Cheap Pontiac Grand Am Car Insurance in 2026 (Big Savings With These 10 Companies!)

Get excellent coverage for cheap Pontiac Grand Am car insurance for $48 a month from State Farm, Progressive, and Allstate. Allstate has a variety of discounts, Progressive has an easy-to-use platform, and State Farm excels in personalized service, making them the best insurance for your unique vehicle needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent

Tim Bain is a licensed life insurance agent with 23 years of experience helping people protect their families and businesses with term life insurance. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Updated August 2025

Company Facts

Min. Coverage for Pontiac Grand Am

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Pontiac Grand Am

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Pontiac Grand Am

A.M. Best Rating

Complaint Level

Pros & Cons

State Farm, Progressive, and Allstate emerge as top providers for cheap Pontiac Grand Am car insurance with boasting rates as low as $48 per month.

These companies are recognized for their customer-focused approach and comprehensive range of discounts tailored to various driver profiles and vehicle safety features. For a thorough understanding, refer to our detailed analysis titled “Safety Features Car Insurance Discount.”

Our Top 10 Company Picks: Cheap Pontiac Grand Am Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $48 B Personalized Service State Farm

#2 $52 A+ User-Friendly Platform Progressive

#3 $55 A+ Range of Discounts Allstate

#4 $60 A+ Deductible Benefits Nationwide

#5 $63 A Customizable Policies Farmers

#6 $68 A Membership Benefits AAA

#7 $70 A Personalized Discounts American Family

#8 $72 A Coverage Options Liberty Mutual

#9 $75 A++ Competitive Rates Travelers

#10 $80 A++ Competitive Pricing Geico

Factors such as location also play a significant role in determining these rates, highlighting the importance of comparing quotes to secure the most suitable coverage for your needs.

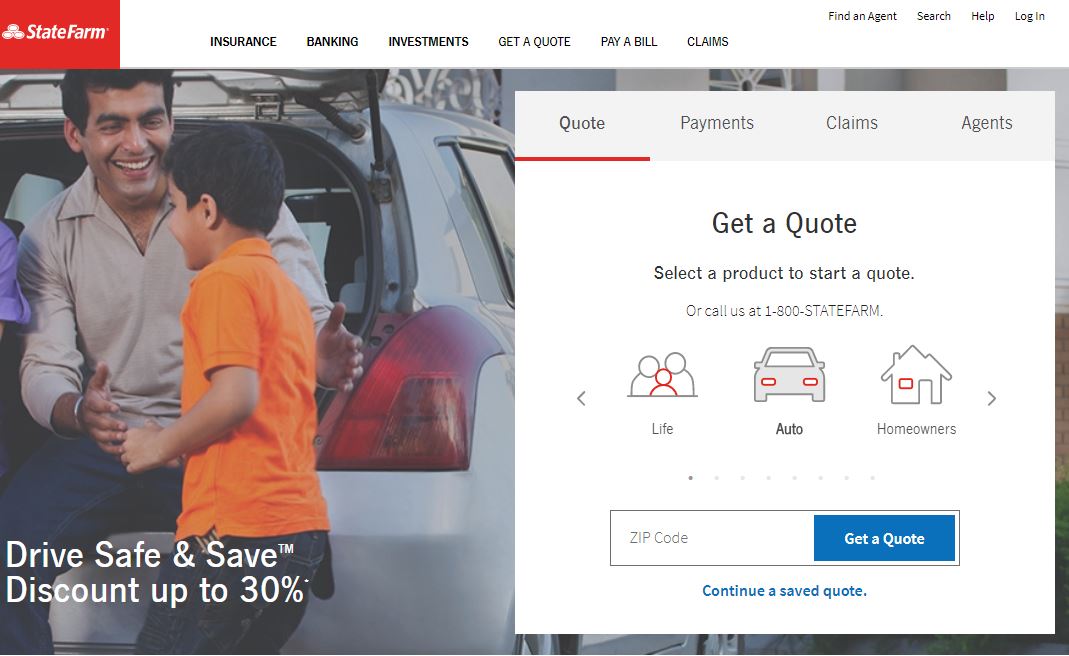

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

- State Farm offers Pontiac Grand Am insurance from $48/month

- Tailoring insurance to driver profiles and vehicle safety impacts affordability

