Cheap Dodge Neon Car Insurance in 2026 (Save With These 10 Companies!)

USAA, Erie, and Progressive offer the best options for cheap Dodge Neon car insurance, starting at just $32 a month. These providers stand out due to their competitive rates, extensive coverage options, and exceptional customer service tailored to Dodge owners, making them ideal for budget-conscious drivers.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from S...

D. Gilson, PhD

Former Licensed Insurance Producer

Laura Berry has experience as a licensed producer selling life, health, and property insurance coverage for both Allstate and State Farm. She has dedicated many hours to helping her clients understand the insurance marketplace so they could find the best car, home, and life insurance products for their circumstances. While she currently helps businesses take advantage of the federal R&D tax...

Laura Berry

Updated November 2024

Company Facts

Min. Coverage for Dodge Neon

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Dodge Neon

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Dodge Neon

A.M. Best Rating

Complaint Level

Pros & Cons

These providers are distinguished by their tailored services for Dodge owners, ensuring competitive rates and comprehensive protection. Whether you’re seeking basic liability coverage or full comprehensive insurance, these companies offer a range of options to suit different needs and budgets.

Our Top 10 Company Picks: Cheap Dodge Neon Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $32 A++ Military Savings USAA

#2 $39 A+ Filing Claims Erie

#3 $42 A+ Loyalty Rewards Progressive

#4 $44 A Online Tools Safeco

#5 $49 A+ Vanishing Deductible Nationwide

#6 $54 B Financial Strength State Farm

#7 $56 A High-Risk Coverage The General

#8 $60 A++ Specialized Coverage Travelers

#9 $72 A++ High-Value Vehicles Chubb

#10 $81 A+ UBI Discount Allstate

With a focus on customer satisfaction and cost efficiency, they represent the best choices for Dodge Neon owners looking for reliable and economical car insurance. Learn more in our “Dodge Car Insurance Discount.”

Searching for more affordable premiums? Insert your ZIP code above to get started on finding the right provider for you and your budget.

- USAA stands out as the top provider of cheap Dodge Neon car insurance

- Dodge owners benefit from tailored coverage options that meet specific needs

- Insurance options for Dodge Neon emphasize affordability and reliability

#1 – USAA: Top Overall Pick

Pros

- Exclusive Military Benefits: USAA offers specialized discounts and benefits exclusively for military members and their families.

- High Customer Satisfaction: Renowned for exceptional customer service and high satisfaction rates among policyholders. See more details on our USAA insurance review & ratings.

- Superior Financial Strength: With an A++ rating from A.M. Best, USAA ensures strong financial stability and claim-paying ability.

Cons

- Limited Availability: Services are only available to military members, veterans, and their families.

- Fewer Physical Locations: Limited number of physical offices compared to other insurers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Erie: Best for Filing Claims

Pros

- Efficient Claims Process: Erie is known for a quick and efficient claims process, making it easier for policyholders during stressful times.

- Personalized Service: Offers a personal touch with agents known for providing customized service. More information is available about this provider in our Erie insurance review & ratings.

- Rate Lock Feature: Erie provides an option to lock in your car insurance rate to prevent increases in the future.

Cons

- Regional Availability: Erie’s coverage is not available nationwide, limiting its accessibility.

- Limited Online Tools: Less advanced in digital tools and online services compared to competitors.

#3 – Progressive: Best for Loyalty Rewards

Pros

- Loyalty Rewards: Progressive offers unique discounts and perks for long-term customers. Check out insurance savings in our complete Progressive car insurance review & ratings.

- Wide Range of Discounts: Provides numerous discounts including multi-policy, safe driver, and online quote discounts.

- Strong Online Presence: Advanced online tools for managing policies, filing claims, and obtaining quotes.

Cons

- Customer Service Variability: Some customers report variability in service quality.

- Higher Rates for High-Risk Drivers: Rates can be significantly higher for high-risk drivers compared to other insurers.

