS 6.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Specialized Insurance Options for High-Performance Vehicles Like the Audi RS 6

As a high-performance vehicle, the Audi RS 6 may require specialized insurance options. Some insurance providers offer specific coverage tailored to high-performance cars, taking into account the unique risks and needs associated with these vehicles.

You may check out our guide on “How can I find car insurance policies that include coverage for custom or aftermarket parts and accessories?“.

Specialized insurance options may provide additional coverage for modifications, track events, or driving schools. These policies ensure that your Audi RS 6 is adequately protected in various scenarios. If you own a high-performance vehicle like the Audi RS 6, it’s worth exploring these specialized insurance options to ensure comprehensive coverage.

Tips for Lowering Your Insurance Premium While Maintaining Adequate Coverage for Your Audi Rs 6

Lowering your insurance premium for your Audi RS 6 without sacrificing adequate coverage requires a careful balance. To achieve this, consider several tips. First, shop around and compare insurance quotes from multiple insurance providers to find competitive rates for your Audi RS 6. Maintaining a clean driving record and taking defensive driving courses can also help, as they display your responsible driving habits.

Increasing deductibles, if financially feasible, can lead to lower insurance premiums. Bundling your car insurance with other policies might offer potential discounts and added convenience. Inquire about available discounts specific to high-performance vehicles or safety features of the Audi RS 6. Assess the necessity of comprehensive coverage based on the vehicle’s value and your risk tolerance.

Additionally, consider the potential cost savings and risks associated with insuring a new or used Audi RS 6. Regular maintenance of your Audi RS 6 can demonstrate its good condition, reducing the risk associated with mechanical failures. Lastly, explore specialized insurance options designed for high-performance vehicles like the Audi RS 6 to ensure you receive comprehensive coverage.

Common Misconceptions About Insuring an Audi RS 6 Debunked

Misconceptions about insuring an Audi RS 6 abound. Some believe it’s unaffordable, but with diligent exploration, affordable options exist. Price doesn’t equate to quality; coverage alignment and insurer reputation matter. Modifications aren’t always a guarantee of higher rates; safety enhancements can even lead to discounts. Cheaper policies may not offer adequate coverage; it’s crucial to review each policy thoroughly.

Factors like vehicle value, horsepower, and driver profile influence insurance rates. Exploring car coverage types and comparing quotes can lead to suitable and affordable options. Regularly adjusting coverage ensures ongoing protection for your Audi RS 6.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Importance of Audi RS 6 Car Insurance

Car insurance for the Audi RS 6 is crucial for protecting your investment and ensuring financial security in the event of accidents or unforeseen incidents. Let’s explore real-life examples highlighting the significance of adequate insurance coverage for Audi RS 6 owners.

- Case Study 1 – Protecting Against Theft: John woke up to find his Audi RS 6 missing. Thanks to his comprehensive insurance coverage, John received compensation for the stolen vehicle.

- Case Study 2 – Coverage for Collision Damage: Sarah was involved in a minor collision. Her collision coverage covered the repair costs, sparing her from overwhelming expenses.

- Case Study 3 – Protection During Natural Disasters: Mark’s Audi RS 6 was damaged by hail during a severe storm. His comprehensive insurance covered the repairs, sparing him significant out-of-pocket expenses.

These case studies underscore the critical role of car insurance in protecting Audi RS 6 owners from financial losses and unforeseen circumstances.

Delve more insights on “Collision vs. Comprehensive Car Insurance“.

Whether it’s theft, collision damage, or natural disasters, having comprehensive coverage ensures peace of mind and preserves the enjoyment of owning such a prestigious vehicle. Remember to review and update your insurance policy regularly to adapt to changing needs and circumstances.

The Roundup: Audi RS 6 Car Insurance

In conclusion, securing adequate insurance coverage for your Audi RS 6 is essential. By considering factors such as vehicle value, driving history, and location, you can make informed decisions to find affordable rates. Exploring various insurance companies, coverage options, discounts, and bundling opportunities can help lower premiums while maintaining comprehensive protection.

Regularly reviewing and updating your policy ensures it aligns with your evolving needs. Remember, the cheapest policy may not always provide the best coverage, so prioritize finding a balance between cost and protection. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code below.

Frequently Asked Questions

What factors affect the cost of Audi RS 6 car insurance?

The cost of Audi RS 6 car insurance can be influenced by various factors such as the driver’s age, driving history, location, coverage options, deductible amount, and the insurance provider’s rates.

Are there any discounts available for Audi RS 6 car insurance?

Yes, insurance providers may offer discounts for Audi RS 6 car insurance. These discounts can vary between companies but commonly include options like multi-car discounts, safe driver discounts, bundling with other insurance policies, and anti-theft device discounts. It’s advisable to inquire with different insurers for available discounts.

Is Audi RS 6 car insurance more expensive compared to other Audi models?

Generally, the insurance cost for an Audi RS 6 may be higher than for other Audi models due to its high-performance nature and higher value. Insurance companies often consider factors like the car’s horsepower, speed capabilities, and repair costs when determining the premium. See if you’re getting the best deal on car insurance by entering your ZIP code below.

Does the cost of Audi RS 6 car insurance vary by location?

Yes, the cost of Audi RS 6 car insurance can vary depending on the location. Insurance rates are often influenced by factors such as the area’s crime rate, population density, frequency of accidents, and local laws. Generally, urban areas or regions with higher risks may have higher insurance premiums.

Is Audi cheaper than BMW?

Nevertheless, there exist variances in cost between the two brands. Typically, BMWs are marginally pricier than Audis, boasting a higher initial price across most models. Nevertheless, BMWs also demonstrate a tendency to retain their value better over time, thus mitigating the upfront expense. Check out more insights on our “How much does BMW M4 car insurance cost?“.

Is Audi RS6 expensive to maintain?

RS versions of Audi models, like the RS4 and RS6, typically entail higher operational costs as well. These models are geared towards performance, featuring engines that place less emphasis on efficiency, consequently placing them in higher insurance brackets.

Is Audi RS6 a luxury car?

An option for an eight-speed automatic transmission and Quattro all-wheel drive is on offer. Additionally, a 48-volt hybrid system has been integrated to enhance fuel efficiency. Despite its capability to outshine numerous vehicles, the RS6 Avant remains fundamentally a luxury model. Consequently, its interior boasts a contemporary aesthetic and cutting-edge technological features.

Is Audi cheaper than Benz?

Both models establish a standard for compact luxury sedans. Let’s compare the 2022 Audi A4 45 TFSI Premium quattro with the Mercedes-Benz C 300 Sedan. Starting with MSRPs, Audi’s A4 is priced impressively $3,700 less than the Mercedes-Benz. Obtain more knowledge with our “Best Mercedes Car Insurance“.

What class is the Audi RS6?

The styling of the Executive car Audi RS 6 quattro is characterized by a sleek design and impeccable assembly. Originating from Germany, specifically Neckarsulm, this vehicle belongs to the Executive car class (E). It features a front-engine layout with all-wheel-drive capability, known as quattro.

Is the Audi RS6 rare?

This car possesses a confidence-inspiring quality that surpasses its competitors—a characteristic cherished in vehicles within its performance class. This commendation, however, contrasts with Audi’s disappointing sales figure of only 1,435 units in the USA. Despite its limited availability, its attractiveness, power, and exclusivity combine to create a formula destined for success among enthusiasts.

Is RS6 faster than R8?

What are the cons of owning an Audi?

Which is better Benz or BMW or Audi?

Is an RS6 a supercar?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.