- Compare quotes to find the best coverage for your budget

#1 – State Farm: Top Overall Pick

Pros

- Personalized Service: State Farm insurance review & ratings showcase the company’s dedicated agents who provide personalized assistance, which can be beneficial when dealing with specific needs of owning a Pontiac Grand Am.

- Extensive Network: With a large network of agents and offices across the country, State Farm offers convenience and accessibility, making it easier to manage insurance needs for your vehicle.

- Claims Handling: State Farm is praised for its efficient claims handling process, which can be reassuring in case of accidents or repairs needed for your Pontiac Grand Am.

Cons

- Higher Premiums: While State Farm offers personalized service, its premiums may be higher compared to some competitors, which could be a consideration depending on your budget.

- Limited Digital Tools: State Farm’s online tools and mobile app, while improving, may not be as advanced or user-friendly as those offered by other insurers, potentially affecting convenience for tech-savvy users.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for User-Friendly Platform

Pros

- User-Friendly Platform: Progressive excels in providing a user-friendly online platform and mobile app, which can be convenient for managing your Pontiac Grand Am insurance needs digitally.

- Innovative Features: Progressive insurance review & ratings reveal the company’s innovative features like Snapshot, which can help you save on premiums based on your driving habits, potentially reducing costs for insuring your vehicle.

- Wide Range of Discounts: Progressive offers numerous discounts that could apply to insuring a Pontiac Grand Am, such as multi-policy, safe driver, and homeowner discounts.

Cons

- Customer Service Reviews: Some customers have noted inconsistencies in customer service quality, particularly in claims handling or resolving issues promptly.

- Complex Pricing: Progressive’s pricing structure can sometimes be complex, making it harder to understand how specific factors impact your premiums for a Pontiac Grand Am.

#3 – Allstate: Best for Range of Discounts

Pros

- Range of Discounts: Allstate provides a broad range of discounts, including those for safe driving, vehicle safety features, and bundling policies, which can help save money when insuring a Pontiac Grand Am.

- Innovative Tools: Allstate offers useful tools like the Drivewise program, which monitors driving habits to potentially lower premiums over time, beneficial for Pontiac Grand Am owners.

- Local Agents: Allstate insurance review & ratings unveil the company’s network of local agents, Allstate offers personalized service and support, which can be advantageous when managing insurance for your Pontiac Grand Am.

Cons

- Higher Premiums: Allstate’s premiums can be higher than competitors, particularly if you don’t qualify for many discounts, which could impact budget-conscious Pontiac Grand Am owners.

- Claims Process: Some customers have reported issues with the claims process, including delays or disputes, which might affect satisfaction and peace of mind when insuring your vehicle.

#4 – Nationwide: Best for Deductible Benefits

Pros

- Deductible Benefits: Nationwide insurance review & ratings introduce the company’s deductible benefits that can be advantageous for Pontiac Grand Am owners, potentially lowering out-of-pocket costs in case of a claim.

- Strong Financial Stability: With high ratings from A.M. Best, Nationwide’s strong financial stability provides reassurance that claims for your Pontiac Grand Am will be covered reliably.

- Customer Satisfaction: Nationwide is known for high customer satisfaction ratings, indicating good overall service and support for policyholders.

Cons

- Limited Local Agents: Nationwide’s local agent network may not be as extensive as some competitors, which could affect personalized service for Pontiac Grand Am owners in certain areas.