#4 – Safeco: Best for Online Tools

Pros

- Advanced Online Management: Safeco provides sophisticated online tools for policy management and claims.

- Customizable Coverage: Offers a wide range of customizable options to tailor coverage to specific needs. Discover more about offerings in our Safeco insurance review & ratings.

- Accident Forgiveness: Includes accident forgiveness policies to prevent premium spikes after the first at-fault accident.

Cons

- Mixed Customer Reviews: Customer satisfaction can vary significantly based on region and individual experiences.

- Policy Premiums: Premiums can be higher than some competitors, especially for basic coverage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide offers a deductible that decreases for each year of safe driving.

- Broad Coverage Options: Wide array of coverage options to suit diverse insurance needs.

- SmartRide Discount: Offers discounts for safe driving through their SmartRide program. Access comprehensive insights into our Nationwide insurance review & ratings.

Cons

- Inconsistent Customer Service: Customer service quality may vary depending on the region and specific agents.

- Higher Premiums: Some customers may find the premiums higher than those of other insurers, especially without discounts.

#6 – State Farm: Best for Financial Strength

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: State Farm provides a substantial discount for low-mileage usage.

- Wide Coverage: State Farm offers various coverage options tailored for different business needs. Read up on the “State Farm Car Insurance Review & Ratings” for more information.

Cons

- Limited Multi-Policy Discount: The multi-policy discount of State Farm is not as high compared to some competitors.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels.

#7 – The General: Best for High-Risk Coverage

Pros

- Accepts High-Risk Drivers: The General specializes in offering coverage to drivers who may be considered high-risk.

- Flexible Payment Options: Provides multiple payment plans to accommodate different budget needs. Delve into our evaluation of The General car insurance review & ratings.

- Quick Quote Process: Fast and efficient online quote process, especially beneficial for those needing immediate coverage.

Cons

- Higher Premiums for High-Risk: While it caters to high-risk drivers, premiums can be substantially higher.

- Customer Service Concerns: Some users report less satisfactory customer service experiences.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Specialized Coverage

Pros

- Customized Packages: Travelers offers specialized coverage options that can be tailored to unique needs.

- Discounts for Hybrid Vehicles: Provides discounts for environmentally friendly vehicles.

- Intuitive Mobile App: Strong mobile app for policy management and claims filing. Unlock details in our Travelers car insurance review & ratings.

Cons

- Pricing: Travelers can be more expensive than some competitors, especially without custom discounts.

- Complex Policy Options: Some customers may find the range of options confusing.

#9 – Chubb: Best for High-Value Vehicles

Pros

- Exceptional Coverage for Luxury Cars: Offers extensive coverage options designed specifically for high-value vehicles.

- Agreed Value Coverage: Chubb provides agreed value coverage, ensuring owners receive the full insured amount without depreciation in case of a total loss.

- Superior Claims Service: Known for a smooth claims process and high-quality repair services. Discover insights in our Chubb insurance review & ratings.

Cons

- High Premiums: Premiums are higher, reflecting the specialized and high-value coverage offered.

- Niche Market Focus: Best suited for owners of luxury or high-value cars, which may not appeal to the average car owner.

#10 – Allstate: Best for UBI Discount

Pros

- Usage-Based Insurance Discounts: Allstate leads with its Drivewise program, offering discounts based on actual driving behavior.

- Wide Coverage Options: Extensive options ranging from standard to highly specialized coverages. If you want to learn more about the company, head to our Allstate insurance review & ratings.

- Multiple Discount Opportunities: Offers several ways to save on premiums, including good student and safe driving discounts.

Cons

- Variable Premiums: Premium rates can vary widely depending on driver profile and location.

