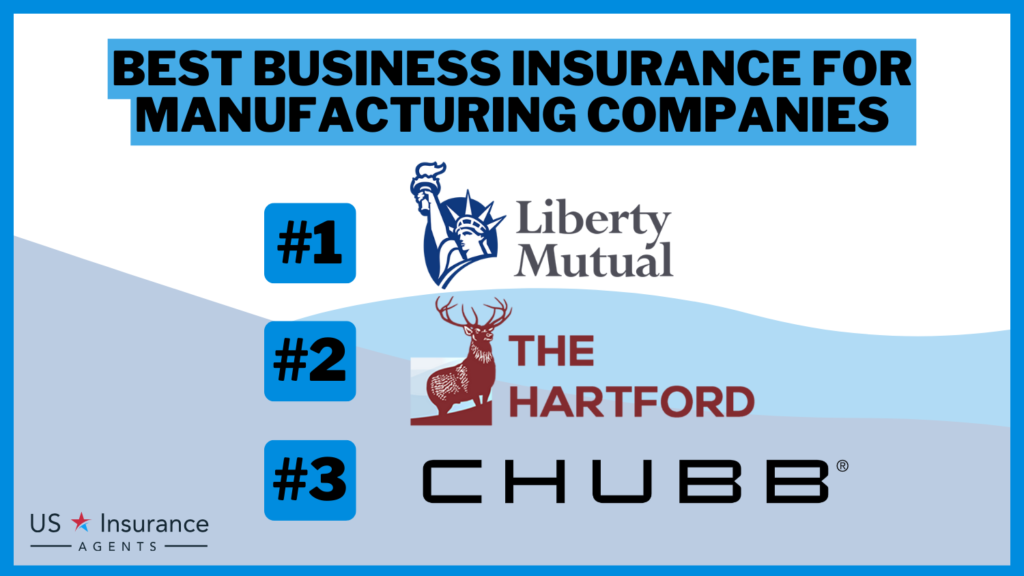

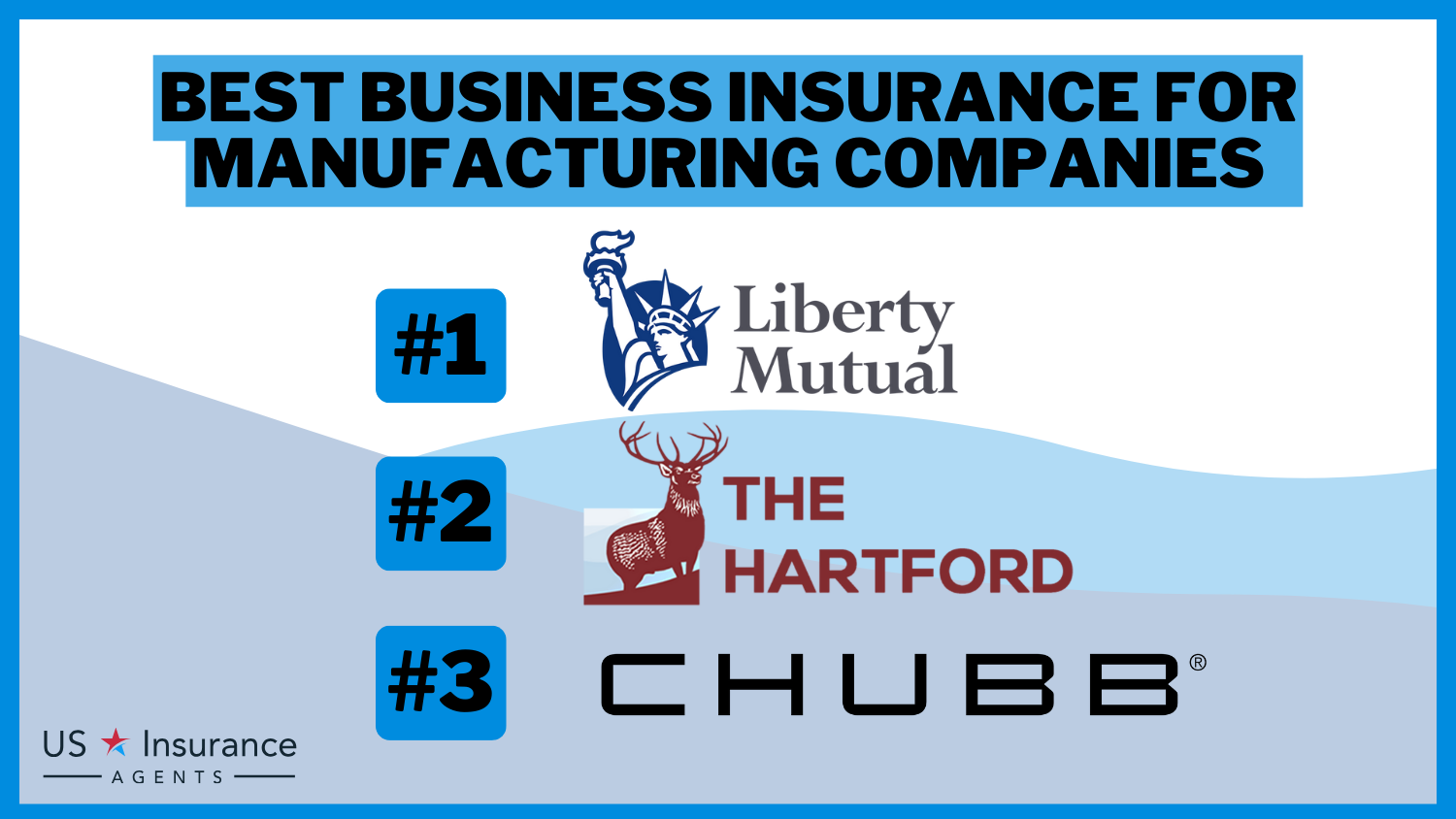

Best Business Insurance for Manufacturing Companies in 2026 (Top 10 Companies)

The best business insurance for manufacturing companies is offered by Liberty Mutual, The Hartford, and Chubb, known for their specialized coverage in the manufacturing sector. These providers offer competitive rates with a 15% discount, ensuring tailored support for manufacturing operations.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Professor of Nutrition & Kinesiology

Melissa Morris has a BS and MS in exercise science and a doctorate in educational leadership. She is an ACSM certified exercise physiologist and an ISSN certified sports nutritionist. She teaches nutrition and applied kinesiology at the University of Tampa. She has been featured on Yahoo, HuffPost, Eat This, Bulletproof, LIVESTRONG, Toast Fried, The Trusty Spotter, Best Company, Healthl...

Melissa Morris

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated January 2025

3,792 reviews

3,792 reviewsCompany Facts

Full Coverage for Manufacturing Companies

A.M. Best Rating

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews 765 reviews

765 reviewsCompany Facts

Full Coverage for Manufacturing Companies

A.M. Best Rating

Complaint Level

Pros & Cons

765 reviews

765 reviews 82 reviews