- Coverage Options: Some customers find Nationwide’s coverage options to be less flexible or customizable compared to other insurers, potentially limiting choices for insuring your vehicle.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Customizable Policies

Pros

- Customizable Policies: Farmers offers customizable policies, allowing Pontiac Grand Am owners to tailor coverage to their specific needs, which can be beneficial for ensuring adequate protection.

- Additional Coverage Options: Farmers insurance review & ratings broadcast the company’s variety of additional coverage options that could enhance protection for your Pontiac Grand Am, such as roadside assistance or rental car reimbursement.

- Claims Satisfaction: Farmers often receives positive feedback for its claims satisfaction, with efficient processing that can be crucial during stressful situations involving your Pontiac Grand Am.

Cons

- Higher Premiums: Farmers’ premiums may be higher compared to some competitors, which could be a consideration for budget-conscious Pontiac Grand Am owners.

- Customer Service Availability: Some customers have reported challenges in reaching customer service or local agents promptly, potentially affecting support when needed.

#6 – AAA: Best for Membership Benefits

Pros

- Membership Benefits: AAA members enjoy additional benefits beyond insurance, such as roadside assistance and travel discounts, which can complement coverage for a Pontiac Grand Am.

- Strong Reputation: AAA has a strong reputation for reliability and customer service, offering peace of mind to Pontiac Grand Am owners regarding insurance and related services.

- Multi-Policy Discounts: AAA insurance review & ratings publicize the company’s discounts for bundling auto insurance with other policies, which can lead to savings for insuring your Pontiac Grand Am.

Cons

- Membership Required: To access AAA’s insurance and additional benefits, membership is required, which adds an extra cost for Pontiac Grand Am owners who are not already members.

- Regional Availability: AAA’s services and insurance coverage may vary by region, potentially limiting options for Pontiac Grand Am owners depending on where they live.

#7 – American Family: Best for Personalized Discounts

Pros

- Personalized Discounts: American Family offers personalized discounts based on factors like driving habits and vehicle safety features, potentially lowering premiums for insuring a Pontiac Grand Am.

- Strong Customer Service: American Family insurance review & ratings advertise the company’s known for its attentive customer service, with agents who can provide personalized advice and support tailored to Pontiac Grand Am owners.

- Bundle Options: American Family offers bundling options that can combine auto and home insurance policies, providing convenience and potential savings for customers.

Cons

- Limited Geographic Availability: American Family’s insurance services may be limited to certain states, which could restrict options for Pontiac Grand Am owners in other locations.

- Claims Experience: Some customers have reported mixed experiences with American Family’s claims process, with occasional delays or disputes impacting satisfaction.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Coverage Options

Pros

- Coverage Options: Liberty Mutual offers a wide range of coverage options, allowing Pontiac Grand Am owners to customize policies to fit their specific needs and preferences.

- Digital Tools: Liberty Mutual insurance review & ratings provides robust digital tools and a user-friendly mobile app, making it convenient to manage policies, file claims, and access information related to insuring your vehicle.

- Discount Opportunities: Liberty Mutual offers various discounts, including those for safe driving, multi-policy, and vehicle safety features, which can help reduce insurance costs.

Cons

- Premiums Can Be Higher: Depending on the driver’s profile and location, Liberty Mutual’s premiums may be higher compared to some competitors, which could impact affordability for Pontiac Grand Am owners.

- Claims Process: Some customers have reported mixed reviews regarding Liberty Mutual’s claims process, noting occasional delays or challenges in resolving claims efficiently.

#9 – Travelers: Best for Competitive Rates

Pros

- Competitive Rates: Travelers Insurance is known for offering competitive rates, potentially providing cost-effective options for insuring a Pontiac Grand Am without compromising on coverage.

- Strong Financial Stability: With an A++ rating from A.M. Best, Travelers demonstrates strong financial stability, ensuring reliability in paying claims promptly and efficiently.

- Customizable Policies: Travelers insurance review & ratings illustrate the company’s customizable policies, allowing Pontiac Grand Am owners to tailor coverage options to suit their individual needs and preferences.