- Customer Service Feedback: Some customers report mixed experiences regarding claims and customer service.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

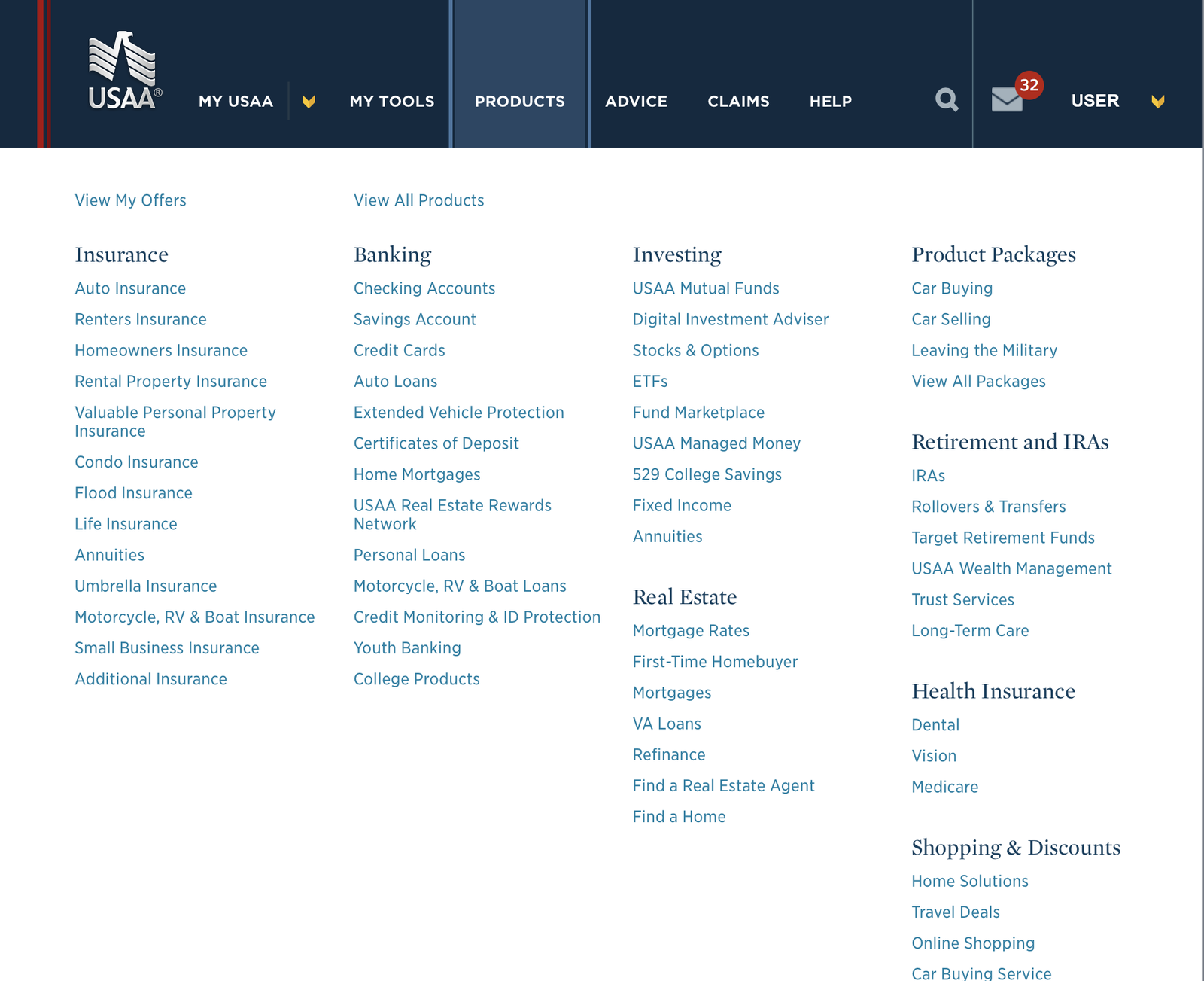

Dodge Neon Insurance: Monthly Rates by Coverage Level

When evaluating car insurance options for a Dodge Neon, it’s essential to consider the varying costs associated with different levels of coverage offered by each insurance company. The table below provides a comprehensive overview of monthly rates for both minimum and full coverage policies across various providers.

