Cheapest Car Insurance in Wisconsin

Find the Best Deals: Discover the Cheapest Car Insurance in Wisconsin and Save Big on Premiums

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Michael Leotta

Updated September 2024

Finding affordable car insurance in Wisconsin is essential for all drivers. Car insurance provides financial protection in case of accidents, damages, or injuries, and it is required by law in the state of Wisconsin. However, with so many options available, it can be overwhelming to know where to start.

Understanding The Importance Of Car Insurance In Wisconsin

Car insurance is not just a legal requirement; it is also a vital financial tool that protects you from potential financial hardships resulting from accidents. In the event of an accident, your car insurance policy can cover expenses such as vehicle repairs, medical bills, and legal fees. Without proper insurance coverage, you could face significant costs that could jeopardize your financial stability.

Moreover, having car insurance demonstrates your responsibility as a driver and shows that you are prepared for unforeseen circumstances. It is essential to understand the different factors that can affect car insurance rates in Wisconsin to make informed choices and find the cheapest options available.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors That Affect Car Insurance Rates In Wisconsin

Several factors play a role in determining your car insurance rates in Wisconsin. These include:

- Your driving record: Your driving history, including accidents and citations, can impact your insurance rates. Safe drivers with a clean record generally enjoy lower premiums.

- Your age and gender: Younger drivers, especially teenagers, typically have higher insurance rates due to their lack of experience. Additionally, statistics show that male drivers tend to have higher rates compared to female drivers.

- The type of vehicle you drive: The make, model, year, and safety features of your car can influence insurance rates. More expensive or high-performance vehicles generally cost more to insure.

- Your location: The area where you live also affects your insurance rates. Urban areas with higher population densities and increased risk of accidents may result in higher premiums.

By understanding these factors, you can make informed decisions when selecting car insurance coverage and potentially find cheaper options based on your specific circumstances.

Exploring Different Types Of Car Insurance Coverage In Wisconsin

Car insurance coverage options vary, and it’s important to choose the right type of coverage for your needs. In Wisconsin, the minimum required coverage includes liability insurance, which provides coverage for injuries or damages you cause to others in an accident.

However, it’s advisable to consider additional coverage options to protect yourself and your assets. These options include:

- Collision coverage: This coverage pays for repairs to your vehicle after an accident, regardless of fault.

- Comprehensive coverage: Comprehensive insurance covers damages to your vehicle resulting from non-accident-related incidents such as theft, vandalism, or severe weather conditions.

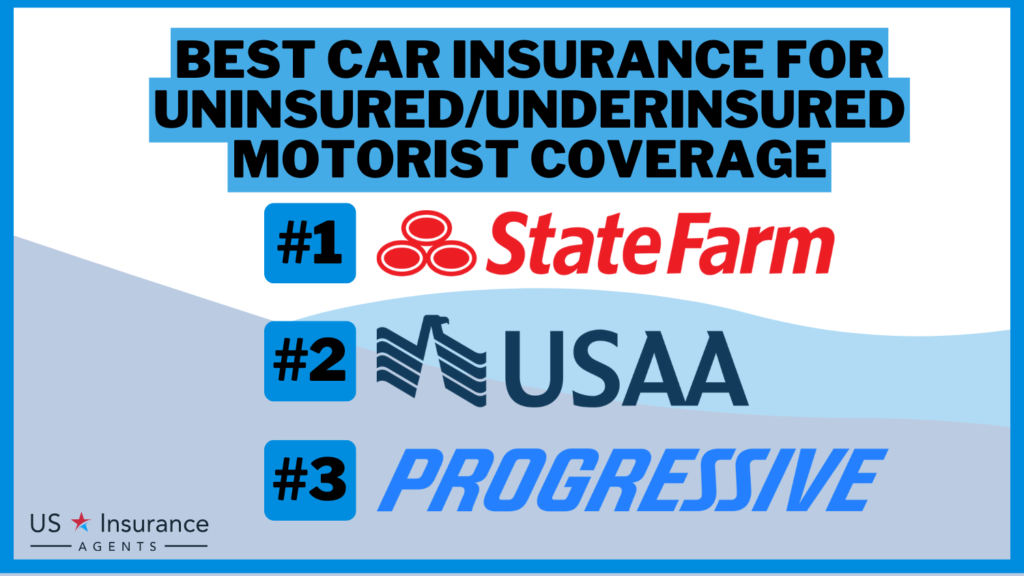

- Uninsured/underinsured motorist coverage: This coverage protects you in case you are involved in an accident with a driver who doesn’t have sufficient insurance to cover your damages.

- Medical payments coverage: This coverage takes care of medical expenses for you and your passengers in case of an accident.

While additional coverage options come with additional costs, they offer peace of mind and increased financial protection. Evaluate your needs and budget to determine the right level of coverage for you.

Tips For Finding The Cheapest Car Insurance In Wisconsin

Finding the cheapest car insurance in Wisconsin requires research and comparison. Here are some effective tips to help you secure affordable coverage:

- Shop around and compare quotes from multiple insurance providers. Each company may have different rates and discounts available.