82 reviewsCompany Facts

Full Coverage for Manufacturing Companies

A.M. Best Rating

Complaint Level

Pros & Cons

82 reviews

82 reviews

Manufacturers insurance can depend on comprehensive protection against risks and damages, with a strong focus on personalized service and expert recommendations.

Our Top 10 Company Picks: Best Business Insurance for Manufacturing Companies

| Company | Rank | Safety Programs Discount | Business Experience Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | 10% | Safety Innovations | Liberty Mutual | |

| #2 | 10% | 10% | Risk Management | The Hartford |

| #3 | 20% | 15% | Excellence in Coverage | Chubb | |

| #4 | 15% | 10% | Business Solutions | Nationwide | |

| #5 | 15% | 10% | Comprehensive Coverage | Travelers | |

| #6 | 10% | 15% | Risk Solutions | CNA | |

| #7 | 20% | 10% | Manufacturing Excellence | Zurich | |

| #8 | 15% | 10% | Global Coverage | AIG |

| #9 | 15% | 10% | Safety Solutions | Allianz | |

| #10 | 10% | 15% | Flexibility and Affordability | Progressive |

With their proven track record and commitment to meeting the unique needs of manufacturing businesses, these insurers stand out as the go-to options in the industry.

Shield your business from financial setbacks. Enter your ZIP code above to shop for cheap commercial insurance rates from top providers near you.