Dodge Neon Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $81 $158

Chubb $72 $145

Erie $39 $89

Nationwide $49 $114

Progressive $42 $96

Safeco $44 $100

State Farm $54 $121

The General $56 $128

Travelers $60 $134

USAA $32 $82

The monthly premiums for minimum coverage range from as low as $32 with USAA to $81 with Allstate, demonstrating a significant variance based on the provider. For full coverage, the rates increase substantially, reflecting the broader protection offered. See more details on our “Full Coverage Car Insurance: A Complete Guide.”

USAA remains the most economical option at $82 per month for full coverage, while Allstate’s rate climbs to $158. This disparity highlights the importance of comparing both coverage levels and providers to find the best rate for your needs.

For example, Erie offers a balanced rate of $39 for minimum coverage and $89 for full, making it a competitive choice for those seeking a middle ground between affordability and comprehensive protection.

Factors That Influence the Cost of Dodge Neon Car Insurance

Several key factors affect the cost of car insurance for your Dodge Neon. One of the primary considerations is your driving record. If you have a history of accidents or traffic violations, you may be considered a higher risk, resulting in higher premiums. On the other hand, a clean driving record can lead to lower rates.

Your location also plays a significant role in determining the cost of insuring your Dodge Neon. Insurance companies analyze local crime rates, traffic patterns, and accident statistics to assess the risk level associated with a specific area. If you live in an area with high crime rates or heavy traffic, your insurance premiums may be higher.

Another factor that insurance providers consider is your age and gender. Statistics show that younger drivers, particularly males, have a higher likelihood of getting into accidents. As a result, insurance premiums for young male drivers tend to be higher than those for older drivers or females. Check out insurance savings in our complete “Who gets in more car accidents, women or men?”

The coverage options you choose for your Dodge Neon can also impact the cost of your insurance policy. Basic liability coverage is typically the least expensive option, as it only covers damages to other people and their property in the event of an accident. However, if you opt for additional coverage like collision or comprehensive insurance, which cover damages to your own vehicle, your premiums will be higher.

Understanding the Average Cost of Insuring a Dodge Neon

While it’s difficult to determine the exact cost of insuring a Dodge Neon without considering individual circumstances, it’s helpful to understand the average cost. According to data from various insurance companies, the typical monthly premium for a Dodge Neon varies between approximately $83 and $125. Discover more about offerings in our “How does the insurance company determine my premium?”

Keep in mind that these figures are based on general assumptions and may not accurately reflect your specific situation. Insurance premiums are influenced by an array of factors, including your age, driving record, location, and coverage options, as previously discussed. To get an accurate estimate of the cost to insure your Dodge Neon, it’s best to request quotes from multiple insurance providers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Importance of Comparing Insurance Quotes for Your Dodge Neon

When it comes to finding affordable car insurance for your Dodge Neon, one of the most crucial steps is comparing quotes from different insurance providers. Each company uses its own unique formula to calculate premiums, resulting in varying costs for the same coverage.

By obtaining quotes from multiple insurance companies, you can compare prices and coverage options to find the best deal for your Dodge Neon. Keep in mind that the cheapest option isn’t always the best choice. It’s essential to consider the reputation of the insurance company, their customer service, and the coverage provided in addition to the cost.

Exploring Different Coverage Options for Your Dodge Neon

When it comes to protecting your Dodge Neon, there are several coverage options available. Understanding these options can help you determine the most suitable coverage for your needs and budget.

Liability insurance covers damages and injuries to other parties if you are at fault in an accident. This coverage is typically required by law in most states. The minimum coverage limits mandated by your state may differ, so it’s essential to understand and meet the legal requirements.

Collision insurance covers the cost of repairs or replacements if your Dodge Neon is damaged in a collision with another vehicle or object, regardless of who’s at fault. Comprehensive insurance, on the other hand, covers damages to your vehicle caused by non-collision events such as theft, vandalism, or natural disasters.