- Consider bundling your car insurance with other policies, such as homeowners or renters insurance, to potentially qualify for multi-policy discounts.

- Maintain a good credit score. Insurance companies often use credit scores as a factor in determining rates, so improving your credit can help lower your premiums.

- Take advantage of available discounts, such as safe driver discounts, low mileage discounts, or discounts for having anti-theft devices installed in your vehicle.

- Consider increasing your deductibles. Higher deductibles can lower your premiums, but be sure you can afford to pay the out-of-pocket expenses if an accident occurs.

By implementing these tips and exploring different options, you can increase your chances of finding the cheapest car insurance policy in Wisconsin.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Quotes From Different Car Insurance Providers In Wisconsin

When searching for the cheapest car insurance in Wisconsin, it is crucial to obtain quotes from various insurance providers. Comparing quotes allows you to understand the different rates and coverage options available to you.

Start by requesting quotes from both national and local insurance companies. While national companies may offer competitive rates due to their size and resources, local providers might have more personalized offerings to suit your specific needs.

When comparing quotes, ensure that the coverage limits and deductibles are consistent so you can make an accurate comparison. Additionally, consider the reputation and customer reviews of the insurance companies to ensure they have a positive track record of customer satisfaction and claims handling.

How To Lower Your Car Insurance Premiums In Wisconsin

In addition to finding the cheapest car insurance policy, there are several strategies to help lower your premiums further:

- Take defensive driving courses to demonstrate your commitment to safe driving and potentially qualify for additional discounts.

- Monitor your mileage and consider carpooling or using public transportation if your annual mileage is low. Some insurance companies offer discounts for low-mileage drivers.

- Consider installing safety features such as anti-lock brakes, airbags, or anti-theft devices in your vehicle. These safety measures can reduce the risk of accidents or theft, leading to potential premium discounts.

- Review your policy annually and ensure it reflects your current needs. As your circumstances change, you may qualify for additional discounts or need to adjust your coverage levels.

- Maintain a clean driving record by following traffic laws and avoiding accidents or citations. Safe drivers typically enjoy lower insurance premiums.

By adopting these strategies, you can actively work towards further reducing your car insurance premiums in Wisconsin.

The Benefits Of Bundling Your Car Insurance In Wisconsin

Bundling your car insurance with other insurance policies can offer numerous benefits. Combining policies with the same insurance provider can often lead to multi-policy discounts, reducing your overall insurance costs.

Besides potential discounts, bundling car insurance with another policy, such as homeowners or renters insurance, can simplify your coverage management. Having all your insurance policies with one provider can streamline claims processes and improve overall customer service.

However, it is essential to assess whether bundling makes sense financially and if the bundled policies meet your specific needs. Take the time to compare the combined quote with individual quotes from other providers to ensure you are getting the best value.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding The Minimum Car Insurance Requirements In Wisconsin

Wisconsin law requires drivers to carry a minimum level of car insurance coverage. To legally drive in Wisconsin, you must have:

- Liability insurance with minimum limits of $25,000 for the injury or death of one person, $50,000 for the injury or death of more than one person, and $10,000 for property damage.

- Uninsured motorist coverage with minimum limits of $25,000 for the injury or death of one person and $50,000 for the injury or death of more than one person, as well as $10,000 for property damage.

It is crucial to understand that these minimum requirements may not provide sufficient coverage for all situations. Consider your personal circumstances, assets, and financial capabilities to determine whether additional coverage is necessary to adequately protect yourself and your assets.

Exploring Optional Coverage Add-Ons For Your Car Insurance In Wisconsin

In addition to the minimum required coverage, car insurance providers offer various add-ons and optional coverage options to enhance your protection. These optional coverage add-ons can include:

- Rental car coverage: This coverage helps cover the costs of renting a vehicle while your car is being repaired due to an accident.

- Towing and roadside assistance: This add-on provides assistance if your vehicle breaks down or you need a tow.

- Gap insurance: Gap insurance covers the difference between your car’s actual cash value and the remaining balance on your auto loan in the event of a total loss.

- Medical payments coverage: Additional medical payments coverage can increase the limits for medical expenses related to an accident.

Although these add-ons may increase your premium, they can provide valuable coverage in specific situations. Evaluate your needs and potential risks to determine if any of these optional coverage add-ons would be beneficial for you.

Common Discounts Available For Car Insurance In Wisconsin

Insurance companies often offer various discounts that can help you further reduce your car insurance costs in Wisconsin. Some common discounts to be aware of include:

- Safe driver discount: If you have a clean driving record and no recent accidents or citations, you may qualify for a safe driver discount.

- Multi-vehicle discount: Insuring multiple vehicles with the same provider can often result in a discount.

- Good student discount: Full-time students who maintain good grades may be eligible for a good student discount.

- Defensive driving course discount: Completing an approved defensive driving course can result in a premium reduction.