- Liberty Mutual offers 15% discount for manufacturing coverage

- Tailored policies address equipment breakdown and product liability

- Competitive rates, comprehensive support for manufacturing insurance

#1 – Liberty Mutual: Top Overall Pick

Pros

- Innovative Safety Measures: The Liberty Mutual review & ratings outlines advanced safety initiatives utilized by Liberty Mutual to mitigate risks within manufacturing processes.

- Tailored Coverage Options: They offer customizable insurance solutions designed specifically for manufacturing businesses.

- Strong Financial Stability: Liberty Mutual maintains a solid financial strength rating, ensuring they can fulfill obligations promptly.

Cons

- Potentially Higher Premiums: Premiums with Liberty Mutual may be comparatively higher, requiring careful cost-benefit analysis.

- Customer Service Challenges: Some customers have reported issues with customer service responsiveness and claims processing efficiency.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – The Hartford: Best for Risk Management

Pros

- Strong Risk Management: The Hartford is known for its robust risk management services, offering tailored solutions to help manufacturing businesses mitigate potential risks effectively.

- Comprehensive Coverage: Hartford insurance review & ratings reveals that they offer extensive insurance solutions designed specifically for manufacturing businesses, including coverage for property, liability, and business interruption, catering to their unique requirements.

- Specialized Industry Expertise: The Hartford has deep industry expertise in manufacturing, understanding the unique challenges and requirements of this sector to offer specialized insurance solutions.

Cons

- Higher Premiums: Some businesses may find The Hartford’s premiums to be on the higher side compared to other insurance providers.

- Limited Availability: The Hartford’s services may not be available in all geographic regions, limiting options for businesses operating outside their coverage areas.

#3 – Chubb: Best for Coverage

Pros

- Excellent Coverage: Chubb offers comprehensive insurance packages tailored to the unique needs of manufacturing businesses, providing robust protection against various risks.

- Competitive Rates: Chubb provides competitive pricing with favorable terms, making their insurance solutions cost-effective for manufacturing companies.

- Strong Reputation: Chubb insurance review & ratings showcase a strong track record of outstanding customer service and efficient claims handling, providing policyholders with a sense of security.

Cons

- Premium Costs: Chubb’s premiums may be higher compared to some competitors, especially for businesses with specific risk profiles.

- Limited Local Presence: Chubb’s local presence may not be as extensive in certain regions, potentially affecting accessibility for some businesses.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Importance of Business Insurance for Manufacturers

Business Insurance for Manufacturing Companies is crucial for several reasons. Here are key points highlighting its importance:

- Risk Protection and Legal Compliance : Manufacturing faces equipment malfunctions, product defects, and property damage. Business Insurance prevents significant financial losses while legal compliance cover by jurisdictions mandate like Workers’ Compensation Insurance for manufacturing. Compliance ensures labor law adherence and avoids penalties.

- Financial Security and Liability Coverage: Business Insurance protects investments in equipment and inventory from fire, theft, or disasters, providing funds for repairs, and guards against lawsuits due to product defects or accidents, covering legal expenses and damages.

- Peace of Mind: Comprehensive Business Insurance offers reassurance, handling unexpected challenges financially and allowing focus on business growth.

Remember, when it comes to Business Insurance for Manufacturing Companies, it’s essential to carefully assess your specific risks and work with reputable insurance providers who understand the unique needs of your industry.

Jeff Root Licensed Life Insurance Agent

Additionally, business insurance ensures compliance with legal requirements such as Workers’ Compensation Insurance and offers peace of mind by covering liability for accidents and unexpected events. To gain in-depth knowledge, consult our comprehensive resource titled “What is Worker’s compensation?.”

Key Business Insurance Policies for Manufacturing Companies

Types of Coverage to Consider for Manufacturing Businesses: When it comes to protecting your manufacturing business, it is essential to consider various types of coverage to ensure comprehensive protection. Here are some key insurance policies to consider:

- Property and Product Liability Insurance: protect manufacturing businesses covering buildings, equipment, inventory, and claims from defective products causing harm to customers. Together, they ensure comprehensive coverage and financial protection.

- Business Interruption Coverage: Provides financial support for ongoing expenses and lost income during disruptions such as power outages or equipment breakdowns.

- Employment Practices Liability Insurance (EPLI): Protects against claims related to employee harassment, discrimination, or wrongful termination.