Other options to consider include uninsured/underinsured motorist coverage, which protects you in the event of an accident with a driver who doesn’t have sufficient insurance, and medical payments coverage, which covers medical expenses for you and your passengers. Access comprehensive insights into our “Why You Should Always Take Pictures After a Car Accident.”

Tips for Getting Affordable Car Insurance for Your Dodge Neon

While car insurance costs for your Dodge Neon may seem daunting, there are several strategies you can employ to potentially lower your premiums.

One tip is to maintain a clean driving record. By avoiding accidents and traffic violations, you can demonstrate to insurance companies that you are a responsible driver and potentially qualify for lower rates. Delve into our evaluation of “Best Safe Driver Car Insurance Discounts.”

Jeff Root Licensed Life Insurance Agent

Another tip is to consider raising your deductibles. Higher deductibles mean you’ll pay more out of pocket in the event of a claim, but it can also lead to lower insurance premiums. Just make sure you have enough savings set aside to cover the deductible amount if the need arises.

Additionally, many insurance providers offer discounts that can help reduce the cost of your Dodge Neon car insurance. Examples of common discounts include multi-policy discounts, good student discounts, and safe driver discounts. It’s worth asking insurance providers about potential discounts you may qualify for.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Your Driving Record Affects the Cost of Insuring a Dodge Neon

Your driving record is one of the primary factors taken into consideration by insurance companies when determining your premiums. Traffic violations, at-fault accidents, and other negative incidents on your record can categorize you as a higher-risk driver, resulting in higher insurance costs.

On the other hand, if you have a clean driving record with no accidents or violations, you may be eligible for discounts and lower insurance rates. It’s crucial to drive responsibly and follow traffic laws to keep your driving record favorable and save on insurance costs for your Dodge Neon. Unlock details in our “Defensive Driving Courses Can Lower Your Car Insurance Rates.”

The Impact of Your Location on Dodge Neon Car Insurance Rates

Where you live plays a significant role in determining the cost of insuring your Dodge Neon. Insurance companies analyze local factors such as crime rates, traffic congestion, and accident statistics when assessing the risk associated with a specific area. Discover insights in our “What is voluntary accident insurance?”

If you reside in an urban area with high crime rates or heavy traffic, your insurance premiums may be higher than if you live in a rural area with lower population density. Additionally, areas prone to severe weather events may result in higher insurance rates due to the increased risk of damage to vehicles.

Common Discounts Available for Dodge Neon Car Insurance

To make car insurance more affordable, insurance providers often offer various discounts for Dodge Neon owners. These discounts can help you save significantly on your premiums. Here are several common discounts to be aware of:

- Multi-Policy Discount: If you have other policies, such as homeowner’s insurance or renter’s insurance, with the same insurance provider, you may be eligible for a discount when you bundle your policies together.

- Good Student Discount: If you or a family member who drives your Dodge Neon is a student with good grades, you may qualify for a discount. Insurance providers often reward responsible student drivers with lower premiums.

- Safe Driver Discount: Maintaining a clean driving record is a surefire way to potentially score a discount on your car insurance. If you have a history of safe driving, be sure to inquire about a safe driver discount.

- Anti-Theft Device Discount: Equipping your Dodge Neon with anti-theft devices such as an alarm system or GPS tracking system can help reduce the risk of theft and potentially earn you a discount on your insurance. Learn more in our “Best Anti Theft System Car Insurance Discounts.”

It’s essential to discuss these and any other potential discounts with your insurance provider to ensure you receive all the savings you qualify for.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors to Consider When Choosing an Insurance Provider for Your Dodge Neon

With numerous insurance providers offering coverage for your Dodge Neon, it’s important to consider several factors before making a decision.

One key consideration is the financial stability and reputation of the insurance company. You want to choose a provider that has a track record of handling claims promptly and fairly, as well as one that has the financial resources to pay out claims.

Additionally, it’s important to assess the coverage options and exclusions offered by different providers. Make sure the policies you’re considering provide adequate coverage for your specific needs.