It’s wise to ask insurance providers about all available discounts and determine which ones you may qualify for. These discounts can significantly reduce your premiums and make car insurance more affordable.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Impact Of Your Driving Record On Car Insurance Rates In Wisconsin

Your driving record plays a significant role in determining your car insurance rates in Wisconsin. Insurance companies consider factors such as accidents, citations, and traffic violations when assessing your risk level as a driver.

Accidents or traffic violations, especially those involving serious offenses like DUIs or reckless driving, can have a significant impact on your insurance rates. Insurance companies view these behaviors as indicators of increased risk and may raise your premiums accordingly.

On the other hand, maintaining a clean driving record demonstrates responsible driving habits and can lead to lower insurance rates. Safe drivers who consistently follow traffic laws and avoid accidents and citations are typically rewarded with lower premiums.

Tips For Maintaining A Good Driving Record To Get Cheaper Car Insurance In Wisconsin

To maintain a good driving record and potentially qualify for cheaper car insurance rates in Wisconsin, consider these tips:

- Observe all traffic laws, including speed limits, stop signs, and traffic signals.

- Avoid distractions while driving, such as texting or using a cell phone.

- Use defensive driving techniques to anticipate and avoid potential hazards.

- Avoid aggressive driving behaviors such as tailgating or excessive speeding.

- Don’t drink and drive. Always designate a sober driver or use alternative transportation if you plan to consume alcohol.

By practicing safe driving habits consistently, you can maintain a clean driving record and potentially enjoy lower car insurance premiums in Wisconsin.

The Role Of Credit Score In Determining Car Insurance Rates In Wisconsin

In Wisconsin, as in many other states, insurance companies may consider your credit score when determining your car insurance rates. Credit scores are used as an indicator of financial responsibility and stability.

Studies have shown a correlation between low credit scores and a higher likelihood of filing insurance claims. Due to this correlation, insurance companies may assign higher rates to individuals with lower credit scores.

To improve your credit score and potentially lower your car insurance rates, make sure to:

- Pay your bills on time and avoid late payments.

- Reduce credit card balances and keep credit utilization low.

- Monitor your credit report for errors and address any discrepancies promptly.

- Avoid opening unnecessary lines of credit or taking on excessive debt.

By maintaining good credit practices, you can improve your credit score and potentially qualify for better car insurance rates in Wisconsin.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Different Payment Options For Car Insurance Policies In Wisconsin

When it comes to paying for car insurance in Wisconsin, policyholders have various payment options to choose from. The most common payment options include:

- Annual payment: Paying your entire insurance premium upfront for the entire policy term can often result in lower overall costs.

- Semi-annual payment: Splitting the premium into two equal payments, paid every six months.

- Quarterly payment: Paying the premium in four equal installments, usually every three months.

- Monthly payment: Spreading the premium into smaller monthly payments, often with an added convenience fee.

It’s essential to review the payment options offered by your insurance provider and choose the one that aligns with your budget and financial preferences. Keep in mind that some payment plans may have additional fees or charges, so consider the overall costs before making a decision.

How To File A Claim With Your Car Insurance Provider In Wisconsin

In the unfortunate event of an accident or other covered incident, it is essential to know how to file a claim with your car insurance provider in Wisconsin. The following steps can guide you through the claims process:

- Report the incident to your insurance provider as soon as possible. Most companies have a dedicated claims department that will guide you through the process.

- Provide accurate and detailed information about the incident, including the date, time, location, and description of what happened.

- Cooperate fully with the insurance company’s investigation. This may involve providing additional documentation or speaking with claims adjusters.

- Keep copies of all communication and documentation related to the claim, including estimates, police reports

Frequently Asked Questions

What factors affect car insurance rates in Wisconsin?

Car insurance rates in Wisconsin are influenced by various factors including the driver’s age, driving record, type of car, coverage limits, deductible amount, and even the zip code where the car is primarily parked.

How can I find the cheapest car insurance in Wisconsin?

To find the cheapest car insurance in Wisconsin, it is recommended to compare quotes from multiple insurance providers. You can either contact insurance companies directly or use online comparison tools to easily compare rates and coverage options.

What discounts are available for car insurance in Wisconsin?

Several discounts are available for car insurance in Wisconsin. These may include discounts for safe driving, having multiple policies with the same insurer, being a good student, completing a defensive driving course, or having certain safety features installed in your car.

Is it possible to get car insurance in Wisconsin with a bad driving record?

Yes, it is possible to get car insurance in Wisconsin with a bad driving record. However, having a poor driving history may result in higher premiums. Some insurance companies may specialize in providing coverage for high-risk drivers, but it is important to compare rates and coverage options to find the best option.

What is the minimum car insurance requirement in Wisconsin?

In Wisconsin, the minimum car insurance requirement is liability coverage with limits of 25/50/10. This means you must have at least $25,000 bodily injury liability coverage per person, $50,000 bodily injury liability coverage per accident, and $10,000 property damage liability coverage per accident.

Can I cancel

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.