Cons

- Limited Local Agents: Travelers’ insurance offerings may be primarily accessed through agents rather than local offices, which could impact the level of personalized service available to Pontiac Grand Am owners.

- Discount Availability: While Travelers offers various discounts, the availability and applicability of these discounts may vary depending on factors such as location and policy specifics.

#10 – Geico: Best for Competitive Pricing

Pros

- Competitive Pricing: The company is widely known for its competitive pricing, offering affordable premiums that can be appealing for budget-conscious Pontiac Grand Am owners.

- Digital Experience: Geico provides a streamlined and user-friendly digital experience, including a mobile app that allows for easy policy management, claims filing, and access to insurance documents.

- Wide Range of Discounts: Geico car insurance discounts disclose the company’s broad range of discounts, such as multi-vehicle, defensive driving course, and federal employee discounts, providing numerous opportunities to save on insuring your Pontiac Grand Am.

Cons

- Customer Service: While Geico’s customer service is generally rated positively, some customers have noted occasional challenges in claims handling or communication, which could impact overall satisfaction.

- Coverage Options: Geico’s standard coverage options may be more limited compared to some competitors, which could require additional customization for Pontiac Grand Am owners seeking specific coverage needs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors Affecting Pontiac Grand Am Insurance Costs

When insurance providers determine the cost of insuring a Pontiac Grand Am, they consider several factors. One of the primary factors is the model year of the vehicle. As the vehicle ages, the cost of insurance generally decreases due to the reduced value of the car. The location where the car will be driven also plays a significant role. Areas with higher rates of accidents or thefts tend to have higher insurance premiums.

Additionally, the driver’s history and driver profile impact insurance rates. Factors such as age, gender, driving experience, and previous accidents or violations can affect the cost of insurance. Younger drivers and those with a history of traffic violations may incur higher premiums.

The vehicle’s safety features and theft deterrent systems may also contribute to insurance rates. Anti-theft devices, airbags, and other safety features could result in premium discounts. Furthermore, the type and level of coverage selected, including liability, comprehensive, and collision, can significantly impact the cost of insurance.

Pontiac Grand Am Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $68 $180

Allstate $55 $165

American Family $70 $185

Farmers $63 $175

Geico $80 $200

Liberty Mutual $72 $190

Nationwide $60 $170

Progressive $52 $155

State Farm $48 $145

Travelers $75 $195

A higher credit score is often associated with responsible financial behavior, which can be seen as an indicator of a lower risk driver. For a detailed breakdown, consult our comprehensive guide named “Understanding Credit: A Score that Impacts Everything from Your Cell Phone Bill to Car Insurance.”

Furthermore, the annual mileage driven in the Pontiac Grand Am can also impact insurance rates. Insurance providers may ask for an estimate of the number of miles driven per year, as higher mileage can increase the likelihood of accidents and therefore result in higher premiums.

Insurance Rates for Pontiac Grand Am: A Guide

The insurance rates for Pontiac Grand Am can vary significantly from one provider to another. Each insurance company has its own underwriting guidelines and algorithms to assess risk and calculate premiums. As a result, it is crucial to shop around and obtain quotes from multiple insurance providers to find the best coverage and rates for your specific Pontiac Grand Am.

When requesting insurance quotes, it is essential to provide accurate details about your Pontiac Grand Am and your driving history. This information will enable insurance providers to provide a more accurate quote based on your specific circumstances.

Factors that can affect the insurance rates for Pontiac Grand Am include the model year, trim level, engine size, and safety features. Newer models with advanced safety features may qualify for discounts, as they are considered less risky to insure.

Additionally, the driver’s age, gender, and driving record can also impact the insurance rates. Younger drivers or those with a history of accidents or traffic violations may face higher premiums. For an exhaustive analysis, check out our complete guide entitled “Car Accidents: What to do in Worst Case Scenarios.”