Laura Walker Former Licensed Agent

Customer service is another vital aspect to consider. Look for an insurance company that is responsive, knowledgeable, and helpful when it comes to answering your questions and assisting you with any concerns.

Finally, compare quotes from multiple insurance providers to ensure you get the best value for your money. While cost is an important factor, it shouldn’t be the sole determining factor in your decision. Balancing cost with coverage and customer service is essential to finding the right insurance provider for your Dodge Neon. See more details on our “Insurance Quotes Online.”

The Role of Vehicle Safety Features in Determining Dodge Neon Insurance Rates

The safety features of your Dodge Neon can play a role in determining your insurance rates. Insurance companies often provide discounts for vehicles equipped with certain safety features that reduce the risk of accidents or injuries.

Examples of safety features that can potentially earn you insurance discounts include anti-lock brakes, traction control, electronic stability control, airbags, and automatic seat belts. These features can enhance the safety of your vehicle and reduce the severity of injuries in the event of a collision.

When shopping for car insurance for your Dodge Neon, be sure to mention and provide detailed information about the safety features present in your vehicle. Insurance providers may offer discounts or reduced premiums as a result of these safety features. Discover more about offerings in our “Best Safety Features Car Insurance Discounts.”

Explaining Comprehensive and Collision Coverage for Your Dodge Neon

When considering car insurance for your Dodge Neon, it’s important to understand the difference between comprehensive and collision coverage. Access comprehensive insights into our “Collision vs. Comprehensive Car Insurance.”

Collision coverage protects you in the event of an accident involving another vehicle or object. It covers the cost of repairing or replacing your vehicle, regardless of who’s at fault. This coverage is particularly valuable if your Dodge Neon is newer or has a higher value.

Comprehensive coverage, on the other hand, covers damages to your vehicle that are not a result of a collision with another vehicle or object. This can include damages from theft, vandalism, fire, natural disasters, or impacts with animals. Like collision coverage, comprehensive coverage protects the value of your Dodge Neon and can provide peace of mind in various situations.

When deciding on coverage options for your Dodge Neon, consider factors such as the age and value of your vehicle, your budget, and your personal preferences. Assessing these factors will help you determine if collision and comprehensive coverage are necessary, and which deductibles are most appropriate for your circumstances.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Deductibles Affect the Cost of Insuring a Dodge Neon

When choosing car insurance for your Dodge Neon, one important factor to consider is the deductible. The deductible is the amount you must pay out of pocket before your insurance coverage kicks in. The higher your deductible, the lower your insurance premiums will be.

For example, if you have a $500 deductible and file a claim for $5,000, you will be responsible for paying the $500 before your insurance company covers the remaining $4,500. Opting for a higher deductible can lead to savings on your premiums, but it’s crucial to ensure you have enough savings set aside to cover the deductible in the event of a claim.

When determining the deductible for your Dodge Neon, consider your budget, the value of your vehicle, and your risk tolerance. If you have a higher deductible, you’ll need to pay more out of pocket in the event of a claim, but your insurance premiums may be lower. Conversely, a lower deductible means higher premiums but less out-of-pocket expense when filing a claim. Delve into our evaluation of “What is out-of-pocket costs?”

The Influence of Age and Gender on Dodge Neon Car Insurance Premiums

Age and gender are two factors that can influence the cost of car insurance for your Dodge Neon. Insurance providers use statistical data to assess risk factors associated with different age groups and genders, resulting in varying insurance premiums.

Young drivers, particularly males under the age of 25, tend to have higher insurance premiums due to the higher likelihood of accidents in this demographic. As drivers get older and gain more experience on the road, insurance rates generally decrease. Unlock details in our “Best Car Insurance for 21-Year-Old Drivers.”

When considering insurance for your Dodge Neon, it’s essential to be aware of these factors affecting premiums and prepare accordingly. Young drivers may face higher costs, and it’s important to factor this into your budgeting and decision-making process.