Protecting your manufacturing business involves key insurance coverage types. Property and product liability insurance ensure financial security by covering buildings, equipment, inventory, and claims from defective products.

Business Insurance for Manufacturing Companies: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AIG | $300 | $800 |

| Allianz | $280 | $750 |

| Chubb | $320 | $850 |

| CNA | $290 | $780 |

| Liberty Mutual | $310 | $820 |

| Nationwide | $270 | $730 |

| Progressive | $300 | $800 |

| The Hartford | $280 | $750 |

| Travelers | $330 | $880 |

| Zurich | $320 | $850 |

Business interruption coverage provides support during disruptions like power outages or equipment breakdowns. Additionally, employment practices liability insurance (EPLI) safeguards against employee-related claims. For a comprehensive analysis, refer to our detailed guide titled “Liability Insurance.”

Essential Measures for Manufacturing Companies Success

In the fast-paced world of manufacturing, it’s crucial to have measures in place to protect your operations and assets. Here are some key considerations and coverage options to help you safeguard your manufacturing operations:

- Business Interruption Coverage: This insurance helps you recover lost income and cover ongoing expenses during unexpected disruptions, such as equipment breakdowns, power loss or power outages. To broaden your understanding, explore our comprehensive resource on insurance coverage titled “Business Insurance.”

Equipment breakdown insurance protects your machinery and equipment from breakdowns by covering the cost of repairs or replacements. It ensures that your production remains uninterrupted and maintains productivity.

While Supply chain disruption coverage provides financial protection against supply chain disruptions caused by supplier bankruptcies, natural disasters, or other unforeseen events. It covers additional expenses incurred to mitigate the effects of disruptions, helping you maintain a steady flow of materials and resources.

- Cargo and Transit Insurance: If your business involves transporting goods, this insurance safeguards your products during transit. It covers loss or damage caused by car accident, theft, or other unforeseen incidents, ensuring the safe delivery of your cargo.

- Cyber Liability Insurance: Protects your business from the financial and legal consequences of cyber threats. It covers expenses related to data breaches, cyber-attacks, and business interruption caused by cyber incidents, safeguarding your digital assets and maintaining your reputation.

Safeguarding your manufacturing team and assets with manufacturers insurance that has your back ensures a secure and resilient business. Explore easy-to-customize manufacturers insurance options to protect your operations effectively, consulting with an insurance expert for personalized recommendations.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ensuring a Secure and Productive Work Environment for Your Manufacturing Team

The safety and well-being of your employees should be a top priority in your manufacturing business. To ensure their protection, consider implementing the following measures and coverage options:

- Safety Culture: Create a strong safety culture by providing comprehensive training and enforcing safety protocols. Regularly audit for potential hazards and encourage open communication about safety concerns.

- Ergonomic assessments: Conduct ergonomic assessments to identify and address potential risks. Make necessary modifications to workstations and provide ergonomic tools to prevent musculoskeletal to employee injuries.

Employee wellness programs promote physical and mental well-being. Offer health screenings, fitness activities, and stress management resources to support your team’s overall health. To gain further insights, consult our comprehensive guide titled “Health Insurance: A Complete Guide”

- Employment practices liability insurance (EPLI): Protect your business from claims related to employment practices violations. EPLI coverage offers legal defense and financial protection in case of harassment, discrimination, or wrongful termination claims.

Ensuring the safety and well-being of your manufacturing team not only protects them from harm but also contributes to a positive work environment and increased productivity, especially for larger firms. Additionally, it is crucial to consider product recall and protecting your manufacturing property to mitigate risks and ensure business continuity.

By implementing comprehensive safety measures and obtaining the right insurance coverage, you demonstrate your commitment to their welfare.

Case Studies: Business Insurance in Action for Manufacturing Companies

Discover the essential role of insurance tailored for manufacturing companies in safeguarding operations and mitigating risks.

- Case Study #1 – Equipment Protection: Atlas Manufacturing’s equipment insurance proved essential when a critical machine malfunctioned, halting production. The policy covered repair expenses swiftly, ensuring minimal downtime and maintaining operational efficiency.

- Case Study #2 – Product Liability Defense: Silver Star Manufacturing faced a product defect claim that threatened their reputation. Their product liability insurance covered legal fees and settlement costs, safeguarding the company’s finances and brand integrity. For additional details, explore our comprehensive resource titled “Commercial General Liability (CGL) Insurance.”