Factors in Choosing Insurance for a Pontiac Grand Am

When selecting car insurance for your Pontiac Grand Am, several critical factors can influence your decision. Understanding these factors will help you choose the right coverage that meets both your needs and budget.

- Assess Your Driving Habits: Evaluate whether you use the Pontiac Grand Am for commuting, pleasure, or business, as well as your average mileage and time spent on the road.

- Choose Your Coverage Level: Decide on the right level of insurance coverage, considering options like liability, comprehensive, and collision based on your needs and budget. For a comprehensive review, see our in-depth guide titled “Collision Car Insurance: A Complete Guide.”

- Consider Vehicle Age and Condition: Factor in the age and condition of your Pontiac Grand Am, as older vehicles may have lower insurance rates, while newer ones may require more coverage.

By carefully assessing your driving habits, coverage requirements, and the condition of your Pontiac Grand Am, you can make informed decisions about your car insurance. This approach ensures that you have adequate protection on the road while optimizing your insurance costs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding the Cost of Insuring Your Pontiac Grand Am

It is challenging to determine the exact monthly cost of insuring a Pontiac Grand Am as it varies depending on several factors. However, according to industry data, the average annual insurance premium for a Pontiac Grand Am can range from approximately $67 to $125 per month. Remember, this is an average estimate, and individual rates may vary significantly based on the factors discussed earlier.

Factors that can influence the cost of insuring a Pontiac Grand Am include the driver’s age, driving record, location, and the level of coverage chosen. Younger drivers or those with a history of accidents or traffic violations may face higher premiums. For a detailed overview, refer to our extensive guide called “How does the insurance company determine my premium?”

Additionally, the location where the vehicle is primarily driven and parked can impact insurance rates, with urban areas often having higher rates due to increased risk of theft or accidents. Lastly, the level of coverage selected, such as liability-only or comprehensive coverage, will also affect the cost of insurance for a Pontiac Grand Am.

Comparing Insurance Rates Across Pontiac Grand Am Models

When comparing insurance rates for different models of Pontiac Grand Am, it is crucial to consider their potential impact on premiums. Certain models may have higher or lower insurance rates due to factors such as performance capabilities, safety features, and the likelihood of theft. For an in-depth investigation, peruse our comprehensive guide named “Anti Theft System Car Insurance Discount.”

Luxury or high-performance versions of the Pontiac Grand Am may have higher insurance premiums compared to base models.

Additionally, the age and condition of the Pontiac Grand Am can also affect insurance rates. Older models or those in poor condition may have higher premiums due to increased risk of mechanical failure or accidents. It is important to thoroughly assess the condition of the vehicle when comparing insurance rates to ensure accurate pricing.

Strategies for Lowering Your Pontiac Grand Am Car Insurance Premiums

If you are looking to lower your Pontiac Grand Am car insurance premiums, there are a few strategies you can consider. Firstly, maintaining a clean driving record free of accidents and traffic violations can help you secure lower insurance rates. Additionally, completing defensive driving courses or installing anti-theft devices in your vehicle may make you eligible for discounts.

It is also worth exploring bundling your car insurance with other insurance policies you may have, such as homeowners or renters insurance. For a thorough examination, take a look at our detailed guide entitled “Renters Insurance: A Complete Guide.” Many insurance companies offer discounts for bundling multiple policies.

Another way to potentially lower your Pontiac Grand Am car insurance premiums is by increasing your deductible. A higher deductible means you will have to pay more out of pocket in the event of a claim, but it can also result in lower monthly premiums.

Furthermore, maintaining a good credit score can also have a positive impact on your car insurance rates. Insurance companies often consider credit history when determining premiums, so it’s important to manage your finances responsibly.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Finding Affordable Car Insurance for Your Pontiac Grand Am

Finding affordable car insurance for your Pontiac Grand Am begins with research and comparison shopping. Start by obtaining quotes from multiple insurance providers and carefully reviewing the coverage options and rates they offer. Consider reaching out to insurance agents or using online comparison tools to simplify this process.