Understanding the Claims Process for Your Dodge Neon Insurance

In the unfortunate event of an accident or damage to your Dodge Neon, understanding the claims process is essential. Being prepared can help streamline the claims process and ensure a smoother experience.

When making a claim, the first step is to contact your insurance company and provide them with all the necessary details of the incident. This includes the date, time, and location of the accident, a description of what happened, and any other relevant information. The insurance company will assign a claims adjuster who will guide you through the remaining steps.

Melanie Musson Published Insurance Expert

The claims adjuster will assess the damages to your Dodge Neon and determine the coverage and claim amount based on your policy. They may request additional documentation or information, such as police reports or photos of the damage, during the investigation process.

Once the claims adjuster completes their evaluation, they will provide you with instructions on how to proceed. Depending on the extent of the damages, repairs may be authorized, or a settlement amount may be offered if your vehicle is deemed a total loss.

Throughout the claims process, it’s important to maintain clear communication with your insurance company and promptly provide any requested information. This will help facilitate a timely resolution and ensure you receive the appropriate compensation for your Dodge Neon.

Enter your ZIP code below to compare rates from the top providers near you.

Frequently Asked Questions

What factors affect the cost of Dodge Neon car insurance?

The cost of Dodge Neon car insurance can be influenced by several factors, including the driver’s age, location, driving history, credit score, coverage limits, and deductibles.

For additional details, explore our comprehensive resource titled “What age do you get cheap car insurance?”

Is Dodge Neon considered an expensive car to insure?

Generally, the Dodge Neon is considered an affordable car to insure compared to many other vehicles. Its relatively low cost and availability of parts contribute to lower insurance premiums.

Are there any specific safety features on the Dodge Neon that can reduce insurance costs?

Yes, the Dodge Neon comes equipped with various safety features that can potentially lower insurance costs. These features may include anti-lock brakes, airbags, traction control, and electronic stability control.

Are there any discounts available for Dodge Neon car insurance?

Insurance providers often offer discounts for various factors related to the Dodge Neon, such as having anti-theft devices installed, being a safe driver, bundling policies, or having multiple cars insured with the same company. It’s recommended to inquire with different insurance companies to explore available discounts.

What is the average cost of Dodge Neon car insurance?

The average cost of Dodge Neon car insurance can vary depending on numerous factors. However, on average, the monthly premium for a Dodge Neon can range from $67 to $125.

To find out more, explore our guide titled “How To Get Free Insurance Quotes Online.”

Who is offering cheapest car insurance?

According to our research team’s analysis of national average prices for minimum coverage, Geico offers the lowest car insurance rate at $38 per month. The top 10 most affordable car insurance companies include Nationwide, Geico, State Farm, Travelers, Progressive, AAA, Allstate, Chubb, Farmers, and USAA.

Is a Dodge Neon a reliable car?

Overall, numerous owners commend the Neon for its exceptional reliability. On everyauto.com, many have given it a five-star rating, noting that they’ve driven it over a hundred thousand miles without significant problems.

Are older cars cheaper to insure?

Typically, insurance for older cars might be less expensive than for newer models of the same type, particularly if the older vehicle costs less to repair or replace.

What cars are hard to insure?

Generally, certain companies might not offer a policy or may impose limitations on insuring vehicles that fall into these categories: vans that accommodate 12 or more passengers, camper vans, cargo vans, step vans, vehicles used for commercial purposes, and those with custom or modified builds.

To learn more, explore our comprehensive resource on “Commercial Auto Insurance: A Complete Guide.”

How fast can a Dodge Neon go?

Dodge Neon reached 200.9 mph at the Texas Mile, featuring a nearly stock engine with some bolt-on modifications that initially allowed it to hit 169 mph.

How long do Dodge Neons last?

Why did Dodge stop making Neons?

Does car insurance go down at $30?

What age pays the most for car insurance?

Should I keep full coverage on a 10 year old car?

What is the common problem with Dodge?

In what states is car insurance not mandatory?

Who has highest auto insurance rates?

Is USAA good insurance?

Why is my car insurance always so high?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.