- Case Study #3 – Business Interruption Recovery: Summit Steelworks encountered a fire that damaged their manufacturing facility. Business interruption insurance provided financial support for ongoing expenses and lost income, enabling a smooth recovery and resumption of operations.

Ensure business continuity and financial security by investing in specialized insurance coverage designed to protect manufacturing operations from equipment risks, liability claims, and unforeseen disruptions.

Zach Fagiano Licensed Insurance Broker

Invest in tailored insurance solutions to protect your manufacturing business against unforeseen challenges and support long-term success.

Brief Recap: Securing the Future of Your Manufacturing Business

Protecting your manufacturing business is crucial for long-term success. This guide emphasized the importance of Business Insurance, covering risk protection, legal compliance, financial security, liability coverage, and peace of mind.

Types of coverage, including Property Insurance, Product Liability Insurance, Business Interruption Coverage, Equipment Breakdown Insurance, Workers’ Compensation Insurance, and Employment Practices Liability Insurance (EPLI), were explored to ensure comprehensive protection. To learn more, explore our comprehensive resource on commercial auto insurance titled “What is comprehensive coverage?”

Prioritizing the safety and well-being of your team through a safety culture, Workers’ Compensation Insurance, wellness programs, ergonomic assessments, and Employment Practices Liability Insurance (EPLI) was emphasized. Work with reputable insurance providers to customize your coverage and protect against potential risks.

Comparing quotes is integral to finding the best rates possible. Enter your ZIP code below into our free tool today to see what quotes might look like for you.

Frequently Asked Questions

What are the best insurance policies for manufacturing companies?

The best insurance policies for manufacturing companies include property insurance, general liability insurance, product liability insurance, and business interruption insurance. Contact commercial insurance providers for tailored quotes and coverage options.

Is manufacturers insurance suitable for small business owners?

Yes, manufacturers insurance can be beneficial for small business owners, providing coverage for property, liability, and other specific risks associated with manufacturing operations.

Protect your company and employees with adequate coverage — enter your ZIP code below to instantly compare commercial insurance quotes with our free comparison tool.

How can manufacturers insurance made for your business be customized to fit your needs, and what factors determine the premium?

Manufacturers insurance made for your business can be customized to match your specific needs, with premium costs influenced by factors like coverage level, business size, location, claims history, and industry risks.

To delve deeper, refer to our in-depth report titled “How does the insurance company determine my premium?.”

Who needs a manufacturer insurance policy?

Manufacturers, including small business owners and larger industrial operations, benefit from manufacturer insurance policies to protect against property damage, liability claims, product defects, and business interruptions.

What is industrial special risk insurance?

An ISR Insurance Policy provides cover for property damage to your valuable assets by any cause not excluded under your policy. Cover can include loss and/or damage to buildings, plant and machinery, contents, stock, raw materials, unregistered vehicles and the property of directors and employees.

What is the most popular type of insurance?

Depending on your coverage, auto insurance is intended to assist in protecting your finances against injuries and vehicle damage.

For a thorough understanding, refer to our detailed analysis titled “Personal Injury Protection (PIP) Insurance.”

How can you effectively cover your manufacturing operations with insurance?

You can effectively cover your manufacturing operations with insurance by securing policies such as property insurance, general liability insurance, product liability insurance, and business interruption insurance tailored to your specific business needs and risks.

To find cheap business insurance, enter your ZIP code into our free quote comparison tool below and get covered today.

How can you effectively protect your manufacturing property?

You can effectively protect your manufacturing property by securing comprehensive property insurance coverage that safeguards buildings, equipment, and inventory against various risks such as fire, theft, vandalism, and natural disasters.

What insurance is most important for a business and where can I get a quote?

The most crucial insurance for a business typically includes general liability, property, and business interruption coverage. To get a quote, contact insurance providers directly or use online comparison tools.

To gain profound insights, consult our extensive guide titled “How to Get Free Insurance Quotes Online.”

How can you effectively protect your manufacturing team?

To effectively protect your manufacturing team, implement safety protocols, provide proper training, offer personal protective equipment, and secure appropriate workers’ compensation insurance. Additionally, prioritize workplace safety measures and address any potential hazards promptly.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.