When reviewing the quotes, pay close attention to the coverage limits, deductibles, and any additional features included in the policy. For a comprehensive assessment, read through our detailed guide titled “What is the difference between a deductible and a premium in car insurance?”

Ensure that you are comparing apples to apples to make an accurate comparison. While it may be tempting to focus solely on the lowest premium, it is important to evaluate the overall value and coverage provided.

Additionally, it is important to consider your driving habits and needs when selecting car insurance for your Pontiac Grand Am. If you primarily use your vehicle for commuting to work or running errands, you may want to opt for a policy with lower mileage restrictions.

Exploring Coverage Options for Pontiac Grand Am Insurance

When exploring different coverage options for Pontiac Grand Am car insurance, it is essential to understand the various types of coverage available. Liability insurance covers damages you may cause to others in an accident.

Comprehensive insurance covers damages caused by non-collision incidents, such as theft or weather-related damage. Collision insurance covers damages caused by a collision with another vehicle or object.

In addition to these standard coverage types, you may have the option to add additional features such as roadside assistance or rental car reimbursement. For a thorough analysis, consult our comprehensive guide named “Types of Car Insurance Coverage.”

Evaluate your needs and consider the potential financial impact of different coverage options when selecting your Pontiac Grand Am insurance policy.

Discounts and Factors in Pontiac Grand Am Insurance Rates

Insurance companies offer various discounts to reduce the cost of insuring a Pontiac Grand Am, such as safe driver discounts, discounts for students and military personnel, and bundling policies. Checking for available discounts when getting quotes is beneficial. For an extensive exploration, refer to our detailed guide entitled “Lesser Known Car Insurance Discounts.”

Your driving record significantly influences Pontiac Grand Am insurance rates. A clean record with no accidents or violations often qualifies for lower premiums. Conversely, a history of incidents may lead to higher premiums due to increased perceived risk.

The age and location of your Pontiac Grand Am also impact insurance rates. Older vehicles generally have lower premiums due to their lower value. However, newer models with advanced safety features may qualify for reduced rates. Geographical factors, such as accident rates and theft statistics, also affect insurance costs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Choosing Insurance for Your Pontiac Grand Am: Key Factors to Consider

When selecting an insurance provider for your Pontiac Grand Am, consider factors beyond just the cost of insurance. Look for a reputable company with a strong financial standing and excellent customer service. Research the company’s claims handling process and read customer reviews to ensure they provide prompt and fair claim settlements.

It is also worthwhile to evaluate the company’s online tools and mobile app capabilities, as they can make managing your policy and filing claims more convenient. Lastly, consider their coverage options, discounts, and any additional features that may be beneficial to your specific insurance needs. To gain further insights, consult our comprehensive guide titled “Your Insurance Agent’s Role in the Claims Process.”

Impact of Modifications on Pontiac Grand Am Insurance Costs

If you are considering adding modifications or upgrades to your Pontiac Grand Am, it is important to understand how they can impact the cost of insurance.

Modifications that enhance performance or increase the vehicle’s value may result in higher insurance premiums. Additionally, modifications that alter the safety features or make the vehicle more prone to theft could also lead to an increase in insurance rates. For additional details, explore our comprehensive resource titled “Car Driving Safety Guide for Teens and Parents.”

Before making modifications or upgrades to your Pontiac Grand Am, it is advisable to consult with your insurance provider to understand how they will affect your coverage and rates. Failure to disclose modifications to your insurance company may result in denied claims or policy cancellation.

Case Studies: Tailored Insurance Solutions for Your Pontiac Grand Am

Discovering the right insurance coverage for your Pontiac Grand Am involves considering a range of factors, from safety features to coverage options that fit your lifestyle. State Farm, Progressive, and Allstate stand out as top providers, each offering tailored solutions designed to safeguard your vehicle and provide peace of mind on the road.

- Case Study #1 – Family Security and Savings: Emily prioritizes safety and savings for her Pontiac Grand Am with State Farm. By installing advanced safety features and bundling her auto and homeowners policies, she enjoys comprehensive coverage and significant discounts. To delve deeper, refer to our in-depth report titled “Homeowners Insurance: A Complete Guide.”

- Case Study #2 – Comprehensive Coverage for New Owners: John, a new Pontiac Grand Am owner, chooses Progressive for its competitive rates and comprehensive coverage options. With tailored support for first-time car owners, including accident forgiveness and roadside assistance, John feels secure on the road while keeping insurance costs manageable.

- Case Study #3 – Loyalty Rewards and Support: Lisa, a long-time Allstate customer and Pontiac Grand Am owner, benefits from loyalty discounts and personalized service. Allstate’s commitment to customer satisfaction includes flexible coverage options and exceptional claims handling, ensuring Lisa’s vehicle is protected wherever life takes her.

Frequently Asked Questions

What is the cheapest car insurance for full coverage and for new drivers with a Pontiac Grand Am?

State Farm often provides the cheapest car insurance for full coverage and new drivers with a Pontiac Grand Am, offering competitive rates and comprehensive coverage options.

Which insurance company is usually the cheapest and gives the best insurance for a Pontiac Grand Am?

Progressive is usually one of the cheapest insurance companies and is known for giving the best insurance for a Pontiac Grand Am with competitive rates and excellent coverage options.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

What type of car insurance is cheapest and best for old cars like a Pontiac Grand Am?

Liability insurance is generally the cheapest type of car insurance and is often best for old cars like a Pontiac Grand Am. Companies like Allstate and Progressive provide affordable liability coverage.

To expand your knowledge, refer to our comprehensive handbook titled “Liability Insurance: A Complete Guide.”

What is the best car insurance for new drivers and old cars like a Pontiac Grand Am?

The best car insurance for new drivers and old cars like a Pontiac Grand Am is often provided by State Farm and Progressive, which offer comprehensive protection at affordable rates.

What car brand is the cheapest to insure and has the lowest insurance premium, including a Pontiac Grand Am?

Brands like Honda and Toyota are the cheapest to insure and generally have the lowest insurance premiums, but for a Pontiac Grand Am, State Farm and Allstate offer competitive rates.

Which company gives the best insurance and has the cheapest full-coverage auto insurance for a Pontiac Grand Am?

Progressive is known for giving the best insurance and often has the cheapest full-coverage auto insurance for a Pontiac Grand Am, providing comprehensive protection at competitive rates.

To gain profound insights, consult our extensive guide titled “Full Coverage Car Insurance: A Complete Guide.”

What car insurance is cheapest for new drivers and full coverage, specifically for a Pontiac Grand Am?

Allstate offers some of the cheapest car insurance for new drivers and full coverage, specifically for a Pontiac Grand Am, providing competitive rates and various discounts.

Which type of car insurance is best and the most popular in the US for a Pontiac Grand Am?

Full coverage car insurance, including liability, collision, and comprehensive coverage, is the best type and is most popular in the US. State Farm and Progressive are leading choices for a Pontiac Grand Am.

What age is car insurance most expensive and which car insurance cover is best for a Pontiac Grand Am?

Car insurance is most expensive for drivers under 25 and for those over 65. Full coverage insurance is generally considered the best, and companies like State Farm and Allstate provide excellent options for a Pontiac Grand Am.

For a comprehensive overview, explore our detailed resource titled “Best Car Insurance for 21-Year-Old Drivers.”

What is the best car insurance for old cars like a Pontiac Grand Am and what is the name of the lowest car insurance?

The best car insurance for old cars like a Pontiac Grand Am often includes a combination of liability and collision coverage from companies like State Farm and Progressive. Progressive is frequently associated with the lowest car insurance due to its affordable rates.

Take the first step toward cheaper car insurance rates. Enter your ZIP code below to see how much you could save.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.